OGJ Newsletter

Market Movement

OPEC to sustain oil production cut

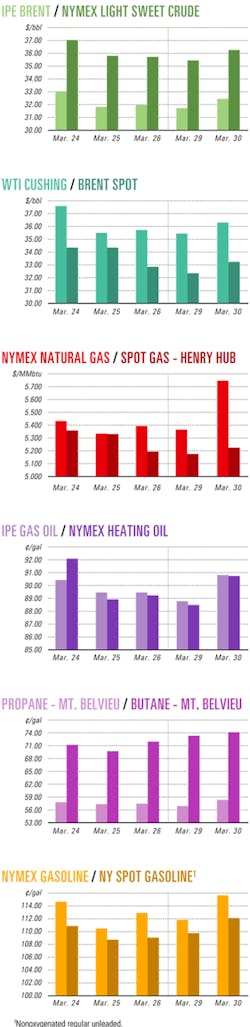

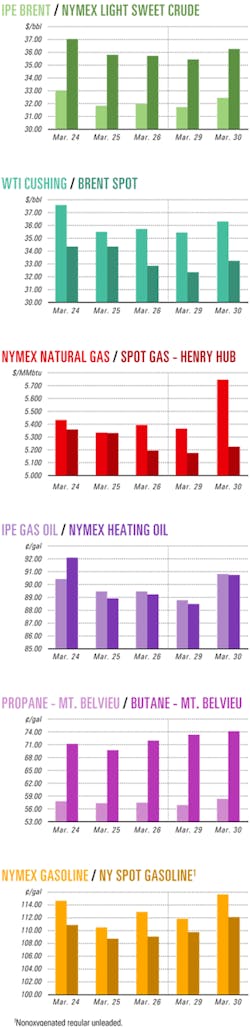

Energy futures prices climbed ahead of the Mar. 31 meeting of the Organization of Petroleum Exporting Countries in Vienna as traders lost hope that the group might postpone a 1 million b/d oil production cut planned for Apr. 1.

As widely expected, OPEC ministers quickly voted to sustain the previous agreement at their February meeting in Algiers to reduce their official oil production quota to 23.5 million b/d.

Prior to the Mar. 31 session, officials from Kuwait and the UAE had said they favored postponing the proposed production cut in line with calls by US officials for more OPEC crude to reduce energy prices. But most of the affected members—Saudi Arabia, Algeria, Venezuela, Libya, and Qatar—backed the lower quota going into that meeting.

OPEC credibility

"We took a decision in Algiers to be implemented. If we don't do that, we will lose credibility," said Chakib Khelil, Algeria's oil minister, before the Mar. 31 meeting. "The lack of credibility of OPEC would have disastrous consequences on pricing levels," he said.

"As far as Saudi Arabia is concerned, [the] Apr. 1 [reduction] has been implemented, and I believe others have done so as well," Saudi Oil Minister Ali al-Naimi told reporters Mar. 30 in Vienna.

"We expect compliance with this new quota to be minimal and forecast actual production [among the 10 affected OPEC members, minus Iraq], which is currently about 25.5 million b/d, to drop to about 25 million b/d in April and average about 24.5 million b/d in the second quarter. We estimate that the call on the OPEC-10 during the second quarter will be about 22 million b/d," said Michael Mayer, an analyst with Prudential Equity Group LLC, New York, in a Mar. 31 report.

"This means that inventories will build by about 2.5 million b/d in the second quarter, much more than the typical seasonal build of about 1 million b/d," he said.

However, Paul Horsnell, head of energy research at Barclays Capital Inc., London, said OPEC "can produce well above quota without increasing inventories beyond the usual season build."

He said OPEC's decision to implement the production cut "was almost forced by questions of credibility and by a natural risk aversion should the supply and demand picture prove worse than most currently expect it to be. However, we do not think that the OPEC-10 will have to produce anywhere near the 23.5 million b/d target ceiling."

