OG Newsletter

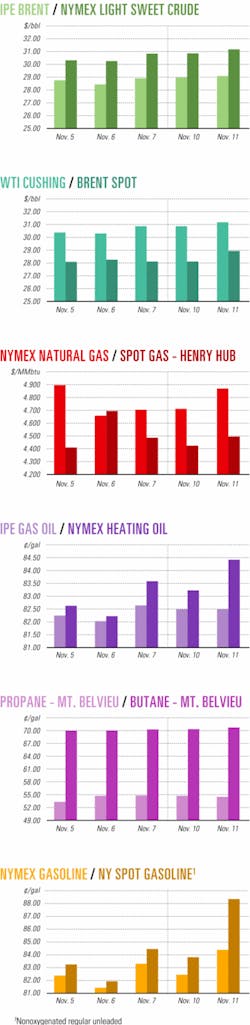

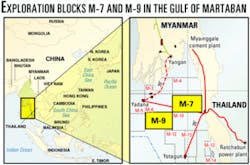

Market Movement

Cold weather, terrorism spike prices

Colder weather that increased energy demand in the northeastern US and terrorist attacks that threatened oil supplies from the Middle East combined to push up prices for crude and petroleum products Nov. 10-12.

The threat of more terrorist attacks apparently has become a major concern among traders.

At a maritime defense convention in Singapore last week, Singapore Defense Minister Teo Chee Hean warned of the possible threat of maritime terrorism, particularly for vessels moving energy products. His warning came just days after an oil tanker and an LPG carrier were boarded by armed pirates in nearby Indonesian waters.

"For terrorists, the payoff from a successful maritime attack could be considerable," Dow Jones quoted him as saying. "The damage could be horrific if terrorists turned supertankers, LPG, LNG, or chemical carriers into floating bombs."

World oil demand increasing

Meanwhile, with indicators pointing to acceleration of global economic growth, Paris-based International Energy Agency increased its forecasts of world oil demand by 180,000 b/d to 78.6 million b/d in 2003 and by 200,000 b/d to 79.6 million b/d in 2004.

The US gross domestic product surged by 7.2% during the third quarter of this year—"the strongest annualized quarterly rate of growth since the mid-1980s," said IEA officials in a Nov. 13 report. "The Japanese and European economies are expanding faster than originally expected, and Chinese GDP growth keeps roaring along at a blistering pace. While uncertainties may yet constrain the future rate of economic growth," they said, "current trends are positive for the global economy."

EIA is projecting global oil demand will grow "at a healthy 1.7% in 2003, falling back to 1.4% in 2004" with the loss of "one-time factors such as high natural gas prices, nuclear issues, colder-than-normal weather, etc., that supported oil demand in 2003."

That growth trend is "partly offset by lackluster regional developments," however. Oil demand growth among member countries of the Organization for Economic Cooperation and Development "remains decidedly anemic, despite the recent surge in US economic growth and the nascent recovery in Europe and the Pacific," IEA officials said. They project total OECD oil demand will grow by 617,000 b/d in 2003 and 247,000 b/d in 2004.

The projected 2003 growth is up from a 77,000 b/d decrease in 2002 but falls short of the previous 5-year average growth rate, IEA officials reported. "In spite of the surge in economic activity, 2004 oil demand growth reflects a shallower industrial recovery and an extrapolation of recent growth patterns," they said.

IEA is expecting a robust economy to trigger a surge in Chinese demand for oil in 2003-04. "The Chinese economy will need to expand at a torrid pace to create new jobs to be able to absorb displaced workers from inefficient and defunct state enterprises and to position itself for full entry [into the World Trade Organization]," it said.

"Questions abound as to the sustainability of China's GDP growth, the impact of this growth on the environment and social fabric, and whether these growth factors are contributing to a bubble economy," IEA officials acknowledged. Nevertheless, they said, "Our most recent forecast suggests that Chinese oil demand is set to grow by 443,000 b/d, or 9%, in 2003, followed by growth of 306,000 b/d, or 6%, in 2004."

