OGJ Newsletter

Market Movement

Record futures prices signal 'crisis'

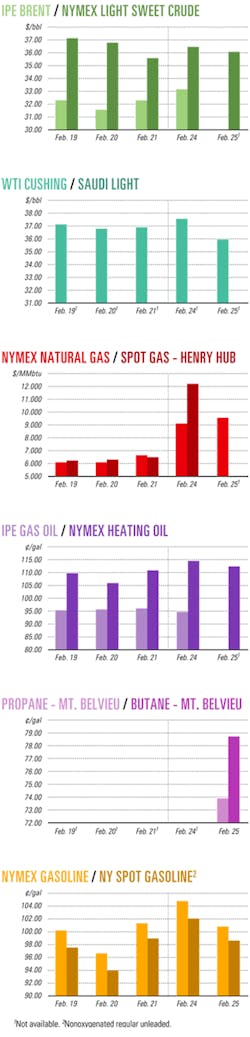

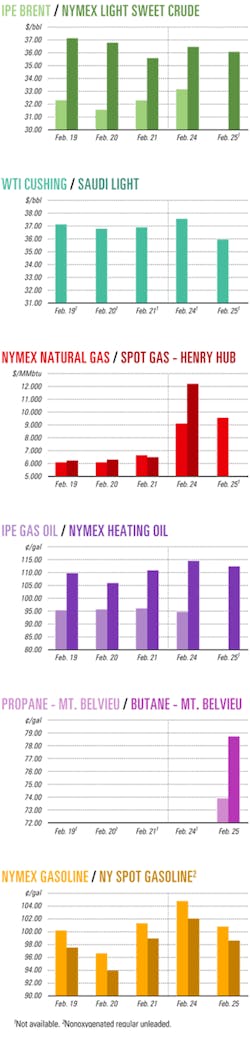

Oil, natural gas, and heating oil futures set or approached price records last week.

The price surges came amid the increasing likelihood of war with Iraq, cold winter weather, and low US inventory numbers.

Crude oil futures reached a post-Persian Gulf War high Feb. 26 on the New York Mercantile Exchange, with the April contract for benchmark US light, sweet crude settling at $37.70/bbl, up $1.63.

On Feb. 27, the market opened at $38.66/bbl in electronic trading, the highest level since crude peaked at more than $41/bbl shortly after Iraq invaded Kuwait in 1990.

The March contract for natural gas surged to a record high of $11.89/Mcf in overnight electronic trading Feb. 24 on NYMEX before stalling early in the next trading session at $10.10/Mcf—the previous record set in December 2000. The contract closed at $9.58/Mcf on Feb. 25 and at $9.13/Mcf on Feb. 26.

At the same time, natural gas spot market prices jumped more than $10 to $37.50/Mcf at the New York city gate, while the Chicago spot market was up $2.67 to $17.87/Mcf (OGJ Online, Feb. 26, 2003).

Heating oil for March delivery hit an all-time high twice within 2 days. It first peaked briefly at $1.1535/gal during the regular Feb. 24 NYMEX trading session, surpassing the previous record of $1.15/gal in November 1979. But that record was short-lived. Heating oil prices surged on Feb. 26, closing at $1.1549/gal, up 3.23¢ from the previous close.

The US Energy Information Administration said that US inventories fell by 1 million bbl for crude, 3.1 million bbl for gasoline, and 3.9 million bbl for distillate during the previous week.

Imminent crisis?

"The US is facing an energy crisis" that "hasn't come suddenly," said Paul Horsnell, head of energy research for J.P. Morgan Chase & Co., London, in a Feb. 26 report.

"Twice within 2 years, the (US natural gas) market, to achieve balance, has had to spike prices to levels where immediate and severe demand destruction occurs. That is not the sign of a market that is either working well or playing a constructive role in the US economy," Horsnell said.

"The (US gas) market has gained 67% in the last 7 trading sessions as utilities scrambled to conserve already-low storage, turning to the cash market to meet incremental heating needs," analysts at Enerfax Daily, Houston, reported at midweek.

The 7.7 million bbl drop in US commercial inventories of oil and petroleum products to 898 million bbl, reported by DOE for the week ended Feb. 21, is "really scary stuff," Horsnell said.

"In the year to date, total (US oil and petroleum products) inventories have fallen by 57 million bbl, which is 38.7 million bbl more than would be expected on a normal pattern," he said. "Put another way, a normal pattern for the year to date would be an inventory draw of under 400,000 b/d, and the US industry has instead sustained an average fall of over 1.1 million b/d."

Among US stocks of petroleum products, distillates were the hardest hit. Horsnell said, "We must now be getting very close to localized physical shortages and the potential for even more-extreme price spikes."

