North Sea operators drilling varied projects

It is a foregone conclusion that North Sea oil production is winding down, but there is still huge potential for additional oil and a great quantity of natural gas. Advanced drilling and production technologies incorporating real-time "smart" operations show promise. Increased collaboration and cooperative arrangements should improve efficiency.

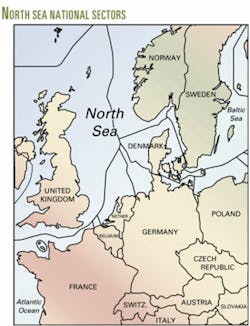

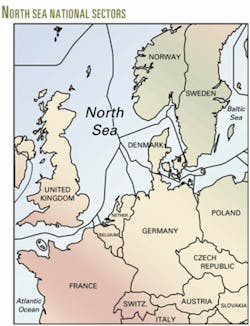

Baker Hughes Inc.'s international rotary rig count for February listed 43 rigs operating offshore Europe in February 2004, up 7 from January, but down 4 from February 2003, with rigs in Denmark (5), Germany (1), the Netherlands (4), Norway (19), and the UK (13).

The North Sea oil industry has seen heavy job cuts in the last several years, but this restructuring and facility upgrading should benefit the industry and make it more competitive. In the past several years, both operating and service companies have been laying off employees and reducing contract staff.

Rumors exacerbate fact. In 1998, Royal Dutch/Shell Group had to address rumors foretelling 2,000 imminent job cuts after the company announced plans to vacate Shell-Mex House in central London. In a Sept. 18 press release, Chris Fay, Shell UK Chairman and Chief Executive said, "This is about buildings, not people. The story that has emerged of 2,000 people losing their jobsUis simply not true, and we are sorry it has mistakenly taken hold."

But Shell announced plans to cut 350 North Sea rig jobs—a 20% staff reduction—on Mar. 17, 2003, raising concerns about safety if rig maintenance is reduced. In an article about the staff reduction the following day in The Guardian, the UK's energy minister Brian Wilson reasoned, "Restructuring by long-established North Sea companies is inevitable as some fields reach maturity."

According to a BP PLC press release, the company cut workers at the 23-year old Sullom Voe oil terminal it operates in the Shetland Islands in 2003, citing declining North Sea production. Sullom Voe is Europe's biggest oil and gas terminal, now handling less than 600,000 bo/d, down from 1.4 million bo/d at its peak, including west of Shetlands transshipment oil.

BP has also cut nearly 1,000 workers at its Grangemouth refinery and petrochemical complex west of Edinburgh in a restructuring that followed a safety review in 2001. Grangemouth is Scotland's only refinery, providing work for 1,400 BP employees plus contractors. In a business activity report, verified by Ernst & Young, BP said, "Job reductions on the site were a regrettable but inevitable consequence of the drive to improve Grangemouth's ability to compete."1

Perhaps we will see more restructuring and redundancies, but continued, steady drilling and development should bring stability to the area.

UK North Sea

Some call this period the Third Age for the UK North Sea.

The industry is realigning because of declining oil production in the maturing North Sea basin. The largest operators are reducing their investments, but new entrant independents may succeed with innovative operator-contractor relationships.

UK gas production grew rapidly in the 1990s, to 10 bcfd from 4 bcfd, driven by increasing demand. It derives from associated gas production as well as increased dry gas production in the southern North Sea.

Simmons & Co. International notes in a Mar. 11, 2004, research report that associated gas volumes grew to 60% of total production in 2002-03, from 50% in 1996-97, according to analyst Ruairidh (Rory) Stewart.

There are several positive notes sounding in the UK sector of the North Sea, including: the entrance of small prospectors, new developments at Buzzard field and Clair field (Shetlands), near completion of the Goldeneye development (Outer Moray Firth), a new 6% exploration expenditure supplement, and an upcoming offshore licensing round which includes a new type of "frontier" license.

UK Buzzard

In November 2003, the UK Department of Trade and Industry approved the $2 billion development plan for the new Buzzard oil field, with an estimated 400 million boe in total recoverable reserves. The discovery was made in 2001 in about 100-m water depth and eight wells and sidetracks have been drilled on the structure since then. Buzzard is the largest field of its kind discovered in the North Sea for a decade, 100 km (62 miles) northeast of Aberdeen and 55 km off Peterhead (OGJ, Jan. 12, 2004, p. 8).

