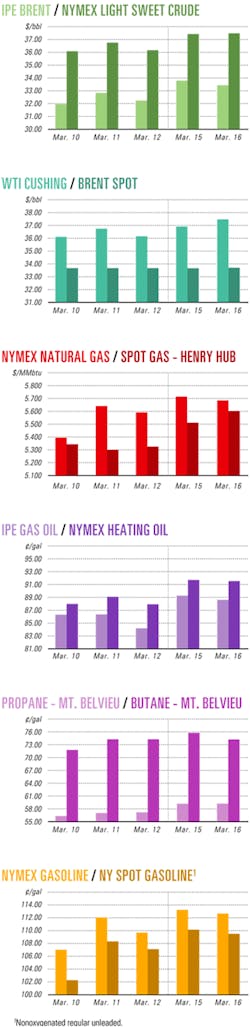

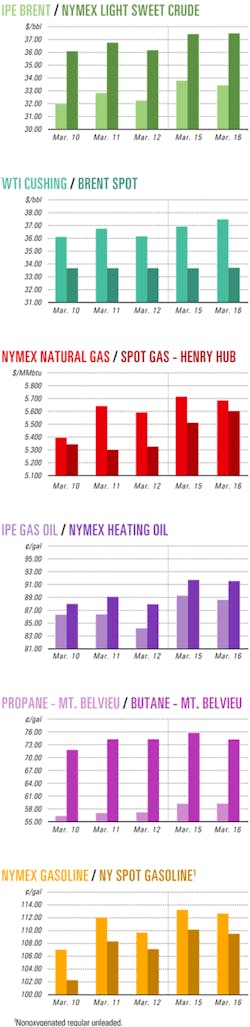

Crude futures prices push record levels

The next-month futures contract for benchmark US light, sweet crudes hit a 13-year high of $38.35/bbl on Mar. 17 before closing at $38.18/ bbl, up 70¢ for the day on the New York Mercantile Exchange, as traders ignored a build in US crude inventories to focus on an unexpected drop in gasoline stocks.

This quarter will record the highest average NYMEX price for benchmark US crudes "since futures trading began in 1983," predicted Paul Horsnell, head of energy research, Barclays Capital Inc., London. "The current month may also record the highest single-month average."

The current record average price for front-month benchmark US crudes is $35.92/bbl, set in October 1990, 2 months after Iraq's invasion of Kuwait. "However, the average for March 2004 to date is higher at $36.67/bbl, raising the strong possibility that this month could represent a new high point," Horsnell reported Mar. 17.

"It is already absolutely inevitable that the current quarter will be the highest in the 21-year history of [NYMEX crude] futures [prices]," he said. "The previous high was the first quarter of last year when prices averaged $33.80/bbl. With just 11 trading days to go, the average for this quarter is currently running more than $1 higher at $34.92/ bbl."

Gasoline leads market

Meanwhile, gasoline for April delivery jumped by 3.4¢ to $1.16/gal Mar. 17 on NYMEX after the US Energy Information Administration reported US gasoline stocks fell by 800,000 bbl to 199.6 million bbl during the week ended Mar. 12, marking the first time since Nov. 28, 2003, that gasoline stocks have fallen below 200 million bbl.

Gasoline is 9.8 million bbl below the 5-year average for this time of year, said EIA officials. They reported distillate fuel inventories also fell, by 900,000 bbl to 11.8 million bbl, with declines in both diesel fuel and heating oil, while US inventories of crude increased by 1.6 million bbl to 281.1 million bbl during the same period.

US oil imports were down by 290,000 b/d to 9.5 million b/d in that period, with large decreases on the Gulf and East Coasts. Crude imports from Saudi Arabia apparently were "relatively low again," said EIA. Crude inputs into US refineries decreased by 269,000 b/d to average nearly 14.5 million b/d, with the largest declines seen in the Midwest and on the West Coast. Nevertheless, EIA reported, "Finished gasoline production averaged nearly 8.6 million b/d, the largest amount since the week [ended] Dec. 26, 2003."

