Plenty of life left in the North Sea

The North Sea oil and gas regime may well be mature, but reports of its imminent demise are not only premature but, it would also seem, somewhat exaggerated.

This is the conclusion to be drawn from a major geological study covering the oil and gas province off the UK, Norway, and Denmark.

Combined known recoverable petroleum reserves and resources are estimated to be 78,662.5 million bbl of oil equivalent, 60% oil, 33.6% natural gas, and 6.4% condensate and natural gas liquids and condensate.

Of this total some 33,982.2 million bbl of oil equivalent have been produced, indicating that there is far more oil and gas still to produce than has been extracted so far. This is not only important to the economies of the countries concerned but also to the global petroleum supply chain, given that the North Sea as a whole has been ranking fourth in the world oil production league, after Saudi Arabia, the US, and Russia and third as a gas producer after the US and Russia.

However, the oil and gas still to be produced from beneath the North Sea will not be easy pickings. The evidence suggests that most of the significant oil and gas fields have been found.

Future production will come from existing developments where improving recovery techniques will prove of increasing importance, small oil and gas accumulations made economically viable by smart drilling and low-cost production techniques, and from the reworking of old fields.

Intensive study

These broad brush findings do not come from a cursory glance at widely available statistics but from the most detailed geological study of the region ever undertaken.

Six years ago, Geological Society of London, Norwegian Petroleum Society, and Geological Survey of Denmark and Greenland decided to join forces to produce a Millennium Atlas of North Sea Petroleum Geology. It has been a mammoth task that cost $4.8 million.

The result is a 22 lb atlas, more an encyclopedia, available from the Geological Society Publishing House in the UK. Its $300 cost was held down through sponsorship by many oil companies with interests in the region.

Originally inspired by the Atlas of the Western Canada Sedimentary Basin, produced in 1994 by the Geological Society of Alberta, the 100-author North Sea atlas is a tribute to the most important commercial development in Northwest Europe in recent times.

It was in 1966 that the first successful well, A-1X, was drilled in the Danish sector. This discovered the Kraka oil field in Upper Cretaceous rocks. Since then, gross oil and gas revenues from the North Sea region have totaled more than $1.5 trillion. Exploration and production activities have generated over 50,000 jobs offshore and 300,000 jobs onshore in the three countries.

As a further indicator of significance, the atlas shows that more than 1,967 exploration wells, 1,231 appraisal wells, and 4,636 development wells were drilled to 1999. As of 1998, 180 fields were on production, 32 approved for development but not yet put on stream, and 19 closed down.

Authors of the 390-page atlas, also available on CD-Rom, estimate that over 500,000 person-years of effort were expended in an attempt to understand the petroleum geology of the area and produce its hydrocarbons as efficiently and as safely as possible.

Plays and fields

Seven hydrocarbon plays are identified and analysed in the study: pre-Triassic, Triassic, Lower and Middle Jurassic, Upper Jurassic, Upper Cretaceous and Danian (chalk), Paleocene, and post-Paleocene.

By far the most important oil play is the Lower and Middle Jurassic, where total discovered reserves-resources of more than 25,172 million bbl have been identified in the Norwegian and UK sectors, around 40% of the total discovered reserves in the central and northern North Sea. UK Brent field and the Norwegian Statfjord, Gullfaks, and Oseberg fields are reservoired in the Lower and Middle Jurassic, which accounts for almost half total North Sea oil production.

The Upper Jurassic play (which, for the purposes of part of this study includes Lower Cretaceous sandstones) is shown to be the second most successful in the central and northern North Sea, containing about a quarter of the total petroleum and accounting for 23% of North Sea oil production. Piper, Magnus, and Fulmar oil fields and supergiant Troll gas field feature in this play.

Discoveries such as these are a testament to the industry's ingenuity and persistence for the Upper Jurassic has proved to be the most variable and complex play in the North Sea. Companies drilled 47 unsuccessful wells into the UK sector's Upper Jurassic before discovering the small Kingfisher accumulation in the Viking graben (UK Block 16/8-1). Similarly in Norway, the industry tried unsuccessfully 60 times before making the small Viking graben gas-condensate discovery in Norwegian Block 15/3-1S.

These strike rates are in sharp contrast to the overall success ratios in the North Sea.

The success rate of exploration wells drilled off the UK, Norway, and Denmark averaged 33%. About 15% of the wells drilled prove economic reserves.

When it comes to the Upper Jurassic, the industry is finally reaping its reward from its persistence, geological understanding, and technical evolution.

