An extended period of relatively high oil and gas prices has provided operators with the financial ammunition to explore some of the world's more remote areas.

What follows are brief accounts of a number of those activities. A few have resulted in discoveries, including some of sizable proportions, while others are just beginning.

For the most part, the accounts exclude the US, which is the subject of its own report to appear in OGJ's Apr. 19 issue. The same phenomenon is occurring in the US, however.

This article gives capsules of frontier exploration efforts and opportunities in Myanmar, Greenland, UK West of Shetlands, eastern Kazakhstan, India, Guyana, Venezuela, Trinidad and Tobago, Cuba, Alaska, Mauritania, Chad-Central African Republic, Egypt, and Niger.

Rakhine basin, Myanmar

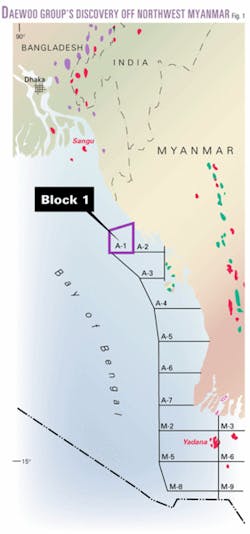

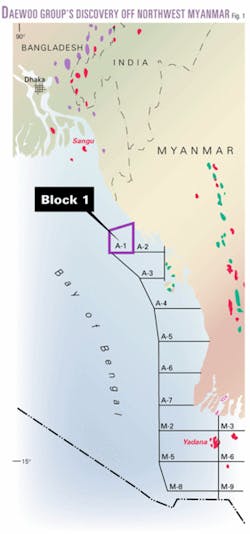

Daewoo International Corp., Seoul, will begin appraising its pioneering giant gas discovery in the nonproducing Rakhine basin off northwestern Myanmar (Figs. 1 and 2).

Daewoo and Korea Gas Corp. said the Shwe-1/1A wildcat (cover of this issue) discovered 4 to 6 tcf of recoverable gas on Block A-1 on the Rakhine basin shelf in the Bay of Bengal

The appraisal program involves 1,200 sq km of 3D seismic data to be acquired in March and April 2004, preceding monsoon season, and several appraisal wells to be drilled starting in November, said Su-Yeong Yang, Daewoo vice-president of energy development.

Shwe-1-1A, drilled to 10,210 ft in 361 ft of water is the first wildcat drilled in the Plio-Pleistocene section off northwestern Myanmar. It is the country's first offshore discovery since Yetagun gas field in the Gulf of Martaban 12 years ago and Daewoo's first well on its first project as operator.

The field is judged to cover 14,900 acres based on results of the first well and 2D seismic data analysis. The gas sands have 24% porosity and 190 md permeability.

Several seismic anomalies on Block A-1 appear similar to the one at the Shwe discovery, indicating considerable upside exploration potential, Daewoo International said.

SW Greenland blocks

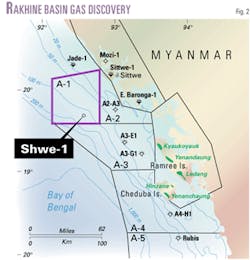

The Greenland and Danish governments plan to offer four blocks in the Davis Strait off West Greenland in a licensing round this year.

The Bureau of Minerals & Petroleum brought together all available modern seismic data, totaling more than 50,000 km, and mapped possible four-way dip closures or "mammoths" larger than 100 sq km. Each feature is thought capable of containing more than 5 billion bbl of oil in place.

The four license areas are characterized by the presence of these giant structures in favorable basin settings. The blocks are (Fig. 3):

1. A 10,500 sq km block in part of the Lady Franklin basin.

2. A 4,900 sq km block on the Kangaamiut basin and ridge.

3. Some 7,000 sq km in parts of the Ikermiut Fault Zone and Sisimiut basin.

4. An 11,200 sq km block over parts of the Atammik and Fylla structural complexes.

License terms will be announced this year and will be based on the existing model license and a standard joint operating agreement. Terms include 30% corporate tax, a favorable surplus royalty regime, and 12.5% carry of the national oil company in the exploration phase.

Two seismic vessels gathered a total of nearly 9,000 km of seismic data off western and southern Greenland in 2003, bringing the total acquired since mid-2001 to 11,000 km. Acquisition extended through the end of November 2003. The vessels used 6,000-8,000 m long streamers.

The long-offset data "confirm a much more widespread distribution of connected deep basins recognized only locally on earlier surveys in the region," the governments said.

