OGJ Newsletter

Market Movement

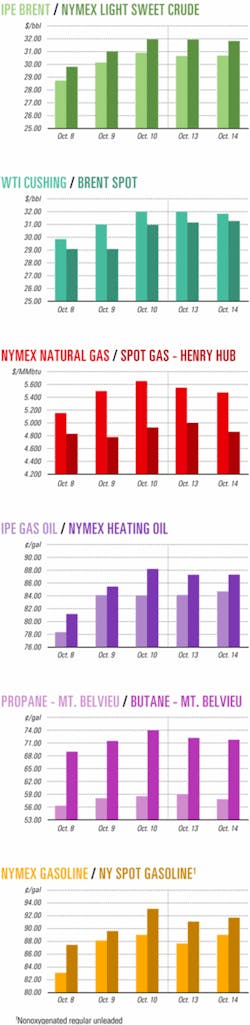

Energy futures prices fall in profit-taking

Energy futures prices fell early last week as traders took profits from the previous week's rally and awaited the next movements in US inventories of crude, petroleum products, and natural gas.

Those same commodity prices previously soared Oct. 9-10 on the New York Mercantile Exchange as cooler weather reminded traders that US inventories of distillate fuel were 18% below year-ago levels just weeks before the start of the peak winter demand period. That triggered a scramble by large commodity-fund speculators to reverse earlier bets that prices for crude and heating oil would fall this winter.

Odds favor colder winter

"Several current weather forecasts (including the ever-reliable Farmer's Almanac) are calling for cooler winter weather this year ([in major US fuel markets] where it matters)," noted J. Marshall Adkins, an analyst in the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla. "We have determined that there is less than a 20% probability that the winter will be warm enough to cause US natural gas prices to fall significantly below $4.50/Mcf," he reported Oct. 13. "We believe that winter gas prices are likely to averageU$4.50-6.50/Mcf, with a 30% probability that prices spike much higher with colder weather."

Based on previous history of winter withdrawals of natural gas from US underground storage, Adkins reported, "A normal winter weather scenario would leave us about 300 bcf short of the comfort zone" by next spring.

"After a 21% runup in the previous seven sessions, the [NYMEX natural gas] market was overbought and due for a profit-taking pullback," Enerfax Daily analysts said Oct. 14.

Iraq's oil exports sabotaged

The drop in oil futures prices early last week was not reversed by two explosions on oil pipelines in northern Iraq that are certain to hamper recovery of that country's oil export and refining capabilities.

One explosion hit the pipeline that connects Kirkuk, Iraq's second largest oil field, with an export terminal in Ceyhan, Turkey. That pipeline was already undergoing repairs of damage from an earlier bomb attack. A senior official of the US-led Coalition Provisional Authority that now rules Iraq recently reported those earlier repairs were expected to be completed by mid-October and that exports would resume from Ceyhan in November when storage tanks at that Mediterranean port were filled (OGJ Online, Oct. 6, 2003).

That pipeline at its most southern point passes near the town of Baiji, only 30 miles northwest of Tikrit, Saddam Hussein's hometown and a stronghold of his loyalists. All of the previous postwar attacks on the Kirkuk-Ceyhan pipeline occurred in that region (OGJ Online, Sept. 26, 2003).

The other explosion was on a pipeline carrying crude to the Baiji refinery, Iraq's largest.

Officials have said they are seeking other outlets through which to export oil from Iraq's northern fields. Postwar looting and sabotage of oil facilities have kept Iraq's oil exports well below its prewar level of 2 million b/d. Iraq currently is exporting 900,000 b/d of crude from its southern terminal of Mina al-Bakr on the Persian Gulf.

Record US oil imports

Meanwhile, US oil imports hit a new monthly high in September, averaging 10.36 million b/d, which was up by 18% from a year ago, American Petroleum Institute reported Oct. 15. The previous record was 10.11 million b/d in April 2001.

Total US imports of crude and petroleum products averaged more than 12.9 million b/d in September, up 16.8% from the same period in 2002. Imports of distillate fuel, including diesel and heating oil, shot up 92.3% from year-ago levels. US imports of gasoline averaged 820,000 b/d, up nearly 1% from last September, said API officials.

"Combined with a 13% increase in various refined overseas products compared with a year ago, total imports represented 66% of the US market in September. So far this year, imports have accounted for an average of about 62% of US consumer supplies," API said. Imports of Canadian crude totaled 1.97 million b/d in September, a 39.5% increase from the same time last year. Canada remains the top oil exporter to the US.

