Market Movement

Bombings fail to move oil futures market

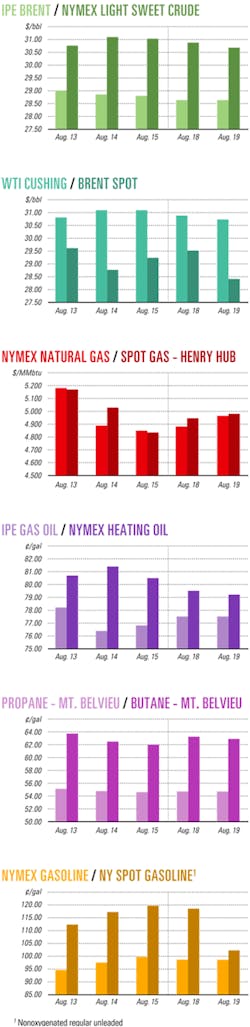

The massive electrical power failure on Aug. 14 that blacked out the US Northeast and southeastern Canada triggered a jump in gasoline futures prices, but oil futures prices continued to decline early last week despite an increase in the number and severity of terrorist attacks in the Middle East.

Refineries go down

The power failure disrupted operations at four US and five Canadian refineries, pushing up gasoline futures prices to 99.94¢/gal—a new high for the September contract—during a 2-hr trading session Aug. 15 on the New York Mercantile Exchange.

The 74,000 b/d Marathon Ashland Petroleum LLC refinery in Detroit shut down following an explosion that officials said was linked to the power outage. The 140,000 b/d Sunoco Inc. plant and the 152,000 b/d BP PLC refinery, both in Toledo, were reported either down or operating on a reduced basis. Premcor Refining Group Inc.'s 165,000 b/d refinery in Lima, Ohio, also was affected.

Disruptions at Canadian refineries included two Imperial Oil Ltd. refineries in Nanticoke and Sarnia, Ont., with capacities of 112,000 b/d and 120,800 b/d, respectively; the Suncor Energy Products Inc. and Shell Canada Ltd. facilities in Sarnia, both with capacities of 70,000 b/d; and the 83,000 b/d PetroCanada Products Ltd. plant in Oakville, Ont.

As electricity was restored to the affected areas, the refineries were starting back up by Aug. 18, causing a respondent drop in gasoline futures prices.

However, Andrew C. Fairbanks, vice-president, Merrill Lynch & Co. Inc., New York, said almost 4 million bbl of production—including 2 million bbl of gasoline and 800,000 bbl of distillate—were lost, "even if the plants come back online perfectly." That, he said, would make "an already tight market even tighter (OGJ Online, Aug. 19, 2003)."

US gasoline supplies already were tight on the East and West Coasts ahead of the Labor Day holiday weekend. The US refineries that were knocked offline represented about 3% of total US capacity.

Nine nuclear power plants also were knocked out by the loss of power. By Aug. 18, six had restarted but were running at reduced capacity, while the other three units were expected to resume operations later in the week.

Bombings ignored

Even as gasoline futures shot up, the September contract for benchmark US light, sweet crudes dropped 4¢ to $31.05/bbl in the Aug. 15 NYMEX session despite a sabotage bombing that same day that destroyed a section of the pipeline from Kirkuk oil field in northern Iraq to the Mediterranean export terminal in Ceyhan, Turkey, only 2 days after that pipeline had been reactivated (see story, p. 48). Saboteurs destroyed another section of that same pipeline the next day, dealing a serious setback to US efforts to reactivate Iraqi oil exports.

Oil futures prices continued to decline in the next two sessions, falling to $30.70/bbl on Aug. 19 as traders ignored more terrorist attacks in the Middle East and civil strife in Nigeria.

A suicide bomb attack that day in Baghdad killed 20 people, including United Nations envoy Sergio Vieira de Mello. Another terrorist bombing killed 18 people in Israel and may have derailed, peace efforts in that area. Israel immediately cut off contacts with Palestinian officials following that attack, described as one of the worst in 3 years.

Meanwhile, Shell Petroleum Development Co. of Nigeria closed its western divisional head office in the oil city of Warri as Nigerian troops moved in to separate warring Ijaw and Itsekiri tribal groups during the fifth day of fighting. Shell and ChevronTexaco Corp. said the fighting had not yet affected their oil operations in Nigeria. However, a similar clash between the Itsekiris and Ijaws in March forced companies to shut in more than 500,000 b/d of Nigerian oil production.

Analysts said the energy futures markets failed to react to those conflicts because they were "already extremely overbought." The investment funds and speculators who currently hold large positions in the energy futures are more inclined to sell into rallies and to liquidate stale long positions that obligate the holder to take delivery rather than buy, they said.

Political analysts speculated that the attack on UN personnel might forge a closer alliance between UN and US officials in dealing with Iraq. The end result could increase the UN's role in pacifying Iraq, including an enlarged and more international peacekeeping force.

It appears that US officials' previous plans to increase Iraq's oil production to 1.5 million b/d by yearend are impossible without a massive improvement in security. Iraq currently is producing less than 500,000 b/d.

