OGJ Newsletter

Market Movement

US too optimistic about Iraqi oil production?

US officials' recent optimistic estimate that Iraq could increase its oil production to 6 million b/d in 3 years, from less than 2 million b/d currently, is "physically impossible," said Paul Horsnell, head of energy research at Barclays Capital Research, a division of Barclays Bank PLC, London (see related article, p. 20).

Iraq's oil ministry "does indeed have a long-term target of 6 million b/d, but in 2014, not 2006," he said. A similar 10-year production target "was in force in 1990 before the first Gulf War, and today the practicalities have certainly not become any easier. A target of 6 million b/d by 2014 is more ambitious than the 1990 target, even if security were to improve dramatically, given that a further 13 years of neglect and corrosion [of Iraqi oil field facilities] have passed," Horsnell said.

Iraq's sustainable production capacity "is not just lower than it was in 1990—it is also falling," Horsnell noted. "To get to 6 million b/d production capacity and an associated 5.5 million b/d export capacity within a few years is, quite simply, physically impossible. Indeed, if Iraq were able to get sustainable capacity beyond 3 million b/d before 2006, we would consider that to be a major achievement under the circumstances."

Weak dollar impacts oil market

Because of its recent depreciation against the euro and other currencies, the US dollar is "coming under increasing scrutiny" as the currency-of-choice in international oil markets, said Wayne Andrews, an analyst in the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla.

"Some leading producers have even openly contemplated adopting the euro as their currency of choice for pricing oil contracts. This prospect may lead to a major restructuring of both commodity and currency markets," he said.

Since peaking in November 2000, the US dollar has declined against other major reserve currencies, down 36% vs. the euro, 33% vs. the Swiss franc, 18% vs. the Canadian dollar, and 17% vs. the British pound.

"This means that refiners and other petroleum users outside the US are paying a lower 'real' price for oil over the past 3 years," said Andrews. "In US dollar terms, for example the price of West Texas Intermediate crude oil has fallen 14% over the past 3 years from $35.40/bbl to $30.46/bbl. When adjusted for the euro-dollar exchange rate, however, the price of oil to European consumers is down a whopping 39% since late 2000. This is the equivalent of European oil prices declining from $35.40/bbl to $21.56/bbl."

That hurts oil exporters, particularly members of the Organization of Petroleum Exporting Countries and Russia.

"Because much of OPEC and Russian trade is with the European Union, the weak dollar reduces the purchasing power of their all-important export earnings," Andrews said.

To compensate, he said, OPEC would have to raise its target-price band to $26-33/bbl from $22/28/bbl. As an alternative, Russian President Vladimir Putin suggested Russia might start pricing its oil in euros. "While he may have difficulty pressuring private sector oil firms to adopt the euro, the possibility of this happening did not even exist just a few years ago," Andrews observed.

"Wholesale adopting of the euro in the oil market worldwide could put the US dollar in a very precarious situation," he said. "This would make it more difficult to attract foreign capital, without which the US cannot keep running huge trade deficits. It could also lead to higher real interest rates if foreign demand for Treasury securities and corporate bonds suddenly dried up. And perhaps most importantly, it could start a vicious cycle in the currency markets—a downward 'death spiral' in which the dollar keeps on falling after it loses its central position in market after market."

However, Andrews noted, "The euro is still in its infancy and has, at best, a mixed track record. Its weakness in its first 2 years after its launch shows that it is hardly a 'safe haven' currency." Moreover, he said, US officials "would strongly oppose any moves to dedollarize oil sales. While the US policy seems to be encouraging a devaluation of the dollar, they do not want a freefall in the dollar. Additionally, both Russia and Saudi Arabia are trying to cultivate better relations with the US for a variety of economic and geopolitical reasons."

Nevertheless, Andrews said, "If the dollar keeps on falling—which seems likely, given the continuation of trade and budget deficits—oil prices should rise even further, everything else being equal."

