Worldwide reserves grow; oil production climbs in 2003

Oil & Gas Journal's new assessment of worldwide reserves shows an increase over previous estimates, with the bulk of the increase from a single country.

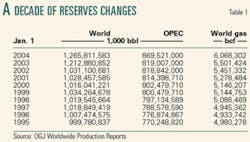

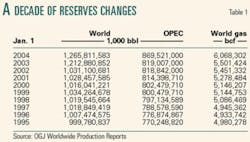

Based on OGJ estimates and an annual survey of government agencies and companies, total worldwide proved crude oil and condensate reserves as of Jan. 1, 2004, are 1.27 trillion bbl. This marks nearly a decade—with the notable exception of the post-collapse reporting year of 1999—of consecutive annual increases in global reserves estimates (Table 1).

The new natural gas reserves estimate is 6 quadrillion cu ft, also up from the previous estimate.

Production of crude oil and condensate increased 4% from 2002, following several years of flat output.

OGJ subscribers can now download free of charge the OGJ Worldwide Report 2003 tables -

Click here to view Worldwide Production Survey

Reserves changes

The largest change in oil reserves in this report occurs with Iran, based on new information from the ministry there. Other countries with updated figures include India, Greece, and Mexico.

Worldwide gas reserves estimates increased 10%, mainly due to large gains in Nigeria, Qatar, and Iran. Qatar's gas reserves are reported at 910 tcf.

Production is the reason for declines in most other countries that show smaller reserves as compared with year-ago figures.

This is the case for countries such as Denmark and Israel. Other changes to the reserves estimates occurred due to reevaluations in certain countries, such as Greece.

Iran

Iran's reserves climbed to the new number from 89.7 billion bbl, which OGJ had reported each year since 1999.

OGJ based its new estimate on a detailed update issued in late 2003 by Iran's Ministry of Petroleum. The update listed developed and undeveloped fields. It showed upward revisions for 16 reservoirs in 14 land and offshore fields. It also showed downward revisions for three single-reservoir fields; reserves for 16 other reservoirs were unchanged. The net of revisions totaled a positive 14.2 billion bbl.

Iran also revised upward its estimates of reserves from improved recovery from 25 onshore and 9 offshore reservoirs. The net of those revisions is a positive 30.3 billion bbl. Additionally, the country claimed 3.2 billion bbl of natural gas liquids reserves in South Pars field. All of the reserves figures are as of Dec. 31, 2002. Iran did not cite reasons for the revisions, such as reservoir performance, development drill- ing, or injection projects.

Iran's 2003 revisions applied only to a small number of its existing developed fields. It compared the new estimates to those of 1999, for which it listed 132 onshore developed oil reservoirs, 84 offshore developed oil reservoirs, 37 onshore developed condensate fields, and 11 offshore developed and undeveloped condensate fields.

Iran listed 80.4 billion bbl of reserves as of the end of 1999. Discoveries minus production in 2000-02 added less than 1 billion bbl, with the country producing 3.6-3.8 million b/d. Adding the upward field and improved recovery revisions brings the country's reserves to 125.8 billion bbl at the end of 2002.

OGJ declined to include "reserves" Iran listed in undeveloped fields. Those included 9 billion bbl in 38 onshore undeveloped oil reservoirs, 5.5 billion bbl in 22 offshore undeveloped reservoirs, and 1.4 billion bbl of condensate in onshore undeveloped gas reservoirs.

With restoration of Iraqi production capacity, Iran has a political reason to increase its reserves estimate. The Organization of Petroleum Exporting Countries historically has assigned the two countries equivalent production quotas. Iran's current quota is 3.7 million b/d.

Iraq has no quota and produced only slightly more than 2 million b/d late in 2003.

The Iraqi Oil Ministry has set a production capacity target of 3.5 million b/d for 2005—a goal officials have said the Iraqi industry can meet with financial and technical assistance from abroad.

OPEC obviously could accommodate that increment of Iraqi production with a quota that wouldn't run afoul of Iranian demands for parity.

For many years, however, Iraq has had a production-capacity target of 6 million b/d.

While achievement of that goal depends on establishment of a stable Iraqi government and investment by international oil companies in Iraqi oil fields —neither of which will occur soon—the ability of Iraqi reserves to support that level of production is not in question.

The prospect of Iraq's raising production significantly beyond 3.7 million b/d gives Iran a motivation to disclose reserves able to sustain comparable increases.

