Market Movement

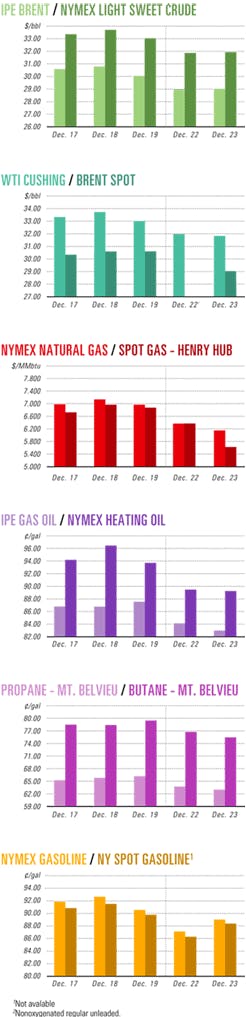

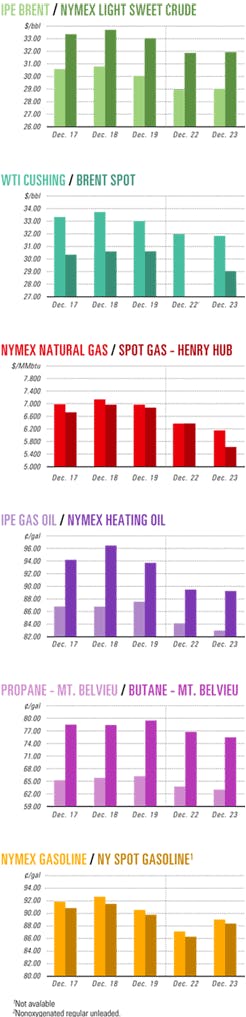

Mild forecasts end NYMEX gas rally

Weather and an abbreviated preholiday trading session led to thin trading volumes across the energy commodities complex in recent futures exchange activity. Unseasonably warm weather in the US Northeast pressured natural gas prices downward.

Inventory reports showed a build in crude stocks for the week ended Dec. 19. But analysts said the market remained most concerned about inventory reports for the week ended Dec. 12, which showed an unexpectedly large drawdown of US crude. That reawakened concerns about possible shortages in the case of sustained cold weather or disruption of fuel supplies later this winter, analysts said.

The New York Mercantile Exchange and Lon- don's International Petroleum Exchange both were closed Dec. 25-26 for the Christmas holiday.

The US and UK raised the level of security alerts, fearing attacks by terrorists groups during the holidays.

Traders cited increased fears of terrorist attacks during holidays as a primary bullish factor, driving prices higher when world markets resumed trading Dec. 29.

But warm weather in the northeastern US and declines in US natural gas prices pressured crude oil futures on NYMEX to settle lower. February crude settled down 46¢ to $32.40/bbl. The market opened at $32.75/bbl, which was the day's highest price.

US oil stocks fall to record low

For the week ended Dec. 12, US crude stocks plunged by 5.1 million bbl to 272.8 million bbl, said US Energy Information Administration officials (OGJ Online, Dec. 17, 2003). That's the lowest level recorded in December since the federal government began keeping records in 1982.

The American Petroleum Institute subsequently reported a smaller decline, to an even lower level, of 2.06 million bbl to 271.98 million bbl for the same period.

EIA reported a 1.7 million bbl build in crude oil stocks to 274.5 million bbl for the week ended Dec. 19. Yet commercial US oil inventories re- mained 25.3 million bbl below the 5 year average.

API said crude stocks climbed 3.8 million bbl to 275.7 million bbl for the same period.

EIA said gasoline stocks rose by 600,000 bbl to 203 million bbl for the week ended Dec. 19. API reported gasoline inventories for the same period at 201.2 million bbl.

Meanwhile, EIA statistics showed that distillate inventories fell by 2.3 million bbl to 128.4 million bbl, and API said distillate inventories fell by 2.5 million bbl to 130.8 million bbl.

EIA said gas storage withdrawals were 151 bcf for the week ended Dec. 19.