The American Petroleum Institute subsequently reported US gasoline stocks fell by 1.2 million bbl to 197.96 million bbl during the week ended Mar. 12, with distillate stocks down by 625,000 bbl to 112.8 million bbl. It said US crude inventories dipped by 75,000 bbl to 282.2 million bbl.

US gasoline inventories "are tracking last year's path" that "resulted in the two largest price spikes in history and is therefore not a good one to follow," Horsnell said. "Furthermore, inventories are not gaining ground on last year, even with output running more than 500,000 b/d higher and imports moving sharply higher even earlier than last year."

He said, "The degree of additional supply-side flexibility at this point can be roughly assessed as being zero."

Meanwhile, the American Automobile Associa- tion recently reported that US retail pump prices for gasoline are nearly identical to those of a year ago just before the US-led invasion of Iraq. The current nationwide average retail price for self-serve regular gasoline is $1.72/gal, up 0.5¢ from a year ago.

OPEC not to blame?

Under the circumstances, there's no need for members of the Organization of Petroleum Exporting Countries to postpone the 1 million b/d production cut scheduled for Apr. 1, Horsnell said.

"They can see crude oil inventories rising, albeit at no more than the usual seasonal pace and from a lower-than-normal base, and they can see the deficit in total inventories from the 5-year average continuing to narrow," he said. "If they conclude from this that the main issue is a downstream problem of US gasoline production and logistics, they would probably infer that throwing more crude oil at the problem is not the solution."

Instead, Horsnell said, "It would put the root cause for higher global [crude oil] prices firmly at the feet of the US gasoline system and absolve OPEC of any suggestion that they had the responsibility to compensate by the overprovision of crude oil. Indeed, they would probably worry even more about the possibility of laying the grounds for a more severe price fall later, making it seem even more logical to continue with significant output cuts."

Industry Scoreboard

null

null

null

Industry Trends

CASPIAN SEA oil reserves will not free the US from its dependence on the Organization of Petroleum Exporting Countries by 2008, one analyst said.

In a research note last month, Raymond James & Associates Inc. analyst Wayne Andrews called the Caspian reserves "only a minnow in the vast ocean of Middle Eastern oil." Andrews is based in Houston for the St. Petersburg, Fla., firm.

Currently, the Baku-Tbilisi-Ceyhan pipeline is under construction to accommodate further development by Azerbaijan International Operating Co. of the Azeri-Chirag-Gunashli (ACG) complex off Baku. The pipeline will bring oil from Caspian fields to Turkey where it will be exported.

ACG Phase 1 produces less than 150,000 b/d of oil. ACG plans to ramp up production to 1 million b/d by 2008 in three phases, starting with 350,000 b/d in 2005 (OGJ Online, Sept. 18, 2002).

But Andrews said that if production increases sevenfold in 4 years, then the growth represents an extra 850,000 b/d.

"To put this in context, we project that global oil demand in 2004 will average 80.5 million b/d. Even assuming a very conservative 1.2% annual demand growth for the next 4 years, 2008 demand would reach 84.4 million b/d, 3.9 million [b/d] higher than currently," he said.

That means that Caspian oil would provide slightly more than 1% of global supply in 2008, he concluded.

FOR THE FIFTH consecutive month, the International Energy Agency in its Mar. 11 report raised its forecast of growth in 2004 global oil demand, this time by 220,000 b/d to 1.65 million b/d, for a total 80.2 million b/d, on the strength of rising demand in China and other Asian countries outside of the Organization for Economic Cooperation and Development (OGJ Online, Mar. 12, 2004). IEA also raised its 2003 oil demand increase assessment by roughly 100,000 b/d, to 1.59 million b/d, with the bulk of that gain also in non-OECD Asia.

"Chinese economic expansion is boosting neighboring econo- mies, fueling oil demand growth in the entire region," officials said. Fourth quarter data, both new and revised, "show soaring demand in Taiwan, Thailand, and Singapore and recovering consumption in India," they reported.