Venezuela

Venezuela's oil reserves remain at 77 billion bbl in this report, as this is the number the state-run oil company Petroleos de Venezuela SA reported to OGJ as "proven" reserves.

However, company officials also cite a much larger reserves number they describe as "total" reserves: 312 billion bbl. This figure includes an estimated 235 billion bbl that PDVSA says it believes is "technically recoverable" from the unconventional extra-heavy oil resource contained in the Orinoco oil belt. It arrived at that number by applying a 20% recovery factor to a resource estimated at 1.2 trillion bbl of OOIP.

Of the 77 billion bbl listed as proven reserves in Venezuela, 35 billion bbl is attributed to conventional heavy and unconventional extra-heavy crude oil in the Orinoco region.

Of that 35 billion bbl Orinoco share, according to PDVSA officials, 10-12 billion bbl is the target of ongoing development by four massive integrated heavy oil projects undertaken with foreign partners.

Venezuela last reported to the OPEC.secretariat its official proven reserves number as 77.8 billion bbl as of yearend 2002.

That represented a 0.1% increase from the year before.

OPEC production quotas, which have been assigned under a formula that takes under consideration a member country's oil reserves as well as socioeconomic factors, cover only conventional crude oil output.

Thus, lobbying for a larger number for Venezuela's proven reserves in theory would also place its large and growing volumes of unconventional oil—both diluted bitumen and synthetic crude—under consideration for oversight under OPEC production quotas.

North American reserves

In October the US Energy Information Administration released the newest US proved oil and gas reserves figures, showing an increase over the previous estimates.

The statistical arm of US Department of Energy reported that oil reserves increased 1% during 2002 and that reserves additions were 112% of production. Furthermore, EIA said that 97% of all new field discoveries of oil reported in 2002 were in the Gulf of Mexico federal offshore.

US gas reserves increased nearly 2%, with large additions in Texas and the Rocky Mountain states. Large reserves were added in the Powder River basin coalbed methane fields and Pinedale field in Wyoming, and in Wattenberg field and the coalbed methane fields of Colorado. Also, large reserves were added in Texas' Newark East field, the 10th largest gas field in the US.

Canada's reserves changed slightly from a year ago.

The Canadian Association of Petroleum Producers (CAPP) pegs conventional crude and condensate reserves at 4.5 billion bbl, and the Alberta Energy and Utilities Board reports oil sands reserves of 174.4 billion bbl. Canada's gas reserves are now 59 tcf, according to CAPP, down from 60 tcf as reported a year ago.

After adopting the definitions of the US Securities and Exchange Commission for reserves in 2002, Mexico's reported reserves figures dropped more than 50%. Petroleos Mexicanos this year reported its crude and condensate reserves to be 15.67 million bbl and its gas reserves 15 bcf.

Production rises

Worldwide crude and condensate production increased this year. OGJ estimates that production averaged 68 million b/d, up from 65 million b/d last year.

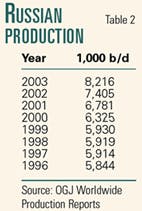

Russian production of crude and condensate surged (Table 2). OGJ estimates that crude and condensate production in Russia this year averaged 8.2 million b/d, up from 7.4 million b/d last year.

Driven by Russian production gains, the countries of Eastern Europe and the former Soviet Union collectively posted the largest increase in output this year at 9.8%.

Higher OPEC export levels gave total Middle East production a slightly smaller boost at 9.6%.

Similarly, African production was buoyed by increases in Nigeria and Libya, pushing up that region's output 6.6% from last year. OPEC oil production—including Iraq—is estimated at 26.4 million b/d for 2003, up 2 million b/d from a year ago.

The Asia-Pacific region and the countries of the Western Hemisphere experienced small declines in oil production, while the Western European countries as a whole posted a 5% output decline.

R-P ratios

The reserves-to-production ratios in Table 3 depict the extent of resource development in a few selected countries, using only conventional crude oil reserves for the calculations.

At the 2003 rate of production and current reserves estimates, the US has slightly less than 11 years of oil production remaining. Excluding oil sands, Canada's R-P ratio is 55.5 years.

Outside North America and among countries with the highest level of resource development among these selected countries, the UK has 6 years of production remaining.

Saudi Arabia's current estimate of reserves would last another 84 years, and Kuwait's reserves would produce at its current rate for another 143 years.

Click here to view Worldwide Reserves and Production in PDF.