OGJ Newsletter

Market Movement

OPEC makes surprise cut in production quota

In a surprise move last week, members of the Organization of Petroleum Exporting Countries voted to trim their production quotas by 900,000 b/d to 24.5 million b/d, starting Nov. 1.

That effectively offset previous action at OPEC's April meeting when members raised production quotas by 900,000 b/d as of June 1. At that time, OPEC ministers also announced a simultaneous 2 million b/d cut in actual production in an attempt to rein in overproduction and regain credibility with world markets.

"Since June, production by the OPEC 10 [the active members minus Iraq] has risen by 70,000 b/d to 25.8 million b/d. Including Iraq, production has risen by 640,000 b/d to an estimated 26.9 million b/d," said Frederick P. Leuffer, an analyst with Bear, Stearns & Co. Inc., New York.

Still, several OPEC ministers previously indicated that no production change was contemplated at the Sept. 24 meeting in Vienna. At the start of that session, Abdullah bin Hamad al-Attiyah, Qatar's energy minister and OPEC conference president, noted, "Crude oil prices have weakened since our last meeting 2 months ago, but they remain within the range of our price band of $22-28/bbl for OPEC's reference basket [of seven benchmark crudes]."

However, futures prices for oil and petroleum products immediately spiked Sept. 24 in New York and London markets as OPEC's surprise move to curb production sparked a buying frenzy. The November contract for benchmark US light, sweet crudes soared by $1.11 to $28.24/bbl in the biggest 1-day surge since Aug. 1 on the New York Mercantile Exchange. The spot market cash price for benchmark US crude at Cushing, Okla., shot up by $1.15 to $28.08/bbl. In London, the November contract for North Sea Brent oil gained $1.15 to $26.67/bbl. The average price for OPEC's basket increased by 45¢ to $25.59/bbl that same day.

Make room for Iraq

OPEC's decision to cut production ahead of increased winter demand was generally viewed by analysts as a move to make room for additional oil production from Iraq, which was represented at the Sept. 24 meeting for the first time since the invasion of that country by US-led coalition forces to oust Saddam Hussein from power.

At that session, Ibrahim Bahr al-Ulum, Iraq's new oil minister, said his country is now exporting 900,000 b/d of oil and expects to increase exports to 1.5 million b/d by yearend and to 1.8 million b/d by the end of March. Iraq currently is producing 1.8 million b/d, but is forced to reinject 200,000-250,000 b/d, he said.

"While Iraqi [oil] production has been averaging about 1 million b/d for most of the summer, [it] has increased to 1.5-1.8 million b/d during the past few weeks and is expected to reach 2.8 million b/d by the end of March," said S. Magnus Fyhr, an analyst in the Houston office of Jefferies & Co. Inc., New York. "This forecast is significantly ahead of our expectations, as we believe increasing terrorist activity in Iraq will continue to limit exports from the northern oil fields of Kirkuk."

Frequent pipeline explosions and fires—usually blamed on terrorist attacks—in northern Iraq have hindered efforts to transport crude to Iraqi refineries or to an export terminal in the Mediterranean port of Ceyhan, Turkey.

"However, given the projected increases in Iraqi production and the fact that oil prices [declined more than] $3/bbl during the past 3 weeks [before Sept. 24], we understand why OPEC is taking a more cautious view on near-termUproduction to support oil prices above $25/bbl," Fyhr said.

OPEC protects revenue

"OPEC is sending a signal that, for now, it remains focused on revenue enhancement, at the expense of market-share protection," said Leuffer. "However, it remains to be seen whether OPEC actually will cut production. Through August, only Venezuela, which is still suffering the effects of the oil workers' strike, and Indonesia [were] in compliance with current quotas."

He speculated that current world oil supplies exceed projected fourth-quarter demand by 1.1 million b/d. "Our estimates of the 'call' on OPEC oil in the third and fourth quarters are 24.8 million b/d and 25.8 million b/d, respectively. Based on August production, OPEC volumes exceed our estimate by 1.5 million b/d in the fourth quarter," Leuffer said.

OPEC ministers "must take into consideration the state of the world economy. Low [economic] growth rates and increasing unemployment will not help demand. Forecasted increases in non-OPEC output will provide an added element of pressure on the call on OPEC oil," said Al-Attiyah.

