Market Movement

Bearish oil stock reports undermine energy prices

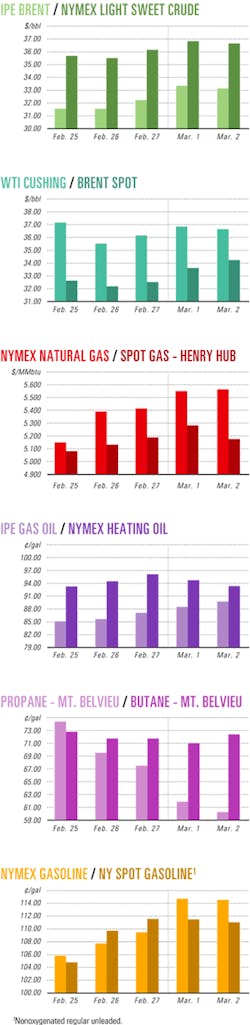

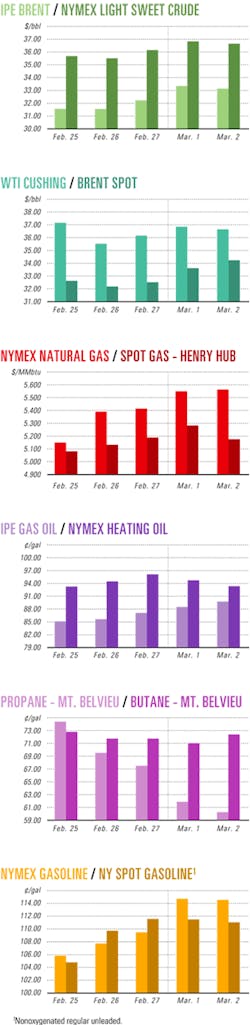

Energy futures prices fell Mar. 3 as traders reacted to what they saw as unexpectedly bearish government and industry reports of a build in US crude inventories during the week ended Feb. 27.

The US Energy Information Administration reported commercial US inventories of crude increased by 2 million bbl to 275.8 million bbl during that week. "This increase may signify an early start to the crude oil build season, as they typically increase by more than 20 million bbl between the end of February and the end of April," said EIA.

However, EIA said, US crude inventories remained 24.2 million bbl below the 5-year average for that time of year.

During the same week, US gasoline stocks fell by 1.4 million bbl to 202 million bbl, which was 9.9 million bbl below the 5-year average. Distillate fuel inventories inched lower by 100,000 bbl to 111.3 million bbl, with diesel fuel falling slightly more than heating oil stocks increased, EIA said.

US oil imports increased by 830,000 b/d to more than 9.8 million b/d during the week ended Feb. 27, continuing a recent seesaw pattern, EIA reported. Most of that increase was on the West and East Coasts, officials said.

Crude inputs into US refineries averaged nearly 14.7 million b/d during the week ended Feb. 27, an increase of 201,000 b/d from the previous week's average, with most of that increase evident on the US Gulf Coast, said EIA.

The American Petroleum Institute subsequently reported US crude stocks increased by 1.6 million bbl to 276.1 million bbl during the same period. Distillate inventories fell by more than 2 million bbl to 113.9 million bbl, while gasoline inventories were down by 1.8 million bbl to 200.9 million bbl, API said.

Implied demand surge

The latest EIA data implied "a further surge in gasoline demand and a cooling off in total [US] demand. Crude oil build is limited to the West Coast, while heating oil data [remained] downbeat for the second week," said Paul Horsnell, head of energy research, Barclays Capital Inc., London.

"Crude inventories rose in aggregate, but they fell outside the logistically isolated West Coast market. In the key Midwest area, inventories continued on their 5-month long downward trek," he said. Gasoline stocks remained "extremely tight, particularly on the East Coast, with the market just being kept under control by unseasonably high production rates compensating for rampant demand and weak import flows," Horsnell said.

"It is not an exaggeration to say that the US gasoline market is now on the cusp of an extremely serious situation," Horsnell reported Mar. 3. A possible record price spike to $1.30-1.50/gal for the near-month gasoline contract on the New York Mercantile Exchange "is not off-the-wall at this point," he said. "If gasoline really were to tip over and spike, this would most probably drag crude oil up to an identifiable short-term peak and a very high one at that."

Earlier fears of possible future shortages, with US gasoline stocks at a 30-year low and demand already building ahead of the peak summer driving season, caused gasoline futures prices to ratchet up Mar. 1 on NYMEX, pulling other energy commodities along.

