Reappraisal of energy supply-demand in 2050 shows big role for fossil fuels, nuclear but not for nonnuclear renewables

Author's note: This article was first published in French in the magazine La Revue de l'Energie (No. 509, September 1999). The original publication did not include the figures and graphs that have been incorporated in this new version, while some information has been further developed.

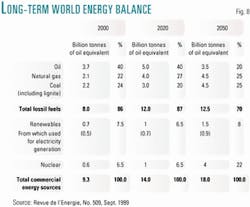

There are a number of different energy scenarios currently being proposed, but most industry analysts forecast that world primary energy demand will double by 2030, climbing to 18 gigatonnes of oil equivalent (Gtoe)/year from 9 Gtoe in 2000, and roughly triple to 25-30 Gtoe by 2050. According to these projections, by 2050 fossil fuels will account for no more than two thirds of all energy consumed vs. 85% today.

The aim of this article is to reexamine the assumptions underlying these energy forecasts covering the next half century and reassess the world's likely energy equation in 2050. This exercise may seem futile, because there is simply no way of predicting the likely impact of technological breakthroughs beyond 2010 or 2020, for example, or the fallout from any major economic or demographic upheavals.

Furthermore—and this is probably the most important unknown factor in the equation—there is no way of knowing whether humankind will adopt more rational bases for determining fundamental social choices or whether the current irrational patterns in their multiple forms will continue to prevail. This factor will have a major impact on the world's energy future, and there is simply no way of predicting it. What is important is not the reality defined by scientists, but what people perceive and what they want. This is the very essence of democracy, and it is therefore a key factor for the future of the various energy sources.

The whole debate about sustainable development and the ongoing environmental issues will be driven by our perceptions and desires, which will therefore play a key part in forging future energy trends. Whether or not we accept the risks involved in global warming, nuclear power, and the use of individual transport will impact energy consumption over the next 50 years. And in the same way, whether or not we accept the risks involved in genetic engineering will determine in the coming 50 years our response to the competing land-use requirements of food biomass and energy biomass.

The issues involved here are many, and this article will restrict itself to a reexamination of the key parameters involved: economic growth, demographic developments, use of natural resources and particularly fossil fuels (oil, natural gas, and coal), the outlook for renewable energies, and the nuclear power issue. The aim here is to take a fresh look at the data and synthesize a "new energy equation" for 2050 that may or may not be more accurate than those that have already been formulated. Contrary to usual practice, this article will not present a variety of scenarios here but only what we perceive today as being the most likely future path.

Fossil fuel resources, reserves

The constraints on the future potential supply of the various energies are underestimated by most studies dealing with this subject.

It is presently fashionable to say that "the Stone Age did not end because there was a lack of stones," meaning that the Hydrocarbon Age will terminate not because of a lack of oil and gas resources but because of the environmental problems linked to their massive use. We do not share this view and believe that the decline of world oil and gas production will be largely linked to reserves depletion.

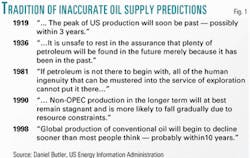

This question of carbon-energy resources constitutes one of the energy industry's most controversial issues, with pessimists and optimists engaged in bitter debate for the past 50 years or more. As far back as the 1930s, analysts were predicting the imminent exhaustion of the world's oil reserves (Figs. 1 and 4), while by 1999, articles in journals just as learned were asserting that to try to predict just when reserves would be depleted was to miss the point altogether. That very depletion, they argue, would generate its own cure: As reserves became scarcer, oil prices would rise, thus not only curbing demand but also triggering fresh efforts to transform existing resources into reserves. A number of points emerge from the debate.

To try to quantify fossil fuel reserves (resources are hydrocarbons known to be "down there," while reserves are hydrocarbons that the industry has the technical ability to produce profitably), whether in solid form (coal), liquid form (oil), or gaseous form (natural gas) is not irrelevant and does constitute a very real problem. The industry is largely unable to quantify finite stocks of "concentrated solar energy" (fossil biomass) when still at the resource stage, i.e., still "down there." This is particularly true in the case of solid-form energy such as coal, lignite, bituminous shales, and gas hydrates.