Buzzard is expected to begin production in 2006 and produce an average of 180,000 bo/d by 2007. EnCana (UK) Ltd. is operator for the Buzzard group that includes Intrepid Energy North Sea Ltd., BG Group, and Edinburgh Oil & Gas PLC.

The Buzzard development plan calls for fabrication of three bridge-linked platforms and 27 wells. In December 2003, the contract to construct the 9,500-ton utility deck was awarded to Heerema Hartlepool Ltd.'s yard in Teesside, which Heerema says will create 250 jobs and "employ 700 personnel at peak periods," said Heerema Hartlepool Director Brian Dixon. This is the "first large integrated deck to be awarded to a UK contractor for over 5 years."

UK Clair

The Clair field is the largest discovered but as yet undeveloped hydrocarbon resource on the UK continental shelf (UKCS), 75 km west of Shetlands in water about 140 m deep. It was discovered in 1977 and 10 wells were drilled 1977-90, followed by 5 wells 1990-95, and 2 in 1997. The project is valued at £650 million.

Heerema Hartlepool will complete the Clair drilling facility in May 2004. The yard was awarded the contract for fabrication of the 2,500-ton derrick equipment set (DES) module with substructure and skid base and the 2,200-ton drilling support module (DSM), designed for drilling high angle and horizontal production wells. Noble Drilling Corp. and Mustang Engineering LP, a subsidiary of Aberdeen-based John Wood Group PLC, provided the front-end engineering design for the Clair field development.

The drilling plans for Clair Phase 1 development include 15 producing wells, 8 water injection wells, and 1 injection well for drill cuttings. Most of the wells will be drilled to about 3 km total depth, but the longest will extend 6 km.

According to the consent decree given under the Petroleum Act 1998 and under the Assessment of Environmental Effects Regulations 1999, effective Nov. 30, 2001, through Dec. 31, 2008, "top-hole drill cuttings will be discharged to sea with lower well section cuttings reinjected. Produced water will be reinjected with a goal of 98% reinjection."

Announcing approval of the project, UK Energy Minister Brian Wilson said, "This news demonstrates that there is a lot of potential left in the UK offshore industry, based on innovation and technology. BP and all of the other Clair partners have undertaken an innovative approach to overcome some challenging obstacles."

Clair field operator, BP Exploration Operation Co. Ltd., said in a business activity report, "efficient development of relatively new fields such as Clair, could help limit the production decline curve [in the North Sea] for many years."2

The Clair partners include BP (28.6%); ConocoPhillips (24%); ChevronTexaco (19.4%); Enterprise Oil PLC (18.7%); and Amerada Hess (UK) Ltd. (9.3%). First oil is projected for fourth-quarter 2004.

UK Goldeneye

The discovery well, 14/29a-3, for the Goldeneye gas-condensate field in the South Halibut basin was drilled from the Rowan Gorilla VII in October 1996. As the first gas development in Outer Moray Firth, the field's £300 million development plan is nearing completion, including five conventional deviated wells with total vertical depths of 8,300 ft and measured depths of 9,000 to 15,000 ft.

Mærsk Contractors began the 250-day drilling campaign on Sept. 7, 2003, using the new ultraharsh-environment jack up Mærsk Innovator (formerly "XL-1"). The Mærsk Innovator, built in 2002, is an MSC CJ70-150 MC jack up rated to work in water depths of 150 m (492 ft) and has a rated drilling depth of 9,144 m.

First gas from this field, 100 km northeast of shore-based processing facilities at St. Fergus, will flow by July 2004, and the project will flow enough gas to meet almost 3% of daily UK demand.

Shell UK is operator (52.5%), joined by Esso UK (39%), Lasmo (TNS) a wholly owned subsidiary of Eni SpA (4.5%), Paladin Expro Ltd. (3%), and Veba Oil & Gas UK (1%).

Tom Botts, managing director of Shell UK E&P, said, "Turning Goldeneye into a viable development has created another technological first for the UK industry—jack-up drilling in 120 m [400 ft] of water as an alternative to sub sea completions is completely new territory for the UK."

Shell, ExxonMobil

Shell UK Exploration and Production Ltd. and ExxonMobil subsidiary, Esso Exploration and Production UK Ltd., are partners in 62 UK North Sea fields. The two companies have a 50/50 joint venture in 35 of the fields.3 Shell is the designated operator for most of the fields per an agreement signed in April 1965.