Although commercial US inventories of crude and petroleum products are tight, some analysts claimed the fly-up of energy prices in late February wasn't supported by market fundamentals. Some predicted a downward correction of market prices during the first week of March.

Still others claimed that, with US inventories near record lows, petroleum product prices may be in for a long bullish haul if the Organization of Petroleum Exporting Countries follows through with its decision to reduce its quota production ceiling by 1 million b/d to 23.5 million b/d of oil, effective Apr. 1, while eliminating previous overproduction of 1.5 million b/d.

Energy prices also were buoyed last week by riots in Venezuela after that country's elections council ruled that opponents lacked enough signatures to force a recall referendum against President Hugo Chávez.

If that turmoil intensifies, it's likely to fan the market's fears of supply disruptions.

Meanwhile, Iraq said it plans to increase its exports of crude to prewar levels of 2.2 million b/d by late March or early April, with the opening of two berths this month at Khor al-Amaya, one of its two main terminals on the Persian Gulf. Iraq also expects at least limited shipments of crude through its northern pipeline to the Mediterranean port of Ceyhan, Turkey, said Robert S. Morris, Banc of America Securities LLC, New York (see related story, p. 28).

Industry Scoreboard

null

null

null

Industry Trends

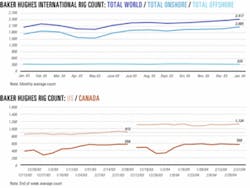

RISING STEEL COSTS translate into higher oil country tubular good (OCTG) costs for US exploration and production companies, but strong gas prices have helped offset the higher steel costs.

Since December, steel prices have risen more than 30%, and April purchases are expected to be nearly double the December levels, Raymond James & Associates Inc. reported.

Analyst J. Marshall Adkins of Houston said in a Mar. 1 research note, "High pipe prices will not kill drilling activity." His conclusion was based upon analysis of US rig counts and OCTG consumption as well as E&P companies' comments.

"Specifically, we expect to see a 10-12% increase in 2004 drilling activity levels. This assumption is predicated on what we believe are exceptional well economics and returns for domestic E&P companies," Adkins said. Meanwhile, increasing tubular costs affect the bottom line less than one might assume, he added.

"When considering an all-in cost of drilling and developing reserves, we believe tubular costs drop to less than 10% of total E&P capital expenditures. Thus, we believe this makes increasing tubular costs less consequential to finding and development economics," Adkins said.

Meanwhile, RJA analysis shows that current returns for an average well are in excess of a 50% internal rate of return at long-term gas price assumptions of $5/Mcf. "While we do anticipate further increases in finding and development costs as a result of higher service costs and potentially lower rates of return on drilling additional wells, we believe that natural gas prices have increased enough to more than offset the higher costs," he said.

Adkins concluded that "the E&P operating environment offers healthy returns for companies ramping up drilling activity despite the rise in F&D costs."

MAURITANIA is an emerging deepwater play, and it's commercially viable when compared with other West African deepwater project economics, Edinburgh-based Wood Mackenzie said.

In a report last month, WoodMac outlined the West African country's exploration history and evaluated Chinguetti, Mauri- tania's first oil and gas development, that could start production as early as 2006. Early estimates put reserves at 100 million bbl recoverable (OGJ Online, Sept. 18, 2003).

"Exploration and licensing activity in Mauritania originally began back in the late 1960s and was dominated at that time by the major oil companies, " said WoodMac analyst Catriona Bog- gon. "Exploration activity was minimal, and 11 unsuccessful ex- ploration wells were drilled prior to the companies leaving the country in 1993, due to hostilities between Mauritania and Western Sahara." After a lull in exploration activity of more than 10 years, licensing resumed in 1996 when Australian-based independent Hardman Resources NL acquired much of Mauritania's offshore acreage.

Since then, Australia's Woodside Petroleum Ltd. and UK-based Dana Petroleum PLC have become the two main operators in the country, Boggon said.

"The other companies involved in Mauritania's upstream business are either small or midsized independents," she said. "ENI [SPA]'s recent exit from the country demonstrates that Mauritania is not presently a core area for the major oil companies."

Government Developments

US FEDERAL AGENCIES have agreed to coordinate their roles in monitoring and approving LNG import terminals.

The Federal Energy Regulation Commission will be the lead agency for environmental review under the National Environmen- tal Policy Act and will coordinate its review with the US Depart- ment of Transportation (DOT) and the US Coast Guard (USCG). Under the agreement, the agencies will work to build a consensus on any hazard studies or other documents that might include safety and security analyses.

FERC officials said the agreement "clearly delineates the roles and responsibilities of each agency relative to LNG terminals and LNG tanker operations and stipulates that the agencies identify issues early and quickly resolve them."

