Parallels with earlier energy crises underscore US vulnerability to oil supply shocks today

Various measures of US energy security indicate that the US might be heading for an energy crisis.

Many of the warning signs that existed before the energy crises of 1973 and 1979 exist today, and they indicate that the current situation could be even worse.

US dependence on petroleum imports has grown steadily for over a decade and has been at record levels for several years. US petroleum inventories are low, and the ability of the Strategic Petroleum Reserve (SPR) and commercial petroleum stocks to cope with an interruption in imports matches the historic lows preceding the 1973 and 1979 energy crises.

The potential for an energy crisis has never been higher. Oil prices have recently exceeded $30/bbl, and they may continue to increase.

The disruption of Venezuelan oil supplies has increased US dependence on Middle Eastern oil and made the US more susceptible to supply interruption.

With the crisis in Venezuela, the capacity of the Organization of Petroleum Exporting Countries to meet any additional supply interruption is limited, and a war with Iraq would put OPEC at its limit.

Any energy crisis in the near future will hinder President Geoge W. Bush's efforts to stimulate the economy through tax cuts and other fiscal measures. An energy crisis could cause a recession, inflation, and higher unemployment.

In this article, we will discuss various measures of energy security, import dependence, and vulnerability to assess the current US energy situation.

What constitutes energy crisis?

Energy crisis is a situation in which the nation suffers from a disruption of energy supplies (in the US case, oil) accompanied by rapidly increasing energy prices that threaten economic and national security.

The threat to economic security is represented by the possibility of declining economic growth, increasing inflation, rising unemployment, and losing billions of dollars in investment.

The threat to national security is represented by the inability of the US government to exercise various foreign policy options, especially with regard to countries with substantial oil reserves. For example, the recent disruption of Venezuelan oil supplies may limit US policy options toward Iraq.

Looking at the energy crises of 1973 and 1979, we find some common elements between the two. Both events:

- Started with political turmoil in some of the oil producing countries.

- Were associated with low oil stocks.

- Were associated with high import concentration from a small number of suppliers.

- Were associated with declining US petroleum production.

- Were associated with high dependence on oil imports.

- Were associated with low level of oil industry spending.

- Led to speculation.

- Caused an economic downturn.

- Limited US policy options in the Middle East.

The same indicators and warning signs that existed prior to the energy crises of 1973 and 1979 exist today: a political crisis in Venezuela that has halted most Venezuelan oil exports, the threat of war with Iraq, stocks at their lowest level in 26 years, imports nearly at a record high, more concentrated imports than ever, and low upstream expenditures.

However, the current problem is even worse than the previous two energy crises because, unlike the 1970s, we are starting from a case of low economic growth. The massive stimulus package that is planned by the Bush administration could exacerbate the situation by increasing the demand for oil.

Some experts argued in 2000 that the US was heading for an energy crisis at that time. Although the crisis did not happen because not all the warning signs existed at that time, the current situation is much worse because US production is lower, import dependence and import concentration are higher, and world excess capacity is lower and matches that of the 1973 crisis.

Measures of energy security

There are five principal measures in evaluating petroleum security from a national perspective: domestic production capacity, dependence on imports, the degree of import concentration, petroleum inventory relative to imports, and the ability to second-source petroleum imports in the event of an interruption from one or more suppliers.

Domestic production capacity

US oil production is currently at a record low and has been steadily declining since 1986 (Fig. 1).

Although US oil production reached its peak in the 1970s, the increased production in the second half of the 1970s came in large part from Alaska. Production from Prudhoe Bay came on line in significant volumes, causing Alaskan production to increase from 464,000 b/d in 1978 to 1.6 million b/d in 1980 and peak at 2 million b/d in 1988.

Petroleum production in the Lower 48 dropped from 9 million b/d in 1973 to 7.5 million b/d in 1978. Only the development of oil in Alaska prevented an even higher dependence. By 1980, the production decline halted, and there were very modest gains that extended through 1985. The US oil industry experienced a greater rate of price increase than the rest of the world, as domestic prices were deregulated.

The collapse of oil prices in 1986 wiped out production from many of the stripper wells, especially in Texas, Oklahoma, Louisiana, and Colorado. The US lost 1 million b/d in production during 1986-89. The aftermath of the Kuwait invasion raised oil prices and halted the declining trend until 1992.

US oil production suffered another major setback in 1998 and early 1999 when world oil prices approached $10/bbl. However, higher oil prices since 1999 have led to relatively stable US petroleum production of 5.7 million b/d, about 60% of US production in 1973.

Dependence on imports

US dependence on foreign oil has increased steadily since 1986. This dependence reached a record high in the last 2 years and declined slightly after the terrorist attacks on Sept. 11, 2001.

