Refining capacity creeps higher in 2003

The worldwide refining industry added capacity in 2003, despite a decrease in the total number of refineries. For the second year in a row, worldwide refining capacity set a record.

OGJ subscribers can now download free of charge the OGJ Worldwide Refining Report 2003 tables via these links -

Click here to view the 2003 Worldwide Refining Survey Introduction.

Click here to view the 2003 Worldwide Refining Survey details.

Click here to view Worldwide Refining Capacities in PDF.

Click here to vew the US Refining Capacities in PDF.

New crude capacity

Refinery closures

Primary crude refining capacity was shut down mainly in the US and Asia.

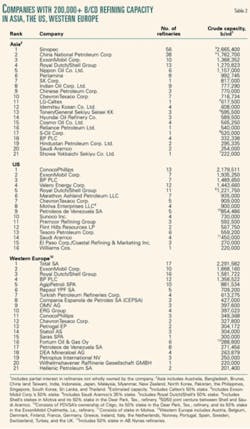

Largest refining companies

Africa had a slight capacity increase of 10,500 b/cd.