Master plan urged for Iraq's downstream industries

Iraq needs a master plan for modernization and expansion of its refining and gas processing industries.

Although global attention focuses on Iraqi production and exports of crude oil, the country's processing capability is crucial to the performance of the oil industry and economy. The refining and gas processing infrastructure requires extensive rehabilitation and modernization as it suffered a great deal due to three wars and 13 years of sanctions.

In parallel with the effort to revive production of crude oil, therefore, Iraq needs to increase the productivity of light products in its refineries by increasing conversion capacities and advancing the use of natural gas before building new refineries.

A master plan for the processing industries should:

- Include a critical review of Iraq's energy needs and available sources.

- Resolve problems associated with overproduction of fuel oil and enhance the availability and use of natural gas.

- Emphasize refinery conversion projects rather than construction of new refineries.

Much work needs to be done in the Iraqi refining and gas processing industries.

As Iraq emerges from a difficult period, the industries will provide opportunities for international engineering and licensing companies.

Refining industry

The Iraqi refining industry is old and, by modern standards, unsophisticated. Its product slate doesn't match current or expected Iraqi demand patterns.

Iraq's first refinery was built in 1924: a 10,000 b/d unit at Alwand, close to the border with Iran.

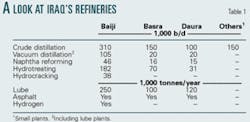

The three main refineries came later: Daura, a partly hydroskimming plant built in 1955; Basra, a hydroskimming plant built in 1972 and doubled in 1979; and Baiji, a hydroskimming and hydrocracking plant built in 1982 (Table 1).

An extensive network of product pipelines links the main refineries. All of the main refineries produce lube oils based on furfural extraction and methyl ethyl ketone dewaxing.

The refineries still add tetraethyl lead to boost gasoline octane.

Iraq has seven other small refineries, comprising multiples of 10,000 b/d distillation units with Merox treaters. They were built in remote locations and often to serve special purposes such as pipelines.

All Iraqi refineries sustained severe damage during the Gulf War of 1991. Plant operators repaired the facilities to the extent possible to restore distillation capacity and other supporting units.

But gasoline octane declined, and sulfur concentrations rose. Environmental and safety systems remain below earlier standards. Storage capacity has declined.

During this year's invasion by the US and its allies, none of Iraq's refineries received direct damage.

The main problems have been looting and pillage and the lack of security. Damage to power plants and transmission lines has hampered refinery operations.

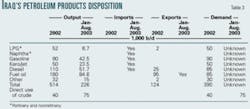

Before the invasion, Iraq was able to meet its product needs and export LPG, diesel, and fuel oil (Tables 2 and 3).

Since restarting, Iraqi refineries have been unable to meet local needs for light products and have resorted to imports for cash or for exchange with surplus fuel oil.

Through October, average capacity utilization was 50-60%.

Unless refineries are upgraded, future production will aggravate the misalignment of refinery output and product demand. In the long term, the Iraqi Oil Ministry hopes to expand capacity to produce crude oil to 6 million b/d and beyond.

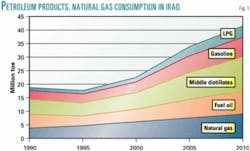

The proportionate increase in gas production will displace more fuel oil. Meanwhile, demand for light oil products will increase rapidly (Fig. 1).

The refining industry, therefore, must expand vertically to raise yields of light products and later horizontally to add crude capacity.

The goals should be to:

- Maintain, rehabilitate, and modernize existing refineries.

- Refine and upgrade product specifications.

- Increase conversion ratios and complexities of existing refineries.

- After upgrading existing refineries, build new refineries with complexities demanded by modern product markets.

Table 4 shows how the Iraqi refining infrastructure is likely to change in accordance with already announced plans.

Further changes may also be expected if the master plan approach is pursued.

Gas processing

Compared with refining, Iraq has a shorter history of gas processing.

The first gas processing units were built during the 1950s to handle associated gas in the northern and southern producing areas and for the limited purpose of oil operations only.

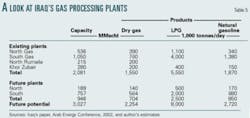

Additions came in 1967, with construction of the 70 MMscfd Kirkuk sulfur recovery plant and 8,000 b/d Taji LPG plant; in 1978, with the 140 MMscfd Zubair gas plant, which was doubled in 1980; in 1983, with the North Gas Plant, two trains of 268 MMscfd each; and in 1988, with the South Gas Plant, 1.05 bscfd and North Rumaila plant, 215 MMscfd.

Iraq's refineries also produce LPG and have been doing so since the 1960s.

Gas processing capacity will have to expand as Iraq increases crude oil production and develops its nonassociated gas fields, only one—Khormor, formerly Al Anfal—produces at present with limited capacity.

Expansion probably will include an additional train at the North Gas Plant and one or two additional trains in the south.

A likely gas strategy will include revival of gas export projects to Turkey and Syria, expansion and integration of the gas network, and increased utilization of gas and LPG to replace other liquid fuels and make them available for export and to improve the environment.

Financial requirements

The financial requirements of this work will, of course, be great.

An estimate presented at the Arab Energy Conference in 1998 and updated in 2002 put investment required through 2010 to rebuild and modernize refineries at $1 billion and to expand and construct new refineries at $2.75 billion.

Development and expansion of products distribution would require $500 million.

In the same projection, $3 billion was seen needed for associated gas projects and $1.7 billion for the gas export project to Turkey.

Other spending in this estimate included $2.4 billion for recovery and maintenance of oil production capacity, $15 billion for expansion of oil production capacity, $11 billion for new power stations, and $2.5 billion for expansion of the petrochemical industry.

Total spending through 2010 in all categories: $39.85 billion.

This estimate may have to be revised upward to alleviate the recent damages and to adapt to the new economic environment created by the war and its aftermath.

Beyond the financial requirements, restoration of Iraq's oil industry awaits resolution of the current predicament and enforcement of the rule of law and democracy.

War and sanctions have cost Iraq much. The United Nations and international community must help Iraq regain independence; revitalize, reform, and modernize its economy; cancel its debts; and allow expansion of its oil industry.

Attempts to force economic models on Iraq, however, particularly in the oil industry, will only cause trouble and repel vitally needed investment.

The author

Saadalla Al-Fathi has worked in various departments of the Ministry of Oil in Iraq. He served as director-general of the Daura refinery in 1976-80 and as president of the Refineries and Gas Plants Administration in 1980-86.

During 1986-94, Al-Fathi worked as head of the Energy Studies Department of the Organization of Petroleum Exporting Countries Secretariat. He was an advisor in the Ministry of Oil during 1994-2002.

Born in Mosul, Iraq, Al-Fathi holds a mechanical engineering degree from Manchester University.