EnCana Corp., Calgary, holds the only active license in the area. The 3,985 sq km tract, awarded in October 2002, is 200 km west of Nuuk in 200-1,000 m of water. Greenland's state Nunaoil has a carried interest during the exploration phase.

Most of the license is in the southern Nuuk basin, but the eastern edge is in part of the Atammik structural complex.

The Geophysical Atlas of West Greenland Basins, first published in 2002, is being revised to incorporate all new data off West Greenland and adjacent Canadian waters and is due for publication this spring, said the Geological Survey of Denmark and Greenland, Copenhagen.

The round will be kicked off with meetings in Copenhagen Apr. 1 and Houston Apr. 6. Deadline for licensing applications is Oct. 1.

UK frontier licenses

The UK licensing authority proposed earlier this year to offer a new "Frontier" license applicable to blocks on the UK's Atlantic margin or continental shelf west of the Shetland and Orkney islands.

The frontier license regime would allow offshore operators to apply for relatively large acreage in those areas at significantly reduced costs. Frontier licenses were to be offered in the upcoming offshore licensing round.

The new license, recently announced by UK Energy Minister Stephen Timms, also gives operators more time to carry out the necessary exploration and development, extending that period for 2 years "over and above" the time allowed under a traditional license, OGJ Online reported on Feb. 11.

The UK Offshore Operators' Association was awaiting specific designation of blocks and exact terms of the new licenses.

In announcing the new license at an energy conference in Sanderstolen, Norway, in early February, Timms cited it as "further proof of our commitment to innovate where possible and maximize the full potential" of oil and gas reserves on the UK continental shelf.

"By reducing the cost and extending the exploration time of the license, we are sending out a strong signal to companies that exploration and development in challenging areas will be supported and encouraged by [the UK] government," Timms said.

"Following on from the success of the Promote license in the 21st round of licensing, which provided great incentives to the smaller prospectors, I believe that the Frontier license offers benefits to the more established players who are more likely to prospect in the new blocks."

The Frontier license will permit operators to apply for relatively large amounts of offshore acreage west of the Shetlands and later to relinquish up to 75% of that acreage after an initial screening phase, during which the normal rental fees will be discounted by 90%.

The new license will be offered only for those areas west of the Shetland Isles, comprising areas 1 and 4 of the UK Department of Trade and Industry's Strategic Environmental Assessment process. However, the exact areas for which the new license will be available have not yet been decided, officials said.

Traditional licenses also will be offered for the same areas west of the Shetlands and for all other areas included in the round, officials said. Promote licenses will be offered only in areas other than west of Shetlands.

The new Promote license offers licensees the opportunity to assess and promote the prospectivity of the licensed acreage for 2 years without stringent financial, technical, and environmental entry checks required for traditional licenses.

However, officials said Promote licensees will not be approved as operators and will not be permitted to drill wells until they have passed those checks and made firm commitments to complete initial-term work programs. For the period of this assessment, the license rental fee will be 10% of the rental fee for the traditional license (£15/sq km).

Kazakhstan's Zaysan basin

One operator appears to have made the first known discovery in eastern Kazakhstan, near the border with China, reports IHS Energy.

This is a remote, lightly drilled, and only recently explored area 300 miles north of Urumqi in northwest China's Xinjiang Uygur Autonomous Region.

Gulf Star Investment Ltd. BVI (GSI) was testing the Sarybulak 2 exploration well on the Zaysan Block. The company was also to drill the Karabulak 1 exploration well 25 km from Sarybulak. Drilling depths were said to be 2,000-2,500 m.

Reserves on the license have been estimated at 1.76 tcf of gas and 100 million bbl of oil.

Kazakhstan and China have discussed the possibility of constructing eastbound oil and gas pipelines that would pass near the Zaysan basin. Such projects would transport hydrocarbons from basins in western and central Kazakhstan to China.

GSI operates three joint ventures in Kazakhstan: Zaysan (Zaysan license), Burgan (Pavlodar Pri-Irtysh license), and Nurbay (Nurbay license). It is the only operator in this part of the country, IHS Energy pointed out.

The JVs are owned 99.9% by Gulf Star Investment Holding BVI, a subsidiary of GSI, and 0.1% by Kuat Holding Co., based in Almaty.

The contracts for Nurbai JV and amendments to the contracts for the Burgan and Zaysan JVs were signed on Apr. 11, 2000. Originally, Kuat became license holder in 1996, but due to lack of finance did not drill the well planned on the Sarybulak prospect.

Investment started again with the formation of a joint venture with Gulf Star Investment Holding in 1999.