US oil production during September increased by 5.1% from the same time last year when production was abnormally low because Gulf of Mexico operations were curtailed by a hurricane. Alaska's production last month was 979,000 b/d, up by 10.5% from last year when heavy maintenance reduced production, said API.

The US market for gasoline, "as measured by deliveries," increased by 4.9% in September. "This occurred while retail gasoline prices dropped by more than 15¢/gal during the month. For the month as a whole, [US pump] prices averaged $1.68/gal for regular unleaded, which was still 20% higher than a year ago," API reported. F

NL Bulletin

The US House sent a strong signal to the White House and congressional leaders when it voted 229-182 on Oct. 15 to oppose a pending energy bill proposal to conduct an inventory of oil and gas resources on the Outer Continental Shelf, including areas now off-limits to drilling because of administrative and congressional moratoriums.

Sponsored by Rep. Lois Capps (D-Calif.), the House language instructs conferees on the Energy Policy Act (HR 6) to oppose the inventory provision, which the House has never accepted but was included in the latest discussion draft. An inventory plan was included in the earlier Republican Senate energy proposal S. 14.

But in the House, opposition to offshore drilling is very strong, even among typically proindustry members.

House Resources Committee Chairman Richard W. Pombo (R-Calif.), said his vote against drilling "renewed [my] pledge to oppose an [OCS] inventory in the energy conference." But Pombo insisted his offshore drilling views were not inconsistent with promoting domestic energy production and renewed his call for opening a portion of the Arctic National Wildlife Refuge.

"Earlier this year on the floor of the House, I made a commitment to oppose the inclusion of an OCS inventory in the energy conference," Pombo said. "I will stand by that commitment today and support the motion offered by Rep. Capps to instruct conferees to exclude the inventory provision.

"This Congress and the American people face increasingly difficult decisions with regard to domestic energy production," Pombo continued. "As lawmakers, we do not have the luxury of opposing all oil and gas production, nor would we be fulfilling our responsibilities to the American people if we maintained the status quo. We must have a balanced, comprehensive energy plan in America, and that requires increasing domestic supplies to meet demand. That is why I firmly believe we must choose to open ANWR for energy exploration and production.

"And while many citizens in the Lower 48 states do not want energy production in their backyards, the Inupiat Eskimo people, the only inhabitants of ANWR's coastal plain, do," Pombo stressed. "In fact, 75% of all Alaskans support safe oil and gas productions in ANWR."

Industry Scoreboard

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

null

null

Industry Trends

STRONG COMMODITY prices are offsetting rising finding and development costs.

Raymond James & Associates Inc. (RJA) issued an Oct. 6 research note saying that the US exploration and production environment offers good returns for new drilling, particularly natural gas wells.

"With solid industry fundamentals driven by historically high oil and gas prices, E&P companies are generating massive amounts of cash flow. And yet their market values still are trading at historically low levels," said analysts Jeffrey Mobley and Wayne Andrews in the Houston office of the St. Petersburg, Fla.-based RJA.

They believe it's a good time for oil and gas companies and for investors.

"Our large [capitalization] E&P coverage universe is currently trading at only $1.30/Mcfe of proved reserves. We believe this is significantly below a fair value range of $1.50-1.75/Mcfe, given that the 12-month natural gas strip is currently at $4.90/Mcf, and cash flows for 2003 are estimated to be 55% higher than in 2002," Mobley and Andrews said.

They noted that some analysts suggest reinvestment risk could pose a problem for E&P companies. Those analysts say that rates of return on drilling new wells are too low to justify the investment, and that E&P companies will destroy capital.

"It is no secret that the US supply basins are relatively mature and most, if not all, of the 'low hanging fruit' has been drilled during previous cycles. With the best prospects already drilled, smaller average reserve targets per well and rising unit F&D costs continue to be the norm in the industry," Mobley and Andrews said.

Acknowledging that higher F&D costs are putting downward pressure on drilling returns, the RJA analysts emphasized that they believe current commodity prices more than offset the higher costs. Findings costs currently are running about $1.50/Mcf.

"We believe drilling an additional well in the current E&P operating environment is highly economical," generating "very generous E&P returns," they said.

The two most critical factors affecting rates of return on wells are commodity prices and F&D costs. Gas prices are at historically high levels, more than compensating for the increase in F&D costs, they said.

"Over time, we expect finding costs to continue trending upward as prospect quality continues to diminish," Mobley and Andrews said. "The industry as a whole is experiencing production declines, which is supporting high natural gas pricesU. In other words, revenues are far outpacing costs."

