DRILLING MARKET FOCUS: Investment, plans signal active year for drilling

Healthy rig counts and utilization rates in most sectors, continued reinvestment in rig fleets and equipment, and substantial drilling plans by operators indicate a vigorous year ahead for drilling. Many of the largest drilling and oil field services companies in North America gave presentations at the Raymond James & Associates 25th annual institutional investors conference in Orlando, Mar. 1-5, 2004.

Drillers included Grey Wolf Inc., Nabors Industries Ltd., Patterson-UTI Energy Inc., and Precision Drilling Corp. Service companies included BJ Services Co., Grant Prideco Inc., Horizon Offshore Inc., Hydril Co., National-Oilwell Inc., and Superior Energy Services Inc.

Eugene M. Isenberg, chairman and CEO of Nabors Industries Inc., discussed the supply challenges for natural gas, pointing out that US and Canadian basins will be the best alternative for North American incremental supply over the next 5-8 years until the materialization of LNG. Despite increased demand, he expects land rig day rates in 2004 to be significantly lower than the 2001 peak. Nabors' earnings distribution has shifted from the US lower 48 (47% in 2001; 23% currently) to Canada and international (16% in 2001; 37% currently).

Hank B. Swartout, chairman, president, and CEO of Calgary-based Precision Drilling Corp., said that by 2012, 14,000 new gas wells/year would be required to maintain production levels in Canada. He noted that national oil companies are outpacing international oil companies in E&P spending, a potential source of new contracts.

Precision has been growing internationally with rigs in three new markets: India, Middle East, and Mexico. In Oman, Precision drilled 32 laterals in over 18 months and was awarded a contract extension in January 2004. In Mexico, Precision has drilled 431 wells with fit-for-purpose rigs through December 2003 under a $220 million contract.

A number of operating companies also presented, including Apache Corp., Chesapeake Energy Corp., Denbury Resources Inc., EnCana, EOG Resources Inc., Forest Oil Corp., Remington Oil & Gas Corp., Talisman Energy Inc., Tom Brown Inc., Western Gas Resources Inc., and XTO Energy Inc.

Houston-based Apache Corp. described 2003 as the year everything went right, with 22% increased production, $1.16 billion earnings, and $1.5 billion acquisitions in the Gulf of Mexico and North Sea. In 2004, Apache will operate under a $1.8-1.9 billion capex budget for exploration and development ($1 billion designated for North America).

Rig counts

The Baker Hughes North American rotary rig count for Mar. 5, 2004, showed 1,685 rigs operating, up 235 from a year ago (16%).

The US rig count at 1,129, is up 200 rigs (22%) from last year. This includes 1,011 land rigs, a 25% increase from a year ago. Major drilling increases are concentrated in Oklahoma (up 46 rigs, 41% from a year ago), Texas (up 62 rigs, 15% increase), and Wyoming (up 24 rigs, 59% increase).

The rig count in the Gulf of Mexico dropped to 96 from 101 rigs a year ago (–5%). There were 556 Canadian rigs operating, up 35 rigs from last year (7%).

According to Baker Hughes, the international land rig count was 554 in February and 568 in January 2004, down 14 rigs for the month, but up 20 rigs from a year ago (4%/year increase). The international offshore rig count was 236 in February and 234 in January 2004, up 2 for the month and up 18 rigs from a year ago (8%/year increase).

Offshore rig utilization rates are high, averaging 88% worldwide as of Feb. 23, 2004 (Table 1). Utilization rates range from 79% for midwater rigs to 90% for jack ups.

GlobalSantaFe Corp.'s worldwide SCORE (summary of current offshore rig economics) issued Feb. 17, 2004, continues to show improvement, up 4.1% in January from the previous month. In particular, West Africa gained 8.2% and Southeast Asia gained 8.8%, while the North Sea dropped 5.6% and the Gulf of Mexico dropped 0.5%.

North American activity

The 4-week moving average of US land well permits issued was 1,025 as of Feb. 23, 2004. The average number of permits issued was more than 1,000 for 3 weeks in a row, last seen in June 2003. Prudential Equity analysts suggest that we may see an increased acceleration in rig counts.

An average of 17 offshore permits/week were issued during the first 3 weeks of January, but that dropped to an average 13 permits/week for the next 4 weeks. It rose again to 18 permits issued Feb. 16-20.

Prudential analysts note that 16 jack up rigs have left the Gulf of Mexico fleet since the beginning of 2003 and that the effective utilization of the current fleet of 115 is about 80%. They expect 2-5 additional jack ups to leave the gulf before the end of June 2004.

There were 27,454 well permits issued across Canada in 2003, breaking the previous record of 21,967 permits issued in 2000. The total included 18,244 development and 6,360 exploration permits for oil and gas, and 2,739 permits for evaluation and observation wells, many of which were for bitumen and oil sands.