At those rates, Chinese oil demand is expected to eclipse Japanese oil demand in the second half of 2003 and will represent the equivalent of 67% of OECD Pacific oil demand in 2004. "This underpins a clear disconnect in regional oil demand developments," IEA reported. "At this juncture, China is the engine of global oil demand growth, with significant room for further expansion in the industrial and transportation sectors."

Low gasoline prices

Adjusted for inflation, retail prices for gasoline in the US are at the lowest level in 85 years, said the American Petroleum Institute in a letter to Congress. API noted the seasonal falloff in gasoline demand in autumn, reducing the August peak in prices that was fueled by strong demand, low inventories, pipeline disruptions, and an electrical blackout over a large portion of the US.

Moreover, oil prices—the single largest component in gasoline costs—are now down to $29/bbl from $32/bbl in September, API said.

It claimed fuel inventories had increased in recent weeks to near-normal levels for this time of year. Yet API said gasoline stocks remain about 5 million bbl below average levels. It earlier reported US distillate stocks were at 129 million bbl, down by 1 million bbl below the average for this period. In the northeastern US, the world's biggest heating oil market, distillate stocks are 2 million bbl below average.

US oil stocks decline

US commercial crude oil inventories declined by 800,000 bbl to 291.1 million bbl during the week ended Nov. 7, the US Energy Information Administration reported Nov. 13. That put US oil stocks 12.4 million bbl below the 5-year average for the period.

US distillate fuel stocks fell by 1.5 million bbl to 131.2 million bbl in the same period, 500,000 bbl below the 5-year average, EIA said. Almost all of the distillate decrease was in diesel fuel.

EIA reported US gasoline inventories increased by 1 million bbl to 192.3 million bbl during the week, yet were 8.4 million bbl below the 5-year average.

US gasoline demand over 4 weeks through Nov. 7 averaged more than 9.1 million b/d, or 3.4% above the same period last year. Distillate fuel demand during the same period was down by 0.8%, while kerosine-type jet fuel demand was down 1%.

Crude inputs into US refineries averaged more than 15.1 million b/d during the week ended Nov. 7, down by 395,000 b/d from the previous week, EIA said. Declines were seen in all regions, reversing a 4-week period of input increases. "The drop this week appears to be mostly from some refineries that did not perform maintenance last month," EIA said.

US crude imports averaged more than 9.9 million b/d during the week, down by 228,000 b/d from the previous week. US oil imports also averaged over 9.9 million b/d through the 4 weeks ended Nov. 7, which was 391,000 b/d more than average imports over the same period in 2002, EIA reported. "It appears that crude oil imports from Venezuela were particularly high last week," it said.

US natural gas

There was 32 bcf of natural gas injected into US underground storage during the week ended Nov. 7, increasing total storage to nearly 3.198 tcf, said EIA in a separate Nov. 13 report. US natural gas stocks now exceed the year-ago level by 90 bcf and are 121 bcf above the 5-year average for this time of year.

Consultant C. H. Guernsey & Co., Oklahoma City, earlier said it expects the first storage drawdown, at 28 bcf, during the week ended Nov. 14.

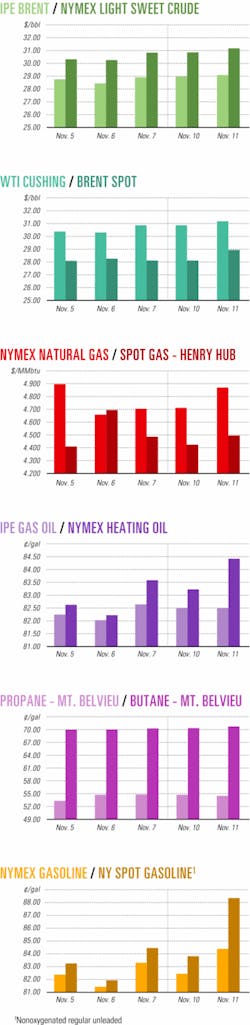

Industry Scoreboard

null

null

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Industry Trends

THE GULF OF MEXICO'S Outer Continental Shelf producing fields' operating costs are increasing while shallow-water shelf production continues to decline.