Working gas in storage was 2.69 tcf on that date, EIA said.

"With the latest 151 bcf withdrawal, the year-over-year storage surplus declined to 159 bcf from 215 bcf in the prior week, and 190 bcf the week before. Inventories are now at a 3 bcf deficit relative to the 5-year average," said UBS Securities LLC analyst Ronald J. Barone of New York.

Natural gas

Mild weather across much of the US in late December halted a natural gas price rally. Gas futures for January delivery expired Dec. 29 at $6.15/Mcf, down 22.9¢. The February contract lost 14.9¢ to $6.243/Mcf.

"Despite predictions for another shot of arctic air in early January, mild weather now and sluggish industrial demand during the Christmas and New Year's holidays helped crater both cash and futures pricesU," Enerfax Daily analysts said.

Many manufacturing plants shut down for 2 weeks during the holiday season, they noted.

An "unexpectedly cold start" to December triggered the previous run-up in natural gas prices that pushed the January contract to a new high of $7.55/Mcf on Dec. 10.

"Natural gas prices have now risen above No. 2, or distillate, fuel oil prices (on an energy-equivalent basis) in all of the three key fuel-switching regions for the first time since this summer," Robert Morris with Banc of America Securities LLC (BAS) in New York said Dec. 18.

"However, substantial switching away from natural gas to distillate if this disparity persists may not transpire until January, when existing contracts [and] commitments expire. Importantly, the relative price of natural gas to distillate fuel oil during the last week of December, or 'bid week'—when users typically make the majority of their fuel usage decisions for the subsequent month—will be a key driver of the potential incremental fuel-switching away from natural gas to distillate in January," he reported.

Analyst Stephen Smith of Stephen Smith Energy Associates, Natchez, Miss., raised his average 2004 natural gas price projection by 50¢ to $4.60/Mcf after price spikes above $7/Mcf earlier this month.

"We did not anticipate, nor can we fully explain, the December natural gas price explosion," Smith said.

Improved market outlook

Based on the growing demand for energy worldwide and continued weakness of the US dollar, BAS raised its 2004 price forecast to an average $28.80/bbl for benchmark US crude, from $24.75/bbl previously, and to an average $4.65/Mcf for US natural gas, up from $4/Mcf.

The investment bank raised its 2005 oil price forecast to $27.10/bbl from $22/ bbl.

"It is becoming more obvious that either higher natural gas and crude oil prices are the new norm or the anomaly is lasting several years," said James K. Wicklund, an analyst in BAS's Houston office. "Since mid-2000, natural gas prices have been over $4/Mcf 63% of the time (on a monthly basis) and had never been above $4/Mcf [as a monthly average] before that. For the previous 10 years up until January 2001, the average prompt month natural gas price was $2.08/Mcf. It [was at mid-December] above $7/Mcf," he said.

The US dollar has declined relative to most major currencies over the last 12 months, as the US Federal Reserve maintained its policy of low interest rates.

Since oil is priced internationally in US dollars, the weakening currency allows European refiners to buy more oil for the same amount of euros. That, said BAS analysts, contributed $3/bbl to their increased oil price forecast in 2004 and $1.45/bbl to the forecast for 2005.

"A 5% move in the dollar-euro ex- change rate affects our crude oil fair-price estimate by approximately 75¢/bbl," they said.

Iraqi production

The bullish market outlook has weathered Iraq's production recovery.

Smith said that the pace of Iraqi oil production is the focus of the Organization of Petroleum Exporting Countries, oil traders, and other market participants going into early 2004.

Iraq's oil production has almost tripled in 4 months, to 1.9 million b/d in November, Smith reported in a Dec. 23 research note.

"Despite this strong Iraqi production ramp-up, and odds favoring more of the same in 2004, fourth quarter oil prices have been stronger than most observers expected at the start of the quarter," he said.

Industry Scoreboard

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Industry Trends

null

null

ANALYSTS SAY that overall US natural gas production rates are on the decline despite reported increased production from some small, privately owned producers.

