OGJ Newsletter

Market Movement

Oil prices unaffected by Saddam's capture

Despite earlier predictions to the contrary, the capture of Iraq's ex-President Saddam Hussein had no immediate effect on world oil prices.

In a strategic brief issued Dec. 14 immediately after Saddam's capture, Michael C. Lynch, president of Strategic Energy & Economic Research Inc., Winchester, Mass., claimed that accomplishment "could cause a quick drop in oil prices, which currently have a security premium of about $5/bbl."

He said, "Expectations that the military situation in Iraq will ease substantially and that [oil] exports through Turkey could add a quick 300,000 b/d to the market could cause a rout of the [financial] bulls, who have been exaggerating impact of the cold weather in the US and political instability in the Middle East (OGJ Online, Dec. 16, 2003)."

Lynch said, "Although world markets remain relatively tight at the moment, most indicators suggest that the crude market is overbought. Product prices remain low, and the degree of backwardation [a market situation in which futures contract prices are progressively lower in the distant delivery months] is fairly minor, while world oil production is soaring. The potential for a crude sell-off, even strong shorting by hedge funds, is very real and could take the West Texas Intermediate price under $30[/bbl] very quickly."

Saddam's arrest "may help catalyze a pull-back in prices" from recent levels of $32-33/bbl that were "politically unpalatable," said Michael Rothman, senior energy market specialist at Merrill Lynch Global Securities Research & Economics Group, New York. However, he said, "The breadth and pattern of resistance to US occupation of Iraq suggest that the insurgency producing a spasmodic reconstitution of the country's oil industry may not dissipate quickly even with Saddam's capture. In this regard, any claims about an imminent elimination of terrorist activity in the postwar period may prove premature" (OGJ Online, Dec. 15, 2003).

On Dec. 17, near-month contracts for benchmark US crudes closed at $33.35/bbl on the New York Mercantile Exchange and at $33.38/bbl on the US spot market.

Iraq recovery factored in

Even if Saddam's incarceration opens the door for an immediate rebound of Iraq's oil production and exports to prewar levels, Rothman said, "The basic outlook we have for prices in 2004—an average of $26.50[/bbl] for WTI—would go unchanged." It is already assumed that Iraq would reach those output and export levels by spring, and the projected average demand next year for 27 million b/d of crude from the Organization of Petroleum Exporting Countries "allows for a comfortable reintegration" of Iraqi production, he said.

Furthermore, said Rothman, "We disagree with assertions by many market pundits that current oil prices reflect a 'terrorist premium' of up to $9/bbl. These views, like those about the 'war premium' earlier this year, ignore underlying fundamentals, including a still large storage deficit and limited spare production capacity."

Meanwhile, postwar investments into Iraq's oil sector "appear to be a pittance relative to what is needed to stop the capacity declines and start to stabilize the system," said Paul Horsnell, head of energy research at Barclays Capital Inc., London (OGJ Online, Dec. 17, 2003).

"There are 'technocrats' within Iraq who believe that the system is being pushed too far in order to get the maximum amount of cash out quickly, whereas the longer-term interests of Iraq will be better served by constraining production in the short term and by putting billions of dollars of investment into the sector with some extreme urgency," he said.

"Ultimately, the resolution of that issue will be more important than how often the pipelines are blown up," Horsnell said.

Energy prices generally declined during the first 2 trading days after Saddam's capture. But most financial analysts attributed that primarily to a break in recent cold weather over much of the US and profit taking among traders after sharp price increases of the previous week. By Dec. 17, energy prices jumped again with government and industry reports of a large drawdown of US crude inventories during the week ended Dec. 12.

"The inventory deficit continues to widen, with the gap between total inventories and their 5-year average increasing by 8.7 million bbl to now stand at 64.1 million bbl. Recent weeks have seen a pattern of tightening in crude oil and a lesser easing in oil products, but this [latest] week both have tightened," Horsnell said.

The US Energy Information Administration reported US oil stocks plunged by 5.1 million bbl to 272.8 million bbl during the week ended Dec. 12. The American Petroleum Institute estimated the loss at 2.06 million bbl to 271.98 million bbl.