This trend adds urgency to shelf operators' efforts to manage operating costs, concludes Ziff Energy Group, an energy consultant based in Houston and Calgary.

A recently released "Shelf Reducing Operating Costs" study for 2002 features analysis on a field-by-field basis.

Overall on a volumetric-weighted basis comparing 2002 with 1999, natural gas field unit operating costs increased to 29¢/Mcf from 25¢/Mcf. Oil fields' costs increased 40%, jumping to $2.30/boe from $1.65/boe. Study participants included majors and independents. Participating operators provided operating expenses and technical data on more than 220 operated fields encompassing 1 million boe. The fields' combined annual operating costs were more than $760 million.

The report covered various asset types throughout the Gulf of Mexico, ranging from very shallow to deep shelf assets. Assets also ranged from relatively young in their producing cycle to very mature. Costs were broken out as 10 standard categories. During 1999 through 2002, the surface repairs and maintenance category saw the biggest increase, a 53% hike.

CHINA'S ACCELERATING ECONOMY is contributing to robust energy demand there.

This growing market will benefit an increasing number of global and regional oil companies, said Charles Chang, associate director in Hong Kong for the Chicago-based Fitch Ratings Ltd.

His comments came in an article written for his firm's recent Oil & Gas Insights publication.

Before the 1998 Asian financial crisis, energy growth was balanced among China, southeastern Asia, and eastern Asia. Now, China is the principal growth engine behind the region's oil demand because other Asian countries have switched to natural gas, Chang said. "Asia's energy growth is neither a recent phenomenon nor a cyclical event. It is, rather, a sustained trend that had lasted for over a decade," he said.

The International Energy Agency estimates that China's third-quarter oil demand was 5.42 million b/d, accounting for 25% of oil demand in the Asia Pacific region (35.7% in nonJapan Asia), and 7% of the world's total.

The fundamental growth drivers behind oil remain China's burgeoning demand for electric power and its automobile market, Fitch said. This is expected to accelerate downstream needs and drive upstream acquisitions by China Petrochemical Corp., PetroChina Co. Ltd., and CNOOC Ltd., a unit of China National Offshore Oil Corp.

METHANOL PRICES are starting to soften, and the future bodes better for methanol consumers than for methanol producers, Houston-based Chemical Market Associates Inc. (CMAI) said in its 2003 World Methanol Cost Study. Prices are expected to continue downward while new methanol production capacity is added during the next several years, CMAI said. At least 12 million tonnes/year of new capacity is expected, beginning in 2004 and resulting in "a significant amount of overcapacity" by 2007, CMAI said. Three new methanol plants are scheduled for South America, and four plants are scheduled in the Middle East.

Government Developments

Tax issues again stalled negotiations last week over an omnibus energy bill, with no conference report made available for lawmakers to review.

Senate Republicans and White House officials still predicted legislation would pass this year, but Senate Democratic leaders were less sanguine: Senate Minority Leader Tom Daschle (D-SD) told reporters Nov. 11 the chances of a measure passing by yearend were "far less than 50-50."

Many Democrats have suggested they might consider a filibuster if the bill contains provisions they don't like, most notably a House plan to give limited liability production for the fuel additive methyl tertiary butyl ether. Most other oil and gas provisions in the sweeping 1,700-page document are largely resolved. Provisions exclude a controversial House item allowing the Department of the Interior to lease a limited area of the Arctic National Wildlife Refuge and include a modified loan guarantee for an Alaskan gas pipeline to the Lower 48 that would provide government backing for the Alaska portion of the project.

Republicans, meanwhile, are still arguing over at least three pending provisions, namely a royalty provision designed to direct more money to coastal states, a $220 million "biodiversity pond" in southern Iowa, and a nuclear power tax credit.

THE US SENATE confirmed by unanimous consent the appointments of Joseph Kelliher and Suedeen Kelly to the five-member US Federal Energy Regulatory Commission.

FERC is an independent agency that oversees wholesale electricity markets and approves rates for interstate oil and gas pipelines. In the aftermath of the Enron Corp. scandal, the agency is playing a larger role in monitoring electricity and natural gas trading. The panel has operated with three members since summer—Chairman Pat Wood and Commissioner Nora Brownell, both Republicans, and William Massey, a Democrat.