On the other hand, the uncertainties involved in quantifying reserves of liquid and gaseous hydrocarbons are not nearly as great. Ultimate resources can be assessed with much greater accuracy, probably with about 30% error in the case of oil and 50% error in the case of gaseous (as opposed to hydrate form) gas.

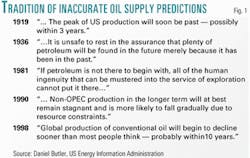

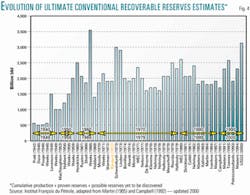

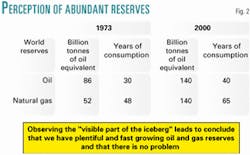

In the case of so-called conventional reserves of oil and gas, the process of gradual reserve depletion and discovery of new deposits has been practically overshadowed in the last 20-30 years by three separate phenomena: the opening up of new zones to international investment for exploration and production; the gradual transformation of nonconventional resources (deep water oil, ultraheavy crudes, etc.) into conventional reserves; and above all a major reassessment of the reserves contained in already discovered deposits (Fig. 2) .

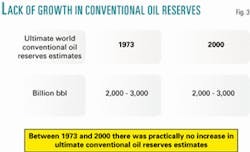

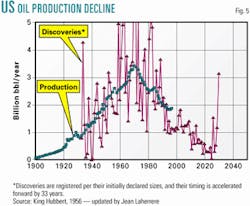

This last phenomenon has itself masked two significant facts: First, estimates of ultimately recoverable reserves of so-called conventional oil have remained practically unchanged over the past 30 years (Fig. 3). Second, exploration programs are no longer managing to replace the volumes being consumed. This process of reevaluation had two very closely related causes: oil in place was frequently underestimated when the deposits were initially discovered, and over time, technological progress led to improvements in the expected rate of recovery. If we take the US oil industry as an example, it is easy to see why, given the combination of all the factors just described above, 30 years went by between the moment (at the end of the 1930s) when new discoveries were no longer large enough to offset the increase in consumption and the moment (in the early 1970s) when domestic production began to decline (Fig. 5). It seems reasonable to suppose that the same phenomenon will recur at world level.

If we take a longer-term view of the situation, (i.e., 2050), the breakdown of energy resources by physical form becomes less relevant, because the industry now has the technological bridging tools to transform resources from one form to another. For example, both coal and oil residues can now be gasified, and liquid hydrocarbons can be produced from gas (e.g., conversion into oil products via Fischer-Tropsch-type processes or conversion of methanol into olefins). This means that energy companies now have a continuum of fossil fuel resources from which to develop production in whatever combination of energy forms the market requires. By 2050, this modular production base will be drawn upon in a variety of ways, depending on the technical and economic parameters prevailing at the time.

Well before 2050, one of the major economic parameters in the equation will be the need to preserve the environment. By 2010 or 2020, we could reach a consensus on the dangers of global warming, and in that case governments will have to take some form of action (ecotaxes, tradable emissions permits, etc.) to ensure that those responsible for the release of carbon into the atmosphere themselves bear the cost, thus guaranteeing that the market regulates carbon emissions in a rational way. The implementation of a "polluter pays" system designed to control the release of carbon into the atmosphere— which is today seen as a probable development—would constitute a slight handicap to the future of coal gasification but it would represent a very serious setback for the gas-to-liquids conversion processes, whether they involve natural gas or gas produced by gasification of solid energy forms (coal, tars, biomass, etc.). On the other hand, the "costing" of carbon emissions would foster the development of an energy policy giving higher priority to hydrogen-based processes, which in turn would require the industry to come up with low-cost carbon dioxide sequestration technology.

As regards the conversion from resources to reserves, the most important factor is the distinction between oil resources and gas resources. When assessing production from an oil deposit, primary recovery is fairly low, particularly in the case of heavy crudes. Primary oil recovery today, averaged out across all crude grades is significantly less than 30%. Recovery rates could be significantly improved in the future with ongoing technological advances, particularly in the case of particularly dense or highly viscous resources. But the same is not true of gas, which does not involve marked qualitative differences. Except in marginal cases, where the reservoir shows very poor gas productivity, natural recovery rates for gas are usually quite high—70-80%—leaving little or no room for enhancing recovery through technology.

