OGJ Newsletter

Market Movement

OPEC to hold current production quotas

Ministers of the Organization of Petroleum Exporting Countries decided Dec. 4 to maintain current oil production quotas at a special meeting in Vienna. Before the meeting was concluded at presstime last week, officials gave mixed signals about what outcome could be expected.

Chakib Khelil, minister of energy and mines for Algeria, said a production cut was necessary because of an expected drop in demand by 2 million b/d during the second quarter of 2004. If world oil production increased during that same period, world oil prices could plummet to $10-20/bbl, he forecast (OGJ Online, Dec. 2, 2003).

But Libyan Prime Minister Shokri Ghanem earlier called for an increase in his country's production quota (OGJ Online, Nov. 4, 2003). Iran also indicated a desire to increase its production quota after revising upward by 36% its estimated oil and condensate reserves to 130.8 billion bbl.

Sheikh Ahmad Fahad Al-Ahmad Al-Sabah, Kuwait's minister of energy, and Obaid bin Saif Al-Nasseri, UAE minister of petroleum and mineral resources, however, said they favored maintaining OPEC's production quota at the 24.5 million b/d level.

OPEC ministers decided to convene again Feb. 10 in Algiers to reassess the market.

Faith in OPEC

Meanwhile, the recent rally in oil futures prices signaled "a premium for terrorism and a view that OPEC will succeed in holding oil prices within its targeted band [of $22-28/bbl]," said Frederick P. Leuffer and Nicole L. Decker, analysts with Bear, Stearns & Co. Inc., New York, in a Nov. 25 report.

"Some oil traders are banking on production cutbacks by OPEC to sop up excess supply. They reason that somehow OPEC has been successful in keeping oil prices in a determined price band, and the organization says it will continue to do so," they reported.

However, they said, "It remains to be seen how long oil traders will ignore fundamentals in anticipation of a major cutback in OPEC production. We see a potentially large buildup of supplies next year from non-OPEC producers and further restoration of supply outages from Iraq, Nigeria, and Venezuela. This could require other OPEC producers to cut production by as much as 4.2 million b/d—a task too great for OPEC alone."

Meanwhile, the analysts said, "After a series of attacks on oil pipeline facilities in Iraq, truck-bomb explosions in Turkey and Saudi Arabia, and new terrorist threats believed to have come from Saddam Hussein and Osama bin Ladan, we believe a terrorist premium is reflected in oil prices. Hardly a day goes by that we are not asked: 'If terrorists can attack oil pipelines in Iraq with such a large US military presence, why can't they attack oil installations in Saudi Arabia?'"

They said, "It is difficult to quantify the 'faith in OPEC premium' vs. the 'terrorist premium' in oil prices. We believe that based on fundamentals alone, oil prices should be in the $22-24/bbl range today—the same price level as early 1997—given that the growth in oil inventories has kept pace with the growth in oil demand during the past 6 years. With oil near $30/bbl, our sense is that the terrorist premium represents about $2/bbl, or 8-10%, with $4-6/bbl attributable to expectations that OPEC will cut output."

Price surge

"The surge in oil prices in the past 2 months is unlike anything we have seen before. Oil prices advanced from an already high level by as much as $7/bbl between Sept. 19 and Nov. 19, rising above $33/bbl despite restoration of supply outages, blatant OPEC quota violations, and a significant build in crude oil inventories," the analysts said.

"Oil fundamentals are weak," they said. "We estimate that demand has increased by only 1.5% in the first 9 months of 2003, even though consumption was boosted by fuel-switching from natural gas in the US and from nuclear in Japan and by colder-than-normal temperatures in the first quarter." As a result, Bear Stearns reduced its 2003 forecast for growth in oil consumption to 1.4%, from more than 2% previously.

"Meanwhile, oil supplies continue to rise," they said. "Non-OPEC supply is expected to grow by more than 1 million b/d this year." They estimated non-OPEC production increased by 500,000 b/d during the third quarter and is up by 1.6 million b/d from the same period a year ago.

OPEC production increased by more than 1.2 million b/d between June and October, "despite the organization's call for output restraint, largely due to higher output from Iraq," the analysts said. "In fact, most 'barrel counters' agree that OPEC production has increased each month since June," they said.