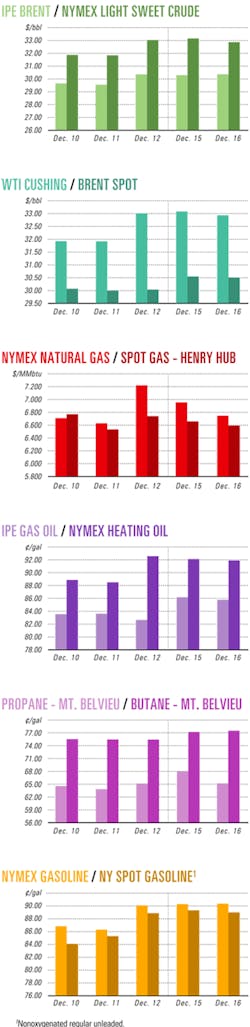

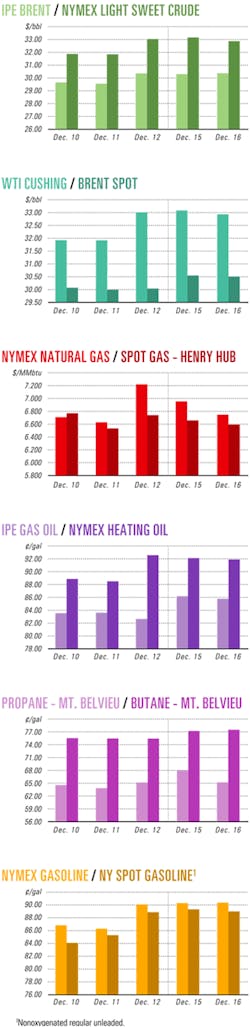

Industry Scoreboard

null

null

null

Industry Trends

THE SEISMIC INDUSTRY needs additional consolidation to drive long-term profitability.

Jefferies & Co. Inc. analyst Stephen D. Gengaro said that seismic companies have started trying to strategically revamp themselves, but that a new round of consolidation is needed.

"Disciplined business tactics, cost-savings initiatives, and downsizing on the operational level, coupled with financial restructuring and more appropriate capital spending plans, are the building blocks for a more stable business," Gengaro said in a Dec. 12 research note.

"The industry is in dire need of consolidation and asset rationalization," he said.

While some consolidation occurred in the late 1990s, too much capacity still remains, he said.

"Companies have acknowledged the capacity issue, particularly on the marine side," Gengaro said.

Although optimistic about underlying fundamentals, Gengaro said, "Several near-term issues will continue to dampen an industry recovery."

He forecast a modest pick-up in seismic activity during the next several quarters, but he also expects that overcapacity will constrain both pricing and profitability.

Meanwhile, seismic spending remains at low levels both in absolute terms and as a percentage of total exploration capital expenditures.

OIL AND GAS COMPANIES recently surveyed agreed that low seismic survey activity will persist going into next year.

That word comes from the monthly PatchWork Survey released Dec. 9 by UBS Securities LLC analysts.

The survey shows that the seismic index often was below zero in 2003, and the latest survey showed the index at –6. The survey uses an index ranging from –100 to 100. A value of zero or close to it indicates that no change is expected during the next 60 days.

Of the companies surveyed, 67% planned no change in their seismic plans for the US and Canada. Meanwhile, 19% said that they planned a decrease in the next 60 days while 14% planned an increase.

CHINA'S GROWING PLASTICS DEMAND played a factor in Saudi Basic Industries Corp.'s (SABIC) decision to expand its petrochemical operations in Saudi Arabia.

Yousef Al-Benyan, general manager of SABIC Asia Pacific discussed the company's plans earlier this month during ChinaPlas 2003, an international plastics and rubber trade fair in Beijing.

"China is the world's fastest growing plastics market, and its demand for petrochemicals has grown at a rapid pace (7.6%/year) over the past 10 years. For the next 2 years, demand is expected to continue to grow at 7.4% annually," Al-Benyan said.

Meanwhile, SABIC has six projects coming on stream by 2006. The company's production of chemicals, polymers, and fertilizers is now more than 40 million tonnes/year, and the company's planned construction, debottlenecking, and expansion projects are expected to increase production capacity by 5.5 million tonnes/year.

One of the largest polymer providers to China, SABIC's polymer products are manufactured by its affiliates throughout Saudi Arabia, including Arabian Petrochemical Co. and Saudi Arabian Fertilizer Co.

Government Developments

THE WORLD BANK has asked Pakistan to significantly increase its tax on natural gas to boost its revenue contribution and raise the levy on petroleum, oil, and lubricant (POL) products.