Because of oil's low natural recovery rates, long-term forecasts such as the 2050 equation being reassessed here, tend to understate oil reserves because they underestimate the "creation of new reserves" via improvement in recovery rate, particularly in the case of heavier grades of crude, as can be seen in the case of initial monetization of the ultraheavy crudes and bitumens in Venezuela's Orinoco Belt.

For the same reasons, forecasters risk making the opposite error in evaluating gas reserves. Except in a marginal way (fracturing combined with the use of horizontal drains in fairly impermeable reservoirs, for example), technology cannot create new reserves by boosting gas recovery rates. Gas exploration is not as far advanced as oil exploration, so the discovery of new fields is still boosting reserve statistics and could continue to do so for 10 or even 20 years to come. On the other hand, once yearly consumption finally overtakes the volume of new reserves added by exploration, the depletion of reserves will be rapid and inexorable, with no help from technological progress and little or no mitigation from any price rises triggered by rarefaction of supply.

Some mention should also be made here of the solid forms of oil and gas regarded by many industry analysts as "tomorrow's reserves." The key issue here is whether, by 2050, energy companies will be in a position to transform resources such as oil shales and gas hydrates into reserves of oil and gas in significant quantity. For the purposes of this article, a fairly conventional approach has been adopted in evaluating "solid" fossil fuel reserves, taking into account oil shales as "solids" but not bituminous sands or ultraheavy crudes, even when these are in a "pasty" state or even solidified by reservoir conditions (this is the case with the bituminous sands in Canada's Athabasca deposits). This distinction is justified because there is a significant difference between bituminous sands and oil shales. The former are true crudes that have migrated and been made heavier by oxidation and biodegradation, while the latter are in reality a form of kerogen, or "source rock," whose organic matter was not completely transformed into oil so that the process of expulsion and migration was not accomplished.

To what extent will shales and hydrate resources add to the reserves available by 2050? By that date, both these resources will probably still be considered as "tomorrow's reserves," as they have been for past decades.

Renewable energies outlook

Most renewable energies are not new, it is just that the late 20th Century rediscovered them, thanks to new technologies. We are still in the early phases of development in this area, which makes it hard to evaluate accurately the contribution these energy sources are likely to make over the next 50 years.

In this early stage of rediscovery, some renewables (solar photovoltaic systems, wind energy, and biofuels) are posting very high growth rates, sometimes of 20-30%/year, but this start-up growth is unlikely to last, and it would be misleading to extrapolate this rate of development over the longer term.

One of the more important questions that needs to be answered regarding the future of renewable energies concerns the most suitable type of aid to speed up their development. In considering this question, we should remember that, at any given time, scientific knowledge advances at a pace determined by its own needs at that development stage.

More research certainly needs to be done on renewable energies today and in the future. But in order to be effective, this research should be decentralized, and the funding must trickle down to a large number of small teams. Efficiency is not served by "throwing money" at large ventures or megaprogams in renewables research. Indeed, in the short term, rather than funding programs proposed by research laboratories and private enterprise, the money would be better spent in subsidizing the price of renewable energies offered to the market. This is just the opposite of the approach that was required for research on nuclear energy, which required large sums and centralized research and development.

What is needed to encourage development of renewable sources is a system of "ecocertificates," "green" pricing, or similar means to make electricity produced by renewable systems (or selected renewables if the aid is to be restrictively targeted) more economically or socially attractive to the consumer.

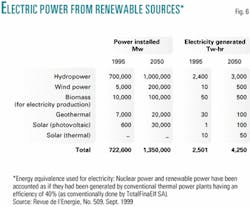

Details of the outlook for the different types of renewable energy have been amply covered in other analyses. It will suffice here, in conclusion, to sum up the expected 2050 breakdown of all renewable energies used for power generation and to compare those projections to figures from the most recent "state of play" drawn up in 1995. As it stands, Fig. 6 includes more than four fifths of the renewable energies likely to be consumed by 2050. This forecast is the author's own prediction. For reasons of space, the bases for that forecast are not detailed here.