Raymond James & Associates Inc. said, "The preponderance of the evidence supports the view that US gas production is falling by more than 4% on a year-over-year basis.

"Furthermore, it does not appear that this trend is likely to reverse itself anytime soon," analysts said in a December research note examining the reasons behind conflicting production statistics from the firm and the US Energy Information Administra- tion.

The EIA estimates that US gas production is growing by roughly 2%/year. But RJA believes production is declining based upon its findings from quarterly surveys of 46 publicly traded US gas producers.

"If we smooth the data out by incorporating a 12-month moving average, one can see a substantial divergence between publicly traded company data and EIA data, beginning in early 2002," said analyst J. Marshall Adkins in the Houston office of the St. Petersburg, Fla.-based RJA.

EIA estimates dry gas production from state-reported data, which is an estimate that will be revised for a trailing 18-month period. After that, the EIA adds supplemental gaseous fuels and imports, subtracts exports, accounts for changes in gas storage, and incorporates a "balancing item" to arrive at a monthly consumption number, Adkins added.

"Not only are US natural gas production revisions for the last 18 months enough to raise an eyebrow at, but the mysterious balancing item estimates and revisions have brought the accuracy of the EIA data under scrutiny for some time," he said.

RJA contemplated whether production from small private companies could account for the differences between its survey figures and EIA data. "Specifically, private company production would have to be growing by nearly 8.5% year-over-year to get close to the EIA dataU.While these smaller companies have been helping to drive the rising US rig count, one must question the quality of prospects available to them. In fact, our analysis shows that it is highly unlikely that the smaller, private E&P companies are driving any increase in US gas production," Adkins said.

RJA said the larger, publicly traded independents represent 29% of US gas production and have been responsible for putting an additional 97 rigs to work, accounting for a 49% increase for this group, since Jan. 1, 2003.

But despite the increased drilling, corresponding production results shows only 2.4% year-over-year growth in gas production.

Meanwhile, the private companies represent 44% of US production and have been responsible for putting an additional 106 rigs to work, a 30% increase.

"Even if we generously assume similar rig and finding efficiencies, private company production would be up only about 1.5%, and therefore total US production would still be down over 1%," Adkins said.

"In summary, without large organic increases in production from only a few of the independents with quality prospects and improved efficiency, it is likely that the private gas producers may not experience production increases at all," he said.

Government Developments

NEGOTIATIONS AMONG 51 European and Asian nations on a legally binding international agreement on energy transit issues have ended unsuccessfully, at least for now.

The Energy Charter Conference reported that member nations could not reach a unanimous decision to adopt the Transit Protocol to the Energy Charter Treaty (ECT).

The talks upon what had been considered a final compromise text were suspended last month during a meeting in Brussels.

Negotiations started in 2000 on the Transit Protocol, which was intended to build on existing ECT transit-related provisions. The protocol would have involved enhanced rules under international law governing energy transit flows across national borders. Agreement was reached on most of the text by Dec. 31, 2002 (OGJ, Oct. 20, 2003, p. 60). The few outstanding issues related to differences between the European Union and Russia.

"Under these circumstances, I consider, as chairman, that there is no purpose to be served by continuing the negotiation process at this time," said Henning Christophersen, chairman of the conference. "Nonetheless, we have not closed the door on the negotiations forever, and I have tasked the Energy Charter Secretariat with reporting back to the next meeting of the Charter Conference in June 2004 regarding the prospects for completing our work on the draft protocol."

Meanwhile, governments still need to create a multilateral framework of rules on transit issues, he said.

GOVERNMENT OFFICIALS representing Yukon and the Northwest Territories signed a preliminary agreement regarding cooperation on the northern territories' joint oil and gas development.

Last month, officials from the two governments signed a "sub-agreement" that commits both territories to outline a plan that will identify development options.

The agreement also recognizes the need for both territories to cooperate regarding the development and management of Beaufort Sea oil and gas, a Yukon government news release said.

"The subagreement will also help to gain access to the proposed Mackenzie Valley pipeline for North Yukon's oil and gas resources," said Yukon Energy, Mines, and Resources Minister Archie Lang.