Meanwhile, Iraq's crude production is rapidly building and is now about 2.5 million b/d—"a bit above prewar levels and higher than any quarterly average in more than 2 years," said Mayer.

But Horsnell said he is "considerably more pessimistic on the prospects for Iraq. The immediate risks to the output profile now lie on the downside."

The May contract for benchmark US light, sweet crudes jumped by 80¢ to $36.25/bbl Mar. 30 on the New York Mercantile Exchange. However, after OPEC confirmed its production cut, the NYMEX contract lost 49¢ to $35.76/bbl Mar. 31 as traders reacted to a reported build in US crude stocks.

Energy inventories

The US Energy Information Administration reported Mar. 31 that commercial US crude inventories jumped by 5.7 million bbl to 294.3 million bbl during the week ended Mar. 26.

US gasoline stocks increased by 1.4 million bbl to 200.9 million bbl during the same period, while distillate inventories dipped by 700,000 bbl to 109.7 million bbl, with a drop in heating oil more than offsetting a small increase in diesel fuel.

US imports of crude averaged nearly 10.1 million b/d in the latest week, down by 31,000 b/d from the previous week. Crude imports from Saudi Arabia were "relatively high" during the period, said EIA officials. Total gasoline imports averaged nearly 1.2 million b/d, the second highest weekly average ever, they said.

Crude inputs into US refineries averaged more than 14.6 million b/d in the week ended Mar. 26, up by 68,000 b/d from the previous week. Crude inputs into US Gulf Coast refineries averaged nearly 7.2 million b/d, the highest average since the week ended Jan. 2, said EIA.

"The US refining system again reveals a lack of flexibility and headroom, sending gasoline prices surging further upwards," Horsnell said. "The focus remains on gasoline in the weekly [EIA] data. The secondary period of seasonal inventory builds has started, but data [are] still showing a system that is very stretched. Product yields are now being very heavily skewed towards gasoline. Crude oil inventory build will abate in coming weeks as refinery runs rise."

Industry Scoreboard

null

null

null

Industry Trends

OIL COMPANIES are showing renewed interest in Libya.

Shell Libya Petroleum Development BV has signed a heads of agreement with Libyan National Oil Corp., establishing a long-term strategic partnership that could lead to the development of world-class integrated upstream projects to enhance Libya's oil and gas production and its LNG export capacity.

The HOA comprises a preliminary understanding regarding key principles that outline Shell's Libyan participation, including onshore exploration and the development of LNG facilities. The companies will continue negotiations on specific projects throughout the year.

"I look forward to our cooperation to becoming a cornerstone in a renewed trade relationship between the UK and Libya," said Malcolm Brinded, CEO of Shell Exploration & Production and Shell Gas & Power.

Shell had been active in the Libyan upstream from the 1950s until 1974 and also explorated there in the late 1980s.

Shell's move comes on the heels of a statement last month by US President George W. Bush essentially opening the door to US and non-US oil companies' resumption of business relationships with Libya, previously banned since 1996 by the Iran-Libya Sanctions Act (OGJ, Feb. 9, 2004, p. 20). Unless renewed, the controversial US legislation will expire in 2006.

Earlier this month, Occidental Petroleum Corp. Pres. Ray R. Irani also met with Libyan officials to discuss resumption of its operations that were suspended in 1986 (OGJ Online, Mar. 15, 2004). Oxy plans to open an office in Tripoli soon, Irani said.

THE FORMER SOVIET UNION holds promise for international oil service companies.

Outside the Middle East, the largest seven identified oil and gas projects worldwide are in the FSU, providing "an enormous opportunity for Western oil field services to step into the fray," said Banc of America Securities LLC analyst James K. Wicklund of Houston.

"While only a small percentage of oil service company revenues today come from the former Soviet Union, this exposure should provide a healthy growth opportunity going forward," Wicklund said in a research note last month.

The Energy Information Association predicts that non-OPEC nations, primarily Russia and those in the Caspian Sea region, will drive higher levels of oil supply. Wicklund agrees that the FSU will lead the non-OPEC production gains.