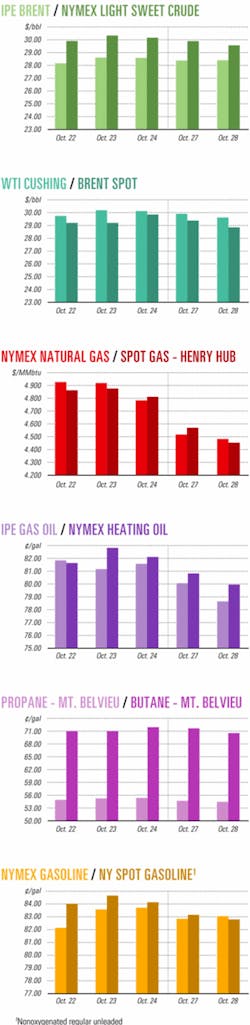

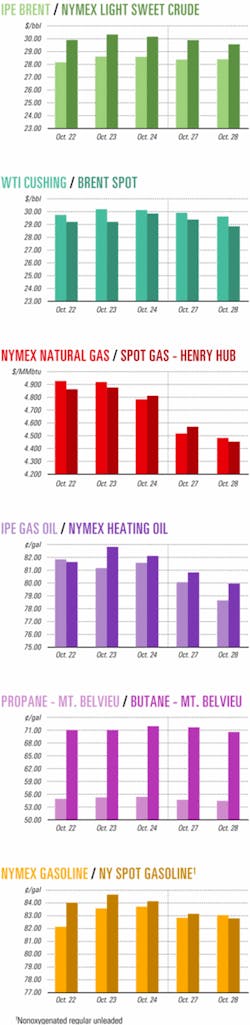

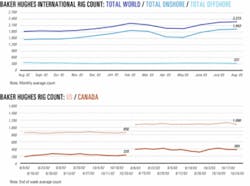

Industry Scoreboard

null

null

null

Industry Trends

US proved reserves of natural gas and crude oil have increased for the fourth consecutive year, the US Energy Information Administration noted in its annual reserves report.

EIA made that observation in releasing an advance summary of its 2002 report on US reserves of oil, natural gas, and natural gas liquids. Oil and gas production declined last year, however, from the year before.

US gas reserves increased 2% in 2002, to 187 tcf, vs. 2001. Reserves additions were 118% of 2002 production, which posted a drop of 2%, to 19.4 tcf, from the year before. Sharp production declines in the Gulf of Mexico were partially offset by large production increases in the Rockies.

In 2002, the Rocky Mountain states and Texas had large gas reserves additions. These additions highlight a continuing shift in US gas reserves and production from conventional natural gas fields to gas produced from tight sands, shales, and coalbeds.

Out of the top 20 natural gas fields last year, 11 were in the Rockies. Large reserves additions were recorded in Powder River basin coalbed methane fields and in Pinedale field (deep and tight sands) in Wyoming and Wattenberg field (tight sands) and CBM fields in Colorado.

In Texas, the prolific Barnett shale play of Newark East field, now the tenth largest US gas field, accounted for a big reserves jump on the year.

Coalbed methane reserves last year increased 5% from 2001 to 18.5 tcf, accounting for 10% of US dry gas proved reserves. CBM production increased 3%, to 1.6 tcf, from 2001 and accounted for 8% of US dry gas production.

Most US gas discoveries in 2002 were made as extensions of existing conventional and unconventional gas fields.

Meanwhile, US crude oil proved reserves increased 1% last year to 22.7 billion bbl.

Reserves additions were 112% of production at 1.875 billion bbl, which compares with output of 1.915 billion bbl in 2001.

The relative contribution by reserves revisions and adjustments to US crude oil reserves additions shows the dwindling contribution of exploration to US reserves growth.

Revisions and adjustments of 1.32 billion bbl accounted for 54% of total crude oil reserves additions in the US last year. Total discoveries—most of which were extensions—accounted for 492 million bbl in 2002. New field discoveries came in at a total of 300 million bbl.

And those discoveries increasingly are being made in the Gulf of Mexico federal offshore. Out of all new oil field discoveries reported in 2002, 97% were on Gulf of Mexico federal offshore leases.

Other EIA statistics point to a level of drilling activity in the US that was little moved by higher commodity prices. Even though the domestic first-purchase crude oil price was 3% higher at an average $22.51/bbl in 2002, exploratory and development completions plunged 38% from the year before.

And NGL reserves, while showing essentially no growth in 2002, accounted for 26% of US liquid hydrocarbon reserves at almost 8 billion bbl.

Government Developments

THE US SENATE overwhelmingly approved the White House nomination of Utah Gov. Mike Leavitt (R) to lead the US Environmental Protection Agency.

The Senate voted 88-8 on Oct. 28 in confirmation of Leavitt. He is expected to assume his post within 2 weeks, EPA officials said on the day of his confirmation.

The Senate's consent never was in doubt, but some Democratic lawmakers held up a final vote on the nomination because of concerns by several mainstream environmental groups.

Throughout the nomination process, Leavitt sought to deflect that criticism, defending his record as governor, and pledging to protect the nation's resources at a reasonable cost.

