OGJ200 list shrinks following more consolidation

The OGJ200 list of publicly traded US oil and gas producers has shrunk to 154.

Although mergers and acquisitions in the oil and gas industry declined last year, such activity claimed nine of the companies that appeared in last year's OGJ200 (OGJ, Sept. 9, 2002, p. 70). The total number of companies in that edition of this special report was 176.

Another nine firms no longer appear on the list because they sold their US producing properties, liquidated, or became private since the previous survey and are therefore no longer eligible to appear in the OGJ200.

This annual compilation—which reflects the prior year's financial and operating results—began as the OGJ400, then became the OGJ300 in 1991. In 1996, the report took on its current moniker, and the first time the list shrunk from 200 companies was 2 years ago when it contained 197 firms.

Click here to view OGJ200 in PDF.

Click here to view OGJ200 Company Index in PDF.

Earnings slide

Total 2002 net income for the OGJ200 companies plunged 39% from a year earlier, and total revenue declined 10%.

The OGJ200 ranks publicly traded, US-based companies by assets. Comparisons of one year's list to another year's compilation must take into account any changes among the companies therein, including the fact that this year's list contains fewer firms that it did last year. Although it contains no privately held companies or entities based outside the US, the list represents a substantial part of the US oil and gas industry.

Total 2002 net income for the OGJ200 group was $19.4 billion. The top two companies in the survey accounted for 64% of the total earnings of the 154 firms.

Total assets and stockholder equity for the entire group each moved up 5% from last year's survey.

The market

Oil prices in 2002 were slightly higher than during 2001, and natural gas prices were lower.

Worldwide oil demand rose by 400,000 b/d last year, the same as the increase the year before, according to the International Energy Agency. High prices and the global economic slump contributed to low growth in demand. The US wellhead price of crude oil last year averaged $22.51/bbl, up from 21.84/bbl in 2001.

The average US wellhead price for gas last year declined to $2.95/Mcf from $4.02/Mcf the prior year. Gas demand in the US was 22.46 tcf last year compared with 22.25 tcf the year before and 23.37 tcf in 2000, according to the US Energy Information Administration.

Meanwhile, EIA estimates that US dry gas production declined to 19.05 tcf from 19.68 tcf in 2001 and that US imports were nearly unchanged. However, gas supplies were plentiful throughout 2002 because of suppressed demand.

Drilling activity

Economic uncertainty decreased capital spending last year, which was reflected in lower drilling rates. The Baker Hughes Inc. count of active rotary rigs working in the US last year declined to an average 830 from 1,156 a year earlier. In 2000, the average rig count was 918, up from 625 in 1999.

The number of rigs operating in the Gulf of Mexico (GOM) also declined last year, to an average 109 from 148 the year before. GOM rigs drilling for gas dropped to an average 95 from 118, and rigs drilling for oil fell to an average 14 from 30.

The 2002 Canadian rig count averaged 266, down from 342 a year earlier and 344 in 2000. Baker Hughes's 2002 international rig count, which excludes the US and Canada, averaged 732, down from 745 the prior year.

Total US exploratory and development well completions numbered 28,125 last year, down from 36,754 in 2001, according to the latest estimates from the American Petroleum Institute.

The current crop of OGJ200 companies drilled 11,517 US net wells in 2002, dropping 21% from last year's group of companies' 2001 operations.

Capital and exploration expenditures during 2002 for the group declined 17% to $57.8 billion.

Group operations

The operating results of the 154 companies reflect the decline in investment and activity. The 2002 production and reserves of the OGJ200 group declined in every category. But again, there are fewer companies in the sample than last year, so any comparison is slightly skewed.

Worldwide production of liquids, which comprises crude oil, condensate, and natural gas liquids, declined 4.5% for the group. Their worldwide natural gas production was nearly 3% lower.

Meanwhile, the group's production of liquids in the US declined 4%, and their US production of gas fell 7.4%.