He expects a greater percentage of capital in the FSU to be spent on drilling and drilling-related services in the near term.

Currently, dedicated service companies of the Russian oil majors dominate the oil services business in Russia, he said, noting that "significant potential exists" for non-Russian companies to get involved in key projects in Russia, Kazakhstan, and Azerbaijan.

Wicklund expects to see a growing trend in which Western oil service companies will acquire or partner with Russian service companies.

"Acquiring locals is not the end of the story, however. On the ground, international service companies must train locals on new equipment, technology, project management, and even vocabulary," he said.

A challenge for international service companies will be learning to understand the FSU customer, he said.

Government Developments

A RUSSIA-BELARUS natural gas delivery standoff has ended.

Russia's OAO Gazprom and TransNafta have resumed gas deliveries to Belarus, Interfax news agency reported last month.

Gazprom had ceased deliveries on Jan. 1, and TransNafta's contract expired Feb. 18. At that time, Belarus, which depends totally on Russia's energy resources, said it had stocks of 600 million cu m of gas, enough for to meet basic needs for 10-20 days. Belarusian President Alexander Lukashenko, denouncing what he called Russian "terrorism," agreed to buy Russian gas on Moscow's terms.

Gazprom supplies 25% of Europe's gas needs, with 17% of that delivered through Belarus.

While Russia and Belarus resolved their dispute, Gazprom supplied gas to Lithuania and Russia's western enclave of Kaliningrad through Latvia. Poland's gas monopoly, Polish Oil & Gas Co., said it faced a 10% shortfall in supplies, and arranged to tap its 10-20 day inventory of gas and to receive Russian gas deliveries via Ukraine, through which Russia's biggest gas customer, Germany, receives most of its Russian gas.

The Russia-Belarus quarrel involved several issues. Belarus wanted to receive the same amount in transit fees from Russia as neighboring Ukraine does. Moscow no longer wanted to sell Belarus gas at Russia's domestic prices, and it charged Belarus with failing to pay for gas supplies. Gazprom also charged that Belarusian gas pipeline operator Beltransgaz, which carries Russian gas to Western markets, was siphoning gas intended for Poland and Lithuania.

During the standoff, Gazprom was said to have lost $10 million/day in deliveries.

THE US Minerals Management Service said three major oil companies have agreed to a 6 month, 100,400 b/d royalty in-kind arrangement designed to help fill the Strategic Petroleum Reserve.

MMS will take crude oil instead of cash for certain Gulf of Mexico leases operated by ChevronTexaco Corp., Royal Dutch/Shell Group, and ExxonMobil Corp. The US Department of Energy will exchange the RIK oil for crude that can be better stored in SPR sites.

MMS also will ship 12,000 b/d of royalty crude directly to DOE, with one unspecified producer transporting another 2,700 b/d to DOE.

The SPR is now about 93% full; its capacity is about 700 million bbl. MMS said the combined transactions means a total of 115,000 b/d will be sent to the SPR from April through September.

Some in Congress would like to see the reserve expanded to 1 billion bbl. But given that building new capacity could cost several billion dollars, it's unlikely that idea seriously will be considered unless the US experiences severe supply shocks in the near future.

Meanwhile, some lawmakers want DOE to suspend the current fill program while crude prices are higher than normal. But US Sec. of Energy Spencer Abraham last month ruled out deferring the SPR fill.

He told lawmakers that the security benefits of filling the reserve far outweigh any negative market signal that comes when the crude is pulled off the market.