Among the top Canadian operators, EnCana Corp. received 5,713 new well licenses, followed by Canadian Natural Resources Ltd. (1,713), Husky Energy Inc. (1,381), EOG Resources Inc. (1,182), and Apache Canada Ltd. (999).

The Petroleum Services Association of Canada forecasts an 8% decrease in drilling in 2004, to 20,005 wells from a record 21,800 wells drilled in 2003. PSAC increased its prediction in late January, up 5% from the 18,965 wells predicted for 2004 in late October 2003 (OGJ, Jan. 26, 2004, p. 53). The organization cited continuing strong activity in Alberta as the reason for the increase (Fig. 1).

PSAC now estimates 14,790 wells in Alberta, 1,100 in British Columbia, and 3,900 wells will be drilled in Saskatchewan in 2004. The forecast is based on $27.50/bbl for oil and Cdn$5.25/Mcf for natural gas. PSAC will release a midyear forecast update on Apr. 28, 2004

Canadian drilling

Chinook Drilling Inc., a wholly owned subsidiary of Calgary-based Total Energy Services Ltd., is building two new land rigs at a cost of $9.5 million to add to its fleet of seven rigs, including four doubles. The company operates in western and northern Canada. The new rigs will be Rigmaster P500 telescopic doubles capable of drilling to 2,800 m.

Rod Rundell, general manager of Chinook Drilling, told OGJ that the rigs are being constructed at the rig shop in Edmonton and that they should be ready within 4-6 weeks of each other, in third-quarter 2004.

Chinook Drilling was acquired by Total Energy Services in April 2000 for $6.5 million. At that time, Chinook operated one Rigmaster P500 double and two Failing 3500 single rigs.

Marathon Canada Petroleum ULC, a division of Houston-based Marathon Oil Co., will drill a 6,000 m well 110 miles off Nova Scotia on the Scotian Shelf in more than 2,000 m water depth. This is the only well planned for offshore Nova Scotia in 2004.

The new well is south of Sable Island, 9 km from the company's August 2002 gas discovery at the Annapolis G-24 deepwater wildcat well. The Annapolis G-24 wellsite is 215 miles south of Halifax in 5,500 ft of water, and was drilled to a final total depth of 20,282 ft.

Marathon is the operator with 40% interest, and its partners are EnCana Corp. (35%), and Murphy Oil Co. Ltd. (25%).

Marathon's Paul Weeditz told OGJ that the company intends to use Transocean's Deepwater Pathfinder and spud the Crimson F-81 well in April or May 2004. The Deepwater Pathfinder is a fifth generation ultradeepwater ship currently working in the Gulf of Mexico for ChevronTexaco Corp. in Mississippi Canyon block 696 at $135,000/day. There are 13 drillships in Transocean's fifth generation fleet, capable of drilling in 7,500 to 10,000 ft water depth.

US drilling

On Mar. 8, Houston-based Grey Wolf announced its acquisition of New Patriot Drilling Corp. from majority owner Lime Rock Partners, a private equity firm. New Patriot Drilling is based in Casper, Wyo., and owns 10 land rigs working in Wyoming and Colorado.

In February, Tom Brown Inc. announced the potential sale of Sauer Drilling Co., its wholly owned subsidiary. Sauer Drilling, a Rocky Mountain company based in Casper, Wyo., owns nine drilling rigs with depth capabilities from 5,000 to 16,000 ft and drawworks ranging from 500 to 1,500 hp.

Jim Lightner, chairman, CEO, and president of Tom Brown, said "TBI originally bought the five-rig Sauer Drilling Co. in 1998 in order to maintain a drilling program on the Wind River Indian Reservation." He added that the company would focus on increasing reserves and production, rather than running a drilling company.

New Mexico's Orogrande basin could have hundreds of new gas wells drilled over the next 20 years now that a plan announced in January by the US Department of Interior's Bureau of Land Management is moving forward (OGJ Online, Feb. 20 and Mar. 10, 2004).

The BLM wants to develop 1.4 million acres in Otero and Sierra counties in southern New Mexico that encompasses thousands of acres of Chihuahuan desert. There are 70,000 acres of existing leases in Otero County.

Harvey E. Yates Co. (HEYCO) drilled a successful well in 1998 on the eastern margin of the Orogrande basin that tested 4.4 MMcfd (OGJ, Aug. 17, 1998, p. 45).

State agencies and conservation groups are challenging the BLM's plan and formed the Otero Mesa Coalition specifically to protect the Otero Mesa desert grasslands, an area covering about 100,000 acres, 90 miles southeast of Las Cruces.

