Perfect Well - Measure drilling performance objectively

Perfect-well analysis complements traditional analysis methods to create performance standards and improve well-cost estimates.

Part 1 (OGJ, Mar. 1, 2004, p. 43) described how to calculate the minimum time in which a well could possibly be drilled—called the "perfect-well time."

It included a review of more than 500 wells and showed how the method could reliably set performance targets and identify where savings can most likely be found.

This article shows how perfect-well analysis can be used to create performance standards, how it complements technical-limit analysis and learning-curve analysis, and how it can be used to improve well-cost estimates.

Perfect-well time, ratio

The perfect-well time is the minimum time in which a well could possibly be drilled and is calculated from physical factors that constrain the drilling time, including rock strength and operational limits of equipment.

For a given geologic sequence, hole-size program, number of casing strings, mud weight, and a particular rig, physics limit how fast drilling operations can possibly be conducted. Part 1contains a more detailed description.

It takes energy to cause rock to fail; given 100 hp to apply to the bottom of a well you will be able to break a certain strength rock only so fast—even with a perfectly sharp bit and perfect hole cleaning.

The only inputs needed for this analysis are the hole-size program, an estimate of the rock strength (accurately derived from a sonic log or seismic travel times in the area), pore pressure, and a few parameters about the drilling rig to be used.

The "perfect well ratio" (PWR)—a dimensionless parameter calculated as the ratio of the actual time to the perfect time—allows comparison of wells in different conditions to a common benchmark of perfection (PWR = 1). For example, a perfect-well ratio of 2.1 means that the subject well took 2.1 times longer than the perfect well to drill.

As discussed presently, the parameter honors differences in well configuration, lithology, and allows for comparisons across different well types.

Knowing the perfect-well time is a bit like knowing the "irreducible oil saturation" of a reservoir.

Just as comparing the oil in place with the irreducible saturation identifies opportunities for improved production, the PWR can identify opportunities for improved drilling performance.

Operations relatively close to their perfect-well characteristics will be difficult to improve, and those farther away should be easier to improve.

PWR analysis

Perfect-well ratio (PWR) analysis was developed as part of a worldwide review of Occidental Oil & Gas Corp.'s well construction operations. Fig. 1 summarizes PWR for more than 500 wells in 24 different actual drilling programs worldwide. The programs varied from 4,200 ft to 19,800 ft in depth, in environments ranging from deserts to jungles on four continents, on and offshore, from rank wildcats to routine developments.

The programs include drilling activities operated by Occidental, Oxy's partners, competitors, and two programs' operations that were managed by an integrated project management provider.

The operations in Fig. 1 are numbered in order of technical difficulty from left to right ("1" being the most difficult and "24" being the easiest, technically). The X-axis shows the type of operation and the well depth. Three lines plotted on the figure indicate the average PWR, the best-observed perfect-well ratio, and the P(97.7) PWR for each of the programs. Additionally, some of the programs had industry "best in class" offsets or rigorously defined technical limits.

The following example applications show how perfect-well analysis can be used to create performance standards, how it complements technical-limit analysis and learning-curve analysis, and how it can be used to improve well-cost estimates.

Complement technical-limit approach

The technical limit approach often improves drilling performance.1 This section provides some examples of how the perfect-well approach can complement the technical limit approach by providing an unambiguous benchmark. The sidebar shows how the perfect-well concept closely correlates with the much harder-to-predict technical limit.

Human-created technical limits don't necessarily define the best possible performance. Operation 9 in Fig. 1 (US, 15,500-ft development) clearly shows the need for the perfect well methodology to complement standard industry practice.

A competitor had recently defined a "technical limit" for the area. But that limit was not the actual limit because clearly the best observed well in Operation 9 exceeded the estimated technical limit.

Technical limits are estimated by a drilling team and therefore may not necessarily be an objective standard measurement. The example also shows that use of a perfect-well-ratio technique would have suggested that in this case the technical limit (with a PWR=4.0) was achievable.

Many similar wells have subsequently demonstrated perfect-well ratios of 3.5 or better. In this case, the PWR serves the organization well by creating an unambiguous performance benchmark showing much more room for improvement than a technical limit estimate indicates.

The technical limits defined for Developments 13 and 15, as well as actual best-observed performance on routine developments (see Developments 20, 21, 22, 23, and 24 in Fig. 1) show that an accurate technical limit for operations is in the range of 1.8 to 2 times the perfect well.

For more complex wells with multiple logging runs and extensive data gathering, the technical limit will be a slightly higher multiple of the perfect well.

Performance evaluation on these complex wells should focus more on the need and value of complexity and not necessarily on overall drilling performance time.

"Best in class" offsets aren't necessarily the best possible.

Development 14 in Fig. 1 shows the possible harm in just "looking over the fence" and comparing to the industry's best in an area. The average for the Oxy development beat the best competitor well so it would be easy to infer and claim outstanding performance.

The overall performance averages a PWR of 6, indicating about 50% more improvement is necessary to get to excellent performance (PWR of 4 or better). In this case, the perfect-well ratio is a better gauge than the industry best in class. Saying "our performance is just as good as the best in class" could be a dangerous source of complacency.

Complement conventional analysis

Besides improving the technical-limit approach, perfect-well analysis can also improve application of conventional learning-curve analysis.2

Development 11 in Fig. 1 was touted by the integrated services provider as an example of excellent improvement, and learning on the project was significant. The initial well was three times longer than the final well. One problem with conventional learning-curve analysis is that it is difficult to distinguish between good learning and poor preparation. Both can show similar results but PWR analysis can help clear up this ambiguity.

In Development 11, the initially very high PWR of 12 indicates that it may not be an example of very fast learning but rather of poor preparation.