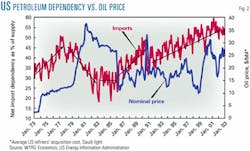

Fig. 2 measures the percentage of petroleum imports relative to total petroleum supply, which is probably the best overall measure of dependence. Major changes in imports are usually related to changes in the US economy and US oil production.

At the time of the October 1973 oil embargo, the US received a little less than 35% of its petroleum supply from imports. In response to higher prices, total petroleum demand dropped to 14.9 million b/d in 1975 from 15.8 million b/d in 1973. US oil consumption growth resumed, and by 1978 total petroleum consumption averaged 17.1 million b/d, 8% higher than in 1973. Imports as a percentage of petroleum supply increased at a more or less steady rate to 42% in 1978 from 35% in 1973 and exceeded 50% for a few months during that timespan. Dependence on imports grew faster than the rate of consumption growth.

The rapid increase in international oil prices starting in late 1978 led to the only sustained period of declining US dependence on imports in the post-1973 embargo period. Two factors led to the decline: higher US oil production and lower consumption caused by substitution, conservation, increased efficiency, and fuel switching.

As a result of the factors just outlined, US oil import dependence fell to 27% in 1985. With the oil price collapse in 1986, dependence once again resumed its upward path, reaching 55% in 2001. The impact of higher prices and the lingering events of Sept. 11 led to a modest reduction to 53% in 2002. The causes for the increase in dependence on imports in the last 15 years are almost the mirror image of the previous decline and are characterized by falling production and ever-increasing demand for transportation fuels. Gasoline, diesel, and jet fuel account for most of the increase in petroleum consumption. The only respites from the escalation in dependence were during the periods of the Persian Gulf war with Iraq and the post-Sept. 11 attacks.

Degree of import concentration

Many experts argue that the degree of dependence has no impact on energy security as long as foreign oil is imported from secure sources. However, if the degree of dependence on nonsecure sources increases, US energy security would be in jeopardy. In this case, US vulnerability will increase, and economic and national security will be compromised. The data indicate that US vulnerability is at an historic high, higher than any of the preceding energy crises.

The authors looked at the percentage of imports from the top five suppliers as a measure of the vulnerability to an interruption by one or more key suppliers. This is an important measure of US vulnerability to supply disruption, because it shows the high level of US import concentration on a few suppliers. Fig. 3 shows that US vulnerability to supply disruption has increased to historically high levels recently, as the percentage of its petroleum imports from its top five suppliers increased to 76% in the first 10 months of 2002 from 62% in 2001. This compares with the 63.8% and 53.4% concentration ratios in the first and second oil supply shocks, respectively. It is also much higher than the concentration ratio during the Persian Gulf war in 1991, when the US was forced to buy oil from areas outside the Persian Gulf as a result of the loss of Iraqi and Kuwaiti crude oil supplies.

The recent Venezuelan experience teaches us an important lesson about "secure sources." It teaches us that "secure sources" are temporary and that they change as politics change. Change in politics is faster than the change in the life of an oil field from exploration to depletion. The problem is that oil supplies take a long time to develop, and consumers and producers look for long-term commitments. Therefore, the best policy for security is to take diversification to extremes rather than classifying oil sources as "secure" and "nonsecure." Iraqi oil is classified as a "nonsecure" source, yet the US is the largest consumer of Iraqi oil.

Stocks and the SPR

Commercial oil stocks in the US are at their lowest level in 26 years. A common measure of energy security is the number of days in which oil in the SPR can replace imports of either crude oil or a combination of crude oil and petroleum products.

We take a broader view and look at total petroleum stocks as a whole, including crude oil in the SPR and in commercial inventories and use the number of days in which those stocks can replace imports. Today, US total petroleum inventories (in terms of days of coverage) are as low as they were during the first and the second energy crises (Fig. 4). Our measure suffers from the weakness that it does not adjust stocks downward by minimum operating inventories, but it is a consistent relative measure of short-term security. Current commercial inventories are near the level at which spot shortages can occur.

It is obvious, judging from the ability to replace imports with current stocks, that the US is in no better shape to handle a supply interruption than it was at the time of the 1973 oil embargo, the Iranian revolution (which began in 1978), or the Iraq-Iran war (which started in 1980).

In 1985, that measure was essentially twice the current level. The causes are relatively simple to identify: lower US production, higher consumption, lower commercial inventories, and the failure to increase the SPR at a rate commensurate with increased US demand.

Although the SPR level has been increasing since President Bush ordered its refilling after Sept. 11, the ability of the SPR to meet a supply crisis is limited. It may provide a cushion for a number of days, but it will not solve the problem in the products market if refiners are running at full capacity. However, an SPR release may have an impact on world oil markets and achieve its goal in avoiding an energy crisis if President Bush announces the release of more than 1 million b/d until the end of the crisis or during a period of time rather than specifying the total amount to be released.