Total US liquids production, according to the EIA, declined less than 1% last year. The information center also estimates that total gas withdrawn from US gas and oil wells last year declined just 1.4%.

Oil and gas reserves for the group were a bit lower than for last year's OGJ200. Liquids and gas reserves worldwide declined slightly for the group, and their US reserves of liquids were nearly unchanged at 13.9 billion bbl. Gas reserves in the US for the group made the biggest decline, falling 3.5% to 97.4 tcf.

Group financial performance

Financial results of the OGJ200 group declined as well, as 39% of the companies posted a net loss for the year. In last year's compilation, 28% of the firms recorded a net loss based on 2001 performance.

Four companies in the group posted a net loss in excess of $100 million, the same as in last year's OGJ200. There are 19 firms in the group with net income of more than $100 million for 2002; in last year's group, there were 30 such companies.

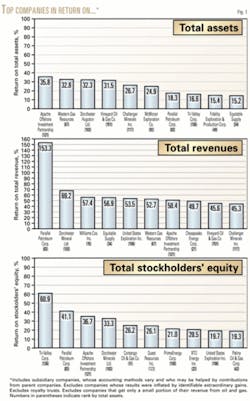

As total stockholder equity for the group increased and profits declined, return on stockholder equity fell to just under 10% vs. 17% for the previous OGJ200 group. Eleven of the firms in the current group had negative stockholder equity, as liabilities exceeded assets.

Return on assets and return on revenue also slid in this year's listing. The group's return on assets was less than 4%, down from 6.5% for last year's group. Return on revenues declined 2 percentage points from last year to 4.2%.

Changes in the group

There are not many changes to the OGJ200 group this year, other than that there are fewer firms.

There are three publicly traded limited partnerships in the group, the same as in the past few editions of the report. The largest, as last year, is Energy Partners Ltd., with $384 million in assets. The smallest is once again Apache Offshore Investment Partners, with $10 million in total assets.

Six of the companies in the group are royalty trusts. This compares with five last year and six in the 2001 edition of the report.

There is one new company in the list. Houston American Energy Corp. was incorporated in April 2001, and ranks at No. 153 with $253,000 in assets.

The highest-ranking companies continue to gain in terms of asset concentration. The smallest asset value among the top 100 firms in this year's list was $44.9 million. In last year's compilation, the 100th largest company had total assets of $94.5 million.

The top 10 companies held 79% of total assets for the 154 firms in 2002, while the top 100 companies accounted for 99.9% of assets for the total group.

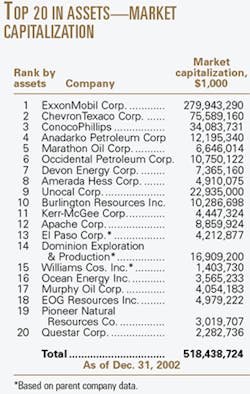

With $152.6 billion in assets at the end of 2002, ExxonMobil Corp. remains the largest company on the list. The Irving, Tex.-based company's assets were $143 billion at the end of 2001.

The smallest company in this year's OGJ200 is Petrol Industries Inc., which was also the smallest firm on the previous list. Petrol Industries' total assets were $225,000 at the end of last year.

Top 20 companies

Thirteen of the companies now ranked in the top 20 moved up from their previous rankings, primarily due to consolidation.

The combination of Conoco Inc. and Phillips Petroleum Co. opened up one spot, and a reduction in assets dropped the ranking of Occidental Petroleum Corp., allowing Marathon Oil Corp. and Anadarko Petroleum Corp. to move up two spots each.

Behind ExxonMobil, ChevronTexaco Corp., and ConocoPhillips, Anadarko is the fourth largest company. Following its acquisition of Howell Corp., Anadarko's assets are $18.2 billion, up from $16.8 billion at the end of 2001.