"I believe as a nation we have an abounding capacity to continue our path of environmental progress and an imperative to do so at less cost. I believe I can help protect this nation's land, air, and water by promoting a higher and more meaningful level of cooperation and the application of new technologies," Leavitt said Aug. 11.

President George W. Bush tapped Leavitt in August to replace Christine Todd Whitman (R), a former New Jersey governor widely seen as a moderate on clean air issues. Environmentalists say Whitman left after she lost several internal battles with other members of the Bush administration over climate change policy and clean air permitting. Whitman resigned June 27, saying then she wanted to spend more time with her family.

Oil industry trade groups largely have avoided comment on Leavitt. Privately, some industry officials said they were encouraged by the White House's choice, given that Leavitt comes from an oil and gas producing state and is very familiar with public land access issues.

Meanwhile, on Capitol Hill, House Energy and Commerce Committee Chairman Billy Tauzin (R-La.) issued a statement in support of the Senate's bipartisan vote.

"Leavitt's balanced approach to environmental stewardship will serve the nation well as he leads America's diverse environmental programs," Tauzin said. "Our nation is fortunate to have his proven leadership at the helm of the EPA."

LOUISIANA'S LAWMAKERS say they will seek federal funding next spring for a wetlands-rehabilitation project estimated to cost $14 billion.

The project to rescue Louisiana's coast was the topic of a panel discussion during American Petroleum Institute's annual meeting in New Orleans last month.

Stacy Methvin, president of Shell Pipeline Co., led a panel seeking support of US oil companies for the project.

Channelization of the Mississippi River and its tributaries has reduced sedimentation in the delta. Consequently, more than 1,500 sq miles of coastal Louisiana has subsided into the Gulf of Mexico. Without preventive measures, a further 1,000 sq miles will disappear by 2050, researchers estimate.

Robert R. Twilley, an ecologist from the University of Louisiana at Lafayette, said the prevention involves diverting fresh water to wetlands to restore sedimentation.

Quick Takes

PETROLEOS MEXICANOS (Pemex), Mexico's national oil and gas company, received a Mexican-Argentine consortium's technical proposal Oct. 29 for development of the Misión block in the Burgos basin of northeastern Mexico. The contract represents the third in a series of seven contracts for Burgos basin development and maintenance to be awarded under Mexico's Multiple Service Contract (MSC) program (OGJ Online, Oct. 16, 2003).

The program bundles such services as seismic surveys, drilling and development, pipeline construction, and maintenance, which previously had been contracted separately.

The bidding consortium for the Misión block is composed of Argentine company Tecpetrol SA—a wholly owned subsidiary of the Techint Group—and Mexican company Industrial Perforadora de Campeche, a subsidiary of the Mexican conglomerate Grupo R.

The 1,972 sq km Misión block contains 21 separate gas fields in Nuevo León and Tamaulipas states.

The winning contractor is expected to increase natural gas production on the Misión block to 91 MMcfd from the current level of 35 MMcfd over the life of the 20-year contract.

Pemex awarded the second MSC Oct. 23 for natural gas development on the Cuervito block to a consortium that includes Brazilian company Petróleo Brasilerio SA, Japanese company Teikoku Oil Co., and Mexican company D&S Petroleum, a subsidiary of Grupo Diavaz (OGJ Online, Oct. 22, 2003). The group bid more than $260 million to develop gas reserves on the 136 sq km block in the state of Nuevo León that Pemex estimates will entail more than 100 wells over the life of the 15 year contract.

In other development activities, Santos Ltd., operator of Mutineer-Exeter oil fields on Exploration Permit WA 191-P in the Carnarvon basin off Western Australia 150 km north of Dampier, chose Tokyo-based Modec Inc. to begin development activities. Santos said capital expenditure for development would be $480 million (Aus.). Modec will provide engineering, procurement, construction, installation, and commissioning for a 930,000 bbl, turret-moored floating production, storage, and offloading vessel and will operate the production vessel for a minimum of 5 years. Development drilling is slated to begin in first quarter 2004, and first oil is scheduled for mid-2005. Initial development will include as many as five wells at Mutineer and two at Exeter. Provision will be made for a total of as many as nine wells at Mutineer and five wells at Exeter. Initial production is expected to be 70,000-80,000 b/d of oil, building to 100,000 b/d. Total production is forecast at 13.8 million bbl in 2005 and 35 million bbl in 2006. Santos' partners are Kufpec Australia Pty. Ltd., Nippon Oil Exploration, and Woodside Petroleum Ltd.