Moreover, he said, "The spectacular spike in natural gas prices has raised the specter of yet more demand trying to move towards distillates, in the context of a market that really can't cope with it. Crude inventories continue to bounce along the bottom, with import flows still failing to keep up with refinery-run increases in any consistent fashion."

Gas price, storage concerns

In a Feb. 25 report, John P. Herrlin Jr., first vice-president of the Merrill Lynch Global Securities Research & Economics Group, said natural gas futures prices in excess of $9/Mcf in February "is not healthy for the demand side of the equation."

Many traders are speculating on season-ending levels for natural gas storage, he said.

EIA reported that working gas in storage was 1.014 tcf as of Feb. 21, which was a net decline of 154 bcf from the previous week.

Stocks were 948 bcf lower than last year at this time, and 508 bcf below the 5-year average of 1.522 tcf.

Herrlin said, "We think refill (of US gas storage) during the summer months may become an issue, but the persistence of truly silly prices will cause some type of elastic reaction."

Meanwhile, National Petrochemical & Refiners Association told a Senate committee hearing last week that any move to encourage US use of natural gas "largely for environmental reasons" should be weighed against the impact on the US petrochemical industry.

Industry Scoreboard

null

null

null

Industry Trends

EUROPEAN DEPENDENCY on natural gas imports is projected to rise to more than 60% by 2015 from 40% today. Consequently, Europe must arrange for more-remote gas sources such as Russian reserves, said Wood Mackenzie Consultants Ltd.

The Edinburgh-based consultant evaluated future gas supply fundamentals and an ongoing liberalization's impact on European gas markets. WoodMac sought to determine a wholesale gas price outlook. The resulting report, based on a detailed modeling of future gas trade flows, outlined a potential contractual supply deficit of 300 billion cu m/year (bcm/y) by 2015.

The biggest projected shortfall, 95 bcm/y, will be in the UK, where indigenous production is forecast to decline significantly starting in 2004, the consultant said. Meanwhile, Norway and Algeria are likely to experience strong export growth into their core northern and southern European markets, respectively, until 2010. In this same timeframe, LNG will become more important, with market share expected to climb to 12% (80 bcm/y), compared with 7% in 2000.

"However, beyond 2015, the potential call on more-remote sources, such as Russian or even Middle Eastern volumes, is considerable; Russian volumes in 2015 could amount to as much as 300 bcm/y, equivalent to 40% of European demand, compared with 160 bcm at present," said Neil Thomas, WoodMac's head of European energy research.

"The challenge for all stakeholders is to ensure that the necessary environment, both within and outside Russia, is created to develop Russia's world-class reserve potential for the European market. In this timeframe, there may also be a requirement to develop new sources of supply, such as Iranian gas, for delivery into Europe," he said.

MEANWHILE, THE US appears to be on the verge of another major natural gas supply shortage, warns Raymond James & Associates Inc. According to its recent survey, US natural gas production declined 6.4% in 2002 compared with 2001 and 2.7% sequentially for the fourth quarter.

RJA released that information upon receiving final results from a fourth quarter 2002 US natural gas production survey of 37 companies. The decline numbers were higher than expected based upon preliminary survey results. Previously, RJA forecast a 0.6% decline by quarter sequentially and a 4.6% decline on a year-over-year basis (OGJ, Feb. 10, 2003, p. 7).

"Of course, these surveys are not a perfect indication of what is to come, but they do tend to illustrate the magnitude of the larger trend to which we preach: Natural gas production in the United States continues to decline at a steady pace both sequentially and (YOY) at the tune of 1.0-1.5% and 6-7%, respectively," said RJA analyst Marshall Adkins.

The fourth quarter 2002 US gas production decline was particularly large because of hurricane-related production volume losses."That said, production declines in the first quarterUwill most likely return to the more typical 1.0-1.5% sequential, 6-7% (YOY) declines to which we have become accustomed, until drilling activity levels increase substantially," Adkins said.

Government Developments

THE UK has proposed a strategy to reduce carbon emissions over the next 50 years though a major expansion of renewable energy and energy efficiency (see Editorial, p. 19).

UK Trade and Industry Secretary Patricia Hewitt said, "Our country needs a new energy policyU. Climate change is a clear and present danger."

She suggested that cuts could be achieved through a combination of measures, including doubling the share of electricity from renewables by 2020 compared with the existing 2010 target of 10%.

She also called for total investments in renewable energy of as much as $550 million during the next 4 years.

