Refining industry to sustain strong margins through 2004

California refineries, such as Valero Corp.'s Wilmington plant on the facing page, are mandated to use non-MTBE oxygenates starting on Jan. 1, 2004. Photo courtesy of Valero Corp.

Refiners enjoyed much-improved margins in 2003 compared to 2002. Many industry experts expect that margins will continue their recovery throughout 2004 due to a refined product imbalance resulting from: strengthening product demand, stagnant capacity growth, and slightly reduced supply due to more-stringent product specifications.

Refiners throughout the world continue to invest in clean gasoline and clean diesel technologies to stay abreast of changing product specifications. Year 2004 is bringing significant changes, especially in the US gasoline markets, as refiners on the West Coast and East Coast have to change the composition of gasoline sold in some states.

The next few years will mark the phase-in of low-sulfur gasoline in the US; refiners there must already have the sulfur-reduction units under construction or already started up to comply with regulations.

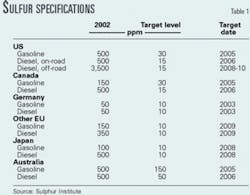

Other areas of the world also must consider low-sulfur specifications (Table 1), either to supply local markets with gasoline and diesel or to export these products to countries that lack sufficient refinery capacity, such as the US.

Supply, demand, margins

After a tough business year in 2002, refiners enjoyed much-improved margins in 2003. An improving global economy helped increase product demand while refining capacity remained essentially flat.

Fig. 1 shows that, according to the latest OGJ Refinery Survey (OGJ, Dec. 22, 2003, p. 64), worldwide refining capacity increased by 177,000 b/cd to a total of 82.055 million b/cd. This net increase amounts to an increase of only 0.2%.

The fixed supply base, combined with increasing demand due to recovering economies throughout the world, have helped support higher fuel prices and higher margins.

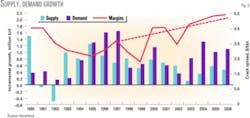

Fig. 2 shows the upward trend in cash margins since early 2002.

Future supply will result primarily due to capacity creep; few new refineries are currently under construction according to the latest OGJ construction survey (OGJ, Nov. 24, 2003, p. 20).

Fig. 3 shows the incremental supply and demand picture. The incremental numbers are expected year-on-year supply and demand increases globally. The graph shows that 3-2-1 crack spreads will continue to increase in the next few years, which is good news for refiners.

"[The year] 2003 was a very good year, refining margins were solid," according to David Mowat, Global Managing Partner for Accenture. "Our view is that the next 2 years will continue in that way, and possibly for the first time in 2 decades there will be significant demand growth.

"We know the differential crude supply that is coming in to refineries is increasingly sour. What that means is that upgrading margins—which is where refiners make a lot of money—are going to be strong."

However, other analysts feel that margins will be not quite as strong as 2003.

"We don't see the same factors driving the strength in margins [in 2004] as we saw last year," according to William Veno, director of downstream oil for Cambridge Energy Research Associates.

Worldwide refining

The global refining industry continues to consolidate. The consolidation trend that prevailed in the US in the late 1990s has started to affect other regions.

Most notably, refiners in Asia Pacific are beginning to shut down smaller, less-efficient refineries (OGJ, Dec. 22, 2003, p. 64).

The refining industry is becoming much more global. Product imports are much more likely to account for any product shortages in a given region.

"We see that the products market is becoming increasingly global," Mowat said. "40% of all refined product flows originated on a different continent."

US

Investment in the US refining sector is still primarily dedicated to producing the cleaner-burning transportation fuels required by new environmental regulations. Those refiners that have finished investing in clean gasoline production units must now change their focus to low-sulfur diesel.

US petroleum product demand increased a little more than 1% in 2003, according to a report from the American Petroleum Institute.

This rate was higher than the most recent 4-year average of 0.6%/year. To supply this additional demand, US refiners operated at a 92.4% utilization rate for 2003. Gasoline production was 8.46 million b/d, which almost matched 2002's record level, and distillate production was an all-time high of 3.72 million b/d in 2004.

In addition, refiners imported more products in the US. Product imports increased nearly 10%, according to the API report.