DOT's Office of Pipeline Safety has the authority to promulgate and enforce safety regulations and standards for the transportation and storage of LNG in or affecting interstate or foreign commerce under pipeline safety laws. OPS authority extends to the siting, design, installation, construction, initial inspection, initial testing, operation, and maintenance of LNG facilities. Operation and maintenance includes fire prevention and security planning.

USCG exercises authority over LNG facilities that affect the safety and security of port areas and navigable waterways.

Currently, FERC, in cooperation with DOT and USCG, is evaluating the hazards associated with potential LNG spills on water. Study results, due at the end of March, will be aimed at developing a model for calculating vapor and thermal hazards associated with any spills.

THREE NEW MEXICO state agencies have filed letters of protest with the US Department of the Interior's Bureau of Land Management (BLM) concerning development of the Otero Mesa grasslands.

New Mexico's department of Energy, Minerals, and Natural Resources; Environment; and Game and Fish each filed protests to proposed drilling plans, arguing that the Chihuahuan Desert and grasslands are at risk in the New Mexico counties of Otero and Sierra.

"The BLM has conducted a 'bait and switch' of the proposed plan and reduced protection of our natural resources. It's unacceptable," New Mexico Cabinet Sec. Joanna Prukop said last month.

BLM announced Jan. 6 a controversial plan allowing limited development in Otero Mesa grasslands. But environmentalists and New Mexico Gov. Bill Richardson oppose the plan.

If the BLM proposal moves forward, an estimated 140 new wells could be drilled in the region, about 90 miles southeast of Las Cruces, NM (OGJ, Jan. 26, 2004, p. 28).

Prukop suggested the BLM close the area to drilling, adding that BLM has "failed to require nonnegotiable reclamation standards and criteria by not requiring a permanent cover of native species capable of self-regeneration. The expectations for revegetation described cannot be accurately called 'reclamation' or 'restoration.'"

Harvey E. Yates Co., Roswell, NM, made the first commercial gas discovery on federal land in the Orogrande basin in August 1997. Although that discovery was on federal land, gas deposits are believed to range over large areas and have attracted the attention of numerous companies.

Quick Takes

MARATHON OIL CO. has cancelled its proposed $1.5 billion LNG complex in Baja California, following California's move to expropriate property near Tijuana, Mexico, that included the site Marathon had selected as critical to its project (OGJ Online, Mar. 2, 2004).

Marathon's subsidiary Gas Natural Baja California SRL de CV (GNBC) and partners Grupo GGS SA de CV and Bermuda-based Golar LNG Ltd. had options to purchase the land but did not own it at the time the property was taken.

Marathon said that the action was "a signal the project will not be supported" by local authorities, even though Mexico's Energy Regulatory Commission last year awarded the group a natural gas storage permit.

Since then, public and political resistance has intensified toward the project as well as toward a ChevronTexaco Corp.'s proposed LNG receiving terminal and associated facilities off northern Baja California (OGJ Online, Feb. 3, 2004).

Marathon's complex was to have included an LNG offloading terminal, a 750 MMcfd regasification plant, a power generation plant, a 20 million gpd water desalination plant, wastewater treatment facilities, and related gas pipeline infrastructure (OGJ Online, Mar. 1, 2002).

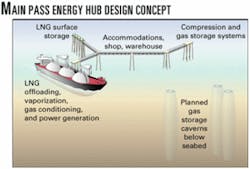

McMoRan Exploration Co. subsidiary Freeport-McMoRan Energy LLC, New Orleans, has filed application with the US Coast Guard for authorization to develop a $440 million, deepwater LNG receiving terminal at its Main Pass energy hub, 37 miles east of Venice, La. The 1 bcfd deepwater LNG port would be accompanied by onsite storage in several 2 mile diameter subsea salt caverns to be leached at the site, enabling the proposed facility to have an aggregate deliverability of 2.5 bcfd, including deliveries from storage. Main Pass Block 299 lies in 210 ft of water and is near shipping channels. Existing platforms and infrastructure at the site, designed to withstand a 200 year storm, will be used to house LNG vaporization and surface storage facilities. Pending timely approvals, facilities could be operational by late 2007, McMoRan said.

CHEYENNE PLAINS GAS PIPELINE CO., a unit of Houston-based El Paso Corp., has received US Federal Energy Regulatory Commission approval of the environmental impact statement for its proposed 380 mile natural gas pipeline from El Paso's Cheyenne Hub south of Cheyenne, Wyo., to Greensburg, Kan. (OGJ Online, May 28, 2003).