On Jan. 31, 2004, Gov. Bill Richardson signed Executive Order 2004-005, "State agencies act to conserve and protect resources of Otero Mesa," making it state policy to protect Otero Mesa. Richardson spokesman Billy Sparks said, Gov. Richardson "remains skeptical that any drilling in Otero Mesa could be done without damage to the environment."

The New Mexico Energy, Minerals and Natural Resources Dept., the state's Environment Dept., and the Dept. of Fish and Game have filed protest letters with the BLM, citing environmental concerns.

Mexican Drilling

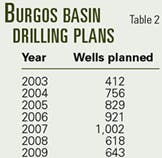

Pemex Exploration & Production (PEP) has outlined an aggressive drilling plan for the onshore Burgos basin (Table 2). The basin covers 1.1 million sq km and contains 96 producing fields, 64 fields with remaining reserves but no current production, and 14 depleted fields.1

There were 412 wells drilled in the Burgos in 2003.

PEP plans to drill 40 exploratory and 360 development wells in 2004. The government expects another 35 exploratory and 321 development wells to be drilled under the MSCs, for a total of 756 new wells in 2004.

Petróleos Mexicanos (Pemex) issued a tender for a 24-month drilling and well-completion services contract on the Jujo-Tecominoacan project, south region (Tabasco/Chiapas).2 The registration deadline was Mar. 19. Bids are due Mar. 25, and offers will be disclosed on Apr. 14, 2004. As of Mar. 5, there were at least eight bidders: Nabors Perforaciones de Mexico SA (a subsidiary of Nabors Drilling International Ltd.), Halliburton de Mexico SA de CV (unit of Halliburton Co.), Perforadora Central SA de CV, Dowell Schlumberger de Mexico SA de CV, Industrial Perforadora de Campeche (IPC), Compania Perforadora Mexico, Great Wall Drilling de Mexico (a subsidiary of CNPC Services & Engineering Ltd.), and Constructora y Perforadora Latina SA.

Pemex also posted a tender for a 24-month drilling and well-completion services contract in the onshore Veracruz basin. There were eight registered bidders. Bids were submitted by Feb. 10, 2004, and the decision was pending as of Mar. 5.

Dowell Schlumberger de Mexico won a 35-month Pemex contract, beginning Feb. 17, 2004, to provide vertical and directional drilling works in the onshore Burgos basin and North region for $23 million.

On Dec. 19, 2003, Constructora y Perforadora Latina SA was awarded a Pemex contract to construct 30 geothermal wells in the Cerro Prieto (Mexicali) geothermal field in Baja California. There were eight other registered bidders. The 1,035-day, lump sum contract runs from Feb. 1, 2004, to Dec. 1, 2006.

Pemex cancelled tenders for two offshore oil-drilling rigs with 250 ft and 300-ft water depth capacity. There had been 12 bidders.

Venezuela drilling

Petrobras Energía Venezuela SA (PEV) and Anadarko Petroleum Corp. plan to drill 15 development wells in Venezuela's Oritupano-Leona field in 2004. They also plan more than 50 workovers.

PEV is a wholly owned subsidiary of Petrobras Energía SA, controlled by Petrobras since May 2003.

PEV operates four oil and gas fields in Venezuela under operating service agreements with Petroleos de Venezuela SA (PDVSA): Oritupano-Leona, La Concepción, Acema, and Mata, producing a total of 51,000 boe/d.

Anadarko holds a 45% stake in the 395,000-acre Oritupano-Leona field, with 267 producing wells, in the northeastern part of the country in the states of Anzoátegui and Monagas. Anadarko states that the field produces about 45,000 b/d.

Venezuela offered offshore tracts along its maritime border with Trinidad in a bidding round in February 2003 and two operators will drill in 2004.

Norway's Statoil ASA will drill two wells in Block 4 beginning in May or June 2004, budgeting $58 million. Statoil analyst Mariela Poleo said "We have a contract to do three wells in 4 years."

ChevronTexaco Corp. will spud its first exploratory well in Block 2 of the eastern Deltana offshore region in August 2004.

The company plans to spend $49 million on offshore Venezuela activity this year and a total of $170 million drilling on the concession. In mid-February 2004, ChevronTexaco was also awarded Block 3 in the Deltana region, for which it paid a $5 million bonus.

In western Venezuela, Tecpetrol de Venezuela may drill a new well in the La Palma field as early as fourth-quarter 2004. La Palma is one of eight fields in the 3,000+ sq km Colón unit, in the Catatumbo sub-basin of the Maracaibo basin. The new well will target the fractured Cretaceous below the Mirador formation.

The unit is operated by Tecpetrol (43.75%), with partners CMS Oil & Gas Co. (a subsidiary of London-based Perenco PLC; 43.75%) and Sweden's Lundin Petroleum AB (12.5%) under the Colón unit operating services agreement awarded in 1994.