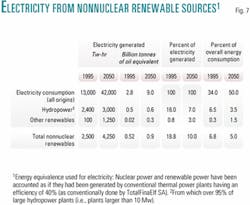

The conclusion to be drawn is that by 2050, renewable energies (excepting major hydroelectric schemes) will still be playing only an accessory role in contributing to energy supply. Even with major subsidies, it is clear that from 1995 to 2050 the share of renewables in world energy production will actually decrease rather than grow markedly as many other forecasters assume (Fig. 7).

This does not mean that governments should abandon their support for renewables development. That support should most definitely continue. But it should not be assumed that renewables can offer a credible alternative to the other nonfossil energy: nuclear power. However, it is conceivable that renewable energies will develop more rapidly that suggested here. One trigger could be a significant breakthrough in genetic engineering, leading to a substantial improvement in the economics of biomass energy thanks to GMOs (genetically modified organisms). Obviously, development of artificial chlorophyll synthesis could have an even greater impact.

Future of nuclear energies

In this discussion of nuclear power, both singular and plural will be used to describe the nuclear industry, and the reasons for choice of plural in this section heading will become obvious by the conclusion. First of all, what is the current state of play? Nuclear power accounts for 18% of world power generation, i.e., 6% of all energy consumed and more or less equivalent to hydroelectric power.

Nuclear power plants in use in the world today are fairly homogeneous, being conventional fission reactors rather than the fast-breeder type. While there are various types of processes in use, suffice to say that the great majority of nuclear plants involve pressurized water reactors. These plants use an enriched uranium cycle involving either conventional fuel (3.5% uranium-235) or mixed-oxide fuel containing plutonium and uranium oxides. These processes are regarded as safe and reliable. There has been only one major accident involving a nuclear power plant so far—at Chernobyl in the former USSR—and this was considered by the industry as a "Soviet accident" rather than a "nuclear accident." However, this very description points up the possible Achilles' heel in nuclear power: The major risk is not so much of a technical breakdown or accident but an incident arising from human error or political context (terrorist attack, civil strife, war, etc.). It is possible to evaluate the risk for a nuclear power station operating under "normal" conditions (technical incidents are commonly measured in terms of likely fatalities), and truly technical risk has now been brought down to a level lower than that involved in the operations of any other major industrial activity.

Another objection frequently voiced concerning the nuclear sector involves fears about final-phase waste disposal: What is to be done with spent but still radioactive fuel (whether reprocessed or not)? Where and how is waste to be stored? How are power stations and other facilities to be dismantled when no longer needed? Nuclear power companies obviously still have a lot to learn about communications, because the industry already has or soon will have the means to solve these problems, using either techniques already developed or processes that are reasonably likely to be ready for use by the time they are needed, and at a cost that will not significantly raise the cost of nuclear-generated electricity.

The third major question hanging over the nuclear industry concerns supplies of fissionable material or fuel. Given the cycles currently in use, this means uranium reserves. Fortunately, it is possible to lower quite markedly the minimum acceptable richness of the ore being used (if necessary, even seawater could eventually be used as a source of uranium) without greatly increasing the unit cost per kilowatt-hour generated, because nuclear fuel cost is only a minor element in the cost breakdown of nuclear electricity.

Furthermore, should nuclear fuel resources in fact become so depleted as to raise the cost of power generated, within 15-20 years, the industry could restart fast-breeder programs. Fast-breeder reactors produce a much greater quantity (30-40 times more) of electricity from the same amount of uranium. Indeed, it was something of a surprise when the most advanced prototype in the world, France's Superphénix, was finally shut down. Given that reserves of uranium could run short by 2050 and that fast-breeders should contribute to solving the problem of disposing of spent fuel, the government's shutdown decision does not seem rational. On the contrary, with no firm data yet on the greenhouse effect, the precautionary principle would seem to dictate that such a power plant remain in operation for as long as possible, producing at the maximum capacity considered safe by the relevant authorities. In that way, power producers would have benefited from 30-40 years of fast-breeder operation at industrial level, gaining knowledge of operating and maintenance costs, equipment aging problems, and reliability, etc. Such experience would have been invaluable, more than justifying the long-term operation of the plant, even in the unlikely event that the actual operations resulted in a marginal net loss in financial terms.