In addition, it may have an important psychological impact and reduce oil prices if the president announces that some of the oil released from the SPR will be exported to other countries. The impact of the release could be larger if it is coordinated with the release of strategic stocks in other countries that are members of the International Energy Agency.

While such releases may help avoid an energy crisis, that could be a temporary measure if the release is ill-timed. The premature release of SPR crude can jeopardize US national security in case of continued political problems in oil-producing countries by weakening US ability to respond to additional shortages. Premature release of SPR stocks can reduce the incentive for private companies to maintain a stock cushion, thereby further increasing US vulnerability to supply interruptions.

World excess capacity

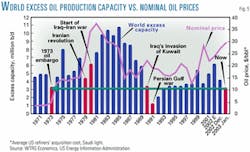

The world's excess oil productive capacity today is similar to that of the first energy crisis in 1973, substantially lower than surplus capacity during the second energy crisis in 1979-80, and slightly lower than excess capacity in 1990 when Iraq invaded Kuwait.

As shown in Fig. 5, current excess world oil productive capacity is the lowest in 30 years if we exclude 1991, when Iraqi and Kuwaiti capacity were taken off the market as a result of the Persian Gulf crisis.

As with the energy crises in 1973 and 1979, current excess capacity exists in only a very few OPEC countries, primarily in Saudi Arabia. OPEC data indicate that the current level of excess OPEC capacity is similar to that of the previous energy crises.

The Saudis' ability to expand capacity by another 500,000 b/d will not help the US in case of immediate oil shortages, because it takes a long time to get that oil to the US for two reasons. First, it requires 60-90 days to bring that capacity on line. Second, it takes 4-6 weeks to get that oil to the US.

In addition, some experts believe that OPEC capacity statistics as reported by the US Department of Energy's Energy Information Administration are overestimated. In fact, EIA in its most recent reports revised downward some of its estimates of excess capacity in Kuwait and Indonesia.

In conclusion, world excess capacity is at a record low and is concentrated in a few OPEC member countries, and it takes time to get the oil to the US. These three reasons can exacerbate the shortages in the US and create a potential crisis.

Conclusion

By every measure of petroleum security or vulnerability that we have examined, the US is as vulnerable, and in most cases more so, than at the time of the 1973 embargo.

Domestic production is about half of what it was then, dependence on imports is 50% higher, the number of days that stocks can replace imports is 5% lower, and a larger percentage of imports is concentrated in a few suppliers. In addition, any military action in Iraq would result in the elimination of most of the world's excess capacity for an indeterminate period of time.

An energy crisis is a situation in which we have a disruption in oil supplies that increases energy prices rapidly and threatens our economic and national security. The experience of the Persian Gulf war shows us that indicators showing vulnerability in many areas in and of themselves do not mean that there will be an oil crisis, but the current measures do indicate that the potential is historically high.

The lack of public information regarding the amount of storage by the Saudis and others in the Caribbean region makes it difficult to predict the amount of stocks available to US markets. In fact, if rumors about a large storage build-up in the Caribbean are correct, the US may suffer from a period of high oil prices even though supplies actually may be sufficient.

There are some signs that production is beginning to rebound in Venezuela, leading to some additional supply.

In addition, the normal seasonal decline of 2-2.5 million b/d in the spring will soften the impact of any supply interruption from Venezuela, Iraq, or any other country.

If there are shortages, the lessons that we will learn in the coming months have the potential for shaping energy policy in the US for years to come.

The authors

James L. Williams ([email protected]) is the president of WTRG Economics and publisher of Energy Economist Newsletter. Williams has 23 years experience analyzing and forecasting the global and domestic oil and gas industry. He is the author of several papers, is regularly quoted in the national and international media, and has taught at several colleges and universities. His experience includes forecasting as a senior economist for a major energy company and as a consultant to major producers and consumers of energy as well as oil and gas service and equipment manufacturers. Williams's work ranges from analyses of the influence of geopolitical forces and events on oil and gas prices to their impact on the industry and individual companies. His forecasting experience includes rotary and workover rig counts, oil country tubular goods and services, compressor sales, petrochemical prices, and gasoline sales.

A.F. Alhajji ([email protected]) is an associate professor of economics at the University of Northern Ohio at Ada, Ohio. He was a research assistant professor and visiting assistant professor at Colorado School of Mines during 1997-2001. He taught for 3 years at the University of Oklahoma, where he received his PhD in petroleum economics in 1995. Alhajji has published more than 300 articles and columns. He continues to contribute to academic journals and international publications, including the Energy Journal, OPEC Review, Energy Policy, Journal of Energy, and Development and Dialogue. Alhajji has been recognized as an honorary associate at the Center for Energy, Petroleum, and Mineral Law and Policy at Dundee University in Scotland and as an honorary member of the Honor Society for International Scholars.