The "subagreement" was negotiated under an Intergovern- mental Relations Accord that the governments of Yukon and the Northwest Territories signed on Mar. 13, 2003.

ALASKA IS WOOING independent oil and gas producers.

Alaska Gov. Frank H. Murkowski met last month with a group representing more than 12 independents.

"We are looking to find out what we can do better to make Alaska's oil and gas province more attractive for investment of your exploration dollars," Murkowski said during the meeting in Juneau.

Acknowledging that high risk sometimes produces high rewards, Murkowski promised to continue working to open Alaska oil areas on the North Slope, the Alaska Peninsula, and in the Cook Inlet area to independents.

The independents' representatives suggested revising the state's tax credit incentive for producers and expanding the credit to state income taxes. Another issue is the pipeline tariff and the fact that it often determines whether marginal oil reserves will be produced or left in the ground, they said.

Quick Takes

A GROUP led by Chevron Canada Resources Ltd. 50% won exploration rights on all eight deepwater parcels awarded in the frontier Orphan basin off Newfoundland. Imperial Oil Resources Ltd. and ExxonMobil Canada Ltd., which hold 25% each, are the other members. The group bid a total of $673 million (Can.) for Parcels 3, 4, 5, 6, 7, 10, 11, and 12, which encompass 5.25 million acres. Six parcels drew no bids.

Parcel 11 is 75 miles north of the closest discoveries in the Jeanne d'Arc basin (OGJ Online, Mar. 25, 2003). The other awarded parcels are 180-230 miles off Newfoundland and Labrador.

The bids represent the amount committed for exploration during the first 5 years of a 9 year exploration license with as much as 5% of the bid amount allowed for research and development and education and training in the province.

In other exploration news, ExxonMobil Corp. subsidiary Mobil North Sea Ltd. (MNSL) made a natural gas discovery in the southern North Sea, 5 miles southeast of MNSL-operated Camelot field and 32 miles east of Bacton, England. The discovery well found gas in the Rotliegend reservoir and was tested at a flow rate of 65 MMcfd through an 80/64-in. choke, ExxonMobil said. Data analysis and additional studies are currently being conducted. MNSL is operator with 70% interest, and EOG Resources Inc., Houston, holds the remaining interest. Truong Son Joint Operating Co. (JOC) has made an oil discovery on Block 46/02 in the Malaysia-Viet Nam Commercial Arrangement Area (CAA) off Viet Nam. On test the Song Doc-1X exploration well flowed 7,300 b/d of 38° gravity oil, with flow constrained by testing equipment. Reserves potential is being evaluated. Truong Son JOC is owned by PetroVietnam Exploration & Production Co., operator, with a 40% interest; Talisman (Vietnam 46/02) Ltd., a subsidiary of Calgary-based Talisman Energy Inc., 30%; and Petronas Carigali Overseas Sdn. Bhd., a wholly owned subsidiary of Malaysian state oil firm Petronas.

BRAZIL STATE OIL FIRM Petróleo Brasileiro SA (Petrobras) signed three contracts totaling $753 million Dec. 19 for construction of its 180,000 b/d P-52 semisubmersible production platform to be installed in Roncador field in the Campos basin off Brazil. Three basic contracts were awarded to:

- The Brazilian-Argentine combine Fels Setal-Technip Consortium, a $775 million contract for engineering, procurement, construction, and assembly of the platform hull and topsides.

- Rolls-Royce Power Engineering PLC, London, an $82.6 million contract to supply, assemble, operate, and maintain the platform's electricity generation modules.

- Nuovo Pignone SPA, Florence, a $65.8 million contract to supply and assemble the platform's gas compression modules.

The Brazilian Development Bank will finance the contracts' domestic sourcing of services and equipment.

CALGARY-BASED Petro-Canada, owner-operator of Clapham field on Block 21/24 in the UK Central North Sea 165 km east of Aberdeen, achieved first oil from the field in late November.