And of course any evaluation of the long-term prospects for nuclear power must include all potential nuclear cycles, not just those currently operating in industrial mode. To start with, by 2010 or 2020, there will be a demand for reliable and easy-to-operate, small-capacity (100-500 Mw) nuclear power stations, especially in emerging economies. The high-temperature, helium-cooled cycle should be well-suited for this purpose. Other cycles could also be used to reduce even further the risk of overheating and core meltdown. With this in mind, Nobel Prize-winning physicist Carlo Rubbia has proposed using so-called "spallation" reactors that involve an external flow of particles that would be stopped automatically as soon as any function of the reactor went outside normal operating parameters. In the much longer term, we could see fusion reactors. There is some debate about whether the solution here is "hot" or "cold" fusion, but in the long run, some form of fusion is likely to add to the available nuclear options. This is why it is more accurate to refer to nuclear energies in the plural rather than the singular.

In conclusion, it is quite unrealistic to consider nuclear power as an accident of history and doomed to extinction; nuclear energies will be making a comeback well before 2050.

World energy equation in 2050

The approach used in this concluding assessment will be the following: First, an evaluation of production levels of the various fossil fuels, factoring in reserves and likely production costs. Correlation against energy needs will then be used to determine the quantities of noncarbon energies required by 2050.

Consider 2050 production volumes of fossil energies. As regards coal, the production constraints involve the amount of available reserves, or volumes economically producible (as opposed to resources), and acceptable levels of CO2 emissions. Not to mention sulfur, methane, dust particles, and ash, which will go beyond local pollution to become a regional and global issue as well. Future coal-fired power plants will be able to filter out most solid particle emissions, particularly if gasification processes are used, but little can be done about particles going up the millions of household chimneys. The same is true for sulfur emissions. And all coal deposits contain quantities of coalbed methane that are released directly into the atmosphere during mining operations (whether open pit or underground mines).

Given the high costs involved in coal logistics (transport costs per energy unit are even higher than those for natural gas), a large part of the planet's coal resources will still not be counted as reserves by 2050, even despite the potential for clean conversion of coal into electricity (with or without gasification) at the pit head. Furthermore—and this may well be the most important factor here—available data on reserves suggest a certain confusion and that some resources may be counted incorrectly as actual reserves. It is high time that the coal industry worldwide made the effort to apply the same (or at least similar) distinction as do oil and gas companies, which release very few figures on resources but detailed data on reserves.

Without going into details here, these factors suggest that by 2050, world production of coal and lignite could rise to 8-10 gigatonnes/year (4-5 Gtoe/year) from the 2000 level of 4.8 gigatonnes/year (i.e., 2.2 Gtoe/year). These figures suppose—and this is the weak link in the hypothesis—that restrictions on release of CO2 into the atmosphere will not have a major impact on production. This assertion assumes that humankind will, in the end, accept a much greater global warming risk than seems reasonably acceptable to us today.

As regards oil consumption, a slowdown due to the depletion of reserves will be felt quite rapidly, say between 2010 and 2020. By that stage, it will be clear to most analysts that new discoveries are no longer able to cover the volumes lost to consumption, and that the statistical increase in reserves and consumption is mainly due to two factors: an increase in reserves within conventional deposits already discovered, and the increasing conversion of nonconventional resources into conventional reserves. This latter factor will involve mainly extra-heavy crudes and bitumens, which should supply 500-1,000 billion bbl of new reserves by 2050, and the deep and ultradeep waters, which will supply 100-200 billion bbl of additional reserves. Added awareness of this situation should slow the physical rarefaction of reserves by triggering price rises that should put a brake on consumption. It seems probable that the present world oil output of 3.7 Gtoe/year will rise not much more than about 30% to peak at 5 Gtoe/year between 2010 and 2020 before falling back fairly rapidly to about 4.5 Gtoe/year by 2030. By 2050, overall production likely will have fallen back to a level close to current output, about 3.5 Gtoe/year, plus the relatively marginal volumes of liquid hydrocarbons produced by GTL processes. This scenario fits currently available data concerning not only proven oil reserves but ultimate resources and reserves.

