CERA: Geopolitics, doubt loom over future oil markets

Continuing political tension in the Middle East as well as uncertainty surrounding the world's oil supplies will create an unsure path for global oil markets in the coming year and beyond, according to the recently released Global Oil Trends 2003, a study conducted by Cambridge Energy Research Associates in collaboration with Accenture and Sun Microsystems.

The study was released Feb. 12 at CERA's annual week-long energy conference in Houston.

While world oil consumption remained relatively flat, world oil reserves in 2002 rose to 1.213 trillion bbl, which included for the first time 175 billion bbl of previously unreported extra-heavy oil in Alberta's oil sands, CERA reported (OGJ, Dec. 23, 2002, p. 113).

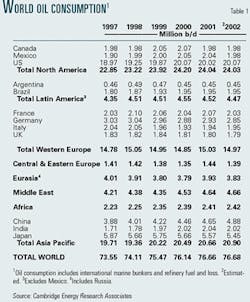

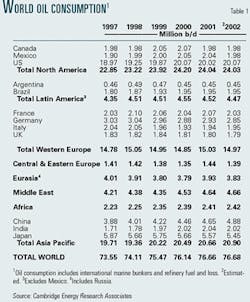

World oil consumption

According to the study, worldwide oil consumption rose by an "anemic" 20,000 b/d in 2002, CERA said, reaching 76.68 million b/d ( Table 1). "The combination of a weak global economic environment and the post-Sept. 11 effects on demand resulted in a stagnant global oil market during 2002," CERA noted.

In spite of the small increase in overall worldwide demand, however, "significant changes occurred at the regional and country levels," the report noted.

"In the Atlantic Basin, demand dropped broadly throughout the region, while the Asia and Pacific region, including its key supplier the Middle East, experienced rising oil demand," CERA said. "In the Atlantic Basin, total demand fell 270,000 b/d, led by Latin America and Western Europe. Latin American demand was particularly hard hit by economic and political disruptions in Argentina, Brazil, and Venezuela.

"Total North American demand also declined slightly, to 24.03 million b/d, as a result of weaker oil demand in Mexico offsetting a modest gain in the United States."

Combined demand of 260,000 b/d was added by the Middle East and Asia- Pacific region east of the Suez Canal, CERA noted. The bulk of this increase was made up by China, South Korea, and other non-Organization for Economic Cooperation and Development countries.

"Demand in China grew 230,000 b/d in 2002, boosting demand by 5% to nearly 4.9 million b/d. In contrast, the stagnant Japanese economy saw total oil demand decline by 126,000 b/d."

World oil production

Worldwide oil production, meanwhile, declined by nearly 1.1 million b/d in 2002, CERA reported. Average global production during 2002 was 65.62 million b/d (Table 2). The decline marked the first in world crude oil output since 1999, CERA said.

"The decline was concentrated among (Organization of Petroleum Exporting Countries) members, whose collective output tumbled from 27.43 million b/d in 2001 to 25.38 million b/d in 2002— a 2.05 million b/d volume decline," CERA said. "In contrast, total non-OPEC crude oil output rose 1 million b/d," the study added.

CERA found that OPEC's share of global crude output has fallen to 39% in 2002 from 42% in 2000. "Production restraint to support oil prices is the main reason OPEC's market share has fallen," CERA noted. "In January 2002, OPEC reduced its production quota by 1.5 million b/d to 21.7 million b/d. This quota level remained in effect for all of 2002," it said.

Meanwhile, in non-OPEC production, Russia led the gains. Output from that country rose 500,000 b/d to 7.5 million b/d in 2002.

"The strong growth in Russian output is due to several factors: extensive field surveys, and in some cases restudy of fields surveyed earlier, using modern methods such as 3D seismic mapping, outsourcing of oil field service operations to independent contractors through competitive bidding, and a fusion of Western and Russian players to produce teams that are able to implement technological solutions that are 'fit for purpose' and yield the most economic results," CERA said.

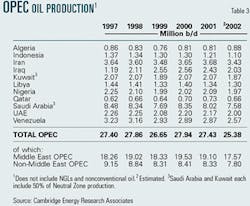

OPEC oil production

OPEC crude oil production during 2002 was down more than 2 million b/d from the year before, CERA reported ( Table 3).

"In January 2002, an OPEC-10 (minus Iraq) quota of 21.7 million b/d took effect, which was 1.5 million b/d less than the previous quotaU. The quota reduction was OPEC's reaction to low oil prices in late 2001 and to a fear than prices would fall further if output was not reduced. OPEC maintained this quota level for all of 2002 because of concerns about weak demand and also because most members maintained production well above quota. For example, in November, OPEC 10 production was 24.3 million b/d —2.6 million b/d above the quota," CERA said.

Iraqi production, meanwhile, "was affected by the retroactive pricing policy imposed by the (United Nations) sanctions committee in October 2001 in response to the illegal surcharge that Iraq's state-owned oil company instituted in December 2000," CERA said.

"Retroactive pricing acted as a disincentive to purchasing Iraqi crude, along with concerns about reliability of supply, given speculation about a US offensive. In addition, second quarter production was low—1.5 million b/d— because of Iraq's 1-month self-imposed embargo on exports through the oil- for-(aid) program during Apr. 8-May 8," CERA noted.