ExxonMobil has the second largest acreage position of any operator on the UK continental shelf, producing 12% of the UK's oil and 15% of the natural gas. ExxonMobil holds interests in about 90 fields, including 74 fields operated by other companies: 19 in the Northern North Sea, 35 in the Central North Sea, and 30 fields in the Southern North Sea.

ExxonMobil subsidiary, Mobil North Sea Ltd., operates fields in the northern and southern sectors of the North Sea.4 In the Northern North Sea, Mobil operates the Beryl Alpha and Beryl Bravo platforms. In the Southern North Sea, Mobil operates the Camelot, Lancelot, Guinevere, Excalibur, Galahad, and Malory fields, the Thames field complex, and the Welland platform off Norfolk.

UK supplement

The UK government introduced a new Exploration Expenditure Supplement to help promote exploration and investment in the North Sea. The government had previously allowed companies to write off 100% of money spent on exploration against taxable income. Effective Jan. 1, 2004, new entrants are allowed an additional 6% write-off, compounded annually for up to 6 years.5

The UK Treasury has collected an average of £5 billion/year in taxes from North Sea petroleum operations since development started in the 1960s, but the number of exploration wells drilled in the UK North Sea has declined sharply in the past decade.

In a Jan. 20, 2004, press release, the UK Treasury's Paymaster General Dawn Primarolo said, "The North Sea oil and gas industry is a vital contributor to the UK economy. The new exploration expenditure supplement will ensure new entrants get support for the important early stages of investment."

UK licensing round

On Mar. 4, 2004, the UK government announced the 22nd offshore oil and gas licensing round. The formal invitation for applications was announced in the Official Journal of the European Union. Substantial acreage is offered in the north, central, and southern North Sea (64° N to 51° N) and in the West of Shetlands region. Twenty of the blocks are being "recycled" after being relinquished by previous license holders.

A new Frontier Seaward License is being offered, in addition to the Traditional Seaward License; applications for both types will be accepted on June 3, 2004. Applications for the relatively new Promote Seaward License will be accepted on June 4, 2004. The license application fee for seaward production licenses is £2,820.

Under the "frontier" and "promote" licenses, the rental fee will be cut by 90% for the first 2 years as compared with the traditional 4-year, £35,000 exploration licenses. The frontier license will only be available for West of Shetlands, and the promote license is offered everywhere but West of Shetlands.

In a Mar. 4, 2004, press release, Malcolm Webb, chief executive of the UK Offshore Operators' Association (UKOOA) said: "the Government has taken an innovative approach in the 22nd licensing round by combining new and old licenses types as a means of maximizing interest in exploring for oil and gas in the UK Continental Shelf.

"In particular, the new frontier license could prove to be instrumental in revitalizing exploration activity in the more difficult areas of the Atlantic Margin to the North West of Scotland where acreage is being offered up for the first time in many years."

UKOOA was formed in June 1973, and is the representative organization for companies licensed by the British government to explore for and produce hydrocarbons in UK waters. UKOOA has 30 members and four associate members.

UKNS operations

Tuscan Energy (Scotland) Ltd., a wholly owned subsidiary of Aberdeen-based Tuscan Energy Group Ltd., has a drilling and production conhtract with Rowan Cos. Inc. for the supergorilla class jack up, Rowan Gorilla VII. The rig is working in the Ardmore field (previously Argyll field) in the Central North Sea.

Talisman Energy (UK) Ltd. began a fixed 3-year, £30 million contract with Odfjell Drilling AS for drilling and maintenance services on Talisman's UK platforms after GlobalSantaFe Corp. decided to pull out of the sector. The contract was announced in September 2003 and includes options for two 1-year extensions. Talisman uses two drill crews but may require an intermittent third crew through 2004. This is Odfjell's first platform drilling contract in the UK North Sea.

BP in Aberdeen has contracted to use Odfjell Drilling's semisubmersible Deepsea Bergen beginning in June or July 2004 for 12 months of production drilling at the Rhum gas field in license P198 of the UK North Sea. The contract is worth about $30 million, according to a Sept. 25, 2003, press release from Odfjell. The £350 million Rhum field development is a joint venture between BP Exploration Operating Co. Ltd. and Iranian Oil Co. (UK) Ltd.