Commissioner Massey's term expired in June but temporarily was extended to preserve a quorum. The White House is expected to renominate Massey to serve a term that ends June 2008.

The two nominations were relatively uncontroversial, but the appointments stalled over political squabbling related to Enron misdeeds and the California power crisis.

Kelliher, a Republican, is a former congressional aide and currently a senior policy adviser to Sec. Spencer Abraham. His term runs through June 2007.

Kelly, a Democrat, is the former New Mexico Public Service Commission chair and currently a University of New Mexico law professor. She assumed the remainder of a term that expires next summer.

Trade associations praised the appointments.

"It is a crucial time for the nation in terms of energy policy, and we will need all hands on deck to ensure efficient regulation where necessary and, where possible, balanced, market-based solutions to the supply and demand challenges ahead," said Skip Horvath, president of the Natural Gas Supply Association.

Don Santa, president of the Interstate Natural Gas Association of America, said his group "is thrilled that the two nominees were approved by the Senate, and we look forward to working with them at the commission."

Quick Takes

AN OAO GAZPROM-LED CONSORTIUM plans to rehabilitate and upgrade the 20-30 year old Central Asia-Center (CAC) natural gas pipeline system from Turkmenistan to Russia and Ukraine.

The Russian company Zaburzhneftgazstroi and the Ukrainian company Frunze Alliance are partners. The 10-year program will cost an estimated $1.3 billion, with $500 million to be spent before 2005.

The group also is assessing the feasibility of building a new, $1.2 billion pipeline along the Caspian Sea coast through Kazakhstan to provide additional gas export capacity. Kazakhstan would be a partner in that pipeline.

CAC has numerous pipelines feeding into two main export trunklines, one through western Kazakhstan and a larger mainline through Uzbekistan.

Although CAC's design capacity is 90 billion cu m(bcm)/year, it currently transports only 45 bcm/year because of its dilapidated condition.

Russia will purchase 60-80 billion cu m/year of gas from Turkmenistan during 2004-28, and Ukraine is negotiating for at least 45 bcm/year during 2007-32. However, Uzbekistan recently said it plans to export its own natural gas through its system and would make available to Turkmenistan only about 20 bcm/year of capacity, hence the plans for the new pipeline and remediation and upgrade of the Kazakhstan branch.

A division of Netherlands-based Bateman BV will prepare a detailed feasibility study for the rehabilitation-upgrade of the 823 km Kazakhstan mainline, five spurs totaling about 5,000 km of pipe, more than 170 turbocompressor units, and three gas metering stations.

Bateman will assess pipeline and compressor station conditions, establish a rehabilitation and modernization plan, and increase capacity to 100 bcm/year without interrupting gas flow. It also will provide a cost estimate and financing plan.

PETROLEOS DE VENEZUELA SA (PDVSA) launched a public tender Nov. 3 for local companies to secure seven contracts for upcoming major and routine maintenance of the state oil firm's two linked refineries at the Paraguana Refining Complex (CRP) in northwestern Venezuela, OPEC News Agency reported.

Contract work includes deep and medium conversion at the Cardón refinery at CRP, medium conversion at the Amuay refinery on its distillation and lubricants units, and auxiliary supplies and general repairs. The tender will be concluded Dec. 2.

In other refining news, Motiva Enterprises LLC has awarded a $40 million maintenance contract to Baton Rouge-based engineering firm Jacobs Engineering Group Inc. for Motiva's upcoming fluid catalytic cracking (FCC) unit turnaround at its Convent, La., refinery in 2006. Jacobs will provide engineering, design, and procurement services for new facilities to meet its required emission standards. The 235,000 b/d refinery currently has 85,000 b/d of FCC capacity. Turkmenistan is planning a major upgrade of its Seyidi refinery, according to a report Nov. 11 in Central Asia News. A $300 million upgrade to a total capacity of 120,000 b/d of oil is planned along with an $800 million gas processing and petrochemical production complex at Seyidi. A $1.2 billion modernization of the Turkmenbashi refinery 2 years ago has enabled the country to produce high-octane gasoline. After the Seyidi refinery's renovations, the two facilities together will be capable of processing 300,000 b/d of oil by 2010 (OGJ, Oct. 7, 2002, p. 20).