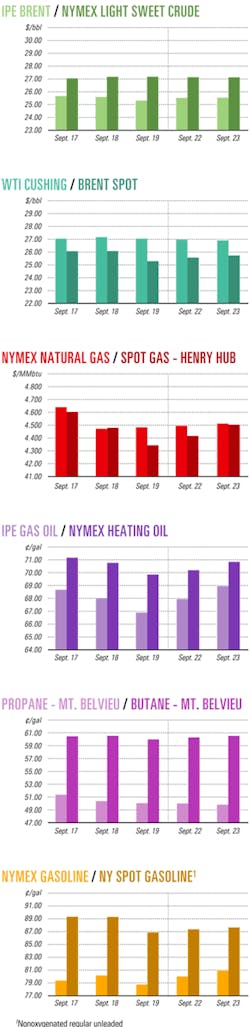

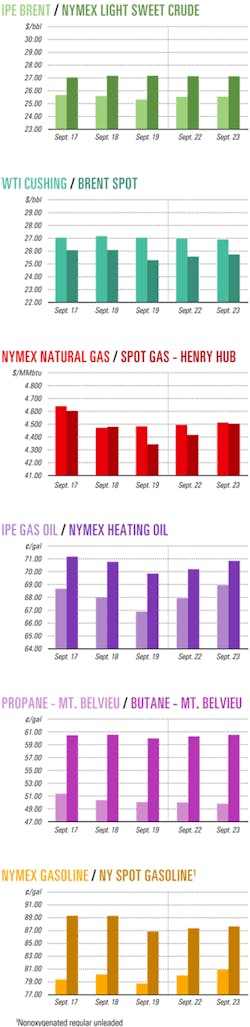

Industry Scoreboard

null

null

null

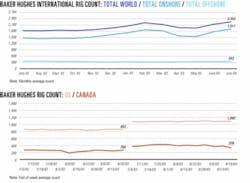

Industry Trends

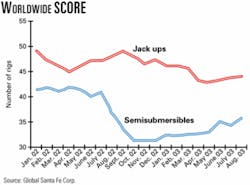

JACK UP RIG day rates across much of the world are on the increase.

Houston-based GlobalSantaFe Corp.'s worldwide Summary of Current Offshore Rig Economics (SCORE) for August 2003 was up from the previous month's SCORE by 2.4%.

"We're encouraged by the trend in jack up utilization and day rates in the major drilling markets of West Africa, North Sea, and Gulf of Mexico," said GlobalSantaFe Pres. and CEO Jon Marshall.

SCORE compares the profitability of current mobile offshore drilling rig day rates to the profitability of day rates at the 1980-81 peak of the offshore drilling cycle. At that time, SCORE averaged 100%, and new contract day rates equaled the sum of daily cash operating costs plus about $70/day/$1million invested.

Southeast Asia showed a decline for August, down 1.1% for all classes of rigs to a SCORE of 48.4. All the other regions showed an improvement.

The Gulf of Mexico was up 2.9% to 34.4 for the month, the North Sea rose 4% to 42.6 for all rig classes. West Africa climbed 2.4% to a SCORE of 46.6.

The SCORE for jack up rigs worldwide improved by 0.8% to 44.2, while semisubmersibles rose by 4.2% to 35.8.

US DEMAND growth for petroleum products is expected to outpace the "creep" of added US refinery capacity in 2003-04 for the first time since 1999, said Prudential Equity Group Inc., Newark, NJ.

"We forecast an average annual product demand growth rate of 1.6% over the 2003-04 period, 527,000 b/d greater than our average annual capacity growth forecast (0.4%) for the same period," analysts said.

According to the group's sixth annual survey of 26 companies that account for 96% of US refining capacity, that capacity "will likely increase by 0.2% in 2003 and 0.5% in 2004." That's less than the 2002 increase of 1.3% and below the average annual increase of 1.1% in 1998-2002.

Government Developments

A NATURAL GAS report predicts US energy consumers could save $1 trillion in gas costs over the next 2 decades if the White House's energy policy strategy is adopted.

That word came from industry officials familiar with the National Petroleum Council document before it was released last week.

The report is said to outline a portfolio of policy choices that Department of Energy officials will tout as a way to dampen market volatility, sources said.

The report predicts that "traditional" North American production will be able to meet only 75% of US gas demand by 2025. To meet new demand, policymakers will need to allow drilling in areas now off limits, encourage energy efficiency and LNG regasification plants, and promote more fuel-switching among industrial customers.