US INTEGRATED companies are expected to see strong earnings this year.

Merrill Lynch Global Securities Research & Economics Group has raised its third quarter and 2003 earnings per share estimates based upon strong commodity prices and downstream margins.

The New York-based Merrill Lynch said refining indicators show that the integrated oil companies will achieve an even greater level of downstream profitability in the third quarter than the firm had anticipated.

"Refining indicators in the US were 20-30% higher than robust second quarter levels in all regions," analysts said.

Government Developments

POPULAR OPPOSITION to Bolivia's plans to export LNG threatens to oust that country's government.

For the second time in 8 months, the presidency of Gonzalo Sanchez de Lozada hung in the balance at presstime. Riots that led to a bloodbath in the Bolivian capital and neighboring city of El Alto left dozens of people dead.

Antigovernment opposition groups mobilized thousands of people to protest plans by a consortium led by Repsol-YPF SA, BG Group PLC, and PanAmerican Energy Inc. to export some of Bolivia's vast natural gas reserves via Chile to Mexico and the US.

The president's backing for the ambitious $5 billion Pacific LNG gas export project was undermined. To try to restore calm, Sanchez de Lozada made a television address to the nation announcing his intention to stay on the job, come what may, and to issue a supreme decree committing the government to "no new gas exports."

The decree says the government will first carry out a "people's consultation" and reach consensus on what is to be done with Bolivia's newfound gas wealth. Opponents complain that 18% royalties payable by foreign oil companies on gas exports are too low, and that the scheme will benefit others more than Bolivia.

Protestors chanting, "Our gas is not for sale," called for Bolivia's gas to be monetized inside the country in new industrial development schemes and to not be sold cheaply abroad.

The government has failed in its attempt to explain that the two schemes would have to go hand in hand. Extraction of Bolivian NGLs and methane for petrochemical feedstocks and other uses are not deemed economically feasible without a major increase in gas production tied to an export scheme.

US TAR SANDS leasing legislation is making progress.

The US House of Representatives Oct. 8 passed an oil industry-supported measure sponsored by Rep. Chris Cannon (R-Utah) that aims to remove regulatory uncertainty surrounding tar sands leasing on federal lands. The Senate has yet to consider the bill.

HR 3062 amends the Mineral Leasing Act to authorize the secretary of the Interior to issue separate leases for tar sands and oil and natural gas within the same area. Sponsors of the measure say federal land managers find the existing law confusing because it combines leases for both resources, often triggering "complex" environmental reviews that discourage exploration.

Cannon said that the Department of the Interior knows of 11 designated tar sands areas in Utah covering more than 1 million acres of federal land. Since those areas were made available for development in the early 1980s, only one lease has been issued.

Some public land advocates say that the new bill may cause split-estate problems similar to what has happened with coalbed methane production. But the bill's supporters do not foresee extensive legal ramifications.

The measure requires a lease for tar sands to be issued using the same bidding process, annual rental, and posting period as a lease issued for oil and gas.

Quick Takes

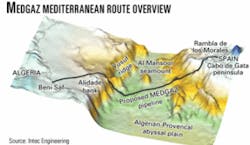

THE MEDGAZ CONSORTIUM has awarded Intec Engineering (UK) Ltd., Woking, UK, a contract to perform front-end engineering design for the ultradeepwater MedGaz pipeline project. The system will deliver as much as 16 billion cu m/year of Algerian natural gas to Spain for European markets. Initial deliveries in third quarter 2006 will be 7 billion cu m/year.

MedGaz plans 200 km of dual 24-in. high-pressure subsea pipelines from Beni Saf, Algeria, to landfall at Playa del Charco, near Almeria, Spain. The lines include shore approaches and short onshore pipeline sections connecting onshore terminals at each end of mainlines that will be installed in water as deep as 2,160 m.

Intec also will prepare bid packages for engineering, procurement, installation, and commission of the lines. Front-end engineering is slated to be completed in February 2004. Survey vessels currently are gathering geotechnical information along the pipeline route.

MedGaz partners include Algeria's national oil company Sonatrach, Cía. Española de Petróleos SA, Endesa SA, Iberdrola SA, BP Group LLC, Total SA, and Gaz de France.