"While the sustainability of China's rapid economic growth rates remains a matter of debate, structural shifts in Chinese oil demand set the stage for continued expansion," IEA said.

Total world oil supplies rose by roughly 60,000 b/d to 82 million b/d during February. Production among members of the Organization of Petroleum Exporting Countries fell by some 90,000 b/d last month, while non-OPEC production increased by about 140,000 b/d, EIA said. Production by the 10 OPEC countries subject to quotas, excluding Iraq, held relatively steady at 25.8 million b/d during February, representing 1.3 million b/d of overproduction.

Government Developments

POLITICAL TENSIONS remain high in Venezuela, and the threat of violence there will linger, with continuing upward pressure on oil prices this year the likely result.

Opposition to Venezuelan President Hugo Chávez got a boost last week when the electoral branch of the Venezuelan Supreme Court essentially validated enough referendum signatures to allow a recall referendum election to proceed. The court's surprise decision rejuvenated the campaign to oust Chávez, after the National Electoral Council earlier had refused to confirm more than 876,000 referendum petition signatures, thereby putting the opposition short of the 2.4 million required.

On Mar. 17, however, the court's constitutional branch—seen as friendlier to the regime—vacated the decision. Now the full 20-magistrate court must settle the issue.

Therein lies the likelihood of a protracted legal wrangle that is likely to underpin simmering tensions and higher oil prices in the months ahead.

Chávez, meanwhile, continues to bait the US government and demonize the Bush administration as the alleged source of a possible coup against him. He ratcheted up the dispute last week when he offered political asylum to ousted Haitian President Jean-Bertrand Aristide. Chávez claimed his government will not recognize the new, US-supported Haitian administration, and he reiterated Aristide's claims that US troops forced the Haitian leader into exile—even going so far as to claim that US troops "kidnapped" Aristide.

The Venezuelan leader also has threatened to cut off oil supplies to the US should he perceive US attempts to remove him from office—even as state oil company officials seek to improve relations and reaffirm oil supply commitments to the US (see related story, p. 27).

Even if the referendum proceeds, that doesn't mean the unrest would ease. Under the Venezuelan constitution, having a successful recall vote after Aug. 19 allows the current vice-president to fill out the recalled president's term. That would keep Chávez's party in power until the next scheduled election in 2006—an outcome anathema to the opposition.

If the recall referendum election is allowed to proceed, it could come as early as next month.

But there is no guarantee that Chávez even would lose the referendum; while some polls in Venezuela show support of as much as 70% for his recall, he remains popular with Venezuela's poor, still a majority in the country. And if Chávez is recalled, he has vowed to defy the recall, which he deems an illegal, US-orchestrated ouster of his regime.

So civil strife is likely to continue in Venezuela no matter what shakes out in terms of the recall referendum.

A complete halt to Venezuelan oil production and oil exports—as with last year's strike—is unlikely this year. That's because the mass firings that were the government's response to the strike amounted to a "political cleansing" of state owned Petroleos de Venezuela SA. Although the remaining PDVSA staff is stretched to the limit after the loss of 18,000 employees, or nearly half the company's workforce, the state company insists its production and exports have recovered to nearly normal levels (OGJ, Dec. 22, 2003, p. 22).

But remaining staffers also warned of continuing sabotage attempts targeting oil facilities. As the opposition's frustration mounts over the stymied recall referendum election, efforts from outside PDVSA to cripple the country's oil sector may not prove as successful as last year's strike but could bedevil production and exports enough to add yet another risk premium to oil prices this year.

Quick Takes

Central Lease Sale 190 for federal oil and natural gas leases off Louisiana, Mississippi, and Alabama drew apparent top bids totaling $368.8 million out of total offerings of $636.8 million by 83 companies Mar. 17 in New Orleans.

The sale drew 829 bids on 557 of the 4,324 tracts offered, comprising nearly 23 million acres in the Gulf of Mexico. "The fact that this was the highest number of bids received in a Central Sale in the past 6 years is a clear indication of the industry's continued confidence in the gulf as a source of energy for the nation," said Johnnie Burton, director of the US Department of the Interior's Minerals Management Service, which conducted the sale.