Report authors said the key messages of the study are the following: North America is no longer gas self-reliant; the US must balance its energy policy to ensure that incentives to use gas match access to gas reserves, and future supply-demand balance requires energy efficiency and supply diversity.

The NPC report comes as the US Congress moves toward final negotiations over a comprehensive energy bill. Republican leaders hope to reach consensus on final legislation early next month, but parts of the bill are so controversial that discussions could stall the process through the fall.

Anticipating criticism from environmental groups, the report is expected to point out the study only recommends that access to all moratorium areas be considered as part of a balanced gas future; it does not recommend one area over another or favor any companies' interests over others'.

NPC study authors also will note that their analysis shows that new areas will need to be available for exploration and production in order to meet projected demand for gas.

With regard to leasing in the Arctic National Wildlife Refuge—a provision now in the House energy bill—the NPC study does not show any reserves or drilling opportunities in ANWR, nor does it address the conflicting positions taken by both sides in that debate.

NPC does maintain that the environmental impact of increasing gas supplies through many areas now off limits to drilling could be minimized.

The report is expected to note that while much of the resource base is indeed available for drilling, many areas that are restricted offer higher promise for economically recoverable resources. NPC also is expected to state that 205 tcf of the estimated 1,250 tcf of gas representing the technical resource value is restricted either by lease stipulation or drilling moratoria.

Report authors will note that the 1,250 tcf value is roughly twice the size industry expects to be able to recover economically, even with higher gas prices. NPC also will say that undeveloped areas such as the Rockies, the eastern Gulf of Mexico, and the other offshore moratorium areas offer the potential of larger fields.

Outside of the Rockies and the gulf, production will not grow and will most likely decline slightly, the report will note.

Quick Takes

ConocoPhillips and TransCanada Corp. have formed "Fairwinds," a joint venture that will evaluate a site in Harpswell, Me., about 15 miles northeast of Portland, for the development of an LNG regasification facility.

The Fairwinds JV is asking Harpswell residents to vote on leasing the site, which is owned by the town.

With necessary regulatory approvals, the Fairwinds project could begin construction as soon as 2006 and begin full operation of the plant in 2009.

Natural gas from the facility would be delivered through a proposed pipeline connecting to an existing mainline in Maine, TransCanada said.

In other LNG news, Peru LNG SRL is advertising a public hearing to be held Oct. 2 on an environmental impact study for its project to export LNG from Camisea fields in Peru to the US or Mexico beginning in 2007. The EIS includes the Pampa Melchorita LNG export project and marine installations. The LNG facilities are to be located 169 km south of Lima in the San Vicente de Cañete district between Cañete and Chincha. Peru LNG estimates total costs of the onshore project at $1.6 billion. Meanwhile, it is seeking contractors for the liquefaction plant and LNG carriers. Dallas-based Hunt Oil Co. and South Korea's SK Corp. are managing the project.

PETROLEUM CO. OF TRINIDAD & TOBAGO LTD. (Petrotrin) plans to spend $1 billion to upgrade its 90-year-old Point a Pierre refinery over the next 6 years to meet stricter environmental requirements and produce higher-valued products for markets in the Caribbean and the US.

Eight products currently are produced at the 160,000 b/d refinery: fuel oil (which will be greatly reduced from a 37% yield), LPG, aviation fuel, motor gasoline, kerosine, gas oil, bitumen, and sulfur.

Companies will be invited to bid for upgrading contracts as early as yearend, Petrotrin said. The first set of contracts will be worth $300 million.

Petrotrin also said it is seeking a partner for the refinery project to reduce operating costs.

In other refining news, Viet Nam has started construction on its long-delayed first refinery, Dung Quat, which is slated to be operational by Dec. 31, 2006. A proposed second refinery for northern Viet Nam is expected to be operational in 2008. Petrovietnam has 100% interest in the refinery since Russia's Zarubezhneft withdrew from a previous joint venture (OGJ, Oct. 29, 2001, p. 66). Although the first refinery has taken more than a decade to get under way, officials said they anticipate that a second refinery could be built in about 2 years. The $1.3 billion Dung Quat refinery, in central Viet Nam, will have a 6.5 million tonne/year capacity. A site has yet to be selected for the second refinery, which would have a capacity of 7 million tonnes/year and currently is in the conceptual design phase, Petrovietnam officials said. Foreign investment in the form of a joint venture will be sought for the second refinery. In the future, Petrovietnam would like to invest in petrochemical plants also, particularly naphtha crackers, officials said.