In other pipeline activities, the first 950,000 bbl of crude oil from the recently completed Chad-Cameroon oil pipeline was offloaded into a tanker Oct. 3 from a floating storage and offloading (FSO) vessel in the Gulf of Guinea 7 miles off Kribi, Cameroon, and is being delivered to world markets. The system transports oil 660 miles from landlocked Bolobo, Miandoum, and Kome fields near Doba in Chad, through eastern Cameroon to Kribi, where it is transported to the FSO. The $3.7 billion pipeline and oil development project is a partnership of the governments of Chad and Cameroon, the World Bank Group, and sponsors Esso Exploration & Production Chad Inc. 40%, Malaysia's national oil company Petronas Carigali Sdn. Bhd. 35%, and ChevronTexaco Corp. 25%. Esso, an ExxonMobil Development Co. subsidiary, is operator. Drilling in the fields will continue during the next 2 years. Enbridge Energy Partners LP, following a successful open season on its proposed East Texas natural gas transmission system expansion, is meeting with shippers to finalize agreements and discuss interconnects with other pipelines. The proposed 100 mile pipeline will originate near Bethel in Anderson County, Tex., and terminate at the Carthage Hub in Panola County, Tex. The 500 MMcfd system will transport production from regional plays, including the Bossier sands and Barnett shale, relieving constraints now faced by shippers.

SAUDI BASIC INDUSTRIES CORP. (SABIC), Riyadh, reported that its United Petrochemical Co. subsidiary plans to construct a new 625,000 tonne/year ethylene glycol plant at its Jubail Industrial City plant site in Saudi Arabia. The new plant is expected to go on stream by yearend 2005.

Another EG plant, with capacity of 575,000 tonnes/year, currently is under construction at the site, and SABIC plans to award construction contracts for the new plant later this year.

SABIC announced earlier this year the securing of $1.15 billion in financing for the new plant (OGJ Online, Jan. 9, 2003).

DEVON ENERGY CHINA LTD., a unit of Devon Energy Corp., Oklahoma City, has begun production from Panyu oil fields in the South China Sea. Devon expects peak gross production of 60,000 b/d of oil by third quarter 2004.

Panyu, in about 100 m of water, is on Block 15/34 in the Pearl River Mouth basin of the eastern South China Sea about 200 km from Hong Kong. Oil is produced from two fixed platforms and stored in a floating production, storage, and offloading vessel. First shipments are expected in the fourth quarter of this year.

Devon operates the field for partners CNOOC Ltd. and Burlington Resources China Inc.

In other production news, Calgary-based Canadian Oil Sands Trust, managed by Canadian Oil Sands Ltd., has revised downward its predicted 2003 syncrude production to 78-80 million bbl from 81-83 million bbl. The new figure is due to unscheduled maintenance work requiring a complete turnaround at the Syncrude Joint Venture's oil sands facility at Fort McMurray, Alta. Syncrude Canada Ltd. operates the facility. The facility's Coker 8-1 primary upgrading unit, which experienced operational problems, was taken down Oct. 9 for maintenance. The turnaround is expected to take about 30 days.

PROGRESS ON SEVERAL FRONTS may soon lead to the first drilling in Canada's Yukon Territory in more than a decade. The Yukon expects to issue oil and gas rights in Southeast Yukon in spring 2004, Premier Dennis Fentie said in late September.

Meanwhile, Devon's Canadian unit is conducting geophysical surveys over Kotaneelee gas field, the territory's only hydrocarbon-producing area. Canada Southern Petroleum Ltd., Calgary, is evaluating the field's developed reserves and assessing further development opportunities on the lease.

Kotaneelee, in the southeastern Yukon, in August yielded 25.2 MMcfd of gas and 1,549 b/d of water from the I-48 and B-38 wells and has produced about 200 bcf of gas since 1979. Gas is declining, however, and water production is rising, Canada Southern noted.

Only 71 wells have been drilled in the Yukon, the last a Kotaneelee development well in 1991.

A multiyear lawsuit that involved gas marketing from the field and other matters was settled Oct. 3 (OGJ Online, Apr. 15, 2003), providing greater likelihood that further Kotaneelee development could occur, but it includes no commitment by working interest owners to develop further.

But Hunt Oil Co. of Canada last year paid $1.16 million to explore 155 sections with an area of about 40,200 ha in the Peel Plateau area just south of the Arctic Circle (OGJ Online, Feb. 1, 2002).