Initial capacity would be 560 MMcfd of gas, which could be increased to 730 MMcfd within 1 year.

Cheyenne Plains filed last September for FERC authorization to change the pipe diameter to 36 in. from 30 in. (OGJ Online, Sept. 22, 2003), a proposal that would hike construction costs to $425 million from $332 million. The pipeline is planned to be in service in early 2005.

Sasol Ltd., Johannesburg, reported delivery of first gas Feb. 29 from Temane natural gas fields in Mozambique to Sasol's synfuels plant at Secunda, near Johannesburg. The gas is being delivered via the newly commissioned 865 km pipeline between the two countries.

The $1.2 billion, world class pipeline and gas development project, a joint venture of Sasol and the governments of Mozambique and South Africa, consists of Pande and Temane gas field developments, a central gas processing facility at Mozambique, the pipeline, conversion of Sasol's existing gas pipeline network beginning this month, supply of gas to industries, and the conversion of Sasol Infrachem feedstock in Sasolburg to natural gas from coal by the end of May. Sasol also will use the gas as supplementary feedstock for its Secunda synfuels plant.

Capco Energy Inc., Orange, Calif., completed a well drilled to test the coalbed methane potential of a 4,131 acre lease in North Texas. Testing will continue for 60 days on the well, which encountered 8 ft of coal at 1,100 ft.

Several gas pipelines traverse the acreage, giving Capco a sales outlet for its produced gas.

If commercial quantities of gas are found, Capco plans to increase its land acquisition for extended drilling. The lease also contains conventional gas reserves discovered by utilizing updated seismic interpretation and drilling two wells in 2003.

BOURBON OFFSHORE NORWAY AS, a unit of the French company Groupe Bourbon, has selected Expro International Group PLC to provide process topsides for the Bourbon Opale floating production, storage, and offloading vessel now under construction in Norway for Petroleos Mexicanos.

The FPSO, designed to process as much as 10,000 b/d of 14-40º gravity crude oil, 5,000 b/d of water, and 26 MMscfd of associated gas, is scheduled in early May to replace an existing vessel operating for Pemex in the Bay of Campeche. Engineering and fabrication of the new equipment is under way and slated for completion in April. The topsides will be installed on the vessel in the UK before its transfer to Pemex.

TOTAL SA plans a 500 million euro upgrade of its Normandy refinery near Le Havre. New facilities will include a steam methane reformer and a 2.4 million tonne/year distillate hydrocracker that will enable the refinery to significantly reduce its output of heavy fuel oil, converting heavy fractions of petroleum into low-sulfur distillates.

South African Petroleum Refineries (Pty.) Ltd. (Sapref), a joint venture of Shell SA Energy and BP Southern Africa, has selected Fluor Corp., Aliso Viejo, Calif., to provide engineering, design, procurement, and construction management services for a clean fuels project at its Sapref refinery at Durban, South Africa, the largest refinery in that country. The LION (large increase in octane number) project will produce fuel with no lead and a reduced sulfur content to meet South African requirements by Jan. 1, 2006. Fluor's services include project management, basic and detailed engineering, procurement, construction management, and commissioning.

SOVEREIGN OIL & GAS CO., Houston, has entered into an agreement to work exclusively with Syntroleum Corp., Tulsa, to acquire, develop, and monetize stranded natural gas using Syntroleum's proprietary gas-to-liquids synthetic fuels technology (OGJ Online, Oct. 7, 2003).

The companies will identify and license proven gas fields in remote locations for use as feedstock for Syntroleum's GTL barge, which will produce liquid synfuels from gas to replace high-sulfur diesel and other conventional fuels.

Last month, Syntroleum signed a memorandum of understanding with Spanish engineering contractor Dragados Industrial SA and TI Capital, the finance arm of a Middle East-based crude oil transportation and marketing company, to finance, build, own, and operate the barge plants.

Each plant will contain a 19,000 b/d liquids production plant mounted on an inland barge. The plant, which will use Syntroleum's proprietary air-based GTL technology, is capable of producing about 130 million bbl of liquid synfuels from a 1.2 tcf field.

EXXONMOBIL CORP. unit Esso Exploration Angola (Block 15) Ltd., operator of Block 15 off Angola, has made the 17th oil strike on the block, with the Bavuca-1 well.

The well was drilled to 3,235 m TD in 1,094 m of water and flowed 2,726 b/d of 17-18° gravity oil during a production test.

Esso estimates that the block, which lies about 350 km northwest of Angola's capital Luanda, has oil reserves of 4.5 billion bbl.