QATAR PETROLEUM CO. and PetroWorld Ltd. signed a heads-of-agreement in Doha Sept. 14 to jointly build a world-scale, 12,000-15,000 tonne/day methanol plant at Ras Laffan Industrial City in Qatar.

PetroWorld will conduct a feasibility study, to be completed by yearend, and will develop a plan for process selection and project implementation. The partners expect the proposed $1 billion plant to be on stream by 2008.

Qatar's North field will provide natural gas feedstock for the plant, which will produce fuel-grade methanol for electric power generation plants in areas inaccessible to pipeline gas and LNG.

PetroWorld is a 50:50 joint venture of Petroleum Oil & Gas Corp. of South Africa Pty. Ltd. and Transworld Exploration Ltd., Houston, part of the Transworld group of companies.

A CONSORTIUM led by Woodside Petroleum Pty. Ltd. plans to production-test the Chinguetti 4-5 appraisal-early development well on Block 4 in the Atlantic Ocean off Mauritania, a participant reported. Not yet declared commercial, Chinguetti could become Mauritania's first producing field as early as 2006. Early reserve estimates are 100 million bbl.

Roc Oil Ltd., Sydney, said wireline logging "essentially confirmed the predrill expectation for this well in terms of the thickness, quality, and hydrocarbon content of the reservoir."

TD is 2,605 m.

Chinguetti-1, a 2001 discovery in the Senegal-Mauritania coastal basin, found good quality, low-sulfur oil in Tertiary Miocene deepwater turbidite sandstones on a typical salt dome. The discovery well is in 815 m of water 85 km northwest of Nouakchott (OGJ, Jan. 21, 2002, p. 30).

Participants are Woodside Mauritania Pty. Ltd. and Agip Mauritania BV 35% each, Hardman Resources Ltd., Perth, 21.6%, Fusion Mauritania B Ltd. 6%, and Roc Oil 2.4%. Fusion plans to sell most of its interest to Premier Oil PLC, London.

POSEIDON OIL PIPELINE CO. LLC has contracted with Front Runner field producers to transport crude oil via a proposed pipeline from a planned floating production spar on Green Canyon Block 339 in the central Gulf of Mexico to Poseidon's existing pipeline system on Ship Shoal Block 332. The existing pipeline delivers oil from the central Gulf of Mexico to Louisiana.

Poseidon would construct, own, and operate the new 36 mile, 14-in. pipeline from Front Runner field. The line will have a capacity of 65,000 b/d, expandable to 125,000 b/d. Poseidon expects the spur to be operational by mid-2004.

Front Runner field, in 3,500 ft of water, is 135 miles southeast of Houma, La. A spar-type floating production system, currently under construction, will serve as a production hub for Front Runner, Front Runner South, and Quatrain fields on Blocks 338 and 339. The spar will be capable of handling production of 60,000 b/d of crude oil and 110 MMcfd of natural gas.

Front Runner is owned by Murphy Exploration & Production Co. 37.5% along with Dominion Exploration & Production Inc., Richmond, Va., 37.5%, and Spinnaker Exploration Co., Houston, 25%. Operator Murphy estimates that the three fields hold a total of 150-230 million boe.

Poseidon is a subsidiary of GulfTerra Energy Partners LP 36%, Shell Oil Products US36%, and Marathon Oil Co. 28%.

In other pipeline activity, Cheyenne Plains Gas Pipeline Co., a unit of Houston-based El Paso Corp., has applied to the US Federal Energy Regulatory Commission for approval to increase to 36-in. an earlier proposed 30-in. natural gas pipeline from the Rocky Mountains to Kansas. Cheyenne Plains would construct and operate a 380 mile interstate line from the Cheyenne Hub south of Cheyenne, Wyo., to Greensburg, Kan. (OGJ Online, May 28, 2003). If approved, the new line would have an initial capacity of 560 MMcfd of gas expandable to 730 MMcfd within 1 year of starting service. The expansion proposal will hike the pipeline's construction cost to $425 million from $332 million, but the planned start-up date remains early 2005.

INDEPENDENT Devon Energy Corp., Oklahoma City, said it plans to file the necessary regulatory applications next month for the Jackfish thermal heavy oil project south of Fort McMurray, Alta.

