US independents maintain bullish outlook despite legislative uncertainty

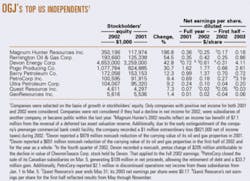

The companies profiled in the sidebar articles are the top nine fastest-growing US independents, in terms of stockholder equity growth, according to their ranking in the latest OGJ 200 (see table on p. 25 and OGJ, Sept. 15, 2003, p. 48).

US independent oil and natural gas exploration and production companies are maintaining a positive outlook for their near and medium-term operational and financial performances against a backdrop of congressional debate over the direction of energy policy.

US E&P independents are trying their best to make the most of the current robust commodity market environment, which of late has been fetching, in benchmark terms, more than $30/bbl for crude oil and $5/Mcf for gas. Those US E&P firms well-versed in the highs and lows of oil and gas markets realize that thriving in today's economic climate hinges on keeping costs low and operations lean. At the same time, they must continue to grow beyond just replacing production while still getting returns on invested capital that will appease shareholders.

"Independents are in a real sweet spot for the next 3 years," Gary Evans, chairman, president, and CEO of Irving, Tex.-based independent Magnum Hunter Resources Inc., told OGJ. Evans's company is one of the nine fastest-growing independents profiled in this issue.

The ranking, based on stockholder equity growth, was compiled last month in OGJ's OGJ200/100 special report (see table, OGJ, Sept. 15, 2003, p. 48). Marathon Oil Corp., an integrated oil and gas company that landed on the No. 9 spot in that ranking, was excluded from this report, which highlights only independent E&P firms.

Other issues being addressed by independents include the ever-steady decline of US gas production and the battle to gain access to new areas to drill oil and gas prospects.

Also, independents are keeping an eye on the development of global LNG projects and the impact that rising gas imports will have on the US gas market.

According to Independent Petroleum Association of America Chairman Diemer True, this year has been a lucrative one for the association and its members. "It's been a great year for IPAA, and our membership is growing. I attribute that to three reasons: $30/bbl crude oil, $5/Mcf natural gas, and the national energy bill that has drawn a lot of focus by the industry to Washington, DC.

"Even though we've seen the industry consolidate, and we've seen declining membership over the last 10-15 years, this year the trend has reversed, and we're really pleased with that," True said.

Politics as usual?

Many independents are waiting with bated breath for the conclusion of voting by Congress on the pending comprehensive US energy bill (see related item, p. 7).

Meanwhile, independent associations, such as IPAA, hope that lobbying efforts pay off in the long run.

"IPAA has been very active in the resource provisions in the tax title, dealing with taxes and permitting," True said. "We have been deeply involved in working with Congress—both members of Congress directly and with the staff—on all of those provisions," he noted. "I have not seen the tax title coming out of the Congress committee yet, but the royalty [and] environmental provisions are very, very constructive, and we're very pleased with them," he said.

"In the federal arena, you're fighting a battle where there's a lot of compromise, so at the end of the day [the energy bill] may not be the only answer for us to increase supplies in the short term, but it clearly is moving in the right direction," said James T. Hackett, president and chief operating officer of Oklahoma City-based Devon Energy Corp. and chairman of the Domestic Petroleum Council (DPC). The DPC membership consists of 24 large US-based independents.

Congress has been very receptive to IPAA representing the independent sector of the industry, according to True. "They certainly have to establish the policy, but they have certainly looked at us to provide input as to what would be meaningful to help develop domestic production, and the dialogue has been remarkably constructive and positive," he said.

True contends, however, that many of the issues creating the most debate in Congress do not in fact belong to independents. "We have not taken a position, for example, on the Alaska pipeline. We think the pipeline ought to be built, but whether there are tax incentives or not, IPAA has not taken a position—that's something that the policymakers need to decide," he said.

IPAA has, however, taken a position in favor of permitting drilling in part of the Arctic National Wildlife Refuge, but the association's members are not going to influence it, True said. "That's just bigger than us, and that's going to come down to negotiations."

True added, "ANWR's been ruled 'dead' over and over and over again, but the proponents are so tenacious, and while I still think it's maybe an uphill battle, you have to give them a lot of credit—and I would not be surprised if they don't figure out some way to compromise."

Currently, electric industry restructuring and the ethanol mandate are the issues holding up the energy legislation, True explained. "The bill, as it stands insofar as we know about producers' issues, is very positive, and [we're] favorable towards it," he said.