On Mar. 18, 2004, Edinburgh Oil & Gas PLC announced that the P1098 license group had just completed drilling well 19/8-1 in the Outer Moray Firth and plugged and abandoned the well. The P1098 license group consists of EnCana (UK) Ltd. as operator, OMV (UK) Ltd., and Edinburgh Oil & Gas.

In February, Venture Production PLC awarded a 3-year contract with two, 1-year extensions to KCA Deutag Drilling Ltd. for drilling services at the Kittiwake platform in the UK North Sea. The contract is valued at £3.75 million over 5 years. Venture and Dana Petroleum PLC purchased Kittiwake from Shell UK E&P in November 2003.

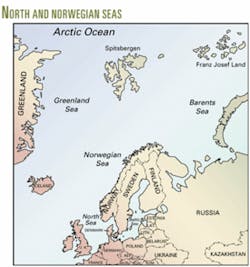

Norwegian arena

According to the Ministry of Petroleum and Energy, 18 companies submitted applications in Norway's 18th offshore licensing round by the Mar. 15, 2004, deadline, up from 13 in the previous round.

Applicants include: Amerada Hess Norge AS, Britain's BG, ChevronTexaco, Norwegian det Norske Oljeselskap AS (DNO), Denmark's state-owned DONG Norge, Italy's ENI Norge AS, ExxonMobil Corp., Gaz de France Norge AS, Japan's Idemitsu Petroleum Norge AS, Marathon Petroleum Norge AS, Norsk Hydro Production AS, Britain's Paladin Resources Norge AS, small Norwegian firms Pertra AS and Revus Energy AS, Germany's RWE Dea Norge, Shell, Statoil ASA, and France's Total E&P Norge AS. Ten of the 18 had not taken part in the 17th licensing round. BP and ConocoPhillips were notably absent from the bidding.

In a Mar. 15 story by Reuters, Norway's Oil and Energy Minister Einar Steensnaes said that he was "satisfied with the interest companies have shown for frontier areas in the Norwegian Sea and the North Sea."

Norway was offering 95 blocks in the North Sea and the Norwegian Sea south of the Lofoten islands (south of the 68th parallel) in the largest licensing round since the country's first round in 1965. This round is nearly three times larger than the 17th offshore licensing round. The Ministry of Petroleum and Energy plans to award the new licenses before summer and the earliest drilling is expected in the spring or summer of 2005.

In the 18th round, Statoil joined forces with Shell for the deepwater parts of the Norwegian Sea and with RWE Dea Norge (a wholly owed subsidiary of RWE Dea AG) in the southern part of Norway's North Sea sector.

Tore Torvund, senior vice-president in Hydro Oil & Energy at Norsk Hydro, said that the company has applied for two blocks in the North Sea and an undisclosed number in the Norwegian Sea.

The Nordland VI area of the Norwegian Sea, off the Lofoten Islands, was not included in the 18th round, but Norway plans to assess the area after the integrated management plan for the Barents Sea is finished.

Norway's resources

More than 1,000 exploration wells have been drilled on the Norwegian continental shelf (NCS) since the 1960s. According to the exploration database of the Oljedirektoratet (Norwegian Petroleum Directorate - NPD), in the 5-year period 1999-2004 (through Mar. 16) there was drilling activity in 91 wellbores and 35 appraisal wellbores. An additional 17 wells were reentered and 2 were abandoned without having reached their targets, contributing to the total of 145 wells (Table 1).

Statoil was the primary operator, drilling 57 of the wells in the 5-year period (39%). Norsk Hydro Produksjon AS served as operator on 29 wells (20%). Saga Petroleum ASA drilled 11 (8%), BP Norge AS and Amoco Norway AS operated 10 (7%), and Esso E&P Norway AS drilled 8 wells (6%).

The other 30 wells (21% of total) were drilled by 10 other operators: Marathon Petroleum Norge AS (5), Norsk Agip AS (5), AS Norske Shell (4), Pertra AS (4), Conoco Petroleum Norge AS (4), Phillips Petroleum Norsk AS (3), Amerada Hess Norge AS (2), Norske RWE-DEA AS (1), Norsk Chevron AS (1), and Mobil Development Norway AS (1).

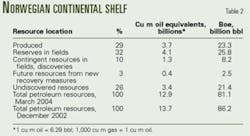

At the 13th Underwater Technology Conference in Bergen, Mar. 17-18, 2004, General Gunnar Berge, director of the NPD, released the latest estimates of resources on the Norwegian continental shelf. The NPD calculates resources of 12.9 billion cu m oil equivalents (Table 2).

