OGJ Newsletter

Market Movement

Markets uncertain of OPEC action

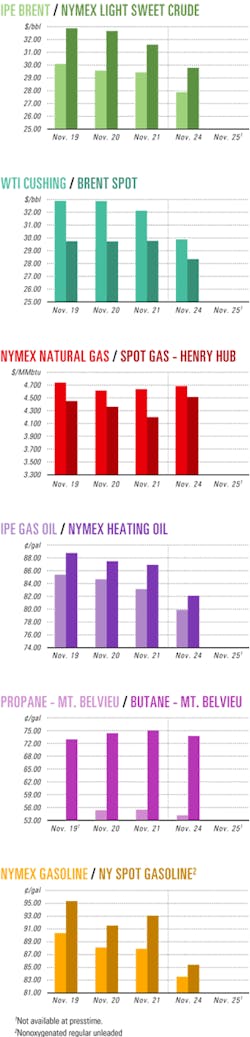

Futures prices for oil and petroleum products plummeted Nov. 24 as Geneva-based Petrologistics estimated that members of the Organization of Petroleum Exporting Countries exceeded their new oil production quotas by a total of 1 million b/d in November.

OPEC members earlier agreed to reduce oil production by 900,000 b/d to a total 24.5 million b/d effective Nov. 1, a move that helped buoy world oil prices in recent weeks.

Market positioned for fall

Meanwhile, the previous runup in benchmark US crude prices on the New York Mercantile Exchange in recent weeks was "tied to massive buying pressure from large noncommercial traders [also known as hedge funds] who built up a net long open interest exposure that has, in fact, now exceeded the levels seen when crude prices trekked towards $40[/bbl] prior to Gulf War II," said Michael Rothman and Steven A. Pfeifer, first vice-presidents at Merrill Lynch Global Securities Research & Economics Group, New York.

In a report issued early Nov. 24, they said, "The funds built a net long [open purchases position] in crude futures and options during the most recent reporting week totaling almost 92 million bbl, which is just shy of the 94 million bbl all-time record high." They also said, "Large commercial [traders, primarily oil companies] used the rally as an opportunity to build a huge short-hedge position, which for the most recent week came in a wee shy of the 90 million bbl mark. The selling activity by commercials hasn't been this intense since the prewar price spike back in February."

That "buying spree" among noncommercial traders pushed up prices "to politically unpalatable levels" and made the oil futures market "highly vulnerable to a very bearish 'paper flow' event, meaning a sharp down move as funds were forced to liquidate long positions," they said. The report of OPEC cheating apparently provided such a trigger.

Based on electronic trading overnight on NYMEX and earlier trade of North Sea Brent crude futures on the International Petroleum Exchange in London, Rothman and Pfeifer concluded that a sell-down would start when NYMEX opened Nov. 24 "in what [would] be an unusually short trading week tied to the US Thanksgiving holiday."

Sure enough, the January contract for benchmark US sweet, light crudes fell by $1.87 to $29.74/bbl on NYMEX on that date, while on the US spot market, West Texas Intermediate at Cushing, Okla., plunged by $2.15/bbl to $29.93/ bbl. In London, the January contract for North Sea Brent oil lost $1.50 to $27.86/bbl on IPE.

OPEC outlook

There has been speculation that OPEC ministers might contemplate an additional production cut when they meet Dec. 4 in Vienna. That meeting was scheduled in September amid some expectations that Iraq's oil exports would rebound to prewar levels by now, "which was also the key reason behind the 900,000 b/d quota cut that was supposed to come into effect Nov. 1," said Rothman and Pfeifer.

"With OPEC crude prices sitting above the top end of the $22-28[/bbl target] range, inventories remaining well below normal [among member countries of] the Organization for Economic Cooperation and Development, and Iraq's exports evidently capped at the 1.2-1.3 million b/d capacity limit of [the Mina] Al-Bakr [export terminal on] the Persian Gulf, the argument could actually be made that the cartel needs to reverse September's cut," they said.

But such a rollback "seems unlikely owing, we sense, to uneasiness among member nations that demand is vulnerable to the downside, if winter weather proves milder than normal in the northern hemisphere," they said. "This cautiousness has become the hallmark of most OPEC decisions these past 4 years, in our estimation, which is quite a departure from the prevalent attitude we witnessed in attending the previous 14 years of OPEC meetings."

The Merrill Lynch analysts said, "To some extent, the cartel's recent historical proclivity to err on the side of undersupplying the market, as seen in inventory data where oil storage in the OECD nations—our proxy for the global figure—has been at lower than normal levels in 34 of the 47 months since November 1999.