Well over 1,000 targets have been drilled, and the average exploration success rate is now put at 27%. Indeed, the Upper Jurassic contains one of the most significant recent discoveries, 500 million bbl Buzzard field, on UK blocks 20/1 and 20/6, found in 2001.

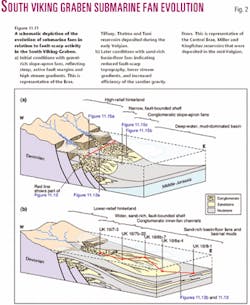

Paleocene play

The atlas defines Paleocene as a separate play because the geology has proved particularly productive in the UK. About 10% of the petroleum in the North Sea has been discovered in this particular play. Paleocene also accounts for 12% of production. Forties field is a notable Paleocene reservoir in the UK sector.

Given that the atlas is very much a geological study of the North Sea, understandably there is very little about the commercial significance or board room excitement generated by such discoveries. For some enterprises, they have been "company makers," as was the case of Nelson field, a Paleocene discovery by Enterprise Oil.

The atlas typically provides ample evidence of the petroleum geology of Nelson field, discovered in 1988 and situated on UK blocks 22/6, 22/7, 22/11, and 22/12, but it ignores the commercial acumen of Enterprise as, armed with its geological interpretations, it set about quietly acquiring the license interests in these blocks.

Upper Cretaceous

The other significant North Sea play, at least to date, is the Upper Cretaceous chalk which accounts for almost 10% of the discovered oil equivalents and 13% of oil production. Almost all of the production off Denmark comes from the Upper Cretaceous chalk.

Indeed, this play has recently received a significant boost with the discovery—some 30 years after the first finds—of HalfDan field in Denmark, one of the area's largest fields. Most of the significant success is to be found in Norway with around 65% of the reserves and in Denmark with 35%. Little has been discovered in Upper Cretaceous chalk the UK.

The atlas demonstrates clearly and in depth how the industry has arrived at its present level of knowledge about the petroleum geology of the North Sea (although it should be mentioned that the Southern North Sea gas basin is excluded from the study).

The Precambrian basement of the North Atlantic and Northwest Europe comprises crystalline rocks derived from at least three tectonic domains that were accreted during Caledonian collision. The North Atlantic Block, or Laurentia, was a particularly quick mover in the advance of plate tectonics. From the latest Precambrian times it drifted "rapidly" at up to 20 cm/year back to low latitudes where it remained to Paleozoic time.

Technology advances

The industry has been helped, of course, by developments in seismic acquisition and the great advances in computerized interpretation. Standard 2D seismic shooting that had started in the UK in 1964 had virtually died out by 1992 when 3D acquisition had become the norm.

Today 4D seismic is giving oil companies an even clearer picture of the content and behavior of their reservoirs. Ocean-bottom cable (OBC) seismic indicates movement of oil-water contact and the effects of gas injection, for instance. In the more mature fields, 4D data reduces risk on infill well locations.

About 80% of the OBC surveys in the world have been carried out in the North Sea, where this new technology originated, the atlas stated.

Development and production techniques are shown to be advancing in step with exploration progress. Horizontal drilling, slim hole drilling, and measurement while drilling technology are featured among the advances.

The deepest well to date in the atlas area was drilled on Norwegian Block 30/3, where the No. 6 well attained 6,085 m TD.

Improved reservoir knowledge and production technology are also seen to be contributing to higher recovery factors.

The majority of fields in the Lower and Middle Jurassic play, for instance, have a recovery factor of around 40%, although it is noted that such published recovery factors tend to increase over time.

The best recovery rates have been achieved in the major fields such as Statfjord, Brent, Gullfaks, and Oseberg. The Brent Group reservoir in the Norwegian Statfjord field, for instance, now has a recovery factor that exceeds 80%.

Geological knowledge is also being put to good use in environmental terms.

The atlas shows that the world's first carbon dioxide storage project, using a natural deep saline reservoir, is in operation in Sleipner field off Norway. The greenhouse gas CO2 produced from Sleipner is reinjected into the adjacent Utsira sandstone formation, some 200 m thick and lying 800-1,100 m below the seabed. Since 1996, the injection rate has averaged 1 million tonnes/year of CO2.

The author

Ray Dafter ([email protected]) is an oil industry journalist and author, covering the development of the North Sea from the early 1970s. Formerly energy editor of the Financial Times, he was for 9 years director of corporate affairs with Enterprise Oil. A Fellow of the Institute of Petroleum and former Fellow of the Center for International Affairs, Harvard University, he is the author of six books. He has also written extensively in newspapers and periodicals around the world.