In the case of natural gas, our lack of accurate knowledge of ultimate resources makes prediction more hazardous. But here again, the question of reserves will come to the fore once the industry realizes that new discoveries are no longer going to be able to replace consumed reserves. The present vision is one of very abundant reserves, and this optimism could last until 2010-20. But once reality dawns, the awakening is likely to be ruder than in the case of oil, because with gas there is less scope for reevaluating the reserves in deposits already discovered.

Of the two factors at work with oil reserves—underestimation or understatement on initial evaluation and technical improvement of the recovery rate—only the former can help in the case of gas. But even just this factor can make quite a difference. Consider the case of the Netherlands' Groningen gas field, which has seen its reserves triple in the space of 30 years. On the other hand, with some fields, there is no progress at all: The actual reserves on Frigg (off Norway) and Lacq (onshore France), easy to quantify because the fields are now depleted (or nearly so), were pretty much identical to the estimates announced during the first years of production. This leads us to a major question: are the gas deposits at Urengoï, on the Yamal Peninsula, and North Dome-South Pars going to turn out like Groningen or like Frigg? Even before 2010, it will probably be clear that initial estimates were fairly accurate and that there is little scope for reevaluation.

The second major question concerning gas reserves is whether, during the next 20-30 years, gas exploration programs are going to yield 50 or so new gas provinces equivalent to the one in southern Bolivia, or no more than a dozen. The second figure appears more likely.

Another factor likely to reduce the level at which world gas output peaks is the lack of physical flexibility in gas chains and the major investments required to set them up. In practice, no major new gas pipelines or liquefaction plants are going to be built unless this infrastructure is guaranteed a profitable working life averaging 30 years. The peak, or at least the plateau of maximum gas production (which could last 30-40 years) should begin about 2015-25 and last until 2050-60. Then world gas output will begin to decline. This decline could be delayed if exploration of the deep horizons of sedimentary basins turns up some unexpectedly major gas reserves or if technological breakthroughs have by that time enabled the industry to convert hydrate resources into gas reserves. Both are possible but fairly improbable.

Production volumes at the plateau stage are likely to be a little more than double present output, i.e., about 4.5 Gtoe/year. So factoring in the estimates outlined here, overall annual fossil energy production by 2050 can be broken down as follows: coal 4.5 Gtoe, oil 3.5 Gtoe, and gas 4.5 Gtoe, giving total fossil fuel output of 12.5 Gtoe. But according to most demand scenarios, overall energy needs could amount to 25-30 Gtoe/year. Even according to the more modest scenario outlined here (which assumes a world population of 8 billion±2 billion rather than 10 billion±1 billion), overall demand will be about 18 Gtoe/year—which is still double the present consumption of 9 Gtoe/year. Even if we accept this latter "modest"scenario, the energy shortfall to be made up by noncarbon energies is still a very significant 5.5 Gtoe/year by 2050.

If renewable energies can contribute only 1-1.5 Gtoe/year, then by 2050 nuclear fission will be called upon to make up the very considerable shortfall of 4-4.5 Gtoe/year (Fig. 8).

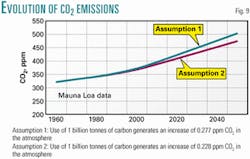

While the questions related to climate change are not a central issue for this article, we have taken into account the important issue of likely CO2 content of earth's atmosphere up to 2050 under this energy supply-demand scenario (Fig. 9).

Omissions

A number of major questions concerning future developments in the energy industry in the short and medium term have been deliberately omitted from the assessment presented here.

No mention has been made of geopolitics, the geographic concentration of reserves, mergers and acquisitions, or of moves to diversify by oil, gas, and power companies. On the technical level, no mention has been made of the complex question of carbon sequestration—whether biological (forests, etc.), chemical, or physical (injection, etc.)—or of the "decarbonization" of hydrocarbons, oxygen-fired power plants (that avoid dilution of CO2 by nitrogen in the air), or of a number of other, similar subjects. This is because, despite their obvious interest, all these issues are relatively marginal to an assessment of the likely global energy mix by 2050.