"While the cartel's output may actually be on the upswing currently to help prevent too tight an oil balance and too high a price," they said, "it seems that the formal decision from OPEC may be little more than [to] roll over the existing agreement."

OECD inventories

"At the end of the third quarter, OECD commercial stocks were 2.59 billion bbl, which was 60 million bbl, or roughly 2.2%, below normal. So when the head of the [Paris-based] International Energy Agency recently warned that a cold winter could strain available stocks, he would appear to have had a reasonable basis for doing so," said Stephen A. Smith, founder and president of Stephen Smith Energy Associates, Natchez, Miss., in a Nov. 25 report.

Moreover, he said, "Several OPEC ministers have also voiced concern that the 'call on the OPEC-10' [minus war-torn Iraq] is about to be severely squeezed when spring weather returns."

Nonetheless, Smith said, "We find OPEC's concern about spring gluts the more plausible of these two suggested possible outcomes. Despite the currently snug OECD storage situation, the supply situation is changing very rapidly, and this, combined with some help from seasonal demand effects, creates the potential for a quick shift from inventory shortage to inventory excess."

Smith claimed, "The pace of production ramp-up in postwar Iraq has been and will continue to be the central focus of OPEC as well as oil traders and consumers for the year ahead." The increase in Iraq's oil production to 1.61 million b/d in October from 660,000 b/d in July "has been significant."

"This changed the forward balance substantially and OPEC's attitude as well," Smith said. "We believe that deeper OPEC-10 production cuts will be needed by yearend."

Smith claimed OECD inventory deficits have "moved steadily closer to seasonal norms in recent quarters" as more Iraqi oil has flowed into world markets. Yet, he noted, "Fourth quarter oil prices have been stronger than most observers expected at the start of the quarter. We attribute this recent price strength to three factors:

"More confidence that oil demand will grow in 2004.

"More confidence that the OPEC-10 are aware of and ready to respond to likely Iraqi production gains in a timely manner.

"Concern that the recent acceleration of terrorist attacks might be expanding to disrupt the flow of oil in Iraq or elsewhere or potentially destabilize key Middle East regimes, such as Saudi Arabia, when the US is already fully occupied with restabilizing Iraq. There is little room for error in the current situation."

Overall, Smith expects oil prices to be "somewhat weaker" at $27-29/bbl for benchmark US light, sweet crudes in 2004, down from the "likely" average price of nearly $31/bbl in 2003.

Industry Scoreboard

null

null

Industry Trends

The Canadian Association of Petroleum Producers' yearly estimate of crude oil and natural gas reserves revealed that Canadian oil sands reserves rose substantially in 2002. "(Canadian) companies replaced 162% of their production to push remaining oil sands reserves to 6.9 billion bbl," CAPP reported.

Oil sands production reached 268 million bbl in Canada in 2002 compared with reserve additions of 434 million bbl last year, CAPP said.

"The ongoing development of Canada's oil sands plays an important role in the industry. Oil sands accounted for just over half of the gross additions to Canada's crude oil and equivalent reserves in 2002," said John Dielwart, CAPP chairman. "Of the $24.7 billion our industry invested in Canada in 2002, $6.7 billion was invested in oil sands projects," he said.

Conventional Canadian crude reserves additions, meanwhile, totaled only 370 million bbl in 2002, compared with 535 million bbl of crude produced a year earlier, resulting in a conventional crude replacement rate of 69%. "Overall, gross additions of crude oil and equivalent in Canada replaced 95% of oil sands, conventional crude oil, and pentanes production in 2002," CAPP reported.

Among conventional resources, activity continued to migrate toward drilling for natural gas, CAPP noted. "Gas targets accounted for 68% of successful wells in 2002 with the focus primarily on shallow gas pools. New reserve additions of 5.3 tcf could not offset production of 6.4 tcf—resulting in a replacement rate of 84%," CAPP said.

New Zealand is finding itself having to cope with an ever-tightening natural gas market in a scenario reminiscent of that currently facing North America, according to a recently released study.

Calgary-based Tag Oil Ltd. reported the release of the in-depth study, New Zealand Gas—Meeting the Challenge, which "examines the impacts of the country's escalating gas demands and its effects on the oil and gas exploration industry."

"New Zealand is facing an energy predicament similar in many respects to that faced in North America: rising prices, dwindling supplies, and increased consumption," said Tag Oil Pres. Drew Cadenhead.

"The Maui field is the principal source of New Zealand's natural gas and, like many of America's gas fields, it was discovered over 30 years ago and is now nearing depletion." Based on the report, independent US engineering group Netherland Sewell & Associates confirmed that giant Maui field, which had been supplying 80% of the New Zealand's oil and gas needs, is rapidly depleting.

