ReedHycalog: US rig fleet utilization drops 15% since 2001

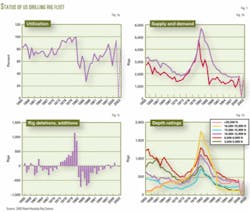

According to the recently released ReedHycalog 2003 Rig Census, US fleet utilization has dropped to 78% from 93% in 2001. Drilling activity in 2001 represented a 20-year high, however, and the 2003 utilization rate is still 5% better than the 50-year mean of 73%. Utilization peaked in 1981 at 98%, and the historical low came in 1986 at 26% (Fig. 1a).

Land rig utilization mirrored that of the entire US fleet, dropping to 78% in 2003 from 93% in 2001. Offshore rig utilization historically lags that of land rigs, dropping to 75% in 2003 from 90% in 2001.

Decreasing number of rigs

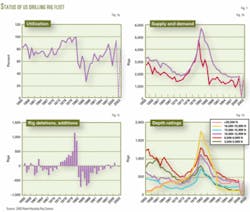

Rig availability increased to 1,719 in 2003 from a low of 1,636 rigs when the market bottomed in 2000 (Fig. 1b). The net change in fleet size from 2001 is a loss of 3 rigs, however, reflecting a slight decline in the size of the US fleet (Fig. 1c). The US fleet currently includes 1,488 land rigs (87%) and 231 offshore rigs (13%).

For a rig to be considered "available" for purposes of this survey, it must be able to start work without incurring a capital expenditure of more than $100,000 (land) or $1 million (offshore), excluding drill pipe. The size of the US fleet has been in decline since the peak of 5,644 rigs in 1981 (Fig. 1b), as significant numbers of the aging fleet have:

- Been cannibalized or auctioned for parts (59 rigs in 2003, 23 in 2001).

- Required large capital expenditure (57 in 2003, 36 in 2001).

- Moved out of the US (45 rigs in 2003, 6 in 2001).

- Remained stacked longer than 3 years (7 in 2003, 28 in 2001).

- Been destroyed (4 in 2003, 3 in 2001;Table 1).

- The US rig fleet was augmented by rigs that were:

- Assembled from components (74 in 2003, 105 in 2001).

- Newly manufactured (48 in 2003, 9 in 2001).

- Brought back into service (37 in 2003, 56 in 2001).

- Moved into the US (10 in 2003, 12 in 2001).

Census logistics

John Deane, president of ReedHycalog, a unit of Houston-based Grant Prideco Inc., summarized results of the 2003 Rig Census at the annual meeting of the International Association of Drilling Contractors (IADC) in Houston in September.

The 50th ReedHycalog Rig Census is based on US rig activity during May 10-June 23, 2003. The census counts all rigs that were actively drilling at any time within the 45-day survey period, and therefore it is always higher than the Baker Hughes Inc. weekly rig count.

There were only 1,334 rigs meeting the "active" definition in the 2003 census, 16% less than the 1,593 rigs counted as active in 2001.

This year's census data are juxtaposed with the census data from 2001. The census was not produced in 2002, in a cost-cutting measure by Schlumberger Ltd., then parent of ReedHycalog. Grant Prideco bought ReedHycalog from Schlumberger in December 2002 and reinstated the annual census this year.

Rigs counted in this census are all rotary rigs capable of drilling deeper than 3,000 ft. This criterion is necessary in order to exclude well-servicing rigs, so that the census results reflect true drilling activity. For the same reason, cable tool rigs are excluded.

Two categories of rigs in the 2003 census, rated for depths between 13,000 and 20,000 ft, respectively, increased by a total of 64 rigs. The other four categories dropped by a total of 67 rigs. The rig depth-rating distribution from the 2003 census is as follows (Fig. 1d):

- 390 rigs capable of drilling deeper than 20,000 ft, a loss of 34 rigs.

- 205 rigs rated from 16,000 to 19,999 ft, a gain of 44 rigs.

- 274 rigs rated from 13,000 to 15,999 ft, a gain of 20 rigs.

- 368 rigs rated from 10,000 to 12,999 ft, a loss of 5 rigs.

- 359 rigs rated from 6,000 to 9,999 ft, a loss of 12 rigs.

- 123 rigs rated from 3,000 to 5,999 ft, a loss of 16 rigs.

Market factors

Deane said he believes that commodity prices normally drive drilling activity, but after significant increases in both crude oil and natural gas prices since 2001, he noted that rig activity "isn't what we expected" and suggested four underlying causes:

1. The "fear factor," or apprehension of a market downturn.

2. Political and supply uncertainties in Venezuela, Nigeria, and Iraq.

3. Increased attention to the balance sheet in the wake of corporate financial scandals.

4. A tendency toward reinvestment in current production rather than new drilling.

Top concerns of contractors in 2003 are rig rates, crew availability, and insurance costs.

Although land rig rates in 2003 are up 6% over 2001, they are offset by increases in maintenance spending (17%), labor costs (4%), and insurance. Onshore rates averaged $8,484/day during the census period. Offshore rates averaged $39,429/day, down about 8% since last year, although the small number reporting was statistically insignificant.

There is a shortage of qualified labor to fill drilling crews, due to the cyclical nature of the industry and job instability. Hence crew availability is the second critical concern voiced by drilling contractors.

Increasing insurance costs have affected many industries. This is the first time in 10 years that insurance costs have been cited as one of the top three concerns by contractors.

Industry consolidation

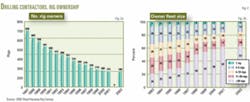

The number of US rig owners has declined for the last 15 years. In the last 2 years, it has dropped to 179, a loss of 12, as a result of consolidation and company closures. Sixty contractors participated in the 2003 survey, representing only 34% of all the contractors, but controlling 72% of the total fleet (Fig. 2a).

Industry consolidation continues; larger contractors (owners of more than 20 rigs) have acquired 63% of the available fleet. The average rig owner in 2003 owns 10 rigs, up from 9 (11% increase in fleet size) in the 2001 census (Fig. 2b).

Projections

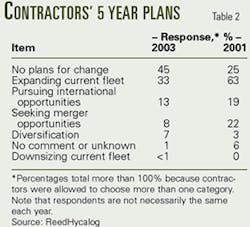

Over the next 5 years, most drilling contractors expect their rig fleets to remain the same size (45%) or to expand (33%). This suggests an optimistic outlook on short-term stability. Rather than foreshadowing a period of new rig construction, however, fleet expansion could take advantage of stacked rigs. Land rig contractors said that rig rates would have to increase 65% before they could consider new builds.

Only one drilling contractor expected to downsize; 7% expect to diversify; and only 8% are seeking merger opportunities this year, compared with 22% in 2001 (Table 2).

Overall, the US rig fleet remains strong and has maintained healthy utilization rates, according to the census results. Utilization is likely to rise slightly to 81% in 2004, reflecting slow, steady growth in drilling activity. "Certainly the health of the fleet is better than it's been in years," Deane concluded.

Census data from 1980-2003 can be downloaded from http://www.grantprideco.com/pressrelease_docs/Census%20history%202003.xls.