Clapham field, expected to produce a peak of 15,000 b/d of oil in 2004, is tied back to the Triton floating production, storage, and offloading vessel. Petro-Canada estimates the field has more than 20 million bbl of proved and probable oil reserves.

Petro-Canada said it plans to invest $640 million (Can.) in 2004 in its international business, of which $240 million will be in the UK—more than half of that for development of Pict field, which also would be tied back to the Triton FPSO.

In other production activities, Shell Exploration & Production BV produced first gas from Carrack gas field in the southern North Sea. ExxonMobil affiliate Esso Exploration & Production UK Ltd. is Shell's partner in the venture. Carrack field, which lies in a remote area 75 miles northeast of Bacton off England, holds 300 bcf of natural gas reserves. The project was developed around a central hub platform that straddles the field. Four additional wells are to be drilled within the next year, and capacity exists for more wells if required. A second, smaller platform serves as a receiving facility for Carrack gas production. These new platforms and the 50 mile Carrack pipeline will facilitate tiebacks of other fields—including any yet discovered—in the area, ExxonMobil said. Operator Shell E&P holds 52% equity interest in the project, and Esso 48%.

SAUDI BASIC INDUSTRIES CORP. plans to construct another olefins complex at Yanbu Industrial City on Saudi Arabia's Red Sea coast.

A new cracker, which is expected to come on stream in 2007, will have production capacity of 1.3 million tonnes/year of ethylene. In addition, plans call for the construction of an 800,000 tonne/year polyethylene plant, a 700,000 tonne/ year ethylene glycol plant, and a 350,000 tonne/ year polypropylene plant.

TERMINAL DE LNG DE ALTAMIRA SRL DE CV—a joint venture of Royal Dutch/Shell Group and Total SA—has awarded a $250 million lump sum, turnkey contract to Ishikawajima-Harima Heavy Industries Co. Ltd. and ICA-Fluor Consor-tium for the construction of an LNG regasification terminal on the eastern coast of Mexico. The agreement includes design, engineering, procurement, construction, and start-up services for the terminal, which would be built near the port of Altamira near Tampico.

The facility will have an initial capacity of 650 MMcfd of gas, with provisions for future expansion, the partners said. Following a 3 year construction period, operations are expected to begin during second half 2006.

The terminal will include LNG ship-berthing and unloading facilities, two 150,000 cu m LNG storage tanks, and regasification send-out installations.

In other LNG news, Shell International Gas Ltd. and Sempra Energy LNG Corp., subsidiary of Sempra Energy Global Enterprises, are combining two previously separate Baja California LNG receiving terminal proposals into a single project—Energia Costa Azul—on Mexico's Pacific coast. Construction is planned to begin in mid-2004 with terminal operations starting up in 2007. The two companies are forming a 50:50 joint venture to build, own, and operate the $600 million LNG receiving terminal in Costa Azul 14 miles north of Ensenada. It will be designed to regasify 1 bcfd of natural gas. Shell and Sempra Energy LNG will share expenses equally, and each will take 50% of the terminal capacity. About half of the terminal's yield will be used in western Mexico and the balance in the southwestern US. Shell Gas & Power originally had planed a 7.5 million tonne/year LNG import terminal 23 km north of Ensenada (OGJ Online, Aug. 6, 2003). Shell said in August that terminal permitting activities were "well advanced." The decision to combine and develop a single project in Baja California "blends the permitting, technical, and logistical expertise required to get this project under way," said Sempra.