STATOIL SA has been fined 1 million kroner by the public prosecutor for Rogaland (county), Norway, as a result of a fatal accident on the Byford Dolphin semisubmersible drilling rig Apr. 17, 2002.

A 44-year-old worker lost his life while the Byford Dolphin was drilling a well for Statoil in Sigyn field on behalf of ExxonMobil Corp.'s Norwegian unit, as Sigyn was to be tied back to Statoil's Sleipner East field in the North Sea.

In June 2002, Statoil terminated its charter with a unit of Fred Olsen Energy ASA for the Byford Dolphin, citing inadequate safety measures. The contract for the rig, which was owned by Dolphin AS, was originally to run until Oct. 8, but Statoil said that new safety measures adopted after the accident had not been satisfactorily followed up (OGJ Online, June 3, 2002).

Statoil said it now "will assess the basis on which the fine has been imposed and decide whether to accept it."

GTL plant to fuel vehicle demonstrations

Tulsa-based Syntroleum Corp.'s new $52 million gas-to-liquids demonstration plant at Port of Catoosa near Tulsa will provide synthetic fuels for a long-term testing and demonstration project in certain government vehicle fleets.

Slated to go on line in early November, the 70 b/d plant was designed and constructed under a federal ultraclean-fuels program managed by the US Department of Energy's National Energy Technology Laboratory to pioneer a new generation of clean transportation fuels for reducing tailpipe emissions.

The program will produce synthetic diesel for a series of test programs, initially in diesel fleets, but the departments of Defense and Transportation have indicated interest in military, construction, rail, and marine fuel applications as well.

DaimlerChrysler AG and Volkswagen AG are participating in the demonstration of engines and emission control systems matched and calibrated specifically for the synfuel.

DOE funded $11.5 million of the plant construction costs, with the balance funded jointly by Syntroleum and Marathon Oil Co. Photo courtesy of Syntroleum.

JAMSHORO JOINT VENTURE LTD. (JJVL) and Sui Southern Gas Co. Ltd. have signed an agreement to construct a $31 million LPG-NGL extraction plant at Jamshoro in Sindh Province, Pakistan.

The agreement includes construction and commissioning.

Hanover Compressor Co., Houston, and Hanover Compression DR have the contract to set up the plant, which will process 200 MMscfd of natural gas and produce about 450 tonnes/day of LPG and 90 tonnes/day of NGL. Hanover will commission the plant by Sept. 30, 2004.

The facility will utilize state-of-the-art turboexpander technology licensed by Ortloff Engineers to recover about 99.4% of propane and almost 100% of butane (OGJ, July 21, 2003, p. 52). It will add about 40% to Pakistan's LPG production, JJVL said.

BHP Billiton Ltd. has made a gas discovery south of its Angostura field off Trinidad's east coast. The discovery, made with the Howler No. 1 well, is in the Cretaceous Naparima Hill formation on Block 2c. The well was drilled to 10,200 ft TD in water 190 ft deep.

Meanwhile, BHP Billiton is said by industry sources also to have discovered hydrocarbons on the adjacent Block 3a. Sources say the discovery was made in the first well BHP drilled on the block near Block 2c on which BHP found the huge Angostura field.

However, a company spokesman said late last month it would be "premature and speculative" to say that an oil discovery has been made with Block 3a's Bimurraburra-1 well. "Drilling operationsUare ongoing and expected to continue over the next few days. Proper disclosure would require accumulation of this additional data and analysis of it by the partners in this well," he said.

In other exploration news, China's CNOOC Ltd. reported that its successful appraisal well, Weizhou (WZ) 11-1-2, in the Beibu Gulf of the western South China Sea confirmed commercial oil deposits in the area. WZ 11-1-2, about 0.4 km east of the original discovery well, Wan 1, was drilled to 3,190 m TD in 39.5 m of water. During a drillstem test it flowed 42-45° gravity crude at an average rate of 8,200 b/d of oil and 13 MMcfd of gas. CNOOC is operator and has a 100% working interest in this prospect. Pakistan issued a petroleum exploration license Oct. 23 to a joint venture of OMV Pakistan Exploration GMBH (operator), ENI Pakistan (M) Ltd. (formerly Lasmo (MP) Ltd.), and Pakistan Petroleum Ltd. to explore Block No. 2669-3 (Latif) covering an area of 1,497.8 sq km in the Khairpur district of Sindh Province, Pakistan. The JV is obligated to carry out reprocessing of 1,000 line km of 2D seismic data, 300 sq km of 3D seismic survey, and the drilling of one exploration well during the 3 year Phase I of the project. The JV's minimum expenditure will be $5.15 million. ChevronTexaco Corp. unit Star Ultra Deep Petroleum Ltd. found oil on deepwater Oil Prospecting License (OPL) 249 off Nigeria. The Nsiko-1 wildcat, drilled to 13,968 ft TD in 5,674 ft of water, discovered substantial net hydrocarbon pay in multiple zones, ChevronTexaco said. One zone tested in the well flowed at 6,500 b/d of high-quality crude under restricted flow conditions. ChevronTexaco will conduct appraisal drilling in first half 2004. Star Ultra Deep has 100% contractor equity in the license. In addition, the Aparo-3 appraisal well confirmed the extension of Aparo oil field in OPL 249. Aparo-3, drilled to 12,000 ft TD in 4,270 ft of water, encountered substantial net oil sand, indicating that OPL 249 Aparo, OPL 213 Aparo, and Oil Mining Lease 118 Bonga SW discoveries share a common structure, possibly leading to a joint oil development by the various licensees.