This resource estimate has been reduced 5.8% from the 13.7 billion cu m estimate released by the NPD on Dec. 31, 2002. The adjustment occurred in May 2003.6

NPD's Eric Mathiesen told OGJ that the adjustment was primarily due to reduced estimates of undiscovered gas resources in the Norwegian Sea and lower expectations concerning increased gas production (future improved recovery). The estimate for undiscovered oil resources is more or less unchanged.

Petroro AS, which manages the Norwegian state's direct financial interest (SDFI), said that the state's net profit from oil and gas production was 34.2 billion Norwegian kroner ($5 billion) in the first half of 2003. Net cash flow to the government totaled 36.8 billion kroner for the same period.

Although Petroro recognizes that Norway's portfolio will shift from being primarily oil-based to being substantially gas-based, the company still believes that production can increase in the long-term through improved recovery technologies and development of additional resources.

Statoil, NCS

Statoil has been using Odfjell Drilling's Deepsea Bergen semisubmersible for a drilling and workover program in the Heidrun field since November 2003. The initial contract for about 40 days work was worth about $28 million kroner and has been extended twice.

The first extension, worth about 22 million kroner, was to drill the Kappa exploration well in PL124 beginning in December 2003. The second extension, worth about 38 million kroner, was to drill and complete an additional well in the Heidrun field.

(Norse mythology inspires many, if not most of the field names off Norway. Heidrun was the name of the she-goat who provided four types of meads to the Norse gods in their banquet hall, Valhalla.)

Statoil chartered Saipem SPA's Scarabeo 5 drilling rig in 36-month contract and began a 12-well drilling program in the Kristen field in August 2003. The West Alpha rig arrived at the field and began drilling in January 2004.

Statoil has also extended its use of the Transocean Searcher semisubmersible. The rig mobilized to Smørbukk South on Statoil's Åsgard license in the Norwegian Sea and should begin drilling in April 2004. The initial 300 million kroner contract is to drill three wells through the new Q subsea template on Smørbukk South, followed by 95 days of work on other wells (OGJ, Jan. 26, 2004, p. 9). Statoil has contract options for three 1-year extensions.

(The Åsgard field also takes its name from Norse mythology; it was the mighty fortress built by the Norse gods that could only be entered by riding over the rainbow, a bridge of flames.)

Statoil, Norne area

Statoil has started two wells so far in 2004. The 6507/8-7 wildcat well in production license (PL) 124 was spudded Jan. 5 and plugged and abandoned on Jan. 31, after reaching in middle Jurassic sediments. The second well started this year is an appraisal well in the gas and condensate Alve field, a small discovery in the Norwegian Sea close to the Norne field.

In a Mar. 15 press release, Knut Chr Grindstad, exploration manager for the Halten/Nordland cluster said it's important for Statoil to develop smaller fields located close to existing infrastructure.

He added, " We're hoping to establish that the field is considerably larger than has already been proven. In our view, there's a good chance that possible additional resources in Alve will be oil."7

The 6507/3-4 appraisal well in PL159 on Alve was spudded Mar. 14 using the West Navigator deepwater drillship (formerly West Navion). Statoil and Norsk Hydro have a 6-week contract with Stavanger-based Smedvig ASA to drill the Alve well, after which the West Navigator is scheduled to drill an exploration well (Linerle) for Statoil in PL128 in the Halten/Nordland area. The drilling contract is worth $13 million.

Statoil holds 50% interest in Alve, Shell has 40%, and Norsk Hydro 10% interest.

On Mar. 11, Statoil announced the intent of the partners in production license 128 to charter the Transocean Arctic rig to work the Norne field and two of its satellites in the Norwegian Sea. The contract with Transocean Inc., which is worth 700 million kroner, will begin July 1, 2004, and run about 19 months. The first activity will be to drill a sidetrack on Norne, followed by seven or eight production and injection wells on the Svale and Stær satellites. Oil production is declining at Norne (discovered 1992) and the Stær (2002) and Svale (2000) fields are only 5 km and 10 km north of the Norne production ship.

(These two satellite fields are named for birds; 'Stær' means starling and 'Svale' means swallow. 'Norne' was the collective name for the three Norse goddesses of fate or destiny, present at the birth of every child.)