Evans hopes an energy bill will be passed that might be helpful in addressing oil and gas issues. "The government needs to look at the uncertainties of the energy markets. Everyone wants cheap energy, but no one wants to help the independents to deliver it," he said.

Like many other independents, Evans favors federal tax incentives "for deep or tight gas and to keep marginal wells producing." Access to oil and gas prospects remains a vital issue for US independents. "There's a lot of oil and gas still left in the Lower 48, but we also need new frontiers," he said.

"The tax credit components could certainly help us—with all of our domestic production being tight sands gas—but I don't know what's happening with it," commented Michael Watford, chairman, president, and CEO, Ultra Petroleum Corp., Houston. "I don't know that anyone knows what's happening with it."

Hackett said that, in American politics, policy is generally managed by crisis. "We've been spoiled for 20 years now in terms of low energy prices for both gas and oil and gasoline," he said, adding, "None of us know, for the most part, how you get gasoline, what it comes from, how hard [crude oil] is to find. We sell our product for less volumetrically than a can of Coke. Now I guarantee there's a hell of a lot more capital investment and risk involved in trying to find oil and gas, and nobody really knows that at all."

Land access issues

According to Bill Whitsitt, DPC president, access to land has been the overriding issue for many of DPC's members. Whitsitt bases his assessment on the recent release of a new National Petroleum Council natural gas report calling for expanding supply and increasing conservation measures to meet growing US gas demand needs by 2025 (OGJ Online, Oct. 1, 2003).

"There are significant resources that we need to be accessing," Whitsitt said. "Hopefully, at some point down the road, on the Outer Continental Shelf, for example, we can find some creative ways to begin to at least allow the demonstration of our improved technology since the moratoria were put in place."

Whitsitt also holds hope that the permitting process will become more efficient and that some of the restrictions on onshore lands—particularly in the Rocky Mountains—might be lifted. These restrictions, he explained, were put in place "when technology was different and the understanding of the environmental compatibility of our operations was not as well understood."

Since those times, Whitsitt said, "We've learned more about the ability to have operations coexist with habitat management, and so all of those things have real importance to our members."

"Finding oil and gas reserves at attractive prices is always a challenge for this industry—always has been, always will be," said J. Larry Nichols, chairman and CEO of Devon Energy Corp., Oklahoma City. "And it has gotten more difficult in the US over the last decade as the government has restricted access to areas where this industry historically has explored and drilled."

President George W. Bush and members of his administration "certainly are trying to change" many of the access and other restrictions on the US oil and gas industry. "But there are groups out there who would like to run all forms of industry—drilling, mining, ranching—off of federal lands," Nichols said.

Higher energy prices "should have raised public consciousness of these problems this summer," he said, "but we still see the same senators lined up in the same way on the same energy issues." As for the energy bill now being hammered out in Congress, Nichols said, "It's got some good parts and some that are not particularly helpful to this industry, but it has changed so often that I haven't been able to keep up with it."

Whitsitt has witnessed progress with the current administration. "We are seeing as a result of the Bush administration a very significant and important increase in attention paid to energy from public lands—nonpark, nonwilderness lands—and the agencies, as a fallout of the administration's national energy plan, are very active in trying to increase our ability to supplyUnatural gas, and even oil.

"The energy bill is very helpful," True noted. "This [current] administration understands the importance of energy to the future prosperity of this country—that's a tremendous help. Instead of being counterproductive, like the previous administration, this administration is really trying to be helpful," he said.

US gas production decline

"The problem with the whole natural gas industry is that there is not enough elasticity in the market," Magnum Hunter's Evans said. With US demand for natural gas on the rise, he said, "The 3 tcf comfort zone [for US gas storage going into winter] is a myth. Storage needs to be at a minimum 3.5 tcf, because peak demand [or deliverability] can't be predicted. That's what is causing all of the price volatility."

A relatively cold winter that tests deliverability to the US gas market could result in price fly-ups to as much as $8-10/Mcf. A cold winter, followed by a hot summer, could stretch gas supplies even thinner and push prices higher. "And that's bad for the industry," Evans observed.

Gas withdrawn from storage represents only 18% of usual US winter demand, Evans noted. "Our swing flexibility needs to be better than that," he said. "Canada has always been the saving grace for the US gas market in the past, but that's not the case anymore."

Like the mature US, Canada's natural gas production is now in decline.

True said that the accelerated depletion rate has been "the big surprise" to the industry. "We're just simply going to have to reinvoke our exploration efforts and bring more gas online domestically," True reckoned. "In the short run, and along with conservation, those are the two things we're just going to have to do."