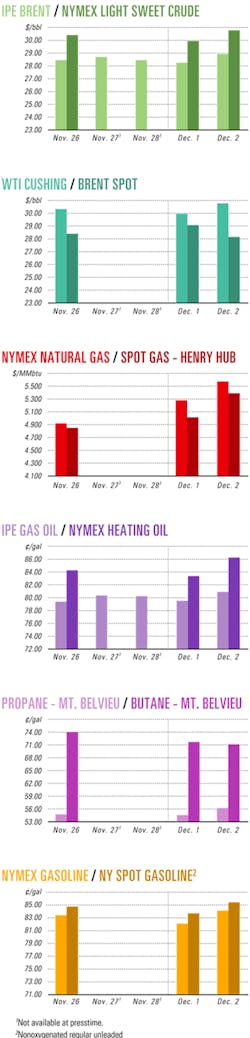

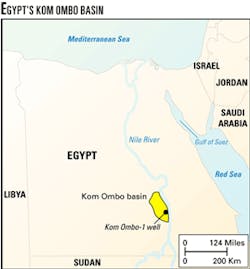

Industry Scoreboard

null

null

null

Industry Trends

A CANADIAN GOVERNMENT STUDY found no evidence of conspiracy behind fluctuating gasoline prices early this year. The higher prices stemmed from the oil and gas industry's competitive reactions to international events and also to abnormally cold weather in North America last winter, the study said.

Last month, the Standing Committee on Industry, Science, and Technology issued its "Gasoline Prices in Canada" report following a series of public hearings that involved testimony from Canada's Competition Bureau, industry executives, and others.

"No evidence was presented to the committee of a conspiracy to raise and fix prices, nor was there evidence presented of abusive behavior on the part of vertically integrated suppliers in the form of squeezing retail margins to eliminate or discipline independent retailers," the committee's report said.

The Canadian Petroleum Products Institute (CPPI) supports the report's sole recommendation that the federal government create a petroleum monitoring agency to collect and distribute information on petroleum prices in the US and Canada. CPPI member companies operate 17 refineries and supply fuel to 10,000 retail stations.

"Commodity markets are unpredictable, and we understand why consumers can be confused, and at times frustrated, by changes in price," said Alain Perez, CPPI president. "This report clearly shows that petroleum prices are influenced first and foremost by external events beyond Canada's control."

The report said that "the lion's share [of the retail gasoline price] is garnered by governments, whose taxes account for 40% of the average revenues earned for the 4-week period ending Sept. 9."

The Competition Bureau said that since 1990, it has found no evidence of any conspiracies or abusive behavior from oil companies.

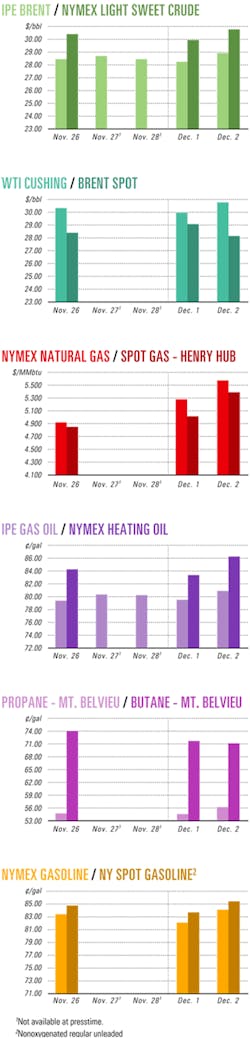

US DRILLING ACTIVITY is expected to increase in 2004 because rig efficiency is improving, said James K. Wicklund, a Houston-based analyst with Banc of America Securities LLC.

He made that forecast in a Nov. 26 research note, saying US drilling activity is expected to increase even if exploration and production companies do not materially increase their spending next year.

Based upon preliminary projections for the firm's E&P coverage universe, Banc of America E&P analysts believe that exploration and development spending will be roughly flat in 2004 compared with 2003, Wicklund noted.

"However, this does not concern us as 2003 E&D budgets for the same companies currently reflect a 14% increase in spending this year vs. only a 2% increase expected for 2003 at this time last year," Wicklund said.

"But even if spending from E&P companies were not to increase materially next year, domestic drilling activity should still increase as efficiency per rig improves," he said.

Separately, Baker Hughes Inc. reported US drilling activity increased by 6 rotary rigs to 1,113 units working as of Nov. 26. That's up from 835 active rigs during the same period a year ago (see Quick Takes, p. 9).