According to a Mar. 9, 2004, news release, Statoil intends to submit a plan for development and operation to Norwegian authorities in May that will probably include three templates—two on Svale and one on Stær—with a total of eight wells tied back to the production vessel. Statoil expects drilling to begin in October 2004 and first production in the autumn of 2005.

The Stær and Svale partnership includes Statoil (40.5%), Petroro AS (24.5%), Norsk Hydro Production AS (13.5%), Eni Norge AS (11.5%), and Shell/Enterprise (10%).

Within the Norne area, Statoil has already found oil in the Falk and Lerke structures (OGJ, Feb. 10, 2003, p. 8) and plans to drill on the Linerle structure northeast of Norne later in 2004 with the West Navigator drillship.

Last year, the company drilled an unsuccessful well 3 km northeast of Norne, on the Gråspett prospect, in 374 m of water to 2,750 m TD (OGJ, Aug. 11, 2003, p. 9).

The Stena Don semisub has been working in the Norne area under contract to Statoil since early 2002. On July 1, 2003, the NPD granted permission for the Stena Don to drill at Norne.

On Mar. 16, 2004, the Norwegian Petroleum Safety Authority (PSA) consented for Statoil to use the Stena Don on PL128. Statoil plans to drill side-tracks in well 6608/10 B-4CH and carryout intervention work in well E-4H.

Shell, NCS

With respect to Shell's bids in the 18th offshore licensing round, Norske Shell's spokesman Svein Ildgruben said, "The Norwegian shelf is the only growth area in Europe."8

A/S Norske Shell contracted with Smedvig for the use of the West Navigator to drill eight wells in about 900-m water depth on the Ormen Lange ("long worm") field in the Norwegian Sea for about $167 million. The drilling program is planned for the second half of 2005, with an estimated drilling period of 740 days. The contract contains an option for four additional wells that could add an additional year.

In a Mar. 19 press release, Kjell E Jacobsen, CEO of Smedvig said "the contract with Shell secures long-term employment for West Navigator and confirms Smedvig`s position within harsh environment deepwater drilling. This contract is an important step in the long-term development of Smedvig."

Marathon, NCS

In late February, Marathon Oil Corp. announced that its Norwegian subsidiary Marathon Petroleum Norge AS would drill two wells in 2004. Marathon has contracted Odfjell Drilling's semisubmersible drilling rig Deepsea Delta to drill both wells.

The first is the Hamsun appraisal well 24/9-7, spudded on production license (PL) 150 in the Alvheim area on Mar. 2, 2004, in 125-m water depth.

Marathon is the Alvheim area operator, holding a 65% working interest. ConocoPhillips Skandinavia AS has 20%, and Oslo-based DNO ASA holds the remaining 15%. The Alvheim group will submit an exploration and development plan to the Norwegian regulatory authorities by mid-2004, and Marathon anticipates approval by third-quarter 2004 (OGJ, Mar. 1, 2004, p. 8).

The second Marathon well, Beluga, spudded early April 2004. The 30-day Beluga contract with Odfjell Drilling is worth about $25 million kroner.

Marathon drilled four exploration wells on the Norwegian continental shelf in 2003, resulting in three discoveries: Kneler and Boa in the Alvheim area, announced Apr. 15 and May 27, and the Klegg oil discovery, announced Sept. 26, 2003. The single unsuccessful well in 2003 was drilled on the Marathon operated Gekko prospect in PL203. It reached a total depth of about 7,500 ft, encountered non-commercial oil and gas, and was plugged and abandoned.

The Kneler 25/4-7 exploration well on PL203 is about 140 miles from Stavanger in 390 ft of water. The well was drilled to 7,425 ft TD and encountered a gross oil column of 155 ft with 115 net ft of pay in the Heimdal Formation.

The Boa 24/6-4 well, on Marathon operated PL088BS, is about 4.5 miles northwest of Kneler discovery. The well was drilled in 400-ft water depth from the Deepsea Bergen semisubmersible rig.

The PL088BS group initially comprised Marathon and Total E&P Norge AS, each with 50% interest. Total's interest in PL088BS was purchased by the PL203 group in the second half of 2003, and the Alvheim group now shares its interest.

The Klegg well 25/4-9S is about 7 miles north of the Heimdal platform, in production license 036, about 129 miles from Stavanger, in 394 ft of water. It was drilled to 7,440 ft TD and encountered a 213-ft gross oil column in the Heimdal formation. Marathon has a 46.9% working interest in Klegg; Norsk Hydro (operator) holds a 28.5% interest, Total E&P Norge AS has 24.2%, and AS Ugland Rederi 0.3%.