Even with the recent rise in the number of rigs drilling for gas, True explained that the same jump occurred a few years ago and industry "didn't' see a great deal of increase in deliverability." This "gives us a little bit of pause," he noted.

Ultra Petroleum's Watford noted, "Our perception is that there's an issue of supply of natural gas in this country. Whatever happens over the short term in terms of pricing, the real issue is supply.

"Even with the rig count up to over 900 rigs drilling for natural gas, on a quarterly performance basis, you're still not seeing production increase," he said.

Watford added that some energy analysts are predicting close to a 3% year-on-year decline in gas production in the third quarter. "This means that companies are still focused on storage fills when storage is only 15% of the demand, soUthat certainly is a component, but it's not even a significant component."

Watford said, "But if we have 900 rigs running, and we continue to have year-on-year decreases in production from North America, then that means you're going to have an issue here of stronger commodity prices for quite a while.

Gas prices, storage

Although content with the current high gas price situation, many independent producers were hesitant when asked to speculate on the future gas market.

When asked to speculate about gas prices, Douglas Lamb, Co-CEO of Benedict, Kan.-based Quest Resource Corp., said, "I don't expend much mental effort on aspects of the business that I can't control. However, I remain confident that gas prices are going to remain at levels where Quest can continue to operate with attractive profit margins for the foreseeable future."

True said, "I am just not prepared to predict natural gas prices, but I think you can say that we've moved up to another level. We've seen gas prices go up basically $2[/Mcf] in a year, and I think our trading range has moved up like that as well. If we have a very warm winter and we don't draw down the stocks in storage, you could see prices tank in spring."

True added that there are too many influences that feed into the matrix of price forecasing, and that his "crystal ball is cloudy."

Gas prices in the near term, say independents, are going to hinge on underground gas storage, particularly since the US is headed toward the winter heating season.

"We are going to enter the winter market somewhere close to the normal 3 tcf in storage," predicted James Watt, president and CEO of Dallas-based Remington Oil & Gas Corp. "I think you'll continue to see companies not showing growth in their production volumes, particularly in the US. We are going to see a shortage in natural gas, particularly coming out of the Gulf Coast—which has been the biggest supplier over time—and that is going to put pressure on gas prices. "I expect that we are more of a $4-5/Mcf gas market as we move into the future than the $2-4 [/Mcf] range that we were in the last 2-4 years," Watt said.

Hackett admitted, "I'm not sure what the magic level of storage is, but ultimately more storage is good if you have the overall productive capacityU. We're getting into the position where you're going to get storage full for each winter, because you have to, and you'll pay whatever it takes to get there."

That doesn't mean, however, that after the heating season, companies will have the right production levels for the rest of the year, Hackett explained. "So you clearly would want more storage on balance, but it isn't the whole answer; you have to get more supply, too."

True said that there certainly exists an influence on prices from storage data, and that "the storage numbers are sufficiently valid to where we know we're going to go into the winter with approximately 3 tcf in storage, as always."

He noted, "If we were off 20%, that would be a real disconcerting problem, but I think the numbers are sufficiently accurate to make decisions, and what the industry is seeing is that we're going to have enough gas going into winter."

LNG competition

Magnum Hunter's Evans figures it will take 3 years before LNG imports start getting factored into natural gas prices in US markets, although it will take at least 6 years to build sufficient LNG infrastructure in or near the US to "turn natural gas into a world commodity" like oil. Until then, he said, "US independents had better enjoy the good times."

Like many industry participants and analysts, Evans foresees LNG imports becoming a swing factor to prevent sharp spikes in US natural gas prices during seasonal periods of peak demand. However, he also recognizes that prices will have to remain relatively high to attract LNG into the US natural gas market.

"LNG puts a $3.50-4/Mcf floor under US natural gas, and independents can make good money at $4/Mcf," he said.

The downside risk of LNG competition "is minimal," said Evans. "The one thing that North American gas producers can't overcome is the ever-increasing gas depletion rate in the US and Canada. That's impossible to turn around. It can be [offset] only by market prices high enough to kill off some demand."

LNG "doesn't worry us at all from a competitive standpoint, because we will have the price advantage of producing gas and transporting it right here in North America," said Devon's Nichols.

"When one of [our] largest fields [the Barnett shale in the Fort Worth basin] is within eyesight of the skyline of Fort Worth, [I] really don't worry about competing with someone who has to liquefy gas and transport it halfway around the world," Nichols said.