"With demand vastly outpacing supply, gas prices have jumped over 300%. It is an environment that lends itself well for junior explorers with good prospects," Cadenhead said.

"The depletion of Maui comes at an inopportune time for New Zealand energy consumers but at a perfect time for explorers. Energy demand is forecasted to rise by 18% between now and 2025, and the economy will falter if new gas supplies are not found." Cadenhead concluded.

Government Developments

US House Energy and Commerce Committee Chairman Billy Tauzin (R-La.) late Nov. 25 said he still is confident that comprehensive energy legislation could pass the US Senate in January.

Senate Republican leaders pulled the bill Nov. 24 when they were two votes short of cutting off debate (see related story, p. 27). Opponents of the measure threatened to talk the bill to death unless House Republicans revised the legislation. A House plan to offer product liability protection for the fuel additive methyl tertiary butyl ether helped derail support. The measure's projected $31 billion cost to the US Department of the Treasury also became controversial and hard for the White House to justify, given that it was three times the amount President George W. Bush had said he wanted when he called on Congress to codify a national energy strategy in spring 2001.

Yet despite these differences, Tauzin said the political will may still exist to pass such a bill in order to reduce dependence on foreign oil and provide jobs. "With energy prices rising and America's dangerous dependence on foreign oil growing, the need to enact a comprehensive national energy bill is crystal clear to everyone except for a handful of disgruntled senators," he said. "Single-handedly, they are holding up action on a much-needed bill, which will provide jobs to nearly 1 million Americans and make our nation's energy supplies more stable and affordable in the future.

"The president supports our bill along with the majority of members of both the House and Senate. Clearly, the time has come to stop playing politics and start putting people back to work again."

Both the House and Senate are expected back briefly the week of Dec. 8 to finish work on a catch-all spending bill. But energy legislation talks are not expected to resume until January, congressional leadership sources said.

Nigeria President Olusegun Obasanjo is optimistic that his country will be able to renegotiate its pro rata production quota with the Organization of Petroleum Exporting Countries.

Speaking last month at Rice University's Baker Institute for Public Policy, Obasanjo said, "Technically, the quota made to us is unacceptable. We have made this case, and the case remains to be acted upon," he said.

Nigeria has a current quota of 2 million b/d (OGJ, Oct. 6, 2003, p. 5). Meanwhile, the new group managing director of the Nigerian National Petroleum Corp. (NNPC) has said Nigeria's capacity for increased production is higher than other OPEC members.

NNPC Managing Director Funsho Kupolokun told reporters in Lagos that Nigeria expects to raise production capacity to 4.1 million b/d by 2006. Initially, the target date for that much capacity was 2010.

Formerly the presidential adviser on petroleum, Kupolokun assumed his NNPC title last month, succeeding Jackson Gaius-Obaseki.

During his Houston visit, Obasanjo also said that fighting corruption is his administration's first priority (see Watching Government, p. 26).

"It is no longer business as usual," he said, adding that Nigeria is working to open its oil and natural gas sector "to the highest level of international scrutiny."

Quick Takes

CONOCOPHILLIPS and partners in the Cuu Long Joint Operating Co. (CLJOC) said they successfully completed the 15-1-ST-1X exploratory well on the Sutu Trang (White Lion) prospect off Viet Nam just as production is beginning in nearby Sutu Den (Black Lion) field (see Production).

Both lie in southeastern Block 15-1 in the shallow-water Cuu Long basin off eastern Viet Nam. Sutu Trang is 135 km east of Ho Chi Minh City and 26 km south of Sutu Den field. CLJOC has conducted a 3D seismic survey over 400 sq km of the Sutu Trang area.

The ST-1X well, in 56 m of water, was drilled to 4,428 m TD, encountering significant pay in multiple Tertiary zones, ConocoPhillips reported. Three zones tested at a combined rate of 8,682 b/d of 38-55° gravity oil and 69.6 MMcfd of natural gas. Technical assessment of reservoir potential is under way.

Partners in CLJOC are ConocoPhillips 23.25%, PetroVietnam Exploration & Production 50%, Korean National Oil Corp. 14.25%, South Korea's SK Corp. 9%, and France's Geopetrol 3.5%.