Quick Takes

QATAR PETROLEUM CO. and Sasol Chevron Consulting Ltd. are studying the feasibility of expanding the capcity of the Oryx gas-to-liquids plant at Ras Laffan Industrial City, Qatar, to 100,000 b/d from 34,000 b/d. The plant would add a three-train, 65,000 b/d facility and start up by 2009. In addition, QP and Sasol Chevron will develop a 130,000 b/d upstream-downstream integrated GTL project based on Sasol's slurry phase distillate process and utilizing natural gas resources from Qatar's North gas field. This will entail installing a six-train facility to start up by 2010. The combined plans represent an investment of more than $6 billion. Marathon Oil Co. and Syntroleum Corp., Tulsa, have shipped the first synthetic diesel fuel from the new GTL demonstration plant at Port of Catoosa, near Tulsa (OGJ Online, Oct. 7, 2003). The companies and the US Department of Energy funded the $60 million facility. It is designed to produce 70 b/d of ultraclean transportation fuels for a long-term testing and demonstration project involving government fleet vehicles. The National Energy Technology Lab will administer the program, and Integrated Concepts & Research Corp. is overseeing testing programs. Following this program, Syntroleum will support testing programs for the US departments of Defense and Transportation.

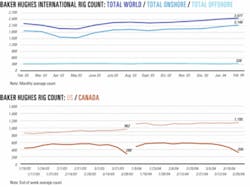

US DRILLING ACTIVITY hit a 30-month high the week of Mar. 22, increasing by 22 rotary rigs to 1,150—the biggest number since mid-September 2001, Baker Hughes Inc. reported. That's up from 962 during the same period last year. All of the gain was in land operations, up by 28 to 1,046 rigs working. Inland waters activity was down by 3 rigs to 14, while offshore operations decreased by 4 rigs to 88 drilling in the Gulf of Mexico and by 3 to 90 in US waters as a whole. With the seasonal thaw, Canada's rotary rig count plunged by 131 to 320 this week, compared with 288 for the same period a year ago. AS Norske Shell, production operator for Ormen Lange natural gas field on deepwater Block 650515/5-1 in the Norwegian Sea, intends to award a $167 million contract to Smedvig ASA, Stavanger, for the semisubmersible drillship West Navigator to drill in the field for 740 days, beginning in second half 2005. The assignment, subject to Ormen Lange governmental approval, includes eight deepwater wells with options for four others. Ormen Lange is scheduled to come on stream in October 2007. The field contains proved reserves of 90 million boe, a figure Shell recently revised downward from 256 million boe (OGJ Online, Mar. 18, 2004). BP Amoco Sharjah has awarded a 2 year extension to Halliburton's Energy Services Group to continue underbalanced drilling services in BP's Sajaa field in Sharjah, UAE. BP recently applied underbalanced drilling to complete its tenth well in the field.

THE US MINERALS MANAGEMENT SERVICE issued a proposed notice of Sale 192, a sale of offshore oil and natural gas leases in the western Gulf of Mexico scheduled for Aug. 18 in New Orleans. The proposed sale includes 3,890 unleased blocks encompassing 21.1 million acres in the western gulf's Outer Continental Shelf planning area off Texas and in deeper waters off Louisiana, MMS said. The blocks lie 5-357 km offshore in 8-3,100 m of water. The proposed sale could result in an estimated production of 136-262 million bbl of oil and 0.81-1.44 tcf of gas, MMS said. BP Egypt found natural gas and condensate off Egypt in the western Nile Delta with its Raven 1 exploration well. The well, drilled northwest of Rosetta, 40 km off Egypt in 650 m of water, is in the North Alexandria concession. Raven 1 tested at 37.4 MMscfd of gas and 741 b/d of condensate. Raven 1 is the second of a three-well program BP is operating in the Nile Delta. BP operates the North Alexandria concession with 60% working interest; Germany's RWE-DEA AG holds the remaining interest. Continental Energy Corp., Langley, BC, plans to develop 5.5 million bbl of oil from Bangkudulis field in East Kalimantan, Indonesia. A subsidiary would develop the field in the Tarakan basin in northeastern Borneo (OGJ Online, Sept. 27, 2000). The A1 discovery well tested more than 6,000 b/d of sweet, 40° gravity oil from 119 ft of net pay in four sandstone zones near 3,200 ft. A fifth zone flowed 4.5 MMcfd of gas.

