Other important issues loom in JDA negotiations

JOINT DEVELOPMENT AGREEMENTS—3

The third and concluding part of this article involves other topics either not always applicable or that may be left for a later date before receiving proper consideration.

That is not to say these matters are not important. As will become clear, some of these matters are extremely important and must be carefully dealt with at some stage. However, the importance of reaching agreement in respect of many of these matters may depend very much upon the type of structure that has been chosen for the joint development zone.

For example, if the parties have agreed that a single state should be responsible for development and should manage it in accordance with its own laws, little is left to be agreed jointly. On the other hand, in most cases where a joint authority is set up, almost everything will have to be agreed by the parties.

Third party rights

The first issue to consider is third party rights.

What happens in circumstances where—at the time the zone is set up by agreement—one or other of the state parties has already awarded rights to some contractor or concessionaire in the zone? This will, to a large extent, depend upon the attitude of the two governments and their willingness to accommodate each other to the greatest extent possible. It will also depend on the attitude of the relevant third party.

The ideal solution, and the one most likely to please most people, would be to allow such third party rights to remain entirely in place (which would actually be possible under the single state management structure) or at least in place as much as possible. For example, in the case of a joint authority, it could be agreed that the joint authority will itself award the relevant third party a concession or rights similar to those already held.

On the other hand, a state might take the view that since the area is disputed, the other state has no right to award contracts or concessions and consider any such award to be the other state's problem. Of course, taking such a position will not help negotiations run smoothly.

If either state is not willing to honor such third party rights, the government that awarded them might find itself defending against a claim for compensation owing to its failure to guarantee these rights.

Exchange of information and joint committees

Another issue that might merit consideration is the exchange of information.

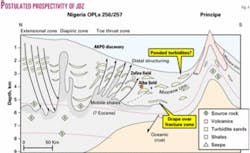

Since development is supposed to be joint, it seems only proper that all information which either party has in relation to, say, prospectivity (Fig. 4), should be shared with the other party. Once such information is exchanged, it would be prudent to have in place provisions to preserve confidentiality.

The need for communication of this type leads on to the next possible ingredient of a joint development agreement, namely the setting up of joint committees—even in cases where there is no joint authority.

Such committees can be useful for the purposes of coordinating approaches and policy and solving problems. Equally, they may be useful venues for other matters that require communication.

Applicable rules-regulations

An important matter that must be considered is the body of rules and regulations that will apply in the zone.

To some extent, this will depend on what body is responsible for managing development. Under a single state management scheme, it seems likely that the managing state's rules and regulations will apply across the board; and the problem in relation to the two state joint venture structure has already been considered above. However, in the case of a joint authority, in a sense everything is "up for grabs." In practice, different aspects will have to be dealt with separately.

Petroleum regime

First, it is necessary to consider the petroleum regime—the rules and regulations under which petroleum activity is carried out.

On the one hand, it could be agreed that the petroleum regulations of one or other of the parties will apply. Alternatively, a new set of regulations could be agreed between the parties. This could be done at the time the main agreement is signed, or later on, as was the case for the Nigeria-STP zone.

However, agreeing on a single regime for petroleum activity—which may include the procedure for awarding concessions—might be difficult, particularly if the two states have systems which are markedly different, for example, where one state favors participation through production sharing agreements while the other has a licensing and royalty system.

Tax regime

A somewhat—although not entirely—related issue is the tax regime that will apply to the zone.

How will the governments collect their share of the resources that are exploited? Normally, the tax regime will depend on the underlying management structure.

As mentioned, where only one state is managing the zone, that state will normally collect revenue and then divide it between the states in the agreed proportions. In the case of the two state joint venture structure, each of the concessionaires will simply fulfill its fiscal obligations to the government that awarded its concession.

The position in relation to joint authorities, however, is less certain. Since the joint authority is responsible for the award of concessions, it might seem natural that it should itself collect revenue in relation to such concessions, in accordance with its own regulations, and pass the appropriate shares on to the two governments. To do so, the joint authority would have to adopt and apply its own tax regime. This was in fact the route followed in the Nigeria-STP zone.

A simpler alternative—which was adopted in respect of the Timor Gap Treaty—is to stipulate that each of the two state parties will tax concessionaires directly by assessing them for exactly 50% (or some other agreed percentage) of the revenue that they would have been assessed for had they been considered wholly under the jurisdiction of that state, and subject only to its tax regime.

As well as the tax regime for petroleum exploitation, other tax and fiscal issues will need to be considered, for example, taxation in relation to employees, as well as customs. Concerning customs, the states will need to agree what status the zone will have for the purposes of import and export duties.