The strategy was outlined in a government white paper "Our Energy Future—Creating a Low Carbon Economy." The proposal suggested four goals for UK energy policy:

- To work towards cutting emissions of carbon dioxide by 60% by 2050.

- To maintain the reliability of energy supplies.

- To promote competitive energy markets in the UK and beyond.

- To ensure that every home is adequately and affordably heated.

The white paper outlined how a cut of 15-25 million tonnes/year of carbon by 2020 could be achieved.

ALASKA OIL AND GAS REGULATORS are considering whether the state needs more authority regarding high-pressure wells.

BP Exploration (Alaska) Inc. had a Mar. 3 deadline to submit a plan for managing Prudhoe Bay wells having high outer-annulus pressure. The company already submitted results of an earlier hazard study that it conducted.

The Alaska Oil and Gas Conservation Commission issued a Jan. 16 order requiring the well management plan following an Aug. 16, 2002, explosion and fire at Prudhoe Bay well A-22 that seriously injured a wellpad operator (OGJ, Sept. 9, 2002, p. 8).

AOGCC is considering expanding the order into a rule that would give the agency more oversight in the maintenance of high-pressure wells. The creation of a rule would require a public hearing process.

BP spokesman Daren Beaudo said the company has improved its management of high-pressure wells, including changes to monitoring, worker training, and other procedures similar to those the AOGCC order requested. "A lot of the elements of the order seem to codify most, if not all, of the actions that we've already pledged or taken," Beaudo said.

THE US MINERALS MANAGEMENT SERVICE reported 2002 was a year of significant deepwater activity in the Gulf of Mexico despite a general downturn in US drilling.

Chris Oynes, MMS regional director, reported 12 new deepwater discoveries, of which 3 were in water 8,000 ft or deeper. Meanwhile, 14 deepwater projects began production in 2002. These joined the 51 already in production, for a total of 65.

"Deepwater development projects continue at a fast pace, and the 14 new projects in the Gulf of Mexico include 11 that were subsea production systems that tied back to another project," Oynes said.

That raised the number of subsea projects to 41 out of the 65 total deepwater projects. Three of the deepwater starts utilized a spar as a production system.

Quick Takes

THE ABORIGINAL PIPELINE GROUP (APG), representing Northwest Canadian aboriginal interests in the proposed Mackenzie Delta natural gas pipeline, says it has struck a financial deal that will allow it to participate in the $4 billion (Can.) project.

APG, based in Inuvik, NWT, said it has reached a tentative deal with industry interests for $70 million to cover APG's share of preliminary design work for the line and up to $300 million in equity if the line is built. APG eventually would have a one-third interest in the project under an agreement signed 16 months ago with the delta producer group that is studying the feasibility of a line. The group is headed by Imperial Oil Ltd. and includes Shell Canada Ltd., ConocoPhillips, and ExxonMobil Corp.

APG Chairman Fred Carmichael said formal announcement of the deal is 3-4 weeks away, after legal work is completed. He said the deal also would require approval from the producer group that owns 5.8 tcf of gas reserves in the Mackenzie Delta.

Carmichael refused to confirm reports that the deal is with Calgary-based TransCanada PipeLines Ltd., which would earn the right to build the 810 mile line from the delta to southern Canada. The line would move 1.2 bcfd and could be expanded to carry 1.9 bcfd.

Frank T'seleie, of Fort Good Hope, NWT, and a member of the APG executive committee but not the negotiating team, said the deal is with TransCanada and that it would obtain the right to build the line. Carmichael would not confirm that, saying the deal is covered by a confidentiality agreement between the parties.

TransCanada also had no comment on the reports. The company has expressed interest in participating in the pipeline project, as has Enbridge Inc., another major pipeline operator, which said it is continuing discussions with producers and does not have information on any deal involving TransCanada. Carmichael said that APG will not give up any of its ownership interests in the pipeline and that there are back-in clauses in the deal that he cannot discuss at this point.

APG initially requested assistance from Ottawa in funding its share of the project, but the federal government declined to become involved. Work has continued on the project, but an agreement to provide for aboriginal financing would be a major step forward.

A pipeline application could be filed later this year with the National Energy Board, initiating a regulatory process that could take up to 2 years. If approved, construction would take 3-4 years. The project would not be completed until 2008-09.

A financing deal for APG also would improve prospects for a Mackenzie Valley pipeline in comparison with the larger Alaska Highway Pipeline project, which North Slope gas owners say is not economic. That project has so far failed to win financial support from the US Congress, although legislation to that effect has surfaced in proposed omnibus energy legislation.

In other pipeline developments, Southern Natural Gas Co. has selected Willbros Group Inc. construction unit Rogers & Phillips Inc., Houston, to construct Phase II of Southern Natural's South System expansion project.