The Baker Hughes' land rig count increased by 3 to 995 rigs, which Wicklund called "the highest level seen in the land count during this time of year since 1987."

Government Developments

PERU'S ENERGY AND MINES MINISTRY is seeking management contracts, joint ventures, or similar arrangements to reorganize Petroperu, the state oil company.

But the government does not expect to sell Petroperu's assets, said Energy Minister Hans Flury. Petroperu's immediate challenge is to obtain $275 million to upgrade the 62,000 b/d Talara refinery and meet World Bank fuel standards before 2005.

Investment also is required for the 12,500 b/d Conchan refinery south of Lima as well as for the 10,500 b/d Iquitos refinery and the 1,600 b/d El Milagro refinery, both in the northern jungle. Petroperu operates the four refineries.

Repsol-YPF SA, in partnership with ExxonMobil Corp., operates Relapasa, the country's largest refinery with a 102,000 b/d capacity. The government owns 31.2% of it.

Petroperu Pres. Alejandro Narvaez estimated losses at $7.5 million for the year. He added that the losses would have been higher except for recent austerity measures.

INDIA is racing against time to fulfill its disinvestment program target of 135 billion rupees ($2.97 billion) before the fiscal year ends Mar. 31, 2004.

Analysts estimate that the combined anticipated offerings in exploration major Oil & Natural Gas Corp. (ONGC) and refiner Indian Oil Corp. (IOC) could total as much as 100 billion rupees. If that happens, it will be the first time that the government meets its divestiture target.

Analysts expect that the government probably will sell 5% of its equity holding in ONGC and 20% of its stake in IOC.

Generally, public offerings take at least 3 months so the Indian government must reach a decision by mid-December if the goal is to be met this fiscal year, analysts said.

THE US MINERALS MANAGEMENT SERVICE reported the state governments' share of federal mineral revenues from public lands increased 30% in the fiscal year (FY) that ended Sept. 30.

MMS distributed more than $1 billion to 35 states during FY 2003 compared with FY 2002 payments totaling $716.3 million.

The money distributed through September represents the states' cumulative share of revenues collected from mineral production on federal lands within their borders, and from federal offshore oil and gas tracts adjacent to their shores.

Wyoming in FY 2003 received the most royalty receipts, a record $467 million, an increase over last FY's $359.3 million. New Mexico was next with $297 million, compared with $191.4 million in FY 2002.

Other large revenue-sharing states include Colorado, which received $53.9 million; Louisiana, $30.7 million; Montana, $25.5 million; California, $25.4 million; and Texas, which nearly doubled its royalty share this year to $17 million.

The federal government shares its lease and royalty revenues with the states where oil and gas production occurs. Half of the revenues go to the state, 40% to the Reclamation Fund for water projects, and 10% to the US Department of the Treasury.

Alaska is the only exception: Under its statehood act, it gets 90% of the federal receipts.

Quick Takes

THE US MINERALS MANAGEMENT SERVICE has issued a proposal for Lease Sale 191 in Alaska's Cook Inlet and scheduled the proposed notice of sale for May 19, 2004. That sale and Sale 199 are scheduled for May 2006. MMS released a single final environmental impact statement evaluating both sale areas. The Cook Inlet lease area in federal waters 3-30 miles offshore covers about 2 million acres extending from just south of Kalgin Island to just northwest of Shuyak Island, in water 30-650 ft deep. MMS estimates that the area may exceed 1 tcf of conventionally recoverable natural gas. Shelikof Strait is excluded from the proposed sale area, as is a narrow band of blocks off the lower Kenai Peninsula and the Barren Islands. Economic incentives for Cook Inlet federal waters include a primary term of 8 years, lower minimum bid ($25/hectare) and annual rental rates ($5/hectare), and royalty suspension volumes. The RSVs would relieve royalty payments on an oil or natural gas producing lease up to the first 30 million boe.

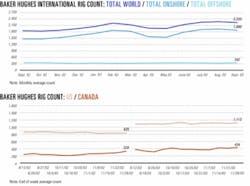

In other exploration activities, Egypt has named Centurion Energy Corp., Calgary, the winner of a 100% working interest in Block 2 in the Kom Ombo basin north of Aswan in southern Egypt. Kom Ombo is a rift basin analogous to the Muglad basin, source of Sudan's oil production. The block covers 5.6 million acres with numerous seismically defined leads that Centurion said hold potential for significant oil reserves. Centurion will spend $2 million in the first 2 years to reprocess 1,000 km of 2D seismic data, reenter and test the Kom Ombo-1 well, and run geological and geochemical studies. A previous operator drilled Kom Ombo-1 in 1997 and tested light oil at 8,150 ft from a good-quality early Cretaceous sandstone reservoir, indicating the presence of a petroleum system, Centurion said.