Devon will apply the steam-assisted gravity drainage (SAGD) process, which it uses as operator of the Dover SAGD project (OGJ, Dec. 9, 2002, p. 39).

The Jackfish lease is designed to produce 35,000 b/d of crude oil from the Alberta oil sands when fully operational in 2008, Devon said. Devon, which owns 100% of the project, estimates total reserves from Jackfish to be 300 million bbl that could be recovered over a 25-year span. First production from the project is expected in late 2006 or early 2007.

In other development news, China's CNOOC Ltd. has begun Phase I development of Dongfang (DF) field 1-1, which has 90 billion cu m of reserves and is the company's largest independent gas field and China's second largest offshore gas field after Yacheng.

The project is part of China's revived offshore exploration and development program (see special report and map, OGJ, Dec. 17, 2001, p. 58). CNOOC is operator with 100% interest in the field.

DF 1-1, in the Yinggehai basin off Hainan province, about 110 km from Dongfang, is in the Beibu Gulf of the western South China Sea. Average water depth is 70 m.

In Phase I, CNOOC will drill 12 wells and construct a central platform, a production platform, and an onshore processing terminal. Designed production capacity will be 154.8 MMcfd.

CNOOC also expects to move up Phase II development to 2006 from 2008. After its completion, the field's production capacity will increase to 232 MMcfd.

HAMMERFEST STRØM AS, a consortium led by Hammerfest Power Co. and including Statoil ASA, Sintef Civil & Environmental Engineering in cooperation with the University of Edinburgh, Zurich-based ABB Group, and Rolls Royce PLC, installed a water turbine Sept. 17 in Kval Sound outside Hammerfest, in northern Norway.

The prototype, designed to generate electricity from the motion of powerful tidal currents flowing through the sound, will supply 700,000 kw-hr/year,enough electricity to supply 35 Norwegian homes, partner Statoil said. And unlike other tidal power stations, the new facility does not depend on the regular alternation in water height between high and low tide.

The submerged structure weighs 120 tonnes, and its turbine blades of fiberglass-reinforced plastic measure 10 m from hub to tip. Their rotation drives a generator, with the power transmitted to the land station through a submarine cable.

NORSK HYDRO ASA began oil production Sept. 23 from giant Grane field on Block 25/11 off Norway. It plans to start output from Fram Vest field in October.

As 12 predrilled wells are linked to the Grane platform in 120 m of water 185 km west of Haugesund, production will increase gradually until it peaks at just over 210,000 b/d in the first half of 2004. The 18.5° gravity oil comes from Tertiary sandstones at 1,700 m.

Grane receives gas from Heimdal gas center via a 50 km pipeline. The gas is injected with water into the reservoir to increase oil production (OGJ, Jan. 27, 2003, p. 50). Grane oil is being shipped through a 212-km pipeline to Hydro's terminal at Stura in Øygarden.

Norsk Hydro expects to recover 700 million bbl of oil from Grane.

The Grane licensees are Norsk Hydro 38%, Norway's state Petoro AS 30%, ExxonMobil Corp. 25.6%, and ConocoPhillips 6.4%.

Fram Vest oil is to be piped to Troll facilities, where capacity will limit Fram Vest output to 45,000 b/d until it peaks at 60,000 b/d in early 2004 (OGJ Online, July 18, 2001).

PAKISTAN NATIONAL SHIPPING CORP. (PNSC) has purchased a 97,789 dwt tanker valued at $5.5 million to facilitate completion of contracts to transport 7.35 million tonnes/year of crude oil for three refiners in Pakistan.

Currently, PNSC is transporting the crude oil through a chartered vessel. PNSC expects that anticipated savings from use of the new tanker will enable it to purchase a second vessel later.

The single-hull tanker, which PNSC has renamed MT Shalamar, has a capacity of 78,000 tonnes of liquid cargo.

Meanwhile, efforts to remove oil from a leaking, PNSC-chartered Greek vessel wrecked off Pakistan's east coast suffered another setback. A ship involved in the lightering operation broke down as rough seas hampered transfer efforts, an official said. As of late August, the remaining 18,000 tonnes of oil in the MV Tasman Spirit had not been removed. The vessel was delivering 67,000 tonnes of oil for Pakistan Refinery Ltd. when it ran aground outside Karachi port July 27 and foundered (OGJ Online, Aug. 25, 2003).