In other exploration news, BP PLC unit BP Exploration (Angola) Ltd. and Angola's state oil company Sonangol reported an oil find, Marte, on ultradeepwater Block 31 175 km off Angola, reinforcing the commercial viability of fields on that block. The discovery follows earlier Plutão and Saturno finds about 20-25 km southeast of Marte (OGJ Online, July 28, 2003). Marte's proximity to Plutão and Saturno may make joint development likely, but development options still are being evaluated, BP said. The Marte-1 well was drilled in 1,978 m of water and reached 4,193 m TD. It flowed as much as 5,200 b/d on test. BP said it plans to drill one more exploration well—Vénus-1—in this area by yearend. The block covers 5,349 sq km in water 1,500-2,500 m deep. Unocal Corp. reported a natural gas discovery at its Happy Valley prospect about 7 miles southeast of Ninilchik on Alaska's Kenai Peninsula. The discovery well found 110 ft of gas pay and was followed by a successful appraisal well, the independent said. Unocal, which holds 100% working interest, said it will likely drill three development wells there next year. Average production from the field is expected to be 20-25 MMcfd during 2005, with first production expected in fourth quarter 2004. Happy Valley field is estimated to hold 75-100 bcf of recoverable gas. This discovery, the second for Unocal on the southern Kenai Peninsula, follows another find made with Marathon Oil Co. in the Ninilchik Unit in 2000, which is currently on production. Remington Oil & Gas Corp. made two natural gas discoveries on separate blocks in the Gulf of Mexico. On West Cameron Block 403, Remington drilled the No. 1 well to 7,750 ft TD and encountered 106 ft of natural gas productive sands. The well flowed on test at more than 16 MMcfed of natural gas equivalent. Remington is installing a caisson production structure and expects production in first quarter 2004.

Remington owns a 60% working interest in the field, and partner Magnum Hunter ResoucesInc., Irving, Tex., holds 40%. Remington also experienced positive test results at Vermillion Block 61, where casing has been set after an exploration well, drilled to 10,160 ft, found 60 gross ft of productive sands. The field is estimated to hold 11 bcfe. The rig that drilled the Vermillion Block 61 find now will spud an East Cameron Block 73 development well from the same surface location. Both wells will be completed after the second well is drilled. Initial production from Vermillion 61 and East Cameron 73 is expected in early 2004. CNOOC Ltd. and Philippine National Oil Co.'s unit PNOC Exploration Corp. have agreed to commence a joint oil and natural gas exploration and development program in the South China Sea. The firms said they would "review, assess, and evaluate available relevant geological, geophysical, and other technical data and information to determine the oil and gas potential of the area," the companies said.

CLJOC (see Exploration) commenced production Oct. 29 from Sutu Den field off Viet Nam (see map). It is producing 60,000 b/d of 36° gravity oil from basement in seven wells in the Phase I area.

Oil is processed and stored in the new Cuulong MV 9 floating production, storage, and offloading vessel. The FPSO, which has a storage capacity of 1 million bbl, initially can process 65,000 b/d of oil and is expandable.

Lower Miocene production will be added in coming years, ConocoPhillips said. CLJOC plans to drill additional development and appraisal wells in both Sutu Den and nearby Sutu Vang (Golden Lion) fields in 2004.

In other production news, Magnum Hunter Resources Inc., operator of South Timbalier 264B platform in the Gulf of Mexico, reported that initial production has begun from two wells in the field.

The wells were flow tested at a combined 9 MMcfd of natural gas and 300 b/d of condensate.

TALISMAN ENERGY INC., Calgary, has completed its $63 million Erith natural gas pipeline, enabling the company to set a new Alberta Foothills gas production record of 153 MMcfd, up from 125 MMcfd in September.

The 69 km, 10-in. pipeline connects Talisman properties in the Alberta Foothills region to its Edson gas processing plant and adds an additional 75 MMcfd of raw gas transportation and processing capacity for area producers.

The project included addition of a 75 MMcfd dehydration facility, flow splitter, and enhanced sulfur recovery unit at the Edson plant.

Talisman said a large portion of its 2004 drilling activity in the Alberta Foothills will be focused in the Chungo-Bighorn area, which is expected to keep the Erith infrastructure at full capacity.

Also expanding its system, Duke Energy Gas Transmission, Houston-based unit of Duke Energy Corp., Charlotte, NC, has placed into service its 95-mile, 24-in. Patriot pipeline extension in southwestern Virginia and northern North Carolina. The line expands the company's existing 1,129-mile East Tennessee Natural Gas Pipeline System in Tennessee and Virginia and transports 365 MMcfd of natural gas to Virginia and the southeastern US. It can be expanded to serve expected future market growth in the Southeast and eastern Mid-Atlantic states, which is projected at 2.3%/year through 2010 (OGJ Online, Nov. 22, 2002).

