Gasoline price controversy

It seems lately that US drivers can't turn on the television without being bombarded by local and national news outfits about the latest gasoline price hike. Will the average price of gasoline top the $2/gal mark? Is Big Oil again gouging consumers to put more money in its pockets?

US consumers already are livid about the high prices of gasoline. Typically, consumers do not see the rising prices of gasoline until it gets closer to the peak driving season, which starts around Memorial Day weekend in late May. So why the early rise in prices? The simple rationale of supply and demand is the main focus once again.

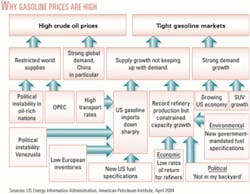

There are numerous factors that influence the price of gasoline (see figure). However, the major components are high crude oil prices and a tight gasoline market.

Oil prices vs. gasoline prices

Last year, when war broke out in Iraq, US drivers saw a jump in prices at the pump. The retail price of gasoline last year at this time, according to Oil & Gas Journal's weekly survey (see Statistics section, p. 70), was $1.72/gal for regular self-serve. Today prices for the same fuel are averaging $1.77/gal.

Restricted world oil supplies, strong worldwide oil demand, the war in Iraq, and the actions of the Organization of Petroleum Exporting Countries all have influenced the price of crude.

Futures prices for May delivery of light, sweet crude closed on Mar. 29 at $35.45/bbl, the lowest since Feb. 24. At this writing—on the eve of OPEC's scheduled Mar. 31 meeting in Vienna—energy futures saw a slight decline in prices for oil, due partly to the expectation that the organization might change its earlier decision to cut production by 1 million b/d effective Apr. 1—a decision that would tighten supplies. But that expectation proved incorrect (see Market Movement, p. 5).

History shows that refiners' acquisition costs are the most influential element in the overall price of gasoline. According to data presented by the American Petroleum Institute, crude costs represented about 44% of gasoline prices in March. In 1980, crude costs accounted for 54%. API's data reflects that gasoline prices in 1980, adjusted for inflation, actually were higher at $2.77/gal.

Despite today's tougher fuel specifications for refiners, the cost of refining and marketing actually has decreased to about 56¢/gal, accounting for 31% of the total cost.

Taxes, both federal and state, also account for a large portion of the retail price of gasoline.

Tight gasoline market

Demand for motor gasoline continues to grow as the US economy picks up. According to the latest data in OGJ's scoreboard for Mar. 19, the 4-week average for motor gasoline was up 6.6% to 9.136 million b/d vs. last year's average of 8.571 million b/d. It is expected that this trend will continue throughout the summer months.

Another strain on the gasoline market is the low inventory of gasoline going into the summer months. Complicating that situation is the fact that US refiners have introduced 18 new formulations, effective this year, to replace the gasoline additive methyl tertiary butyl ether that was banned this year in California, New York, and Connecticut. Those states represented a large portion of all reformulated gasoline sold.