The expansion consists of five new segments of pipeline totaling 46.8 miles of 30 and 36-in. pipeline in Mississippi, Alabama, and Georgia. Work is slated to start in March for completion in July.

UNIVERSITY OF KANSAS scientists, working with oil companies and governmental partners, have studied subsurface rock samples and computer models from a Russell County, Kan., field for 2 years and conducted carbon dioxide tests to determine the best methods for increasing production from declining area fields.

In January, the tests focused on 10 acres in Hall-Gurney field, which has produced more than 150 million bbl of oil since its 1931 discovery but declined to 500,000 bbl in 2001.

"For the CO2 test to be economically successfulU, it will have to help produce an additional 20,000-30,000 bbl of oil over the next 4 years," said Alan Byrnes, a Kansas Geological Survey petroleum geologist.

He told OGJ that researchers are finding the conditions they expected, and testing is going well.

"If you can prove that this works in central Kansas, it could work in lots of other areas around the state," said Martin Dubois, petroleum geologist with the Kansas Geological Survey (OGJ, June 5, 2000, p. 37).

Researchers will try to repressure the depleted field with water injection through an existing well into the Pennsylvanian Lansing-Kansas City formation at about 3,000 ft. If water injection tests are positive, liquid CO2 will be trucked from a nearby ethanol plant to the field, where researchers would pump 400 Mcfd of CO2 into the formation for about 6 months, then alternate injections of CO2 and water for 4 years.

The new ethanol plant, 6 miles away at Russell, Kan., could supply enough CO2 for much of Hall-Gurney field, but producers would need larger volumes for widespread applications in Kansas.

Houston-based Kinder Morgan CO2 Co., a Russell project partner, could provide underground CO2 to Kansas from New Mexico and Colorado via pipeline.

Elsewhere on the production front, Kuwait Petroleum Co. has closed Al Abdali and Al Ratqa oil fields for security reasons, but the closure should not affect Kuwaiti output, OPEC News Agency reported. Kuwait produces 1.966 million b/d of oil under its quota assigned by the Organization of Petroleum Exporting Countries. The closed fields together produce about 35,000 b/d. Located near the border between Kuwait and Iraq, the fields were closed because of rising tensions with Iraq. KPC officials said increased output at Ahmadi, Burgan, and Magwa fields would compensate for curtailed production at the two fields, OPECNA reported.

OCCIDENTAL PETROLEUM CORP. Feb. 21 reported the discovery of two more fields on its 494,000 acre Block 15 in Ecuador's Oriente jungle region.

Two exploratory wells—Yanaquincha Este-1 and Yanaquincha Oeste-1—which lie 12 km and 16 km, respectively, from the existing central processing facilities on the block, encountered 21° and 27.2° gravity oil in three zones: Hollin, Napo U, and Napo T sandstones, at 9,758-10,200 ft. Each test well cut more than 90 ft of net pay, Oxy said.

The Hollin formation tested at 590 b/d of oil, natural, through a 1/2-in. choke, Oxy said. The U formation flowed as much as 2,300 b/d of oil, and the T formation flowed at rates of as much as 3,320 b/d of oil. The two back-to-back, adjacent discoveries follow the successful completion of an extensive 3D seismic survey over Block 15 (OGJ Online, Sept. 10, 2001). The two discovery wells were followed by two delineation wells, and drilling continues with two more delineation wells planned.

Oxy acquired Block 15 in 1985 and had discovered six fields by spring 1999, at which time the company signed a production-sharing agreement with state oil firm Petroecuador, along with a sharing of management responsibilities (OGJ, May 31, 1999, p. 36).

Then-Alberta Energy Co. Ltd. of Calgary (now part of Nexen Inc.) farmed into Block 15 with a 40% interest in late 2000 and assumed certain capital costs through 2004, a transaction that funded Oxy's capital program for existing projects in Ecuador while freeing investment capital for new projects. (OGJ Online, Nov. 1, 2000). Oxy remains operator of the block.

Oxy said its ongoing development plans on Block 15, which target an increase in gross production to 70,000 b/d of oil in 2003, were tied to the successful completion of a crude oil pipeline in Ecuador. Oxy said this year it plans to complete the interpretation of its 3D seismic data on Block 15 and will drill four to seven new exploration wells on the block.

In other exploration news, El Paso Corp.'s Brazilian subsidiary found oil and gas on the BM-Cal-4 block in the Camamu basin off Bahia state in northeastern Brazil, but company officials said more drilling will be necessary before they can determine if the discovery is commercial. The company has licenses to explore and develop two blocks off southern Bahia. The BM-Cal-4 block is the first to be drilled. El Paso owns interests in 19 blocks in Brazil. Most were bought in auctions promoted by the National Petroleum Agency.