SUI SOUTHERN GAS CO. (SSGC), Karachi, has launched a second 5-year gas infrastructure rehabilitation and expansion project to increase its gas distribution network capacity to 1.8 bcfd from 1.2 bcfd by 2007-08.

Major components of the $297 million project include bypassing 13 km of 18-in. pipe on the Quetta pipeline in Dingra Nalas and 9 km of 30-in. pipeline from HQ3 to SMS Sindh University. SSGC also will replace 500 km of 18-in. aboveground pipeline and loop 296 km of 24 in. line on the Sanghar-Hyderabad-Karachi pipeline along with compression, 140 km of 18 in. on the Golarchi-Karachi pipeline, and 106 km of 30-in. Bajara loopline. SSCG also will rehabilitate 64 km of 12-in. pipe on the Zarghun-Quetta pipeline.

In other pipeline activities, Pemex Exploration & Production Co. has selected Global Offshore Mexico S de RL de CV to install 29 km of 24-in. subsea pipeline from Enlace to Uech A platforms in the Gulf of Mexico's Bay of Campeche. The contractor is a wholly owned unit of Carlyss, La.-based Global Industries Ltd. Global also will perform trenching and five crossings as well as pipeline hydrotesting and topside work, and installation of three risers, three expansion loops, and a subsea tie-in. The Titan 2, Cherokee, and Ingeniero II vessels will be used in executing the project.

TNK-BP's OIL PRODUCTION in first half 2003 averaged 1.2 million b/d, but will rise by 12-14% this year, average 7% growth in 2004, and then hold at about 5% annual growth, said BP PLC Chief Executive John Browne.

TNK-BP, formed earlier this year by the merger of Tyumen Oil Co. (TNK) and Sidanco Oil Co., is owned and managed 50:50 by BP and Russian partners Alfa Group and Access-Renova. It is Russia's third largest oil and natural gas company (OGJ, Feb. 17, 2003, p. 34).

TNK-BP expects to increase cash flow to about $1 billion/year from $850 million/year over the near term—putting over 70% into exploration and production.

Browne said Russian President Vladimir Putin promised to help provide necessary tax incentives to stimulate production.

TNK-BP has estimated proven oil reserves of 9.4 billion bbl based on production that can be recovered during full field life.

Robert Dudley, TNK-BP CEO, said the company's top five fields, which have 74 billion boe of OOIP, have a 25% recovery factor, but the recovery factor will reach 30% through the proved developed stage with upside potential of 39-44% ultimate recovery—compared with Alaska's Prudhoe Bay recovery factor of 44%—with a 53% recovery factor through proved developed stage and upside potential of 56-61% ultimate recovery.

In other production news, Sawan gas field and gas treating plant in the Khairpur district of Sindh Province, Pakistan, has been formally inaugurated. OMV (Pakistan) is operator of the SW-Miano JV that discovered Sawan gas field in January 1998 (OGJ, Mar. 2, 1998, p. 42). Production in Phase I commenced this summer at 200 MMcfd, and Phase II production, which will double that rate, is expected to start at yearend. Sawan's proved and probable gas reserves are estimated at 1.3 tcf. The field was developed over 5 years at a cost of more than $270 million. SW-Miano JV shareholders are OMV (Pakistan) 19.74%, Agip Exploration & Production Ltd. 23.68%, Moravske Naftove Doly AS 7.9%, Pakistan Petroleum Ltd. 26.2%, and Government Holdings (Pvt.) Ltd. of Pakistan 22.5%.