Tecpetrol drilled two wells in fourth-quarter 2003, the LPT-8 and 9, resulting in current production of 20,000 b/d from the Colón unit, including about 16,000 b/d from the La Palma field.

KFELS divestment

Keppel FELS Energy & Infrastructure Ltd. divested its 75% interest in Ensco Enterprises Ltd. for $95 million in cash to drilling contractor Ensco Offshore International Co., a subsidiary of Dallas-based Ensco International Inc. KFELS is a public company based in Singapore and part of Keppel Offshore & Marine Ltd., a wholly owned subsidiary of Singapore's Keppel Corp.

Ensco Enterprises is a joint-venture firm set up to build, own, and operate the jack up rig, Ensco 102 (Fig. 2). Ensco exercised a contract option, set to expire May 2004, to buy KFELS' entire interest in the rig.

The Ensco 102 is a premium jack up based on the KFELS MOD V A-class design, built in 2002. It is capable of working in water depths of up to 400 ft and can drill to 30,000 ft. It is under contract to Sarawak Shell at more than $75,000/day, currently working off Malaysia in 360 ft water depth. The rig is scheduled to move to Australia mid-April and remain there through August 2004.

Carl Thorne, Ensco's chairman and CEO, said that Ensco's Asia Pacific jack up fleet has a contract backlog of 10 rig-years.

The favorable market outlook contributed to the company's decision to acquire the nonowned 75% interest in the Ensco 102.

Ensco fleet renewal

Ensco announced in mid-February that it would exchange three Ensco rigs and $55 million of cash for construction of a new high-performance premium jack up rig from KFELS.

The three rigs being transferred to KFELS are the Ensco 55 jack up (780 Mod II, built 1981) and two Gulf of Mexico platform rigs, Ensco 23 and Ensco 24 (built 1980, both currently idle).

The Ensco 55 is working under contract through mid-May at $28,000/day. ENSCO manages 59 offshore rigs worldwide.

The new rig, Ensco 107, will be an enhanced KFELS Mod V (B) design, similar to the Ensco 106 that is currently under construction in KFELS's Singapore yard. The Ensco 106 is to be delivered by year-end 2004 and the Ensco 107 by year-end 2005.

Prudential Financial analyst Grant Borbridge views the transaction as a "long-term positive," noting that Ensco is improving the fleet by shedding lower specification equipment in exchange for a high specification jack up. He said, "quality fleets perform better through volatile offshore drilling cycles, especially in shallow water."

Keppel FELS Ltd. announced in late February that it would sell the three rigs to a drilling services company for $55 million. The Ensco 55 will be refurbished in a KFELS facility.

The average rate for Ensco's jack up fleet was $48,800/day in fourth-quarter 2003, up from $48,000/day in fourth-quarter 2002. Utilization decreased to 84% for the same period, from 86% in 2002.

Ensco CEO Carl Thorne said that day rates were lower than average in the North Sea and higher than average in the Gulf of Mexico in late January. He expected rates to remain stable for the next quarter.

Buy, sell

Houston-based Oceaneering International acquired the drill support remotely operated vehicle fleet, personnel, and contracts in place from London-based Stolt Offshore SA in late February for $48.4 million. The contract was originally announced at $50 million (OGJ Online, Dec. 4, 2003).

The fleet includes 34 work-class ROVs, 10 observation-class ROVs, and ancillary equipment, located in West Africa, Brazil, and Norway. Oceaneering Chairman and CEO John Huff expects the acquisition to generate $1.5-2.3 million incremental net income in 2004 and $2.5-3.0 million in 2005.

Oceaneering also announced a conditional agreement in late November 2003 to acquire 82 ROVs from the Subsea 7 Group, London, for $108 million. The fleet includes 54 work-class and 28 observation-class vehicles. The transaction was not complete as of Feb. 23, 2004.

Subsea 7 is a global service provider for subsea engineering and construction, with about 4,000 employees. The company was formed in May 2002 through the merger of Halliburton Subsea, a business unit of Halliburton's Energy Services Group, and the subsea activities of DSND Subsea ASA, and is equally owned by Halliburton and DSND.

Shares of Houston-based offshore oil and gas driller Todco were sold in an IPO early February 2004. Transocean Inc. sold 12 million shares of Class A common stock in its Gulf of Mexico shallow and inland water subsidiary. It retains Class B shares and 95% of the voting power of all outstanding common stock.

Underwriters exercised their over-allotment option for 1.8 million shares.

Transocean received about $150.2 million net from the IPO and will no longer offer US inland marine or Gulf of Mexico shallow water jack up operations.

References

1. Latin Petroleum Analytics (LAPA), "Mexico—Aggressive plans for the Burgos basin," LatAm Energy eDaily, Feb. 24, 2004.

2. Aramoni Consultants, Project Tracker Report, Mar. 5, 2004.