Nor has there been any discussion of the competition between centralized power generation (major hydro schemes; large coal, gas, or nuclear-fired power plants) and decentralized systems (renewable energies, fuel cells, small-scale cogeneration, microturbines, or even micronuclear plants). This is because these issues have no vital bearing on the 2050 energy mix either. This point of view may seem surprising, but it must not be forgotten that technologies such as microturbines and probably also fixed fuel cells will consume mainly natural gas, while fuel cells used to power motor vehicles will probably generate their hydrogen fuel from liquid hydrocarbons or related liquid-energy chemicals.

We must not forget that producing the amounts of hydrogen required will generate quantities of CO2 more or less similar to those involved when using advanced combustion engines, as the most likely hydrogen production process will be reforming (or some other chemical conversion) either of liquid oil products or of liquid chemical derivatives if the conversion is carried out onboard the vehicle. If the conversion is performed upstream from the vehicle, such as at a hydrogen-filling station, natural gas would be the most likely feedstock. If the process were carried out even further upstream, in large hydrogen generation plants, the feedstock could be any one of crude oil, gas, coal, or biomass. In such case the aim of using large hydrogen plants would probably be to have the possibility to "sequester" the CO2 (reinjection, etc.) to prevent it from being released into the atmosphere.

Only widespread panic about the consequences (real or supposed) of the greenhouse effect and a very high cost of sequestering CO2 could justify in the near future (say before 2020) the costs involved in the other hydrogen-generation option, which is nuclear (either by electrolysis or thermal process). Should environmental concern reach catastrophic proportions—which seems quite unlikely—demand for noncarbon-generated electricity and hydrogen (i.e., essentially provided by nuclear power) would skyrocket. At that stage there would be much lamenting over the 20-30 years of fast-breeder cycle feedback experience lost in the case of France by the politically motivated closure of the Superphénix breeder reactor.

Outlook

In the final analysis, there are two essential factors, linked to the future long-term energy mix, that should be highlighted here.

The first concerns the level of CO2 in the atmosphere over the coming decades and its potential impact in terms of climate change. The consequences in terms of CO2 levels in the atmosphere of the 2050 energy mix hypothesis advanced here are shown in Fig. 9. As can be seen, CO2 levels, which have already risen to 360 ppm from 280 ppm in less than 200 years, will continue to rise, reaching some 500 ppm by 2050.

This situation appears to be almost inevitable, regardless of any new policies that may be introduced over the next 20 years, largely because of the "inertia effect" of existing energy systems (i.e., the huge investment in existing infrastructures both for energy production and for energy consumption). Given that atmospheric CO2 levels never rose above 300 ppm over the preceding 400,000 years, a period which experienced very major climate changes, we can only guess at the potential impact on climate of levels around 500 ppm; in spite of all the advances in mathematical climate modeling, there are still large uncertainties. But whether the consequences are minor, major, or even catastrophic (unlikely, but not totally impossible), we are going to have to live with them.

The second important factor emerging from an analysis of the future energy mix will be the increasing complementarity, or synergies, in the long term between fossil fuels and nuclear power. This complementarity is already evident today in the respective uses of these two families of energy resources. It is worth remembering that liquid hydrocarbons are naturally best suited to three different types of uses:

- As a raw material (petrochemicals, solvents, lubricants, asphalt, etc.).

- As a transportation fuel (land, sea, or air), because of their high energy content per unit of volume.

- As the means to provide energy (thermal or electrical) in offgrid situations (isolated factories, farms, plantations, villages, etc.) where energy demand is relatively heavy. The low cost of transporting liquid hydrocarbons makes this the logical solution in such situations. In very low energy demand situations involving isolated offgrid customers, renewable energies—and above all photovoltaic solar systems—should prevail.

Unlike hydrocarbons, the role of nuclear energy today, and for the next 20-30 years, is limited to power generation in situations where demand is both heavy and geographically concentrated. Therefore, because of their different characteristics, nuclear and fossil fuels are already today much more complementary energies rather than competing ones.