A Feb. 21 barge fire and explosion at the ExxonMobil Corp. Port Mobil terminal on Staten Island, NY, killed two Bouchard Transportation Co. Inc. employees and injured an ExxonMobil employee.

Hank Muller, ExxonMobil terminal manager, said ExxonMobil deeply regretted the injuries and loss of life. Bouchard also issued a statement saying it was deeply saddened by the deaths of its employees.

"Investigators say they have not ruled out any possibilities as to the cause of this accident," Bouchard said. Both Bouchard and ExxonMobil were working closely with the US Coast Guard as well as the New York police and fire departments to determine the cause of the accident.

The barge, containing 100,000 bbl of unleaded gasoline, was being unloaded at the time of the explosion. Remaining product was isolated from the fire, and ExxonMobil acted to redirect product to ensure supply. At the time of the incident, fewer than 500,000 bbl of usable product was stored at the 2.5 million bbl terminal. Clean-up operations began as soon as the fire was extinguished and authorities gave authorization to proceed.

DANSK OLIE & NATURGAS AS (DONG) has let a contract to UWG Group for design, fabrication, project management, and installation of two subsea templates for Nini and Cecile oil fields in the Danish North Sea.

The two 10-slot templates, each weighing 17 tonnes, will be installed from a jack up on the two fields. DONG and its other licensees of Nini and Cecilie fields were granted authority to develop those fields last year (OGJ Online, July 23, 2002).

The Nini template was installed last month, while development work on Cecile is expected to take place in late spring.

Jacket and topsides facility installation will be performed over the templates once well predrilling is complete.

"The templates' circular design presented several unique challenges with respect to sharing the same docking pile modules, as well as their compact modular requirements for transportation and assembly," said Rowan Patterson, UWG business manager, well systems engineering. Reserves in the two fields are estimated at 65 million bbl of crude oil. Ownership interests in Nini are DONG 40%, Denerco Oil AS 30%, and RWE DEA AG 30%. Cecilie interests include DONG 22%, Denerco Oil 37%, Denerco Petroleum AS 24%, and RWE DEA 17%.

In Gulf of Mexico development progress, BP PLC has awarded a $2 million contract to CorrOcean Inc.—the US-based unit of CorrOcean ASA, Trondheim, Norway—to provide monitoring equipment for the production risers on BP's Thunder Horse field semisubmersible platform in the Gulf of Mexico. Thunder Horse, which lies in more than 6,000 ft of water in the ultradeepwater Mississippi Canyon area, is expected to have the largest semisubmersible platform in the gulf (OGJ Online, Dec. 23, 2002). CorrOcean will provide response-monitoring equipment that will be installed on the production risers to provide information on stresses the risers experience during the life of the field. The systems will include sensors to monitor angles, stresses, and strains in both the touchdown zone and top zone of the infield production steel catenary risers. Thunder Horse oil will be delivered ashore via the planned 70 mile, 28-in. Proteus oil pipeline to a booster station platform to be installed on South Pass Block 89, and then to a connection with the proposed 90 mile, 30-in. Endymion pipeline to the Louisiana Offshore Oil Port at Clovelly, La. The two lines combined will have a capacity of 420,000 b/d initially. Both segments are slated for completion in early 2005, in line with Thunder Horse's intended start-up (OGJ Online, Feb. 3, 2003).

SHANGHAI SECCO PETROCHEMICAL CO. LTD.—a 50:50 joint venture of BP and China Petrochemical Corp. (Sinopec)—has awarded a $205 million turnkey contract to France's Technip-Coflexip and Sinopec Shanghai Engineering Co. (SSEC) for the design and construction of two polyethylene plants at Caojing, near Shanghai, China. Each plant, based on BP's Innovene gas-phase technology, will have capacity to produce 300,000 tonnes/year of linear low-density polyethylene.

The BP-Sinopec JV was launched in late 2001 to construct a $2.7 billion olefins derivatives complex at Shanghai Chemical Industry Park (OGJ Online, Dec. 10, 2001). The JV includes Sinopec affiliate Shanghai Petrochemical Corp.

The massive project entails a wide range of olefins and other products and represents a cornerstone of China's petrochemical industry expansion. It also is one of the largest foreign investments in China. Technip-Coflexip has completed the front-end engineering design on the LLDPE units and will carry out, in association with SSEC, detailed engineering, equipment supply, construction, and precommissioning. The plants are scheduled to be delivered "ready for start-up" in late February 2005.