Cairn in Rajasthan, India

Cairn Energy PLC, Edinburgh, said its N-B-1 discovery well in the lightly explored Barmer basin of northern Rajasthan flowed a combined 6,000 b/d of 24-29° gravity oil from three zones and is capable of producing more than 10,000 b/d.

The well intersected a stacked sequence of 12 oil bearing reservoir units in the Fatehgarh formation. Open hole drillstem tests yielded the following stabilized rates:

- Zone 3 tested at 2,837 b/d of oil on a 96/64-in. choke.

- Zone 2 tested at 1,925 b/d of oil on a 64/64-in. choke.

- Zone 1 tested at 1,240 b/d of oil on a 68/64-in. choke.

Reservoir permeabilities are estimated to be between 500 md and 3 darcies.

Cairn was starting the first appraisal well and additional seismic surveys last month as part of an extensive exploration and appraisal program on 5,000 sq km RJ-ON-90/1, where the company holds 100% interest (see map, OGJ, Feb. 2, 2004, p. 44). India's Oil & Natural Gas Corp. Ltd. has a right to 30% of any development area that may result from a commercial discovery on the block.

Guyana exploration

Limited predrilling forms of exploration are proceeding in nonproducing Guyana in spite of an unsettled border dispute with Suriname, which Guyana referred to the United Nations in late February.

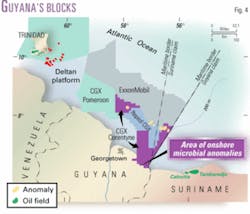

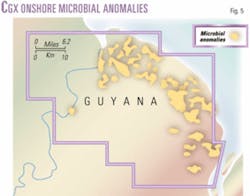

CGX Energy Inc., and ON Energy Inc., Toronto, were preparing to acquire 200 line km of 2D seismic data to identify the depth and thickness of the source of hydrocarbon microseepage picked up during microbial surveys on the onshore part of the Corentyne Block in northern Guyana (Figs. 4 and 5).

The microbial surveys identified 22 anomalous leads, totaling 250 sq km, one of which covers 40 sq km.

GeoMicrobial Technologies Inc., Ochelata, Okla., gathered 8,000 soil samples on the block in October 2003 and analyzed every second sample for microbes that flourish in the presence of hydrocarbon microseepage.

Infill analysis of more than 1,000 samples in areas of high readings significantly improved definition of the leads, and thermogenic hydrocarbons are indicated as associated with many of the microbial anomalies by the sorbed gas analysis, CGX said.

The highly acidic nature of the soil in the area limited the effectiveness of sorbed gas analysis from the current shallow soil samples, but one set of deeper samples indicated better concentration of hydrocarbons (less affected by the acidic soil). CGX therefore plans a limited number of deeper sampling sites will be done in conjunction with the planned seismic.

"We are now in the process of finalizing our integration of the geochemical study with our reprocessed aeromagnetic data," said Warren Workman, CGX vice-president of exploration. "Using the aeromag data, we have identified basement highs and fault structures that may be effective in forming traps to migrating hydrocarbons. We have reviewed the geology associated with the Suriname oil production on trend. The seismic will provide definition as to potential trap on several of our larger microbial anomalies and tie to our aeromag features."

ON Energy, a Guyanese registered company held 85.5% by CGX, owns the 800,000-acre Berbice block. More financing will be required within ON Energy to proceed with the 2D seismic program.

Surinamese military forced a rig preparing to drill for CGX to leave the disputed area (OGJ Online, July 26, 2000).

Falcon, Venezuela

PetroFalcon Corp., Carpinteria, Calif., operates some of the first sustained production in eastern Falcon through its subsidiary, Vinccler Oil & Gas CA.

Vinccler holds the 400,000-acre East Falcon Block in northwestern Venezuela 300 km west of Caracas. Vinccler began gas deliveries in mid-2003 from Cumarebo oil and gas field to the Cementos Caribe cement plant. This was the country's first gas sales agreement between two independent entities. Initial contract volumes are 6-10 MMcfd.

The block also contains underdeveloped La Vela oil and gas field, and Vinccler has defined a number of exploration prospects on the block.

The two fields produce a combined 700 b/d of oil and condensate, which is trucked to Petroleos de Venezuela SA's Amuay refinery on the Paraguana Peninsula.

The companies anticipate much greater demand for their gas within a year. Venezuela's east-west interconnector (ICO) gas pipeline will pass near the two fields. Construction of the first phase of the pipeline is to start shortly, providing a 70-km link between the East Falcon gas fields and the Paraguana refining complex. Gas deliveries are to start in early 2005, backing out some of the crude consumed now.