Kom Ombo-2 encountered significant oil and gas shows in the same reservoir in 1998. Murphy Oil Corp.'s extended drill stem test on the deepwater Kikeh No. 4 well off Malaysia flowed on test for 15 days to an equipment-limited maximum rate of 10,200 b/d of oil. The well, in 4,460 ft of water, is 2.5 miles north of Kikeh field on a separate structural feature, both on Block K off Sabah (OGJ Online, Aug. 28, 2003). Murphy said the well test focused on just one of the multiple oil pay zones in the well and that the well would be incorporated into Kikeh development plans in early 2004. Operator Murphy holds an 80% working interest, and Petronas Carigali Sdn. Bhd. 20%. British Columbia's Ministry of Energy and Mines has solicited proposals, due by Dec. 31, to conduct geophysical surveys in the onshore Bowser-Sustut basin northeast of Prince Rupert, BC, and in the Nechako basin southwest of Prince George. The little-explored basins are the largest areas of Jura-Cretaceous clastics in the province's interior (see map, OGJ, June 26, 2000, p. 38). A project would emphasize seismic surveys and also could take in high-resolution, airborne gravity and magnetic surveys. The ministry and the Geological Survey of Canada are expediting a 4-year, multimillion-dollar geological survey in the Bowser-Sustut basin and a multiyear study of subsurface data from the Nechako area.

SHELL UK EXPLORATION & PRODUCTION, operator of Goldeneye field in the Outer Moray Firth area of the UK Central North Sea, has completed precommissioning 101 km of 20-in. export pipeline and 4-in. mono-ethylene glycol pipeline from the field to its St. Fergus, Scotland, gas plant.

Halliburton Energy Services, a business unit of Halliburton Co., performed the work through its Pipeline and Process Services product service line.

Work included flooding, cleaning, gauging, high-pressure flushing, and hydrotesting the pipelines from onshore. Saipem UK installed the two pipelines, using its Castoro Sei pipelay vessel, in water 120 m deep.

In other development activities, Niko Resources Ltd., Calgary, began work this month on newly acquired Block 9, which covers 6,880 sq km surrounding the Bangladesh capital, Dhaka. Drilling is set for the Rafulpur, Lamlai, and Bangora North prospects. Niko has 60% interest and will become operator upon declaration of a commercial discovery. Block 9 has been the site of 450 sq km of 3D seismic surveys and 1,010 km of 2D seismic surveys, but no drilling has taken place. Niko acquired interest in the block in September from a unit of ChevronTexaco Corp. Other Block 9 participants are Tullow Bangladesh Ltd. 30% and Bangladesh Petroleum Exploration & Production Co. Ltd. (Bapex) 10%. In October, Niko signed a joint venture with Bapex that takes in Chattak gas field in northeastern Bangladesh and Feni field southeast of Dhaka. Chattak and Feni fields have produced gas but currently are shut in. Niko plans to rework one of the existing wells and drill a new well in March 2004 at Feni, which covers 43 sq km. The Chattak structure covers 376 sq km. The upper fault block to the west has produced from one well. Development drilling at West Chattak in third quarter 2004 will be followed by exploration of the downthrown block.

A PROPOSED 60,000 b/d privately owned refinery planned for northeastern Brazil is making headway after a year of delays, reported Business News Americas.

The Brazilian investment group Vibrapar said it expected to receive environmental permits the first week of December for its $189 million refinery planned for the port city of Suape.

Construction is scheduled to begin in February or March 2004, with initial production of 5,000 b/d expected by yearend 2004. Production is slated to ramp up to 30,000 b/d within a year of start-up, possibly doubling that during the next 5-6 years. Initial production would serve the Pernambuco market.

The refinery may import light crude from West Africa or the Middle East to blend with Brazil's heavy oil in a 60-80% light crude blend.

GEORGIA STRAIT CROSSING PIPELINE LTD., on behalf of GSX Canada LP, received approval from a joint review panel to construct and operate the $139.3 million Canadian portion of the Georgia Strait Crossing Project (GSCP), a new international pipeline that would transport natural gas to northwestern Washington and Vancouver Island.