The $18.5 million Phase 1 involves drilling three producers and treating or working over the A1 well. Facilities will be designed for 3,000 b/d of output, although Phase 1 target production is 1,500 b/d. Phase 2 would entail 18-24 wells. Unocal Ganal Ltd. drilled a successful appraisal well in Gehem field 300 ft downdip of Gehem-1 on the Ganal PSC area off East Kalimantan. Gehem-2 was drilled in 6,036 ft of water to 17,505 ft TVD. Tests showed a single gas column of more than 550 ft with a potential 1.5 tcf of recoverable gas, the company said. I the dil stem test, Gehem-2 flowed 31.3 MMcfd of gas and 1,917 b/d of condensate, constrained by test equipment capacity. The well had flowing tubing pressure of 6,545 psi on a 32/64-in. choke. Unocal next will drill a deep test on the Gula structure, immediately south of Gehem, and then a third Gehem well in the second quarter. Operator Unocal Ganal holds an 80% working interest, and ENI-Ganal Ltd. holds the remainder.

Forest Oil Corp., Denver, reported test results for its No. 1 discovery well drilled on West Cameron Block 112 on the deep-shelf Gulf of Mexico. The well, drilled to 15,325 ft TD, flowed 15.4 MMcfd of natural gas and 322 b/d of condensate, with a flowing tubing pressure of 10,475 psi. Forest expects initial production to reach 20-25 MMcfed of gas in the third quarter. Operator Forest holds 55% working interest in the well; Dominion Exploration & Production Inc., a unit of Richmond, Va.-based Dominion, holds the remainder. Statoil ASA spudded an appraisal well Mar. 14 in Alve gas and condensate field, near Norne field in the Norwegian Sea, to determine if crude oil is present or if the field is commercial via a tie-in with the Norne complex. "There's a good chance that possible additional resources in Alve will be oil," the company said. Statoil has a 50% interest in Alve. Other owners are Royal Dutch/Shell Group 40% and Norsk Hydro AS 10%.

MIDAMERICAN ENERGY HOLDING CO., Des Moines, Iowa, has withdrawn its application to the state of Alaska for authorization to develop a $6.3 billion natural gas pipeline from the North Slope producing area to the Lower 48. MidAmerican subsidiary Alaska Gas Transmission Co. filed the application in January with Cook Inlet Region Inc. and Pacific Star Energy, a group of 12 Alaska Native corporations (OGJ Online, Jan. 26, 2004). MidAmerican said the decision—based in part on difficulties in negotiating with the state—is supported by all participants. Warren Buffett and his Berkshire Hathaway Corp. are the major owners of MidAmerican Energy. TransCanada Corp., Calgary, meanwhile, has renewed negotiations with the state of Alaska on the proposed Alaskan portion of the Alaska Highway pipeline project. Company officials said the state extended to TransCanada the same offer that was made to MidAmerican Energy on Mar. 25. TransCanada said it would work to resolve right-of-way issues in Alaska and is open to potential participation of the various Alaska Native corporations. ETC Texas Pipeline Ltd., Dallas, selected Willbros Group Inc.'s construction unit Willbros RPI Inc., Houston, to construct 81 miles of 20-, 30-, and 36-in. natural gas pipelines that will expand ETC's Energy Transfer pipeline system in Texas. Construction is under way and expected to be completed in the third quarter. El Paso Energy Partners LP unit El Paso Field Services, Houston, awarded Willbros RPI a contract to construct about 30 miles of onshore pipeline and the marsh portions of a 24-in. oil pipeline in the Port Neches, Tex., area. The project is a section of El Paso's 380 mile Cameron Highway oil pipeline system that will deliver as much as 500,000 b/d of oil from deepwater production sites in southern Green Canyon and western Gulf of Mexico areas to onshore Texas terminals at Texas City and Port Neches. Work is expected to be completed in the second quarter.