A large number of tracts drawing bids were in ultradeep waters. However, MMS officials said 60% of the bids were for tracts on the Outer Continental Shelf. "We believe this reflects definite industry interest in deep gas in shallow waters in response to royalty relief offered as part of MMS's deep gas initiative," said Burton.

Amerada Hess Corp. submitted the highest single bid of the sale, nearly $35.3 million for Green Canyon Block 468. That was one of 17 apparent high bids submitted by that company for a total $40.7 million, putting it at the top of the list for the total amount of apparent high bids submitted. Other companies on that list include BHP Billiton Petroleum (Deepwater) Inc., 32 bids totaling $18.5 million; Stone Energy Corp., Lafayette, La., 8 bids, $15.5 million; Pogo Producing Co., Houston, 15 bids, $12.6 million; and Tana Exploration Co. LLC, Corpus Christi, Tex., 10 bids, $12.1 million. When the leases are officially awarded, Pogo will be sole owner of each of the 15 leases on which it was apparent high bidder, out of a total of 20 tracts for which it submitted offers, the company said.

Companies submitting the largest number of high bids included Magnum Hunter Production Inc., Irving, Tex., 55 bids totaling $8.3 million; BHP Billiton, 32, $18.5 million; Chevron USA Inc., 29, $10 million; Remington Oil & Gas Corp., Dallas, 25, $4.6 million; BP Exploration & Production Inc., 24, $8.2 million.

Along with its partners, Kerr-McGee Oil & Gas Corp., Oklahoma City, the largest independent operator and producer in the deepwater Gulf of Mexico, was apparent high bidder on 8 shelf and 14 deepwater leases in the sale. The company's net total exposure for all high bids was about $9 million. Pending MMS approval of the sale, Kerr-McGee will be designated operator of at least 95% of the high-bid leases, with an average working interest of 91%.

Spinnaker Exploration Co., Houston, submitted apparent high bids on 15 blocks, including 7 on the shelf and 8 in the deep water, out of 24 tracts on which it bid. Its bids for shallow-water tracts were primarily related to deep shelf gas prospects, officials said. Spinnaker's net exposure on its apparent high bids is about $9.2 million.

Venezuela's Ministry of Energy and Mines has selected ChevronTexaco Corp. unit ChevronTexaco Overseas Petroleum Inc. to operate Plataforma Deltana Block 3 offshore exploration license on Venezuela's Atlantic continental shelf. The company early last year received a license to operate Plataforma Deltana Block 2, in which it now is a partner with ConocoPhillips and state oil company Petroleos de Venezuela SA (OGJ Online, Feb. 10, 2003). Statoil ASA last year was awarded Block 4. The Deltana Plataforma area exploration and production license initiative consists of five blocks totaling 3,000 sq km that are believed to contain giant natural gas-prone structures. Block 5 has not yet been awarded.

Sipetrol International SA, Santiago, operator for a three-company group, has made another oil discovery on the North Bahariya concession in Egypt's Western Desert. Sipetrol, the international unit of Chile's state oil firm ENAP, reported that this discovery closely follows the firm's Ganna-1 oil discovery last year that identified similar, larger structures on the same concession (OGJ Online, Dec. 23, 2003). The Ferdaus-1 exploratory well was drilled on a separate structure 4.5 km east of the consortium's Ganna-1 discovery. The well was completed to 9,479 ft TD in the Kharita formation. Cores were cut from two separate reservoirs, both indicating strong presence of hydrocarbons. Two intervals in the Upper Cretaceous Abu Roash formation tested 43° and 45° gravity oil at 940 b/d and 2,300 b/d, respectively, in water 8,600-8,750 ft deep. In the coming weeks, ENAP said it expects to present to the Egyptian General Petroleum Corp. its development plan for these two discoveries. The consortium also plans to spud another exploratory well on the concession over the next 2 months. Production from the block is expected later this year. Concession interest holders are Sipetrol 50%; IPR Transoil Corp., a member of the IPR Group of Cos., Irving, Tex., 30%; and INA Naftaplin of Croatia 20%. Oilexco Inc., London, said a second appraisal well has defined the Brenda oil find in the UK Central North Sea to be a "stratigraphic trap of significant proportion." The company plans to production-test the 15/25b-8 well, which intersected 56 ft of high-quality oil pay in a Paleocene Forties channel sand. The 15/25b-8 well is the second appraisal well to the Brenda discovery, originally made in 1990 by the 15/25b-3 well. The 15/25b-6 well tested 2,980 b/d of 40° gravity oil through a 40/64 in. choke under stable flowing conditions from the Forties sandstone in late January (OGJ, Mar. 1, 2004, p. 9). The discovery is on License P1042, Block 15/25b, in the Outer Moray Firth. Oilexco holds 100% working interest.