Vinccler also is negotiating with Pdvsa for exploration rights to the adjacent 480,000-acre Agua Salada block.

Off Northeast Trinidad

A group led by BHP Billiton Ltd. is on schedule with development of the Greater Angostura oil and gas discoveries in a previously unexplored area off northeastern Trinidad.

The company installed one of four wellhead protector platforms in the fourth quarter of 2003 and began building an onshore pipeline and storage facilities. Work was on budget and schedule as of the end of the year, and first oil production remained scheduled for yearend 2004.

BHP approved the $327 million first development phase in March 2003, when it estimated proved and probable reserves of 160 million bbl of oil and 1.75 tcf at Greater Angostura.

Gas commercialization under phase 2 will commence 3-9 years after first oil, with the exact timing dependent on reservoir performance and oil recovery considerations, BHP said.

Greater Angostura field, in 40 m of water 40 km offshore, has an estimated production life for both oil and gas of 19-24 years.

Gas will be processed for liquids and reinjected, and oil will be exported from facilities on Guayaguayare Bay with a capacity of 100,000 b/d.

A Pride International crew tends to pipe handling duties on a rig floor in the Doba basin oil fields in southern Chad. Photo courtesy of Esso Chad.

In October 2003, Trinidad and Tobago Energy Ministry Eric Williams said BHP and its partners made a geological discovery on Block 2c near Angostura.

Drilled to 10,200 ft in 190 ft of water, the Howler-1 well found gas in the Cretaceous Naparima Hill formation, considered a source rock in the area (OGJ Online, Oct. 24, 2003). The Angostura hydrocarbons are in shallower pays of Oligocene age. BHP has said only that the well found gas shows and was plugged and abandoned.

Cuba drilling, exploration

Repsol-YPF SA was to spud this month at the first deepwater well off Cuba, while Cuba's main operator, Sherritt International Corp., continued development drilling onshore.

Repsol-YPF is to drill Yamagua-1 on Block 27 using a semisubmersible about 20 miles northeast of Havana and 95 miles southwest of Key West, Fla. (see map, OGJ, Dec. 11, 2000, p. 42). The water depth and proposed drilling depth are not reported.

Sherritt International Corp., Toronto, said it is deferring exploratory drilling pending resolution of the application of investment tax credits for Sherritt-operated blocks in Cuba (see map, OGJ, Oct. 9, 2000, p. 38).

The company said its capital spending in Cuba was to have totaled $70 million in 2003.

Gross working interest oil production in Cuba for the quarter ended Sept. 30, 2003, was 39,997 b/d, down 3% from the same period in 2002.

Production for the first three quarters of 2003 averaged 42,156 b/d, up from 35,992 b/d in 2002. The increase stemmed from completion of new wells in Canasi and Yumuri fields. Sherritt participated in drilling 3 development wells in Cuba in the 2003 third quarter.

Development drilling continued at historic levels in the fourth quarter, Sherritt said. The company had not reported its yearend results at this writing.

Brazil's state owned Petrõleo Brasileiro SA last fall signed a letter of intent for exchange of technological information with Cubapetroleo SA and indicated it would later accept Cuba's invitation to explore for oil in the deepwater Gulf of Mexico off Cuba (OGJ Online, Sept. 15, 2003).

Alaska offshore frontiers

The US Minerals Management Service ([email protected]) is trying to determine if there is any interest among E&D companies in exploring for oil and gas in the Chukchi Sea, Hope basin, and Norton basin.

MMS issued a call for information and nominations in late January and set an Apr. 29 deadline for responses. The basins are all largely unexplored areas of the Alaska Outer Continental Shelf.

The Chukchi Sea and Norton basin have great potential as sources of oil or gas, but high costs due to the distance from any infrastructure make them "challenging areas to lease," MMS said. Economic incentives similar to those offered recently in the Beaufort Sea Sale 186 held in September 2003 may be offered.

If there is interest, a sale will be designed. "If no one expresses interest, we save a lot of work and money," said MMS Regional Director John Goll.

Mauritania's offshore

Mauritania can still be considered a frontier area with an emerging deepwater area and attractive terms.

It has four discoveries offshore in the Atlantic, but the first is not likely to attain production status until 2006.

Analyst Wood Mackenzie notes that 11 unsuccessful wells were drilled between the time licensing began in the late 1960s until oil companies withdrew in 1993 due to hostilities between Mauritania and Western Sahara.