Pending regulatory approvals for the proposed Vancouver Island Generation Project facility to be located at Duke Point, near Nanaimo, BC, the project will include construction of a 37.2 mile, 16-in. natural gas pipeline from Boundary Pass, east of Saturna Island, BC, to an interconnection with the existing Terasen Gas (Vancouver Island) Inc. pipeline west of Shawniga Lake and south of Duncan on Vancouver Island.

The panel was established under the Canadian Environmental Assessment Act and the National Energy Board Act to conduct a joint review of the pipeline project.

GSCP is sponsored jointly by British Columbia Hydro and Power Authority and Williams Gas Pipeline Co. LLC. The cost of the combined Canadian and US portions of the project is estimated at $322.3 million.

CONOCOPHILLIPS (UK) Ltd. initiated production Nov. 28 from a single well in Watt gas field in the UK southern North Sea. Production had steadily increased over 24 hr to reach a stabilized flow rate of 148 MMscfd, reported partner Tullow Oil UK Ltd.

Watt is the fourth field brought on production as part of the five-field development, collectively known as CMS III, that uses the production and transportation facilities of the Caister Murdoch System (CMS) 115 miles northeast of the Lincolnshire coast (OGJ Online, Dec. 9, 2002). Partners in the CMS III development are operator ConocoPhillips 59.5%, GDF Britain Ltd. 26.4%, and Tullow Oil 14.1%.

Current combined production potential from the first four fields is 360 MMscfd, above the predicted rate of 300 MMscfd.

The final well in the CMS III program, Boulton H1, has now been reentered after its temporary suspension, with anticipated production commencing in first quarter 2004.

ENTERPRISE PRODUCTS PARTNERS LP has expanded by 40% the capacity of the natural gas liquids fractionator at its Norco, La., plant.

The expansion will enable Enterprise to fractionate 20,000-25,000 b/d more NGL and to enhance downstream product distribution capability. The company also is increasing its storage capacity and said it now will have the ability to increase plant capacity by an additional 20% at a nominal cost.

The fractionator has increased capacity to 75,000 b/d of mixed NGL feed, up from 53,000 b/d. As a result of the expansion, Norco's capacity can be further expanded to 90,000 b/d at a nominal cost, it says. Plant throughput has averaged 70,000 b/d to date during November.

TRINIDAD AND TOBAGO is pressing development of natural gas-fired power generation to support industrialization and may subsidize electricity prices paid by a prospective aluminum investor in order to develop a metals industry.

Energy Minister Eric Williams said tenders would be called shortly for construction of a 425 Mw power plant to support a proposed world-scale aluminum smelter. The $250 million power plant would be built in La Brea at a new industrial estate being developed on the island's southwest coast 8 miles north of the Atlantic LNG plant.

Williams said negotiations "with a global entity" for the integrated smelter were at a delicate stage. Energy industry sources point to Venezuela's state-owned Industria Venezolana de Aluminio SA as the likely sponsor.

In August, Prime Minister Patrick Manning told parliament that as part of a deal for a fourth LNG train, BP Trinidad & Tobago LLC would provide the country with 100 MMcfd of free gas that could be used to support the power generation plant during 2003-17, after which a 10% royalty rate would apply.

US DRILLING ACTIVITY increased by 6 rotary rigs to 1,113 units working, Baker Hughes Inc. reported Nov. 26. That's up from 835 active rigs during the same period a year ago.

The increase was divided evenly between land, up by 3 units to 995 working, and offshore, up by 3 units to 100 in the Gulf of Mexico, and 104 in US waters as a whole. Drilling in inland waters was unchanged with 14 rigs working.

Canada's rig count increased by 20 to 434 rigs making hole for the week, up from 329 a year ago.

ODS-Petrodata Consulting & Research, Houston, said that two jack up rigs left the US Gulf of Mexico this week, leaving 162 mobile offshore rigs available for work in those waters. The number of rigs under contract decreased by 1 to 123, slightly increasing the utilization rate to 75.9%.

In European waters, the rig fleet increased by 1 to 96, while the number of contracted rigs rose by 1 to 75, for 78.1% utilization. Worldwide, there was a net increase of 3 mobile offshore rigs under contract to 529, out of a total fleet of 656. That boosted the global utilization rate among mobile offshore rigs to 80.6%.