STATOIL, on behalf of its partners on Production License 128 in the Norwegian Sea, has given a letter of intent to drilling contractor Transocean Inc. for the charter of its Transocean Arctic drilling rig for work in Norne field and two of its satellites. The contract is valued at 700 million kroner. The rig's 19 month assignment is to drill a sidetrack in Norne, followed by seven to eight production and injection wells in nearby Svale and Stær fields, which will be developed with subsea equipment and tied back to Norne (see map, OGJ, Apr. 29, 2002, p. 8).

Drilling is scheduled to begin July 1, pending approval of the satellites' development and operation plan.

PETROBRAS NETHERLANDS BV, Rotterdam, a unit of Brazilian state oil company Petróleo Brasileiro SA (Petrobras), has awarded GE Energy, Florence, a contract for the supply of two compression modules for its new P-52 semisubmersible production platform to be placed in Roncador field in the Campos basin off Rio de Janeiro state, Brazil.

P-52, which will be the largest facility off Brazil to extract oil and gas in ultradeep water, will be designed to produce 180,000 b/d of oil and 9 million cu m/day of associated gas (OGJ Online, Dec. 19, 2003). GE's contract includes engineering, construction, unit commissioning and tests, transportation, and training as well as technical assistance during the construction, testing, commissioning, and start-up of the semisubmersible units. The modules will be shipped by August 2005, and commercial operation is expected by 2007.

ConocoPhillips (UK) Ltd. began natural gas production of nearly 140 MMscfd (gross) Mar. 6 from Boulton H gas field in the southern UK North Sea, following the successful completion of the Boulton H development well, 44/22b-H1x. Boulton H is the last field to be brought on production as part of the five-field CMS III development program, said project partner Tullow Oil UK Ltd. CMS III has been developed with the production and transportation facilities of the Caister Murdoch System (CMS), which lies 115 miles northeast of Lincolnshire. Production from the five fields—Murdoch K, Hawksley, McAdam, Watt, and now Boulton H—originates from a number of different Carboniferous reservoirs, Tullow said. Currently, combined production from the fields is 310 MMscfd (gross) of gas. Tullow reported that an additional compressor unit that was installed as part of the CMS III development program is now operational on the Murdoch platform. The unit doubles CMS compression capacity, boosting overall CMS production by about 15%. Partners in CMS III development are operator ConocoPhillips 59.5%, GDF Britian Ltd. 26.4%, and Tullow 14.1%.

CHINA NATIONAL OFFSHORE OIL CORP. (CNOOC) has signed an agreement with the provincial government of Zhejiang to jointly develop China's third LNG terminal.

Reportedly, the terminal is to be built in Zhejiang Province, although a more exact location was not disclosed.

The project is envisaged to include an LNG regasification terminal, a natural gas trunkline, and a gas-fired electric power plant. The designed capacity of the LNG terminal will be about 3 million tonnes/year. CNOOC is expected to take a 51% interest in the project.

