Northern route to remain open for Caspian Sea crude oil

Movement of crude oil north from the Black Sea towards European markets will retain the option of the Odessa-Brody crude oil pipeline, even though the line has lain idle since its completion more than 2 years ago and a Ukraine commission had recommended reversing it to allow Russian crude oil to flow to a new Black Sea oil terminal at Pivdenne (OGJ, Feb. 23, 2004, p. 7).

Ukraine's decision brings to an end a raging internal Ukraine debate over how best to use the pipeline, according to a report last month from the Centre for Global Energy Studies, London.

Speculative investment

The government's decision, said CGES, flies in the face of findings of a feasibility study conducted by the Ukrainian Fuel and Energy Ministry and carried out by Energy Solutions LLC.

It recommended that the line be used to carry Russian oil to the Black Sea for 3 years because this was the only viable use for the line over that period. It further recommended the situation should be reassessed in 3 years because other alternatives for the line might have opened up by that time.

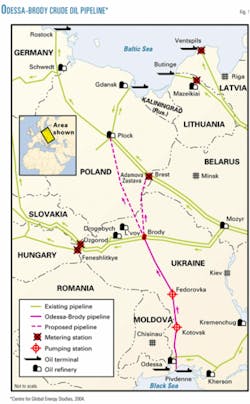

The 414-mile line has a capacity of 12 million tonnes/year (tpy; about 237,000 b/d) and runs north from the new terminal at Pivdenne (about 12 miles north of Odessa on the Black Sea) to a pumping station on the southern branch of the Druzhba export pipeline at Brody (Fig. 1).

Ukraine built the line for about $645 million as a speculative investment, said CGES, in anticipation that Caspian Sea producers would use it to move oil into Europe and bypass the increasingly congested Turkish Straits of the Bosporus and Dardanelles.

Not only were the producers unwilling to use the line, state-owned UkrTransNafta lacks funds to purchase the technical oil to fill the line.

Nevertheless, the Ukraine government has ordered UkrTransNafta to begin shipments of oil northwards through the Odessa-Brody pipeline by May.

CGES said there has been talk of trying to form an international consortium to own and operate both the pipeline and the Pivdenne (Yuzhny) oil terminal, but having struggled to attract users of the line, "finding potential owners may be even more difficult."

Not long enough

CGES said that part of the problem may have been that "the line did not go far enough." Although the southern branch of the Druzhba pipeline, to which the new pipeline interconnects at Brody, has spare capacity, refineries served by the route showed no interest in buying Caspian crude oil. And, proposals to link Druzhba with the Adria system to carry Russian oil to the Adriatic may well soak up much of this idle capacity.

Moreover, plants in Hungary, Romania, Slovakia, and the Czech Republic have relied on Russia's oil majors for most, if not all, of their crude supplies, said CGES's research report. Caspian producers were delivering their oil to refineries in Western Europe and beyond, but the Odessa-Brody pipeline does not help them reach these markets.

CGES said that the longer the Odessa-Brody pipeline lay idle, the "more the political temperature increased."

Both the US government and the European Union strongly supported Ukraine in its desire to see the line used to carry Caspian oil into Europe, while Russian oil companies lobbied for reversing the line to carry some of their growing volumes to the Black Sea.

Reversal of Odessa-Brody appeared to be a quick and relatively inexpensive way of boosting Russia's tightening oil export capacity by around 9 million tpy (180,000 b/d).

In September 2003, TNK-BP, which owns substantial downstream assets in Ukraine, offered to supply 450,000 tonnes of crude oil to fill the pipeline under a 3-year loan at low interest rates.

The offer, which CGES said some saw as pressuring Ukraine to reverse the line, was first accepted, then rejected amid claims that unnamed Kazakhstan oil producers had agreed to move 9 million tpy of oil through the line to Europe.

CGES said the companies were subsequently identified in various unconfirmed press reports as ChevronTexaco Corp. and state-owned KazMunaiGas.

Ukrainian officials have stated that ChevronTexaco is ready to begin shipping oil from Kazakhstan through the Odessa-Brody pipeline later this year.

Extending the Odessa-Brody pipeline to Plock in Poland, which would give access through the existing Pomeranian pipeline to the port of Gdansk and through existing pipelines access to refineries in Germany, might make the route considerably more attractive to exporters seeking markets in northern Europe.

Such an extension has yet to be built, however, although it has long been the subject of inter-governmental agreements between Ukraine and Poland.

In the short term, then, said CGES, Ukraine's best hope for earning revenue from its newest pipeline would indeed seem to be to use it for exporting Russian oil.

The great danger for Ukraine in adopting this strategy, said the report, is that once it is reversed to carry oil southwards, it might then become impossible to switch the flow back to a northwards direction in the future.

"This is clearly a risk that the Ukrainian government has been unwilling to take," said the CGES report.