DPC Chairman Hackett said, "I think that, first of all, there isn't going to be enough [LNG] coming out in the short term to really impact us dramatically. The US will see a 2-3 [bcfd]-type number in recent capacity additions, he explained, adding, "And then you're basically topped out until these new regasification stations are built, and that might not happen for 5-10 years."

True concurred. "It will take years to build any LNG regasification plant in the US—just the permitting alone will take maybe multiple years, and then the actual construction will take multiple years," he estimated. "Just the reality of the inability of the companies to build those plants in the short run, there's probably not going to be a lot of impact [on US markets] from LNG.

"The NPC studyUhas convinced me that we're going to need all of the gas we can get, including LNG. I think the market will be there and be strong and will allow for the importation of LNG, and it won't significantly depress the price," True said.

True voiced one concern: "My concern is that, if there isn't any gas—whether it's the Alaskan pipeline gas or offshore both coasts, and we don't have LNG—that we crush demand so much with very, very high prices that we destroy the market and the market goes to find other sources of energy."

Wood Mackenzie Ltd., an Edinburgh-based consultant, earlier predicted that high natural gas prices should last for years in the US.

In testimony to the US House Subcommittee on Energy and Mineral Resources this summer, Ed Kelly, head of North American gas and power consulting for Wood Mackenzie, said, "We are not in a simple commodity cycle. High prices are likely to endure, and imports will continue to increase in share of the overall North American supply for natural gas" (OGJ Online, June 20, 2003).

Natural gas prices will remain high until an import infrastructure is built, "capable of transporting large quantities of gas to the US," and new native sources of gas can be brought to market, said Kelly. However, he said, "These solutions are approximately 5-10 years away, meaning that gas is likely to remain expensive for at least the remainder of this decade."

LNG is an even more distant solution, Kelly said. "While increasing LNG imports are a near certainty, this growth should be put into perspective," he said. "Wood Mackenzie believes that it will be 10 years or more before LNG represents even 10% of US supplies on an annual basis."

Capital markets, acquisitions

Getting bigger is becoming more difficult through acquisitions, noted many independent producers, although companies are still amalgamating, albeit slower than just 2 years ago.

"I think a lot more companies have to turn to acquisitions because it's been very tough to be an exploration company and grow through just exploration," said Hackett.

"Inevitably, most companies do some amount of exploration, but we have a clear objective at Devon to be an exploration company as well as an acquisition company. And we'll spend a quarter of our budget on high-impact, high-risk exploration. We're pretty committed to the exploration side of the puzzle now," he noted.

Hackett tried to explain the recent lag in merger and acquisition activity among independents: "You have to first keep in mind that since 1997, 55% of the publicly listed larger independents in North America have gone. But there's been a little bit of slowing, and part of it has been because the high commodity prices have generated [such] significant cash flow that companies haven't had toUdo external deals to effectively solve problems they've had."

Hackett added, "But ultimately, the inability to grow your stock value or your production while still generating good returns will lead to more consolidation. I think it will tend to continue to go forward.

"There are obviously [fewer] players now, too, so it's not quite as easy. Some of them are big ones, and it's not so easy to buy them. If you have a very bullish view on prices, you may not feel as inclined to sell to somebody," Hackett said.

Change remains the same

US independents continue to adapt to changes within industry, producers said.

True said, "I think the trend that started 10-15 years ago continues: that's the consolidation of the industry. But also, as much as that's changed, there's still a part of the industry that's below the radar, and my company is a good example of that."

True is partner in the Casper, Wyo.-based independent operating and services company True Cos.

"Part of the industry—and I don't know how big it is, but it's certainly a major percentage—is not publicly traded; we don't share our numbers, so we go out and drill when there's cash flow.

Now, that part of the industry has not changed; it's still out there. Recently the number of land rigs in the US operated by those companies that have three or fewer drilling rigs has grown significantly—over 50% of the land rigs now are being operated by companies that are drilling three or fewer wells.

"And these are the people like us, who, simply, when we get our cash, we have a prospect in the drawer, and we go drill it. When we don't have any cash, we don't drill it."

True said that the larger independents that have significant cash reserves on hand are able to balance their exploration programs much better through the cycles.

"There's been a lot of dramatic changes in the industry, but there's still that smaller element of the industry—the small independents—that if prices stay up, they'll go drill," True said.

"I just see the domestic industry facing a lot of the same problems looking into the future that we've had in the recent past: qualified personnel, capital, and access to the resource. These problems are not going to be solved," True added.