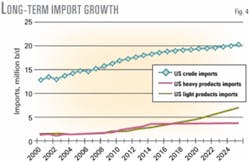

Gasoline imports reached an all-time high of 861,000 b/d and distillate imports of 334,000 b/d reached the near-record levels that occurred in 2001. In the long term, this trend will continue (Fig. 4).

Despite these record or near-record levels, gasoline inventories fell in 2004.

"In the North American market, there seems to be a general perspective that essentially supplies are tight," said Veno. "Crude inventories are lowUproduct inventories are perceived to be low as well."

Another factor creating upward price and margin volatility in 2004 is the introduction of new specifications.

"Jan. 1 saw the introduction of the first phase of Tier II gasoline sulfur specifications in the US, along with the coincident banning of MTBE in California, Connecticut, and New York," Veno said. "So the combination of these factors creates a potential for, not necessarily the reality, but certainly the perception that there would be difficulties in supplying markets with gasoline."

Due to the strong margins in 2003, some US refiners delayed maintenance plans that could enact this year.

"We see a period of more significant, deeper, and more prolonged refinery maintenance as the industry in North America gears up for the next phase of Tier II sulfur specifications on Jan. 1, 2005," according to Veno.

This extended deep maintenance, combined with lower inventories could lead to even lower gasoline inventories at the beginning of the driving season. This is another factor that would place upward pressure on gasoline and distillate prices.

An improving US economy in 2004 will also create more demand for refined products in the US. "We see the prospects on the demand side for stronger growth and demand for gasoline," Veno said.

"We expect that to be a factor in the year ahead and give a 'kick' to diesel fuel and jet fuel as commercial activity increases and helps support margins across the board," he said.

Veno sees that a combination of these factors will keep 3-2-1 crack spreads in the vicinity of $4/bbl.

"Not quite at the level of 2003, which was about $4.50/bbl, but certainly strong and healthy by any measure. Barring any refinery incidents, we see the importance of inventories as well as increasing reliance on gasoline imports from Europe particularly as the key components to the supply-side picture throughout 2004 and in the future," he said.

Western Europe

Because the European transportation sector is moving away from gasoline and becoming more diesel-oriented, refiners there have an excess of gasoline production. Most gasoline exports from Europe are bound for US markets.

With an essentially fixed gasoline production, additional demand for gasoline in the US will probably increase prices in Europe as well.

"Relatively low gasoline inventories together with the gas oil situation is likely to lead to pretty respectable Western European margins," Veno said, "somewhere in the $3-3.50/bbl range.

"In Western Europe we see an improved economic picture there helping to support margins, continued growth in the middle of the barrel in particular—gas oil demand growth likely to exacerbate the already short supply of gas oil in that market helping to support margins there," he said.

Asia

As previously mentioned, Asia refiners are beginning to consolidate surplus refining capacity. This trend, along with expanding and recovering markets, will help to support the refining industry in the region.

"In the Asia-Pacific region we expect to see strong demand, perhaps not as strong as in 2003, but certainly the beginning of the elimination of the surplus in refinery capacity that has been a feature of that market since the late 1990s," Veno said. "The beginning of reduction in some of the surpluses exported out of that region is a sure sign that the region is on a growth track that will help to tighten up the supply side with stronger growth going forward."

This supply and demand tightening will serve to increase margins in the region.

Veno expects that Singapore cracking refinery margins will average more than $1/bbl more than the average for the last 5-6 years. He expects "significantly strengthened Singapore margins in 2004."

After 2004, Veno believes that further "improved margins are needed to justify the significant additional refinery capacity that will be required by the end of the decade."

Middle East

Although regional demand growth (Fig. 5) is continuing at a respectable rate in the Middle East (OGJ, Aug. 11, 2003, p. 56), the region will remain a net exporter of refined products. Some exports from the Middle East will be on par with US specifications, so the region represents a potential source of imports, especially for middle distillates.

Refineries there are significantly upgrading conversion capacity and the region may become a net exporter of gasoline by 2005. Most export growth, however, will occur in middle distillates—exports will exceed 1.3 million b/d in 2005.