Qatar Petroleum Co. and ExxonMobil Corp., 70:30 partners in the Qatargas II LNG expansion project at Ras Laffan Industrial City in Qatar, have awarded a contract to GE Energy for the supply of three gas turbine-driven compression strings for main refrigerant duty—the first application of these units in LNG refrigeration service, GE said. Shipment of the units will begin in November 2005. The equipment will be installed at the existing Qatargas LNG plant, where three existing trains each produce more than 8 million tonnes/year of LNG (OGJ Online, July 11, 2003). The new liquefaction train will be rated for a capacity of 7.8 million tonnes/year. Qatargas II will utilize the new AP-XÔ liquefaction process from Air Products & Chemicals Inc., GE said. The Qatargas II project, which includes an offshore development, large capacity LNG carriers, and a regasification terminal, will supply LNG to the UK. Start-up of the first train is planned for the winter of 2007. Qatar Petroleum has said LNG exports from the facility are expected to exceed 45 million tonnes/year by 2010.

COLOMBIA'S Empresa Colombiana de Petróleos (Ecopetrol) has awarded a basic engineering and licensing contract for upgrading its 230,000 b/d Barrancabermeja refining complex. The work, to be performed by the US subsidiary of French firm Axens IFP Group Technologies, will enable Ecopetrol to produce cleaner fuels that conform to a 2003 government directive. Axens will subcontract individual elements of the work, implementing technologies for upgrading diesel and gasoline qualities to the new specifications.

Prosernat IFP, Paris, will upgrade the sulfur recovery facilities; Technip KTI, Rome, will install the hydrogen production facilities; and Tipiel SA, Bogotá, will perform associated engineering.

Ecopetrol said it would award the engineering, procurement, and construction contract within the year and would have the new units in full operation by 2007.

SAKHALIN ENERGY INVESTMENT CO. LTD.—a consortium of Royal Dutch/Shell Group, Mitsui & Co. Ltd., and Mitsubishi Corp.—along with Sumitomo Corp. have awarded contracts to Yokogawa Electric Corp., Tokyo, to supply the complete upstream measurement and control instrumentation for the Sakhalin II crude oil and natural gas development project in the Sakhalin Island region of Russia's Far East. These follow earlier contracts for the project's downstream measurement and control facilities.

Under the latest contracts, Yokogawa will deliver control, monitoring, and safety systems, a plant asset management package, and other systems for two offshore platforms, onshore production facilities, and the project's associated pipelines. The $10 billion energy development project, led by Sakhalin Energy, will facilitate year-round crude oil and natural gas production in northern Sakhalin Island.

AN EXECUTIVE COMMITTEE comprising the heads of western Canada's environmental assessment and regulatory bodies has formalized the review steps for the proposed Mackenzie Delta natural gas pipeline through the Northwest Territories, preparatory to processing an application by July.

The committee agreed to timetables for setting up offices and coordinating the review processes of the various groups, including a review of participant funding applications, the release of a final draft environmental impact assessment EIA by June 1, and the appointment of a seven-person joint review panel.

The committee represents the Inuvialuit Game Council, Mackenzie Valley Environmental Impact Review Board, Mackenzie Valley Land and Water Board, NWT Water Board, Canadian Environmental Assessment Agency, and the National Energy Board.

The Inuvik-based Northern Gas Project Secre-tariat also was established to coordinate public involvement with easy access to environmental assessment and regulatory review information.

More than 20 pipeline companies filed a motion Mar. 15 for rehearing en banc regarding the recent Fifth Circuit Court of Appeals decision that they must bear the costs for removing and relocating pipelines affected by the Port of Houston Authority's joint project with the US Army Corps of Engineers to deepen and widen the Houston Ship Channel. "We strongly believe that both federal and state law require reimbursement," said Denis Calabrese, spokesman for the pipeline companies. In 2002, US District Judge Lynn N. Hughes had ruled that the Port is responsible under both federal and Texas law for 100% of the pipeline relocation costs, which total $70 million for 70 pipelines' relocation. The Port appealed this ruling to the Fifth Circuit, which reversed the decision Jan. 30 (OGJ Online, Feb. 6, 2004).