In other exploration activities, BHP Petroleum Pty. Ltd., Melbourne, has discovered oil with its Crosby-1 well in the Exmouth subbasin 27 miles off Western Australia. The well, drilled to 4,022 ft MD, encountered a 112-ft oil column in the Pyrenees member of the Cretaceous Barrow Group. Crosby-1, in 646 ft of water, could be developed in conjunction with nearby Ravensworth oil field, said partner Apache Corp., Houston (OGJ Online, July 24, 2003; map OGJ, Aug. 4, 2003, p. 8). "CrosbyUis potentially larger than Ravensworth, as additional oil column may exist updip with no gas cap encountered in the Crosby wellbore," said Apache. Appraisals of both discoveries and additional exploration drilling will be undertaken early next year. Apache also reported that the Van Gogh-1 appraisal well for Vincent field, which extends onto acreage of the Exmouth subbasin 9 miles north of Ravensworth, had encountered an oil column in the Cretaceous Barrow Group. An additional well will be required. Operator BHP has 40% interest in the producer; Apache 31.5%; and Tokyo-based Impex Corp. 28.5% EOG Resources Inc. is conducting a five-well, $75 million gas exploration and development program off Trinidad's east coast. The wells are expected to be drilled back-to-back using the Santa Fe Atlantic rig. EOG will spud the first wells on both Modified U Block and Lower Reverse L Block. Extensive 3D seismic has shown "promising" locations on Modified U Block, EOG said. Development wells also will be drilled on EOG's SECC Block as it attempts to bring on stream its Parula well that discovered almost 500 bcf of natural gas. ChevronTexaco reported a new deepwater Gulf of Mexico oil discovery at the Sturgis prospect on Atwater Valley Block 183 about 150 miles southeast of New Orleans. The Glomar Explorer drilling vessel drilled the Sturgis No. 1 exploratory well in 3,700 ft of water to 25,005 ft TD July 1. The well encountered more than 100 ft of net pay sands, ChevronTexaco said. It also drilled a sidetrack well to 27,739 ft TD and plans additional appraisal wells to delineate the discovery. ChevronTexaco is operator of the Sturgis prospect, and partners are Devon and Canadian firm EnCana Corp. Devon and equal partner Kerr-McGee Corp., Oklahoma City, reported that drilling operations at the Yorktown prospect on Mississippi Canyon Block 886 in the Gulf of Mexico are being abandoned temporarily. "The lower section of the hole had deteriorated, and we couldn't reach total depth," Devon's Brian Engel said. Kerr-McGee added: "A revised drilling plan is currently being developed; however, operations are not expected to resume until 2004." The prospect lies in 2,500 ft of water. Devon is operator of the well, which was being drilled to the Middle Miocene objective and was targeted to reach 25,000 ft TD.

CHEVRONTEXACO unit Caltex (Philippines) Inc. is planning to spend $13.6 million to convert its Batangas oil refinery in the Philippines into a world-class, finished-products import terminal. The refinery, which currently has a 72,000 b/d refinery capacity, will have a storage capacity of 2.7 million bbl. The new Batangas regional supply and distribution hub would import 100% of Caltex's products for distribution throughout the Philippines, ChevronTexaco said.

Asian refining overcapacity, which has increased competition and depressed refining margins, spurred the changeover. ChevronTexaco expects the terminal to be operational by the fourth quarter.

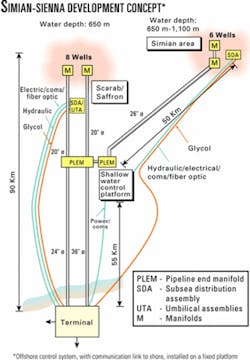

BURULLUS GAS CO. has selected Intec Engineering (UK) Ltd. to provide engineering services for the development of deepwater Simian-Sienna and Sapphire gas fields off Egypt.

Burullus operates the West Delta Deep Marine (WDDM) concession north of the Nile Delta in the Mediterranean Sea for Egyptian General Petroleum Corp., BG Egypt SA, and Petronas Carigali. The project includes a 70-mile, 26-in. gas pipeline that will tie in to facilities at nearby BG-operated Scarab Saffron field.

Technip-Coflexip earlier won a contract for subsea development of Simian-Sienna, which is expected to produce 665 MMscfd of natural gas for the Egyptian LNG plant being built 71 miles away at Idku, east of Alexandria (OGJ Online, July 8, 2003). First hydrocarbons from Simian-Sienna wells are planned for third quarter 2005. Sapphire, west of Scarab Saffron, is scheduled to tie eight production wells in to WDDM in 2006.

Initial development will consist of four production wells in Simian and two in Sienna in water 2,221-3,258 ft deep. Each field will have two production hubs and a 20-in. infield pipeline between two manifolds. Also planned is a dedicated state-of-the-art controls system, 4-in. glycol injection pipelines, and a controls platform linked to an onshore facility via a combined power and communications umbilical.