Currently, Pakistan's natural gas and POL products have disproportionate levels of taxation, despite both having similar market shares, the bank said. Annual revenue for POL products and gas is about 45 billion rupees and 15 billion rupees, respectively.

The bank has advised Pakistan to use a petroleum levy to stabilize tax receipts from POL products and natural gas as it had done in 1999 to help cushion the budget against extreme fluctuations in international oil prices. The bank believes the government could earn much more through increased taxation on natural gas than what it was collecting on POL products.

POL products and natural gas account for about 80% of energy supply in Pakistan; electric power accounts for about 15%, and LPG and coal constitute the balance. The country's reserves of crude oil stand at 300 million bbl.

By contrast, Pakistan has about 27 tcf in gas reserves. Gas production is around 900 bcf/year, and the reserve to production ratio is more than 25 years. Also, there is scope for a substantial increase in gas production. Pakistan's POL product imports stood at 27-31%/year of total imports and averaged 30-36%/year of export earnings during the last 3 years.

THE INDONESIAN MILITARY has proposed withdrawing troops from guard duty at the country's largest energy projects, suggesting that companies assume responsibility for protecting their own facilities. The government has yet to act on the proposal.

Gen. Endrartono Sutarto, the country's top military commander, told a news conference last month that he wants international firms, including ExxonMobil Corp. and BP PLC, to assume control of their own security. This applies to Aceh, now under martial law.

The US, European Union, and Japan issued a joint statement Nov. 6 in response to Jakarta's decision to extend martial law in Aceh for an additional 6 months, beginning Nov. 19.

"We hope that the government, in carrying out its activities during martial law, will reduce the impact on the Acehnese people to a minimum and will approach it on several fronts to provide humanitarian aid, restore the civilian administration and law enforcement," the joint statement said.

ExxonMobil issued no immediate comment on the military's security proposal. BP previously lobbied for control of its security, suggesting a plan that would rely heavily on the local community rather than on the armed forces.

ALASKA said it will consider buybacks of shallow natural gas leases only as a last resort.

Alaska Gov. Frank H. Murkowski said that all other options would have to be exhausted before the state would consider buying back any coalbed methane leases in the Mat-Su Borough and on the Kenai Peninsula.

Currently, state officials are working with the public in drafting rules that will be required for CBM development, such as setback requirements, noise limitations, and water quality monitoring.

Quick Takes

CHEVRONTEXACO CORP. and Schlumberger Oilfield Services reported the setting of new measurement-while-drilling and logging-while-drilling depth and pressure records for the Gulf of Mexico. These results were recorded while ChevronTexaco drilled its deepwater Tonga exploratory prospect on Green Canyon Block 727.

Transocean Inc.'s Discoverer Deep Seas drillship drilled the Tonga No. 1 well in 4,695 ft of water, 150 miles southwest of New Orleans. The well reached 31,824 ft TVD, which exceeded the previous record by 700 ft, ChevronTexaco said. The well's maximum downhole pressure was recorded at 26,138 psi. Schlumberger said that while drilling the well, continuous, real-time surveys were delivered, which allowed the well's trajectory to be kept on target.

In other drilling activities, Total Congo has awarded a letter of intent to Smedvig ASA, Stavanger, to lease Smedvig's T-8 self-erecting tender rig. The drilling assignment, in Congo, West Africa, has a firm duration of 105 days, with options for an additional 300 days. The estimated contract value for the firm period is $5.1 million, with an additional mobilization-demobilization fee of $4 million. Start-up is scheduled for second quarter 2004.

NORSK HYDRO SA, development operator of Ormen Lange natural gas field on deepwater Block 6305/5-1 in the Norwegian Sea, has concluded a new agreement with Statoil ASA giving it responsibility for procurement and delivery of steel line pipe, anodes, and pipeline coating for proposed pipelines from the field to a processing and export plant at Nyhamna, Norway.

The new agreement covers 120 km of large- diameter, dual gas pipelines, and two monoethylene glycol lines of the same length. A separate 3.5-km, insulated monoethylene glycol line also will be installed between two subsea templates in the field. The pipelines must be weighted in shallow waters and insulated in 850 m of water, Statoil said.