In a related action, Sempra signed a nonbinding heads of agreement Dec. 18 for Indonesia and BP PLC to supply 500 MMcfd of LNG from BP-operated Tangguh field off Papua, Indonesia, to its planned LNG terminal on Mexico's western coast for 20 years (OGJ Online, Oct. 5, 2001). BP officials said the Tangguh project is targeting a two-train start-up, although a third train might be added in 2009 or 2010. Cheniere Energy Inc., Houston, applied to the US Federal Energy Regulatory Commis- sion Dec. 22 for permits to construct LNG receiving terminals at Sabine Pass, La., and Corpus Christi, Tex., and for two natural gas pipelines from the sites. One pipeline would extend 120 miles from the Sabine Pass terminal site to Henry Hub, and another from the Corpus Christi site to interstate pipelines 25 miles to the northwest. Cheniere previously had acquired options for LNG sites also at Freeport and Brownsville, Tex. (OGJ Online, Dec. 6, 2001). "Because of the strong interest, our first project (Freeport) received, these terminals will be larger, each with two unloading docks, three 160,000 cu m storage tanks (10.1 bcf), and the ability to import 2.6 bcfd of natural gas," said Charif Souki, Cheniere's chairman and CEO. Earlier this week Freeport LNG Development LP, in which Cheniere holds a 30% limited partner interest, signed an agreement with ConocoPhillips whereby ConocoPhillips would fund $400-450 million in construction costs for the proposed Freeport LNG receiving terminal at Quintana, southeast of Freeport in Brazoria County.

ConocoPhillips also will take a 50% general partnership managing interest (OGJ Online, Dec. 23, 2003), assuming responsibility for construction management and facility operation. All of the 1.5 bcfd of LNG receiving capacity planned for Freeport has been allocated to ConocoPhillips (1 bcfd) and Dow Chemical (500 MMcfd). Natural gas will be transported through a 9.4 mile pipeline to Stratton Ridge, Tex. FERC is expected to approve the Freeport project in the firs quarter this year, ConocoPhillips said, with all other necessary federal, state, and local approvals to follow shortly thereafter. Technip USA Corp., Houston, is under way with the front-end engineering and design study, which it expects to complete in January (OGJ Online, Aug. 12, 2003). Terminal construction is scheduled to begin in second half 2004, with commercial start-up in mid-2007.

PETRO-CANADA plans to reconfigure its Edmonton refinery and supply it with upgraded and refined oil sands feedstock through an agreement with Suncor Energy Inc. Petro-Canada said the deal will enable it to process 53,000 b/d of bitumen, providing processing for existing and future steam-assisted gravity drainage production from its oil sands leases.

Under a 10 year processing and sales agreement, Petro-Canada, starting in 2008, will ship at least 27,000 b/d of bitumen from its MacKay River oil sands facility 60 km northwest of Fort McMurray, Alta., to Suncor's oil sands plant north of Fort McMurray. There it will be processed into about 22,000 b/d of sour crude oil on a fee-for-service basis, blended with an additional 26,000 b/d of sour crude that Petro-Canada will purchase from Suncor, then shipped to Petro-Canada's refinery in Strathcona County, east of Edmonton.

Petro-Canada earlier had applied for a $4-5 billion (Can.) conversion of its Edmonton refinery to process bitumen but instead will spend about $1.2 billion now to expand the existing coker and add hydrogen production and sulfur-handling facilities, taking a writedown this quarter for engineering and cancellation costs related to the original conversion plan.

MacKay River is slated to ramp up to full oil sands production of 30,000 b/d by early this year and retain that level for the full 25 year life of the plant (OGJ Online, Oct. 14, 2002).

In other refining news, ExxonMobil's 523,000 b/d Baytown refinery on Dec. 17 started up new facilities implementing its proprietary Scanfining process that will reduce sulfur in its motor gasoline by 90%. The new facilities also will produce gasoline with lower nitrogen oxide emissions. Fluor Corp. was engineering, procurement, and construction contractor for the 3 year project.

THE WEST NAVIGATOR deepwater drillship has set a drilling-time record off Mauritania while drilling the Tiof West well in Chinguetti field for Woodside Mauritania Pty. Ltd., claims the drillship's owner Smedvig AS. The drillship has been drilling three wells for Woodside in the area (OGJ Online, Dec. 2, 2003).

From arrival on location until the drilling was completed at 2,992 m TD, West Navigator drilled 1,641 m in 5.3 days, including setting and testing the blowout preventer, in water 1,351 m deep, Smedvig reported.

null

The dynamically positioned West Navigator is equipped with dual derricks that enable drilling and completion operations to be performed simultaneously, increasing drilling efficiency by more than 20%.