Growth in China's oil imports could contribute to maintaining the healthy rate structure that will be needed to pay for new tanker construction, said shipping consultant Poten & Partners, New York, in a recently published analysis.

But some believe that because China is employing so much of the world's fleet of tankers, bulk carriers, and containerships, and shipyards are already filled with orders to 2006, a worldwide shipping crisis is imminent.

Large bulk carriers carrying iron ore, medium bulk carriers carrying grains, and container vessels moving to and from China are enjoying boom times, said the company. But is that necessarily so for tankers?

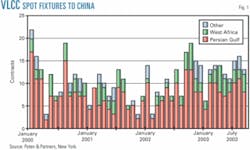

VLCC

Fig. 1 shows very large crude carrier (>200,000 dwt) spot fixtures to China from West Africa, the Persian Gulf, and Other, which includes cargoes from the Red Sea, North Sea, and Venezuela.

VLCC spot fixtures where China is specifically designated as the discharge nation have grown at 25%/year since the low point in 2001 during a global economic retreat.

But the growth rate from 2000—the high point from the previous business cycle—is not that impressive. The question is whether China's imports can keep up with a 25% growth, or will they revert to a longer-term and more subdued rate of growth?

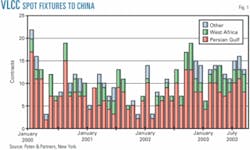

Suezmax

Although Suezmax (120,000-200,000 dwt) spot fixtures are up from 2001, there doesn't seem to be a real upturn in activity (Fig. 2). The trend in Suezmax spot fixtures, if anything, said the consultant, looks flat even though it is up from the 2001 low point.

Other cargoes include those from West Africa and the Red Sea plus a scattering from Southeast Asia, the Caribbean, the Mediterranean, and the North Sea.

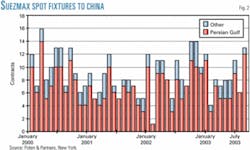

Aframax

Aframax (80,000-120,000 dwt) spot fixture activity to China displays noteworthy growth (Fig. 3). These cargoes include clean cargoes in addition to dirty fuel oil and crude oil.

Consumption of fuel oil in China is escalating rapidly as an industrial fuel. Other cargoes are from the Red Sea, the Far East, and Australia, with a scattering from the Mediterranean and the Caribbean.

Annual growth in Aframax spot fixtures since 2000 is an impressive 17%/year, said Poten & Partners, and it will continue.

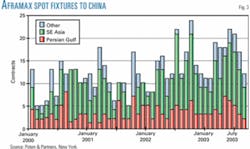

China's oil link to economic growth

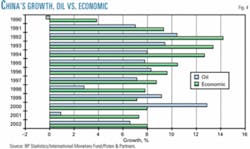

Fig. 4 compares growth in oil consumption with economic growth. Surprisingly, the relationship differs from other developing nations where the two growth rates are about the same.

In China, growth in oil consumption has lagged growth in economic activity in every year since 1990, except 1999 and 2000, the analysis showed.

The overall growth in oil consumption since 1990 has been 7.5%, compared with an overall growth in economic activity of an impressive 9.7%.

Projections of China's continued economic progress are around 8%/year. With a 77% overall linkage between oil and economic growth rates, this implies that oil consumption will increase by more than 6%/year on a long-term basis.

Changes in imports are net of gains in domestic production, which are not expected to be impressive, and construction of a pipeline from Russia, which is far in the future.

Draining the tanker pool?

China's current oil imports are 2.45 million b/d, which is 24% greater than last year's average of 1.98 million b/d. That is far greater than the implied long-term growth of somewhat more than 6%.

But mixed into this surge of imports is inventory replenishment and perhaps even inventory stockpiling as a hedge against potential interruptions of Middle East crude exports. A sustained gain of 24% in imports from consumption alone is without historical precedent, and Poten & Partners does not believe it is sustainable.

While China's oil imports will increase at an impressive rate of growth, it is not going to drain the tanker pool dry, said the company. The existing tanker fleet can handle oil import gains into China.

Considering the expansion in fleet supply where newbuilding deliveries exceed mandatory phase out by a healthy margin, it is highly unlikely that China's growth in imports will exhaust the world tanker fleet.