Woodside Petroleum Ltd. has drilled 7 exploration and 3 appraisal wells since 2001 with three discoveries to show, Chinguetti, Banda, and Tiof/West Tiof. Early this year it declared one, Chinguetti, commercial.

Wood Mackenzie estimated that the Chinguetti project has an NPV (10) of $214 million.

"Comparing the economics of Mauritania's first oil and gas project against other West African deepwater projects of a similar size shows that Mauritania is a commercially viable place to do business in the oil and gas sector," the analyst said.

"The Chinguetti development has a respectable total NPV of $1.65/boe and an IRR of 21%. These figures are not as high as some of the more established deepwater countries. However, Mauritania's oil and gas sector is still very much in its infancy and future developments such as the Tiof field could be more profitable and hence compare more favorably to other West African deepwater projects," Wood Mackenzie concluded.

Woodside and Dana Petroleum PLC are the country's foremost operators, and BG PLC entered the area last month with acquisition of an interest from ENI SPA.

Chad-Central African Republic

Exploration interest is reported to have picked up in central Africa in the wake of the ExxonMobil Corp. group's mid-2003 start-up of oil production in southwestern Chad and deliveries through the Chad-Cameroon oil pipeline (OGJ Online, Feb. 18, 2004).

EnCana Corp. is reported to be drilling one exploration well in each of two basins on 108 million acre Chad Permit H, where it holds a 50% interest in more than 108 million gross acres.

The block covers the majority of the country, taking in parts of seven identified sedimentary basins: Lake Chad, Bongor, Logone-Birni, West Doba, Doseo, Salamat, and Erdis.

EnCana, which has acquired more than 5,000 km of seismic data on the block since late 2001, noted that the Chad-Cameroon pipeline has rendered the basins accessible to international markets.

Approach Resources Inc., Fort Worth, under an agreement with Grynberg Petroleum Co. affiliate RSM Production Corp., is pursuing seismic acquisition on 14 million acres in northeastern Central African Republic in the Doba, Doseo, and Salamat basins (OGJ, Dec. 18, 2000, p. 28).

Kom Ombo basin, Egypt

Centurion Petroleum Corp., Calgary, is prpeparing to explore the 5.6 million acre Block 2 in the Kom Ombo basin of southeastern Egypt.

The work program on the block, which the company secured at favorable fiscal terms, calls for Centurion to spend $2 million in the first 2-year exploration phase. It will reprocess 1,000 line km of 2D seismic data and re-enter and test the Kom Ombo-1 well, plus conduct additional geological and geochemical studies.

Kom Ombo is a rift basin analogous to the Muglad basin in southern Sudan where major discoveries have been made. Block 2 has numerous seismically defined leads that hold potential for significant oil reserves, Centurion said (see map, OGJ, Dec. 8, 2003, Newsletter).

The Kom Ombo-1 well, drilled in 1997, tested light oil at 8,150 ft from an early Cretaceous good quality sandstone reservoir, indicating the presence of a petroleum system, Centurion noted. The Kom Ombo-2 exploration well encountered significant oil and gas shows in the same reservoir in 1998.

Agadem basin, Niger

TG World Energy Corp., Calgary, is waging legal battles when it would rather be confronting exploration challenges in the eastern Niger portion of the Agadem basin.

A TG World affiliate in January 2004 filed conciliation proceedings with the World Bank International Centre for the Settlement of Investment Disputes.

The Republic of Niger government canceled TG World's contract on the Tenere Block and awarded the exploration rights to an arm of China National Petroleum Co.

If conciliation proceedings fail, either party may proceed to formal and binding ICSID arbitration.

TG World said that initiating the action with ICSID freezes the block subject to the outcome of the proceedings.

The Tenere Block lies on trend with the Agadem Block held by ExxonMobil and Petronas, on which 350 million boe have already been discovered. TG World understands that Petronas plans to drill three wildcats on the Agadem Block in coming months.

TG World also began arbitration proceedings under UN rules, alleging that China National Oil & Gas Exploration & Development Corp. breached its obligations to TG World under a confidentiality and noncompete agreement entered into in 2002 in connection with farmout negotiations on the Tenere Block.

CNPC International Ltd., a CNODC affiliate, signed an agreement regarding the Tenere Block with the Niger government days after the expiry of the confidentiality and noncompete agreement, after what the Niger Minister of Mines & Energy described as "long negotiations," TG World said.

TG World also sued CNPC International in Niger courts, alleging the equivalent of tortious interference with contractual relations and seeking $250 million in damages, said Clifford M. James, president and chief executive officer.