Closer to 2050, synergies between fossil fuels and nuclear power are likely to increase. In such a time horizon, it will be necessary to improve further and further the recovery rate from oil deposits, particularly deposits of heavy and extra-heavy crude. It may even be necessary to resort to producing shale oil, a process that was rather widely used in the early 20th century (although an attempt in the US to restart this industry after the first oil shock was a clear failure). To achieve these objectives while at the same time minimizing emissions of CO2, the oil industry will have to use nonfossil heat energy. This in turn means that the required energy, one way or another, could well be provided by nuclear reactors.

The same reasoning should apply to GTL processes, because their high energy consumption (today's processes consume 35-45% of their input energy) means they would be uneconomical if financial penalties on CO2 emissions were imposed. Here again, nuclear energy should provide a convenient solution by providing heat for these processes, ensuring that liquid hydrocarbon resources would remain available longer than presently expected.

Further synergies between hydrocarbons and nuclear-produced hydrogen systems should develop as soon as nuclear hydrogen becomes competitive on a full-cost basis (i.e., costs where external costs such as those linked to CO2 emissions are factored in).1 At that stage, nuclear hydrogen could be used by major refining and petrochemical complexes both for upgrading heavy and extra-heavy crude and for lightening or advanced purification of various oil products or petrochemicals. However, even if by 2050 we can expect the nuclear industry to be able to supply large quantities of hydrogen at a reasonable cost, hydrogen-based energy systems will remain uneconomical or inefficient for the fundamental reasons already outlined in this article. Fortunately, there may well be other ways in which nuclear hydrogen can be used to extend the resource base of the oil industry. In fact, the best way to make hydrogen more energy-compact would be to add carbon, thus creating synthetic hydrocarbons in an ecofriendly version of the Fischer-Tropsch process. This statement may seem rather paradoxical, especially in the light of current energy thinking where decarbonization is commonly regarded as a cure for all evils.

In conclusion, even if concern about global warming does not trigger major changes in the world's preferred energy sources by the year 2050—and this is the supposition that underlies the above forecast (as it provides for a relatively strong increase in coal use to meet the shortfall in overall energy supply)—by 2020 we should be seeing the start of a major change in the energy mix.

Until 2020 there will be a strong growth in the use of hydrocarbons (oil and particularly gas), while from 2030 onwards, much of the additional energy demand will have to be met by nuclear power. We should therefore face these rather inevitable facts and prepare for a largely nuclear long-term future—or, more precisely, for a world where fossil fuels and nuclear fission will become synergetic energy sources ensuring a sustainable energy future.

Acknowledgments

The author wishes to acknowledge the helpful comments and suggestions made by Paul Alba, Denis Babusiaux, Emmanuelle Bauquis, Jean-Claude Boudry, Georges Dupont-Roc, Jacques Foos, and Roland Geoffrois.

Reference

1. Japan has already developed an experimental HTTR nuclear reactor designed to produce hydrogen. This 30 Mw reactor was started up in 1998 but experienced some problems and was shut down. It apparently started operating again in 2000.

Bibliography

P.R. Bauquis, R. Brasseur, J. Masseron, "Les réserves de pétrole et les perspectives de production à moyen et long terme," Revue de l'IFP, Vol. 27, No. 4, July-August 1972, pp. 631-58.

Bauquis, "L'effet de serre et les réserves énergétiques," Energies, No. 35, Spring 1998, pp. 11-12.

Bauquis, "What future for extra-heavy oil and bitumen: the Orinoco case," 17th Congress of the World Energy Council, Houston, September 1998.

Bauquis, "Défis techniques et enjeux économiques des huiles extra lourdes," Pétrole et Techniques, No. 417, pp. 54-62, Novembre-Décembre 1998.

Bauquis, "Les bruts ultra lourds de l'Orenoque et de l'Athabasca," Ingénieurs Géologues No. 74, Juillet 1999.

The author

Pierre-René Bauquis has been a special advisor to the chairman of TotalFinaElf SA since 1995. He also is an associate professor at the IFP (Institut Française du Pétrole) School and is a vice-president of the French Energy Institute. Bauquis served as president of the French Associationof Petroleum Professionals during 1999-2000. He is a member of Environmentalists for Nuclear Energy.