Styrene industry poised for an up cycle

Worldwide styrene margins improved considerably in 2002 and should continue a positive trend during the next 2-3 years, according to Chemical Market Associates Inc. (CMAI).

The 2003 World Styrene Analysis covers 6 years of existing data from 1997-2002 and contains a forecast for 2003-07.

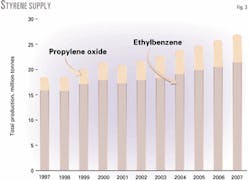

A combination of outages, heavy turnaround schedule, restrictions on supply from propylene oxide-styrene monomer (POSM) plants, and inventory rebuilding pushed effective operating rates and margins higher in 2002, according to the analysis.

Demand recovered after fall of 2001, CMAI says, but supply problems helped tighten the market and improve profitability. Styrene producers, however, did not share this profitability with the derivative producers. Styrene captured most of the chain margin, especially for polystyrene (PS).

Styrene derivatives

Of the styrene derivatives, growth for expandable polystyrene (EPS) was strongest at 7.6%, followed by acrylonitrile-butadiene-styrene (ABS) at 6.9%. Consumption of styrene for PS declined 2.7% in 2001 but recovered to 4.0% growth in 2002. EPS was the only major styrene derivative not to show a demand decline in 2001, according to the analysis.

PS has performed poorly since 1999, the last significant growth year. The average annual growth rate during 1999-2002 was 0.65%/year, which includes 4.0% growth in 2002.

The proportion of world styrene consumption for PS fell to around 50% for the first time. CMAI is concerned that the future business conditions and styrene's increasing volatility relative to other major polymer feedstocks will restrain PS's growth potential.

Demand for other major styrenic polymers EPS and ABS is growing fast, although from a much smaller base. During 1997-2002, demand growth for styrene monomer (SM) for EPS and ABS was twice the rate for PS, the analysis reported.

The discrepancy was wider during the last 3 years. EPS and ABS are less price sensitive than PS and their growth does not suffer as much from high styrene prices, the analysis says. However, their share is still less than 30% of total SM demand.

China has limited inter-polymer competition for ABS; therefore, ABS demand there is sufficient to support worldwide growth, CMAI said.

Legislation has forced the increased use of EPS, and growth in the construction sector is tremendous. Construction is now the major EPS driver in China. EPS encounters little competition in the rapidly growing construction industry.

Styrene demand growth for EPS and ABS has offset the demand decline for PS. According to the analysis, demand for the three major derivatives has held steady at 77% of total styrene.

Demand forecast

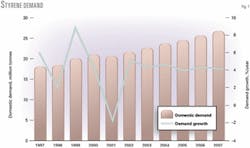

The analysis reported that styrene demand grew by 5.1% in 2002 after a 1.8% decline in 2001.

CMAI expects styrene demand growth to continue in 2003, based on an expected economic recovery and a sustained or higher chain inventory level. Fig. 1 shows the forecast world growth in 2003 at 4.4%.

Although 4.4% seems modest, CMAI reminds that it is nearly 1.0 million tonnes of capacity added to a world market of 21.7 million tonnes.

Higher styrene prices and tightening supply will limit growth in the middle of the forecast period. CMAI's forecast of average growth for 2003-07 is 4.3%/year compared to 3.6%/year during 1997-2002.

Capacity utilization

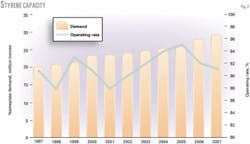

Operating rates recovered to 90% since 2001 on a nameplate basis (Fig. 2). CMAI noted that 2002 was an unusual year due to turnarounds, unplanned outages, and restricted POSM operating rates; roughly 7% of nameplate capacity did not operate during the year.

North America had almost 9% of its capacity down or in turnarounds and Europe had 5% of capacity offline.

Margins were better than expected given a 90% average operating rate. Continued demand growth, even at a modest pace, will improve operating rates steadily until the next wave of capacity comes online in 2006-07.

Fig. 3 shows historical and forecast styrene production.

Demand, capacity

CMAI forecasts that demand and capacity will increase by roughly the same volume through 2007. Demand, however, tends to grow steadily while capacity grows in waves.

There will be limited capacity growth during 2003-05. This is when styrene will have a better global balance.

Local imbalances result from an increasing supply in Europe and increasing shortage in Asia. Imports to Asia will also increase; the US and Europe will supply styrene in the near term and the Middle East in the longer term.

CMAI sees some problems for the styrene industry:

- The "starting price" for styrene in this cycle may be too high. All petrochemicals historically are relatively expensive thanks to higher energy prices.

- Demand growth may be affected by PS. It has price sensitivity issues and is not a healthy industry in terms of structure or typical capacity utilization. Previous styrene booms built on years of low prices that boosted PS demand and raised PS operating rates.

The 2004-05 up cycle may not reach its potential because PS operating rates are so low.

China

CMAI feels that China is a driver of growth even if final demand for much of the styrene equivalent is in major consumer economies.

China is importing large amounts of SM while still increasing imports of styrene in derivatives. It's a market of styrenic superlatives in terms of growth but is a source of price volatility.