US DRILLING ACTIVITY continued to decline the week ended Nov. 21, down by 4 working rotary rigs to 1,107, officials at Baker Hughes Inc. reported. That's up from 826 at this time last year.

The bulk of the decline was in offshore operations, down by 8 rigs to 97 in the Gulf of Mexico and 101 in the US offshore as a whole. Drilling in inland waters decreased by 1 rig, with 14 still working. Those losses were partially offset by an increase of 5 land rigs, with 992 units making hole.

Although Baker Hughes reported a decline in the number of offshore rigs actually drilling that week, ODS-Petrodata Consulting & Research, Houston, said the number of mobile offshore rigs under contract in the US sector of the gulf increased by 2 to 124, while the available fleet decreased by 1 to 164. That boosted the rig utilization rate to 75.6% in those waters.

Drilling activity in Canada dropped by 9 units to 414 active rigs this week, up from 287 a year ago.

In European waters, the number of contracted rigs dipped by 1 to 74, out of an available fleet of 95, dropping utilization to 77.9%. Worldwide, the number of mobile offshore rigs under contract decreased by 1 to 525 out of a total fleet of 656, for a utilization rate of 80% that week.

PETROLEOS MEXICANOS (Pemex) selected a consortium led by Brazil's Petróleo Brasileiro SA (Petrobras) to develop the 371 sq km Fronterizo block in northeastern Mexico under a $265 million Multiple Service Contract (MSC). The 15 year contract includes the drilling of 100 wells, infrastructure installation, and maintenance on the block in Nuevo Leon state.

The contract is the fourth of seven to be awarded in a controversial MSC program in which Mexico seeks to have operators other than Pemex develop nonassociated natural gas in the Burgos basin of northern Mexico, freeing Pemex resources for oil exploration (OGJ Online, June 10, 2003). Pemex intends to increase natural gas production in the Burgos basin to 2 bcfd from 1 bcfd.

The Petrobras-led group, which includes Teikoku Oil Co. Ltd. of Japan and Diavaz Group subsidiary D&S Petroleum of Mexico, also won a $650 million contract Oct. 23 to develop the Cuervito block, also in Nuevo Leon (OGJ Online, Oct. 22, 2003).

Deadline for submissions of technical and economic proposals for the seventh block, Olmos, has been postponed until Jan. 14 to give bidding companies more time to assemble necessary data, Pemex said. Work on that development currently is slated to begin in late February. Unbid Blocks 4 and 5 will be reassessed and bid in 2004.

A CONTRACT IS EXPECTED within the next few weeks for front-end engineering and design work on the Edison Gas North Adriatic LNG terminal to be constructed in the northern Adriatic Sea off Rovigo in northern Italy (OGJ, Sept. 6, 1999, p. 21).

The project will provide northern Italy with natural gas from Qatar's giant North field.

The terminal will be designed to regasify more than 4 billion cu m/year of LNG.

Exxon Mobil Corp. and Qatar Petroleum Co. announced Nov. 20 that they each had acquired a 45% equity interest in the terminal project, while former owner Edison Gas SPA of Italy will retain the remaining 10%.

In addition, supplier Ras Laffan Liquefied Natural Gas Co. Ltd. II in Qatar and Edison Gas signed amended sale and purchase agreements to increase LNG supplies to 4.7 million tonnes/year of LNG, for 25 years commencing in 2007, from the initially agreed level of 3.5 million tonnes/year.

By comparison, Italy imported a total of 2.56 million tonnes of LNG via other facilities in 2002.

In other LNG activity, Atlantic LNG partners are considering the construction of a fifth and possibly a sixth LNG train in Trinidad and Tobago, although construction began less than 3 months ago on the 800 MMcfd fourth train. Major partners are BP PLC unit BP Trinidad & Tobago LLC and wholly owned subsidiaries of BG Group PLC and Repsol-YPF SA. The partners must yet convince the government, which reportedly believes that with the construction of Train 4 it will have enough ethane in the system to justify developing an ethylene plant and it might not need to further expand its LNG industry.

CANADA'S LARGEST REFINER Imperial Oil Resources Ltd., Edmonton, this month is completing a $600 million (Can.) program of reducing sulfur in gasoline content across Canada by more than 90%.

The company said all its operations would be producing fuel averaging less than 30 ppm of sulfur by this month, more than a year ahead of the deadline set by Environment Canada.

In a $140 million (Can.) project wrapping up the program, Imperial completed installation of a sulfur unit at its Strathcona, Alta., refinery late last month, following like facilities installed at its other refineries at Dartmouth, NS, Nanticoke, Ont., and Sarnia, Ont. (OGJ Online, Sept. 8, 2003).