Unitization

Although a joint development zone will solve certain problems associated with boundaries, it will not remove the need to deal with the situation where a petroleum reservoir is straddling a boundary.

In fact, since the perimeter of a JDZ is inevitably longer than the section of boundary that would otherwise be present, the likelihood of unitization being required is in a sense even greater than in the case of a conventional boundary. If unitization does take place at the international level, it will be taking place between the zone—as it were—and the maritime area of a state party or even a third state which is not involved in the joint development zone.

The joint development agreement might contain provisions requiring the states to cooperate in relation to such unitization scenarios. It might also mention the need for unitization to be agreed in respect of the boundaries of different blocks within the zone, in cases where the zone is structured in that way—although strictly speaking, this could be left as part of the petroleum regime, which might be decided later.

Other resources

As already mentioned, although in many cases petroleum is the main resource being developed within the JDZ, the parties may wish to jointly develop other nonliving resources as well as fisheries.

In principle, such other resources could be dealt with in as much detail as petroleum. Alternatively, it is possible to include certain basic provisions in the agreement that highlight the need for further agreement to be reached in respect of the development of such resources in the future and establish temporary measures for the time being.

Health-safety and environmental issues

In most cases, the parties will need to agree on regulations and policies in relation to health and safety and environmental issues.

These include the design and maintenance of installations and work systems and agreed procedures for preventing and remedying pollution. In these matters it might be particularly important for there to be a system of communication between the states so that, for example, they are able to jointly inspect installations and working procedures. However, some thought should also be given to whether, in emergency situations, one state will be able to unilaterally inspect and—if necessary—order the cessation of operations.

Other applicable laws, enforcement, security

The parties will also want to agree what other laws will apply to the zone.

Here, unlike in the previous cases where the adoption of regulations has been discussed, the creation of a whole new body of incidental laws for the zone—for example, tort law, employment-labor law and criminal law—would be extremely impractical, and it would almost certainly be necessary for the parties to agree to adopt one or other of the state's laws for the whole of the zone or to agree that each state's laws should apply respectively in relation to specified parts of the zone.

Another possibility is to base applicable law on the nationality of the individual involved, and this system was adopted in the Nigeria-STP JDZ in relation to criminal law and jurisdiction.

It may also be appropriate for the parties to agree to cooperate in relation to the enforcement of whatever laws are applicable, since such enforcement may depend upon cooperation, in a case where an individual or, say, some relevant evidence is located in the territory of the other party. If there is to be a joint authority, it is possible to vest the authority with its own powers of enforcement in relation to its regulations, although this would probably have to be limited to activity within the zone itself. The parties will also need to agree on security measures for the zone.

Dispute resolution

As with any international agreement, it would be prudent to include provisions as to how disputes relating to the agreement will be dealt with. At the very least these will normally include a requirement for the two states to consult at some level for some period of time. While some agreements will leave the resolution of disputes to such diplomacy, others will allow for third party settlement, which may be by either binding arbitration or resort to some appropriate tribunal, such as the International Court of Justice in The Hague.

In respect of zones with a joint authority, there is one further issue that might need to be considered, which relates to the question of what happens when there is a dispute within the joint authority. Although in many cases, such a dispute might be left for settlement by the two governments and then third party settlement provisions, there are some scenarios where third party resolution may not be appropriate, in particular where the dispute results in a deadlock over policy—for example, a dispute as to whether or not the joint authority should hold a licensing round at a particular time.

Unless a procedure for breaking such deadlocks is devised, there is a real danger that the work of the authority might grind to a halt. Resort to higher levels of governments is one possible method of dealing with such situations.

Duration and termination

Finally, as already mentioned, it will be necessary to include provisions relating to the duration of the zone and the termination of the agreement.

A duration of at least 30 or 40 years is probably desirable, if only to allow a sufficient period for exploration and exploitation to take place and to give certainty to potential investors concerning the continued existence of the zone and its system. Whether or not a minimum duration is agreed, the parties might wish to specify that termination of the joint development agreement can only take place with several years' notice, for the sake of certainty.

Another possibility is for the parties to agree that despite the termination of the agreement itself, the rights of contractors and concessionaires will continue in place. This is the approach taken in the Nigeria-STP Treaty, which also provides that, after termination, the joint authority will continue to exercise its necessary functions in respect of such contracts.

The author

David Lerer (davidlerer@ kendallfreeman.com) is a member of the public international law group of Kendall Freeman solicitors, London. He has been involved in border cases involving Cameroon and Nigeria, Nigeria and Sao Tome e Principe, and Botswana and Namibia. He was an advisor to Kenya on its Exclusive Economic Zone and maritime boundaries and is a member of the team dealing with cross-border water resources in relation to Mozambique. He joined Kendall Freeman in 1993.