The best time observed in the development was quite good (PWR = 3.5), but the initial wells and the average PWR for the entire development were too high to be considered an unqualified success. In this way, the PWR can be used to calibrate the learning-curve analysis.

Improve cost-estimating, targeting

Complementing the technical limit and learning-curve approaches are important benefits of the perfect-well approach. Time matters only as it relates to costs. The perfect-well approach can be used as the primary component for a key performance indicator that calibrates well costs. The perfect-well ratio is an effective tool for estimating exploration drilling performance.

Because exploration wells often lack good offsets, it's often difficult to create meaningful cost targets. The PWR approach can improve cost targets because it accommodates differences in depth, hole program, pore pressure, and lithology.

Programs 4, 5, 6, and 7 in Fig. 1 represent the performance of deep exploration wells drilled in an area offset to shallower, difficult development drilling. The perfect-well ratio for the two exploration wells equals the average for the shallower drilling.

This tie supports use of the rock-hardness approach and the value of using shallow drilling data in an area to assess riskier deeper drilling performance. The wide range for the development drilling intuitively implies a wide range of risk in subsequent deeper exploration drilling.

These data are useful in also testing the P10 and P90 cost estimates in exploration economic analysis often developed by "what if" scenarios.

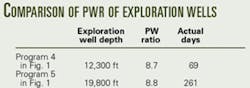

The perfect-well method is useful for gauging deeper drilling in a region with shallow drilling experience. The table illustrates how the perfect-well approach can gauge performance expectations of deeper drilling in regions with shallow well data. The deeper wells match the overall perfect-well ratio though quite different in specific drilling results.

The relationship seems to make sense in that the same rocks and corresponding rock hardness are drilled in each well and the subsequent continuation through progressively deeper horizons might logically follow a similar trend. The authors will spend more time on this element as Oxy's and industry databases are expanded better to assess this specific application utility.

The perfect-well ratio can distinguish between "'good" and "bad" exploration wells even with few offsets. Exploration well No. 2in Fig. 1 shows clearly a failure for a rank-drilling project (its detailed post audit indicated failure as well). Expected performance for similar rank wells and from competitor analysis was 10-12 times the perfect well, while actual results were more than 18 times.

Exploration drilling in a rank environment always presents significant risks and is difficult to estimate. Work-to-date suggests that expectations of 12-14 times the perfect well are reasonable, but unlike the development operations, that recommendation is based on only a few wells. A larger database and more analysis and use of worldwide experience to set targets based on realistic expectations is warranted.

Compare exploration well No. 3 with appraisal well No. 10 and subsequent development No. 13 in Fig. 1. Appraisal well No. 10 shows a comparison of appraisal drilling to subsequent development drilling. The appraisal program appears to be very efficient with a final PWR of <4.

Identify opportunities

Because the PWR is an unambiguous and quantitative performance indicator, it makes an excellent key performance indicator for drilling performance. As mentioned previously, this approach was developed as part of an exhaustive study of Oxy's drilling performance. Detailed performance analysis confirmed the PWR findings that operations with abnormally high PWRs most likely could improve and those with exceptional low PWRs could be used as sources of best practices.

The perfect-well ratio can identify well-managed operations. Operations 9, 10, 12, 15, 19, 23, and 24 in Fig. 1 show excellent risk management and project performance, evinced by a small spread in best-to-average well PWR and a very good average perfect-well ratio of <5 for difficult drilling and <4 for more routine drilling. The P(97.7) values for these programs show the spread required for analysis of risk, which is especially important for small program size (fewer than five development wells) or for appraisal drilling.

The perfect-well ratio identifies areas where increased application of drilling technical and operational effort might yield performance improvements. Developments 6, 7, 11, 14, 15, 16, 18, 20, and 21 in Fig. 1 show programs most likely to be targets for enhancement.

PWR analysis indicates that target improvements in the range of 50-100% are possible because they are so far from normal PWRs for similar type wells.

Achieving such gains would create cost improvements in the range of 25-50% (assume 50% of drilling time savings results in cost savings; low-end average from regression of historical dayrate drilling performance).

Further detailed analysis of these drilling operations showed that these operations could have benefited from fewer starts and stops, more drilling resources, more time to plan operations, and better communication and coordination with the drilling organization's customers. The point is that in these cases perfect-well analysis would be sufficient to identify areas where the drilling operations could be improved.

Epilogue

Perfect-well analysis provides an objective method to measure drilling performance. Once limiting parameters are identified, one may evaluate a portfolio of drilling programs in terms of performance and identify areas to apply resources that will most likely yield better results. The perfect-well method can help organizations:

- Analyze a diverse portfolio of drilling operations.

- Validate other drilling performance methods.

- Gauge organizational and technical performance.

- Separate learning-curve benefits from technical-program changes to gauge change effectiveness.

- Estimate cost improvement targets.

- Allocate resources to improve drilling operations.

Perhaps most importantly, the perfect-well approach has proven to change the conversation between drillers and their customer from "explaining the differences between performance and self-created targets" to "assessing the risk, costs, and rewards of closing the gap between current performance and appropriate expectations."

References

1. Bond, D.F., et al., "Step Change Improvement and High Rate Learning are Delivered by Targeting Technical Limits on Sub-Sea Wells," IADC/SPE Drilling Conference, New Orleans, Mar. 12-15, 1996.

2. Brett, J.F., and Millheim, K.K., "The Drilling Performance Curve: A Yardstick for Judging Drilling Performance," 61st Annual SPE Technical Conference, New Orleans, Oct. 5-8, 1986.

Bibliography

Pratt, C.A., "Underbalanced Drilling: The Past, The Present, and the Future," presented at the SPE/AFTP section meeting, Paris, Sept. 16, 2002.