The contracts are in addition to Statoil's existing agreements for planning and constructing the 44-in. gas export pipeline from Nyhamna to the Sleipner riser platform in the North Sea and from Sleipner to Easington on the UK east coast. (OGJ Online, Oct. 3 and Dec. 5, 2003). Ormen Lange is scheduled to come on stream in October 2007.

ABERDEEN-BASED Ramco Energy PLC, operator of Seven Heads natural gas development project in the Celtic Sea, brought the field into production Dec. 13. Initial production from five producing wells will be 60 MMscfd of gas.

Proved and probable reserves in Seven Heads have been assessed at 390 bcf, Ramco said.

Ramco developed Seven Heads on a fast-track basis via a subsea pipeline tied back to adjacent Kinsale field, Ireland's largest producing gas field. Ramco said it expects Seven Heads field to contribute about 10-15% of Irish gas demand in 2004, "displacing imports from the UK."

Ramco has acquired interests in several other blocks in the Celtic Sea and plans next year to conduct a seismic survey program to assess potential for developing satellite structures to be tied back to existing infrastructure.

Irish authorities have awarded Ramco 100% interest in the East Kinsale Licensing Option 03/10. The LO covers part of blocks 49/17, 49/18, and 49/23 east of Kinsale field.

In other production news, ExxonMobil Corp. and partners have launched natural gas production from Alma field on the Scotian shelf off eastern Canada. The flow of 120 MMcfd of gas and 3,000 b/d of condensate and natural gas liquids from Alma, 125 miles southeast of Halifax, NS, brought the Sable project's average output to 500 MMcfd of gas and 20,000 b/d of condensate. A 32 mile subsea pipeline connects Alma, in 220 ft of water, to the Sable project's Thebaud central processing platform. Tier 1 production from the Sable Project began in late 1999 from North Triumph, Venture, and Thebaud fields. South Venture, the second Tier 2 field, is under development in Halifax and slated to go on production in late 2004. Sable project working interests are ExxonMobil Canada 50.8%, Shell Canada Ltd. 31.3%, Imperial Oil Resources Ltd. 9%, Pengrowth Corp. and Emera Offshore Inc. (pending sale to Pengrowth Corp., closing mid-December) 8.4%, and Mosbacher Operating Ltd. 0.5%.

EXXONMOBIL CANADA, meanwhile, awarded a contract for engineering, procurement, construction, and installation of the Sable compression platform and its facilities to a partnership of Saipem SPA of Italy (leader) and Daewoo Shipbuilding & Marine Engineering of South Korea.

Topsides weight is 7,000 tonnes. The compression platform will be bridge-linked to the existing Thebaud platform, on which additional work will be carried out. Saipem will carry out offshore installation in summer 2006.

In other development news, Apache Corp. has signed a memorandum of understanding (MOU) with Egyptian General Petroleum Corp. and Egyptian Gas Holding Co. for development of the deepwater portion of its Egyptian West Mediterranean concession. The MOU includes a field development plan and a gas sales agreement for 2.7 tcf or more of natural gas over 25 years. Production is expected to start in 2007.

Apache and its partners will supply 400 MMcfd of gas to the Egyptian market during 2007-12 and 375 MMcfd of gas during the following 20 years. Apache will begin appraisal drilling on the concession and start infrastructure construction soon after executing final agreements. Apache said it has "another five Pliocene-age gas exploratory prospects and eight Miocene-age prospects in the area." Apache operates the deepwater portion of the concession with a 55% interest. RWE-DEA AG has a 35% interest, and BP Group holds 10%.

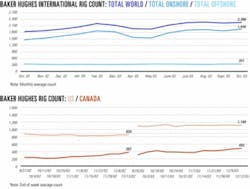

ENI SPA's Tunisian subsidiary Agip Tunisia BV, Tunis, successfully tested the Hawa-1 exploration well in southern Tunisia. Agip spudded the well Sept. 18. It encountered an aggregate 46 m of net oil pay and 9 m of net gas pay in the Acacus A and Tannezuft formations over a gross interval of about 280 m at 3,300 m deep. These zones are equivalent to productive zones in the nearby producing Adam field.

During preliminary testing of the oil-bearing Acacus A intervals, Hawa-1 produced at 2,460 b/d of 41º gravity oil with a gas-to-oil ratio of about 700:1 and flowing top hole pressure of 1,740 psi. The drilling rig is being moved off location, and more-extensive production testing will be conducted by yearend.

A field development plan and hook-up to existing process and export facilities 13 km away is awaiting approval. Field production is expected to begin in early 2004.