Esso holds a 40% interest in Block 15. Partners are BP Exploration (Angola) Ltd. 26.67%, Agip Angola Exploration BV 20%, and Statoil Angola 13.33%. Sonangol is concessionaire.

Esso and Sonangol previously announced 16 other Block 15 discoveries—Hungo, Kissanje, Marimba, and Dikanza in 1998; Chocalho and Xikomba in 1999; Mondo, Saxi, and Batuque in 2000; Mbulumbumba, Vicango, and Mavacola in 2001; Reco Reco in 2002; and Clochas, Kakocha, and Tchihumba in 2003.

Kakocha and Tchihumba were the last two oil finds the partners made on Block 15.

Kakocha-1 was drilled in 1,030 m of water to 2,786 m TD and tested at 4,500 b/d of oil, while Tchihumba-1 was drilled in 1,190 m of water to 4,171 m TD and tested at 7,470 b/d of oil.

Houston-based Apache Corp.'s Qasr-3X well, on Egypt's Khalda concession, found 448 ft of net natural gas pay in the Jurassic Lower Safa formation. The well was drilled 2.1 km northwest of the independent's Qasr-2X well (OGJ Online, Dec. 4, 2003) and 3.5 km west-northwest of its Qasr-1X discovery (OGJ Online, July 7, 2003). The well had "the same gas-water contact seen in the first two wells," Apache said. With the drilling of the third well, Apache said it was able to "fully confirm" its original reserves estimate of 1-3 tcf of natural gas and 20-60 million bbl of condensate for the Qasr area. This year, the company will drill three additional Jurassic delineation wells and at least one shallower Alam El Bueb (AEB) Cretaceous well at Qasr. Facilities design and procurement are under way to develop an extensive pipeline system from Qasr. The line will connect a gas supply hub at Apache's Shams gas field with three existing gas processing plants. Apache's Qasr-1X discovery well, completed in July 2003, tested at 51.8 MMcfd of gas and 2,688 b/d of condensate from two zones. On test, Qasr-2X flowed 35.4 MMcfd of gas and 1,320 b/d of condensate last December. Qasr-2X currently is producing into a 6-in. line to the Salam gas processing plant at a restricted rate of 10 MMcfd of gas and 400 b/d of condensate. Following drilling of the Qasr-2X well, the Egyptian government granted a 95 sq mile development lease to Apache, the company said. An additional 62 ft of pay was logged at shallower depths of the Qasr-2X in the AEB sands that produce oil in the Ozoris field, 4 km to the northeast. Apache also drilled the Qasr-7X well to 11,672 ft TD, 234 yards south of the Qasr-2X, to develop the AEB reservoirs. Qasr-7X tested at an initial 1,579 b/d of oil from 20 ft of perforations in the AEB-3D reservoir, the firm said.

Statoil ASA has acquired a 30% interest in License P1026 on the UK continental shelf west of Shetland under a farmin agreement with operator ChevronTexaco Corp. Dansk Olie & Naturgas AS also is aquiin 10 of the license. ChevronTexaco will retain 40%, and OMV AG 20%. This acreage covers Blocks 213/26 and 213/27, on which lie the Rosebank and Lochnagar prospects, 150 km offshore on the Atlantic margin. Statoil has issued a letter of intent to Smedvig Offshore for use of the West Navigator drill ship to drill an exploration well in block 213/27 this summer.

VIRGINIA AND MARYLAND officials last week were watching a 6 mile fuel oil slick that appeared Feb. 28 about 50 miles off Virginia following the explosion and sinking of the Bow Mariner tanker that left three crewmen dead and 18 missing.

The tanker, en route to Houston from New York, was carrying 3.5 million gal of ethanol, 200,000 gal of fuel oil, and 48,000 gal of diesel fuel. Officials said the ethanol would dissipate, but the oil slick would be of concern if winds shift to the east.

Six of the vessel's 27 crewmen were rescued and three bodies were recovered, but search efforts—called off Mar. 1—failed to find the 18 other crewmen missing and feared dead in the 44°F. water.

Coast Guard officials, who said initial reports were of a "horrendous explosion" in the ship's bow where six ethanol tanks were located, added that the cause of the explosion is still under investigation.

Norway's Odfjell ASA owns the vessel, which is managed by the Greek firm Ceres Hellenic Shipping Enterprises.

AP Moller-Maersk AS, Copenhagen, awarded orders to the Chinese shipyards Dalian New Shipbuilding Ltd. and Guangzhou Shipyard International Co. Ltd. to supply four new product tankers.