Worldwide gas supplies to double by 2025, analyst says

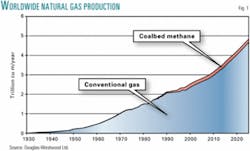

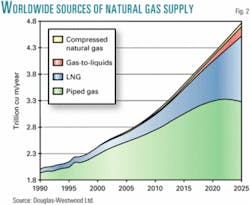

Worldwide production of natural gas, currently at 2.6 trillion cu m/year (tcm/year), is expected to rise to 4.755 tcm/year by 2025, an average increase of 2.75%/year.

The capital required for this increase will be $25-40 billion/year with total expenditures needed to 2025 reaching $630 billion.

So says Canterbury, UK-based energy analyst Douglas-Westwood Ltd. in a recent report about future world natural gas supplies.

Of the total expenditures figure, Douglas-Westwood said about $520 billion will be needed to construct infrastructure, while the remainder will be required for exploration and production.

Investment focus

Douglas-Westwood noted that LNG production likely will demand investment of more than $39 billion over the next 5 years.

This capital will be spent on LNG plants, carriers, and import terminals, the analyst said.

Since 1980, the study said, LNG exports have risen by 6.5%/year from 38 billion cu m (bcm) to more than 150 bcm.

"LNG is now the world's fastest- growing fuel and growth is expected to average 10%/ year so that by 2025, LNG will be conveying 1,240 bcm of gas equivalent or 26% of total yearly production," the study said.

The study's author, Michael R. Smith of EnergyFiles Ltd., said, "Natural gas is the only viable fuel that can link the carbon-based global energy supply used today to a renewables-based energy supply that will have to be used in the future.

"It is the only relatively clean alternative to oil and coal, fully supported by commercially effective production and distribution technologies—there is little doubt that natural gas will be the fuel of the future."

Remaining reserves

Smith went on to state that total remaining worldwide gas reserves and resources are "huge," estimated at 275 tcm, with Russia holding the largest share. Also, Smith said, a large part of worldwide gas reserves is classified as "low risk" gas, "located in the Middle East and other moderately remote areas."

The remainder of reserves is "higher- risk," either located in "technologically challenging (usually deep or deepwater) reservoirs, or in remote regions, especially polar regions," said Smith.

Smith said that indigenous gas supplies, however, are already declining in the three gas-importing areas—North America, Western Europe, and North Asia.

Also, about three quarters of new gas production will be traded across borders into these three regions, said John Westwood, Douglas-Westwood managing director and study series editor.

"The international gas supply trade is set to double from around 24% in 2003 to perhaps 50% by 2025, a level at which oil trade is now," Smith said.

Further investment

The study also forecast a "surge" in pipeline construction across countries and borders. Pipelines currently carry about 94% of global gas, or 2.44 tcm/year, the study noted.

This figure will have increased to about 3.275 tcm/year by 2025, the study said, which will represent 69% of globally marketed gas.