In other exploration news, OAO Lukoil plans the first oil field development in the southeastern Baltic Sea, starting flow in 2004 from small Kravtsovskoe (D-6) field off Kaliningrad. D-6 is expected to recover 64 million bbl of oil in 12 years. Production is to peak in 2006 at 12,000 b/d of 39.5° gravity oil from a Middle Cambrian reservoir at 2,100 m. The fixed platform will accommodate 21 producing wells and 2 spare wells, Lukoil said. Drilling is expected to start in March 2004. D-6 lies in 29-30 m of water on the Baltic shelf 15 miles offshore. A 25 mile, 10-in. subsea pipeline will transport oil to the Romanovo oil-gathering facility. Separated oil will be shipped to the new Ijevskoe onshore terminal, and treated gas will be used locally or flared, with produced water to be injected. Lukoil said the nearby Kaliningradskoe (D-9) offshore oil discovery remains undeveloped. Norway has launched its 18th licensing round, offering all or parts of a hefty 95 blocks in the Norwegian and North seas. Bids are due Mar. 15, 2004, and production licenses are to be awarded by summer 2004. Of the total, 13 blocks lie in the southeastern North Sea, south of Stavanger. The others lie from northwest of Floró to as far north as 67° 30' N. Lat., above the Arctic Circle. The Ministry of Petroleum and Energy offered 46, 48, and 32 blocks, respectively, in the previous three rounds.

SAUDI ARAMCO is promoting a 2 billion riyal international investment program for the development of cogeneration facilities at four of its oil and gas facilities in Saudi Arabia's Eastern Province. This is the first large-scale "independent power project" to be undertaken in Saudi Arabia by the private sector.

The plants, which would produce more than 1,000 Mw of electric power and more than 4 million lb/hr of steam, would be built by joint ventures consisting of one Saudi company and one international company under a "build, own, operate, and transfer" business model. The plants would be ceded to Saudi Aramco after 20 years.

Implementation is expected to begin in first half 2004, and to be completed in phases during 2006. Saudi Aramco said it would supply the gas and water required to produce electricity and steam.

LUKOIL NEFTEGAZSTROY, the construction affiliate of Russia's OAO Lukoil, has tapped Fluor Corp. to construct a 220,000 b/d products and crude oil export terminal at Vysotsky Island on the Gulf of Finland 18 miles north of Primorsk near St. Petersburg. RPK-Vysotsk Lukoil II will own the terminal.

The project includes two tank farms, a marine jetty, a railroad station, and dredging in the Gulf of Finland to allow for the passage of double-hulled crude and product icebreaker tankers. The $300 million terminal is scheduled for completion in December 2004.

About 50,000 b/d of storage will be reserved for crude oil, with the balance for products. Capacity for about 140,000 b/d is expected to be available by 2005. Crude and products will be delivered to the terminal by rail and river (OGJ, Oct. 6, 2003, p. 62).

Kerr-McGee completes Gunnison hub

The Gunnison truss spar system, named the Kerr-McGee Global Producer VII, is now in operation, as the first well in the 10-well field development begins producing 35 MMcfd of natural gas and 500 b/d of oil.

The truss spar was towed to Gunnison field on Garden Banks Block 668 in the Gulf of Mexico on Aug. 18 and upended in 3,150 ft of water, and the 6,260 ton topsides was set on the spar hull Oct. 11. The hub facility has a capacity of 40,000 bbl of oil and 200 MMcfd of gas, which maximizes the efficiency of developing satellite prospects in the area.

Kerr-McGee Corp. affiliate Kerr-McGee Oil & Gas Corp., Oklahoma City, is operator of the new hub.

Production from two other wells is expected to begin by yearend, with total production from all three wells projected at 5,000 b/d of oil and 125 MMcfd of gas by mid-January 2004. Production is expected to increase to 165-180 MMcfd of gas and 28,000-30,000 b/d of oil by yearend 2004, as the seven remaining wells are completed.

Kerr-McGee holds a 50% interest in Gunnison field, which spans across Garden Banks Blocks 667, 668, and 669. Partners are Nexen Petroleum Offshore USA Inc., a unit of Nexen Inc., Calgary, 30%, and Energy Resource Technology Inc., a subsidiary of Cal Dive International Inc., Houston, 20%.

Photos courtesy of Kerr-McGee.