WOODSIDE ENERGY LTD. will invest $1.48 billion (Aust.) in Enfield oil field development on permit WA-271-P off Western Australia. Enfield, 40 km northwest of Western Australia's North West Cape, has reserves of more than 125 million bbl of oil. Operator Woodside, which holds 100% of the permit, said it could bring Enfield into production by fourth quarter 2006. The development would have an initial output of 100,000 b/d of oil and would provide growth potential through a tieback of nearby discoveries, such as Laverda field. The development will include five production wells, six water injection wells, and flowlines to a 900,000 bbl floating production, storage, and offloading vessel. Pemex Exploration & Production Co. plans to award Global Offshore Mexico S de RL de CV a $40 million contract to install three oil and gas pipelines linking production platforms in Akal oil field off Mexico. The Akal-MB development project is in the Cantarell complex in the Bay of Campeche 80 km off the Yucatan Peninsula (OGJ, Aug. 27, 2001, p. 54). Global's Shawnee pipelay-derrick barge will install a 12-in. gas pipeline from Akal BN to Akal-MB and two 24-in., two-phase, oil-gas pipelines—one from Akal-MB to Akal-B and one from Akal-MB to Akal-M. Global's Titan 2 vessel will perform hook-up activities. Pipelaying will begin this spring.

PRIVATELY HELD IRVING OIL LTD., St. John, NB, has submitted an environmental impact statement (EIS) to the Canadian government for the proposed 500 MMscf LNG receiving terminal it is planning at the site of its ice-free oil terminal, Irving Canaport, near St. John. The $500 million (Can.) project was announced in mid-2001 (OGJ Online, July 25, 2001). Pending approvals, Irving would install three 140,000 cu m LNG storage tanks, regasification facilities, and a 350 m offloading jetty with mooring facilities for LNG carriers having a capacity of as much as 200,000 cu m. Calpine Corp., San Jose, Calif., which was in the early stages of investigating the feasibility of constructing an LNG receiving and regasification terminal at Samoa Point, in Eureka, Calif., has withdrawn those plans. The company said it is ceasing development activities on the project. Calpine spokesman Bill Highlander said the company had no partners at the time of the decision and had not yet filed any permit applications. "Based on feedback from the local community and public officials, we believe this decision is best for all parties," said Calpine Vice-Pres. Ken Koye.

A GASOLINE-PRODUCING UNIT caught fire at BP PLC's Texas City, Tex., refinery Mar. 30. The blast was contained to that particular unit and no injuries resulted, a BP spokesman said. The fire was extinguished within 4 hr, and the 435,000 b/d refinery continued to operate at near-normal rates the following day, he said. BP and regulatory agencies are investigating the incident. No damage estimate was available. BP declined to specify the unit involved, but others familiar with refinery operations said that it was an ultraformer, which produces blending components that boost octane in gasoline. Texas City authorities said the fire was an accident, and that there was no indication that terrorism was involved. Husky Energy Inc., Calgary, reported that it plans to upgrade its 10,000 b/d Prince George, BC, refinery. The $73 million (Can.) upgrade will increase the plant's production by 2,000 b/d and equip the facility to produce low-sulfur gasoline and diesel fuels that will meet Canada's new fuel specifications, Husky said. Montreal-based engineering and construction firm SNC-Lavalin Inc. will provide Husky with design and construction management for this project. The upgraded facility is expected to be on stream by second quarter 2005. The 250 million euro project to integrate the refining and petrochemicals divisions at the Mobil-Esso twin sites of Port-Jérôme-Gravenchon in Normandy will be completed in October, said Esso Raffinage SAF Chairman and CEO Dominique Badel Mar. 25 at a press conference. About 20% of construction has been completed. He said 95 million euros would be added to last year's 100 million euro outlay to achieve the "PJ21" project, which he described as "the largest European refining project." In addition, 17 million euros have been added to PJ21 to improve installations and integrate the two refineries.