Marathon expects first production from Alvheim in 2006, and expects its combined Norwegian production to reach more than 50,000 net bo/d during 2007.

Marathon Norway has contracted for use of the Deepsea Bergen beginning in July 2005. Marathon intends to drill 10 wells in 500 days on the Alvheim project on the NCS, under the 490 million kroner contract. Marathon may extend the contract to drill 5 additional wells (estimated 60 days each).

Other NCS activity

ConocoPhillips Skandinavia AS is drilling in the Ekofisk field using the Eldfisk A platform. The company has also contracted with Odfjell Drilling to use the semisub Deepsea Trym for accommodation services supporting the Eldfisk A platform. The initial 6-month contract began Nov. 1, 2003, and is worth about 87 million kroner. It may be extended for two periods of 3 months each.

Esso Norge AS has arranged a 30-60 day contract with Odfjell Drilling to drill the West Cable exploration well with Odfjell's Deepsea Delta semisubmersible. Work will begin May 10, 2004.

Norsk Hydro awarded Odfjell Drilling an 18-month, 600 million kroner contract for use of the Deepsea Delta, scheduled to begin in third quarter 2004. The contract may be extended with six options of 6 months each. Norsk Hydro intends to drill an exploration well, a sidetrack in the Vale field, and also do some development drilling on the Vestflanken project in the Oseberg field on the NCS.

In late February, the Norwegian government approved Norsk Hydro's development of the Ormen Lange gas field, estimated to cost 66 billion kroner. The project was presented to the Storting for approval in March. The field is on the NCS, 100 km off Møre og Romsdal in 800 to 1,100 m water depth. Norsk Hydro expects to double its export of gas when the field comes onstream in October 2007.

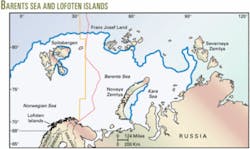

Barents Sea

According to resource accounts from the Norwegian Petroleum Directorate, two-thirds of the remaining undiscovered resources on the Norwegian continental shelf could be located in the unexplored Barents Sea, in the Arctic near the Russian border. More than 60 wells had been drilled in the Barents before the Norwegian government called a halt in 2001 because of environmental issues.

The Norwegian-Russian border is in dispute. There was some drilling in the adjacent Russian area before exploration was banned and Norway expects additional Russian activity in the sector. Oil minister Steensnaes announced that Norway would allow drilling in three areas of the Barents Sea in 2004-05, the newspaper Aftenposten reported on Dec. 15, 2003.

Norway has announced it wants three exploration wells drilled in the Barents in the next 2 years, although the area was not included in the recent 18th licensing round.

Norwegian operators are happy to oblige. They plan to drill four new exploration wells in the Barents Sea this year, according to a Feb. 18, 2004, article in the Norway Post. Statoil has long been interested in two areas in the eastern Barents Sea. Norway's public broadcaster, NRK, reports that Barents drilling could represent nearly 20% of the exploratory activity on the NCS for 2004.

Future

As prices for both oil and natural gas remain high or even increase, we can expect to see more drilling for natural gas and development of portfolio projects sidelined for economic reasons. More of the outer reaches will be offered for lease and explored, including the West of Shetlands area, the Irish margin, the Barents Sea, and perhaps even drilling outside of Norway's Lofoten Islands. F

References

1. "Grangemouth Complex," BP business activity report, http://www. bp.com

2. "Scotland Exploration and Production," BP business activity report, http://www.bp.com

3. Wood Mackenzie Group, "North Sea fields in which ExxonMobil has an interest through Shell/Esso joint operation," Oct. 30, 2003, http:// www.exxonmobil.com

4. "ExxonMobil in the UK: Offshore Oil and Gas," Mar. 24, 2004, http://www.exxonmobil.com

5. Energy Group, UK Inland Revenue, "REV BN 12: Exploration Expenditure Supplement," Budget 2004 report, http://ww.inlandrevenue.gov.uk

6. Norwegian Petroleum Directorate, "The Petroleum Resources on the Norwegian Continental Shelf, 2003," June 25, 2003, http:// www.npd.no

7. "New well on Alve," Mar. 15, 2004 Statoil press release, http:// www.statoil.com

8. Acher, J., "Shell bids for Norway Licenses," Mar. 15, 2004, Reuters.