M&A deal values plunge in 2002, study says

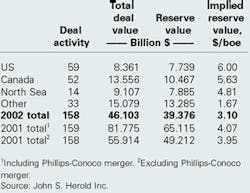

Global energy merger and acquisition transaction values dropped to $46.1 billion in 2002 compared with $81.8 billion in 2001, said consulting company John S. Herold Inc., Norwalk, Conn.

Herold attributed the sharp decline to the absence of mergers between large majors. Excluding the Conoco Inc.-Phillips Petroleum Co. merger, 2001 transaction value was $55.9 billion—21% above the 2002 level.

"US implied reserve values dipped to $6/boe from the record high $6.99/boe in 2001 but remained at historically strong levels. US deal value and deal count fell to a 5-year low, although activity in the Midcontinent and onshore Gulf Coast remained strong," said Christopher Sheehan, Herold analyst and senior vice-president.

Canadian implied reserve costs dropped 14% to $5.63/boe, driven down by the heavy oil component of the PanCanadian Energy Corp. and Alberta Energy Co. Ltd. merger that formed EnCana Corp. (OGJ, Feb. 4, 2002, p. 35). Royalty trusts propped up the Canadian deal count, acquiring highly developed, shorter-lived reserves at relatively high implied costs, the consultant said.

M&A activity continued to climb in the North Sea, where Herold recorded 14 transactions totaling $9.1 billion, nearly double the 2001 total. This trend has continued into 2003 with Apache Corp.'s recent acquisition of BP PLC's stake in Forties field (OGJ Online, Jan. 13, 2003).

"Deal activity in the rest of the world rose, but implied reserve values fell 38% to $1.67/boe on a plethora of deals involving undeveloped properties in frontier regions," Sheehan said. Deal value outside of North America and the North Sea accounted for 33% of total worldwide deal value, down from 43% in 2001 but up from 17% in 2000.