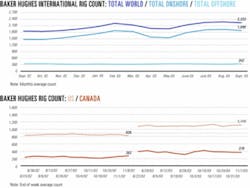

IN THAILAND, PTT Exploration & Production PLC (PTTEP) was awarded a production-sharing contract (PSC) to explore Blocks M-7 and M-9 in Myanmar's Gulf of Martaban, 200-300 km south of Yangon.

PTTEP Pres. Maroot Mrigadat said the blocks, in which PTTEP has 100% interest, have a high petroleum potential comparable with Yadana, the country's largest producing offshore gas field, on Blocks M-5 and M-6. Yadana has certified reserves of 5.7 tcf of natural gas and is now producing 650 MMcfd.

PTTEP must spend $16 million over the first 4 years of the PSC term for geological and geophysical studies, seismic surveys, and the drilling of two exploration wells on the two tracts, which cover a total of 27,000 sq km.

In other exploration activities, Algeria's state oil firm Sonatrach, Anadarko Petroleum Corp., and partners Nov. 12 reported another oil find on Block 404 in Algeria's prolific Berkine basin. The BKNE-AAC-A well was drilled to 11,200 ft TD and found 36 ft of net oil pay in the Upper TAGI formation. The well, which lies in the Berkine North East field exploitation license area, flowed 3,400 b/d of 40° gravity oil on test through a 40/64-in. choke with a wellhead pressure of 620 psia. Test options currently are being evaluated, the partners said. The discovery follows earlier successes on Block 404 with Hassi Berkine North East (HBNE-1), Sif Fatima South West (SFSW-1), and most recently, Sif Fatima South West appraisal well (SFSW-2) (OGJ Online, Apr. 2, 2003). Partners are Maersk Olie Algeriet AS—a unit of Denmark's Mærsk Olie & Gas AS—and ENI SPA unit ENI Oil (Algeria) Ltd. The company plans to drill two more exploratory wells on Block 404 by yearend. Unocal Corp., operator of West Cameron Block 44 in the Gulf of Mexico, has drilled a successful appraisal well on its deep shelf Harvest natural gas field on the block, confirming its commerciality.

Unocal said it drilled Harvest-2 to 14,322 ft TD and encountered more than 140 ft of net gas pay, including 110 ft of continuous pay in one high-quality interval. The well lies about a half mile from the Harvest-1 discovery well, which currently is producing 35 MMcfd of natural gas (OGJ Online, Apr. 8, 2003). Harvest–1, in 35 ft of water, is being developed with a mobile offshore production unit—a converted jack up that enables the company to start production quickly. Unocal expects to begin production from Harvest-2 in mid-December at a rate likely to be higher than that of Harvest-1. A flowline from Harvest-2 likely will be laid to the production unit at Harvest-1. Unocal will drill a second appraisal well on West Cameron Block 44 in 2004 and is evaluating follow-up drilling opportunities on nearby West Cameron Blocks 2 nd 57.

BRASS LNG LTD. JV, a consortium of Nigerian National Petroleum Corp., ChevronTexaco Corp., ConocoPhillips subsidiary Phillips Oil Co. (Nigeria) Ltd., and Italy's ENI SPA, plans to construct an LNG liquefaction plant in Nigeria's central Niger Delta. The group will build the facility offshore near the Brass terminal operated by Nigerian Agip Oil Co. in water sufficiently deep to accommodate large LNG carriers.

Following completion of earlier studies, Brass LNG signed a heads of agreement to conduct front-end engineering and design (FEED) work for two trains, each capable of producing 5 million tonnes/year of LNG. FEED studies are to be completed in 2004, with start-up operations planned for yearend 2008.