Devon Energy Corp. moved up to No. 7 from No. 9 following its merger with Mitchell Energy & Development Corp., which had been the 27th largest company in the previous OGJ200.

Amerada Hess Corp. remains at No. 8, while Unocal Corp. moved up to No. 9 from No. 12.

Burlington Resources Inc. and Kerr-McGee Corp. switched places from last year's ranking and are now No. 10 and No. 11, respectively.

Next are Apache Corp., El Paso Corp., Dominion Exploration & Production Inc., Williams Cos. Inc., and Ocean Energy Inc., which each moved up one spot from a year ago.

Murphy Oil Corp. moved up to No. 17 from No. 20, as assets increased to $3.9 billion from $3.3 billion. EOG Resources Inc. and Pioneer Natural Resources Co. each retained their respective No. 18 and No. 19 rankings from last year, although the assets of each company increased.

Questar Corp. moved up one place to No. 20, with assets of $3.1 billion at the end of last year. At the end of 2001, Questar's assets were $3.2 billion.

Top 20 firms' results

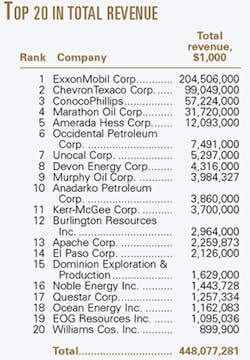

The top 20 companies as ranked by assets—the supermajors and the large independents—dwarf the remaining 134 firms in the OGJ200.

These firms account for 91% of the assets of the total group. They garnered 97% of the OGJ200 revenue and 94% of total profits, but during 2002, they accounted for 86% of the whole group's capital and exploration expenditures.

Compared with the top 20 in last year's OGJ200 group, net income declined 37% to $18.3 billion. Revenue for the top 20 declined 8% from a year earlier, but stockholder equity gained 7%.

Worldwide capital and exploration expenditures of the top 20 totaled $49.5 billion, down 11% from a year earlier. These companies' net wells drilled in the US declined 20% to 7,382, comprising 64% of US net wells drilled for the entire OGJ200 group.

The production and reserves figures of the top 20 firms mostly moved lower during 2002, but by small amounts.

Worldwide liquids production declined 3%, and US liquids production slid at an even slower pace. Worldwide gas production by these companies was 0.5% lower than a year earlier, while US gas production fell 5.6%.

The top 20 firms' worldwide liquids reserves edged up less than 1%, but US liquids reserves gained nearly 2%. These firms' gas reserves declined 0.8% worldwide and 2.2% in the US as compared with a year earlier.

The market capitalization of the top 20 companies as of Dec. 31, 2002, was $518 billion, and the average share price was $37.16 at yearend. The total includes the market cap figures for parent companies of El Paso, Dominion, and Williams.

Fastest-growing companies

Though typically limited to 20 firms, there are only 10 companies that qualify for the list of fastest growers.

The OGJ200 list of fastest-growing companies ranks firms based on growth in stockholder equity. For a company to appear on the list, it must have recorded positive net income in both 2002 and 2001, and it must have increased its net income last year. Excluded from this list are limited partnerships, newly public companies, and subsidiaries.

Magnum Hunter Resources Inc. is the fastest grower in this year's OGJ200. Ranked No. 31 by assets, Magnum Hunter's stockholder equity nearly trebled last year. Remington Oil & Gas Corp. was second on the list, increasing its stockholder equity 55%.

The only company to appear on this year's list of fastest-growing companies and last year's is Pogo Producing Co. Although Pogo slipped to No. 24 from No. 23 in terms of assets, it expanded its stockholder equity 31%. The Houston-based firm was fourth on last year's fastest-growers list with 130% growth in stockholder equity.

Cimarex Energy Co., which ranks at No. 44 by assets, does not qualify for the fastest-growers list only because Helmerich & Payne Inc. spun off the Denver-based company just last year. In order to qualify for the list, a firm must have become public prior to the start of 2002.