In other LNG news, GE Oil & Gas, Florence, Italy, a unit of Atlanta-based GE Power Systems, was awarded a $90 million contract to supply gas turbine-driven compressors for the BP PLC-operated Tangguh LNG liquefaction plant in Indonesia (OGJ Online, Nov. 11, 2003). The equipment will be used in the first compressor train for the two-train facility to be constructed in Irian Jaya. A KBR-led consortium is performing engineering, procurement, and construction for the plant, which will have a gas liquefaction capacity of at least 7 million tonnes/year of LNG. GE Oil & Gas said the two main refrigerant turbocompressor strings for the compressor train are scheduled for delivery in 2005. GE also will provide engineering and procurement services, fabrication, packaging, and full-load testing. The Tangguh LNG facility is expected to begin production in 2007.

ESSO AUSTRALIA RESOURCES PTY. LTD. and 50:50 joint venture partner BHP Billiton Ltd. are preparing to initiate the largest combined E&P drilling program in the Gippsland basin in the Bass Strait off Victoria since the 1980s. They plan to locate and extract oil and natural gas from smaller fields that show potential and that can utilize existing infrastructure in the mature basin (see map, OGJ, Nov. 13, 2000, p. 36).

The JV is negotiating to contract a drilling rig for a long-term drilling program to commence in February 2004. The rig will be capable of drilling wells from either existing platforms or in new locations. The program may extend into 2005, depending on the success of initial wells, the JV said.

The planned drilling program is based on data acquired in 2002 during a 3D seismic survey that covered more than 3,900 sq km. All wells will be drilled within existing production license areas, and will target both crude oil and natural gas, the JV said.

In 34 years more than 3.5 billion bbl of oil and 5 tcf of gas have been produced in the basin. Current production is 140,000 b/d of crude and 570 MMcfd of gas.

TOTAL E&P USA INC., a Total SA affiliate, reported the start-up of Matterhorn oil field on Mississippi Canyon Block 243 in the deepwater Gulf of Mexico.

The field, which Total E&P wholly owns and operates, is 160 km southeast of New Orleans in 850 m of water.

Matterhorn, developed with a tension leg platform, has production capacity of 33,000 b/d of oil and 55 MMcfd of natural gas (OGJ Online, July 18, 2001). Production, transported ashore via flowlines connected to the existing pipeline network, is expected to reach 40,000 boe/d by yearend.

Indo-Pacific's SPDL 1 rig at the Cheal-1 site in New Zealand. Photo by Joe Johnston, Wellington, NZ.

Matterhorn is the third field operated by the Total unit in the deepwater gulf, and the company was awarded 21 new exploration blocks in 2003, Total said.

In other production action, Indo-Pacific Energy Ltd. initiated a successful production test of the Cheal-1 well in the Taranaki basin on the west coast of New Zealand's North Island Oct. 20 (OGJ, Oct. 20, 2003, p. 47). Oil flowed at an average of 70 b/d through a 5/8-in.choke to onsite production and storage facilities. The production test continued for 8-10 days, also producing natural gas at a constrained rate of 1 MMcfd. "Although the test was intended to establish Cheal as a producing gas field, we are delighted with the oil rates also being achieved," said CEO Dave Bennett. The production test was designed to provide estimates of the gas volumes in the reservoir accessed by Cheal-1 so that decisions on a gas export pipeline could be made. Several pipeline op- tions are under evaluation, including connections to the nearby TAWN station where oil temporarily is being trucked, to NGC Corp.'s regional pipeline system, or to Contact Energy Ltd.'s gas-fired power station, 4 miles to the north. The well was shut in for a week to analyze downhole pressure gauges. If these show a critical reserve level, a similar test will be conducted immediately on Cheal-2, a well drilled east of the site in 1995 that flowed gas and oil on test from the same sands. Operator Indo-Pacific will delineate the Cheal productive area in early 2004 with a third well a short distance to the north of Cheal-1 to determine the quality of the oil and gas sands and the oil potential of the underlying shallow Mount Messenger sands that form a separate reservoir target. Cheal-1 hydrocarbon pay is in the Mio-Pliocene Urenui formation (OGJ, July 16, 2001, p. 38). Production facilities were designed to handle the likely total output from all three wells.