Industry Scoreboard

Editor's note: Sept. 1 statistics will appear Sept. 8.

null

null

null

Industry Trends

US GAS STRIPPER WELLS accounted for a significant portion of the increase in US onshore natural gas production in 2002, the Interstate Oil and Gas Compact Commission (IOGCC) reported in a preview of its annual survey.

"At a time when demand for natural gas is rising, it is clear that we need look no further than our own backyard for the increase in supply our nation needs," New Mexico Gov. Bill Richardson, IOGCC chairman-elect, told a National Governors Association meeting in Indianapolis last week.

Marginal wells, which produce 60 Mcfd or less, represent 10% of the gas produced onshore in the Lower 48. Yet, these wells accounted for 43% of the overall rise in natural gas production last year, the survey showed. Stripper well gas production increased in 2002 by 64.76 bcf to 1.4 tcf. Overall domestic onshore natural gas production increased by 149.2 bcf to 14.2 tcf.

Marginal oil wells, each of which produces 10 b/d or less, also produced more last year. IOGCC said marginal oil production increased by 7.7 million bbl to 323.8 million bbl. Overall US onshore oil production declined by 28.9 million bbl to 1 billion bbl for 2002. The full "Marginal Oil and Gas: Fuel for Economic Growth" report will be released in late August.

A HEAT WAVE has begun to restrain European chemical and refining operations.

If the hot weather continues, then more plants could reduce operating rates and worldwide refined market supplies could become tighter. This could provide a "small" positive for the industry, Prudential Securities Inc. analyst Andrew F. Rosenfeld of New York said in an Aug. 14 research note.

The heat wave has reduced water levels in some river and lakes. Refineries and chemical plants use water as a coolant.

BASF AG and Veba Oil, Refining & Petrochemicals GMBH (VOPR), both of Germany, have declared force majeure on a portion of their ethylene production.

BASF said the force majeure was due to low water levels and high water temperatures in the Rhine River. VOPR said its outage was caused by mechanical problems.

The force majeure declaration allows a company to place its customers on allocation without recourse from breach of contract.

Rosenfeld said reduced operating rates could trim volumes of European refined products available for export to the US.

SECOND QUARTER US petrochemical production for 18 reportable petrochemicals increased 1% to 46.7 billion lb compared with first quarter production.

The National Petrochemical & Refiners Association reported the finding of a survey that it commissioned. Veris Consulting LLC of Reston, Va., conducted the survey, basing the regular quarterly petrochemical survey on 18 petrochemicals, including ethylene, propylene, butadiene, benzene, and mixed xylenes.

The report is entitled "Survey of Production and Inventory Report for Second Quarter 2003."

Volumes produced for the most recent quarter trailed the volumes reported for the same time a year ago. Total production of the 18 petrochemicals was down 10% vs. second quarter 2002 production of 52.1 billion lb for 20 reportable petrochemicals.

Government Developments

US AGENCIES AND LOUISIANA have launched a joint offshore royalty-in-kind pilot to test the potential for sales of RIK oil and natural gas.

The US Minerals Management Service awarded sales contracts Aug. 8 for royalty volumes of crude oil produced from certain federal leases in the Gulf of Mexico.

MMS wants to increase revenues and decrease administrative costs associated with federal leases in the 8(g) area off Louisiana. Currently, the state receives 27% of those federal lease revenues.

Sales contracts were awarded to ChevronTexaco Corp. and Shell Trading for royalty volumes from four offshore receipt points totaling more than 1,100 b/d of Heavy Louisiana Sweet crude oil. Physical deliveries begin Oct. 1 for a 6-month term.

Subsequent solicitations are anticipated for potential future sales transactions.

Previously, MMS and Louisiana signed a memorandum of understanding, jointly agreeing to develop and implement an RIK pilot (OGJ Online, Mar. 21, 2003).

"This joint effort represents a true partnership between the federal government and the state of Louisiana," said MMS Director Johnnie Burton. "It provides the state with a more active role in managing its oil resources while protecting state and taxpayer interests."

Jack Caldwell, secretary of the Louisiana Department of Natural Resources, believes the pilot will guide Louisiana to make better-informed decisions regarding RIK from state lands and water bottoms.

Under Outer Continental Shelf Lands Act oil and gas lease terms, royalty payments can be collected either in cash or in kind. Historically, most revenues have been received as cash payments from companies leasing acreage and producing natural resources on federal lands. Based on feasibility studies, MMS believes that RIK will become an integral method to manage mineral royalties, along with the traditional cash payments.

ALASKA GOV. Frank H. Murkowski has invited congressional task force members studying US natural gas supply alternatives to visit Alaska.

He wrote letters to House Energy and Commerce Committee Chairman Billy Tauzin (R-La.) and Richard Pombo (R-Calif.), chairman of the House Committee on Resources, urging them to evaluate Alaska's potential role as a gas supplier to the Lower 48.

"Panel members would be able to see existing operations on the North Slope and in Cook Inlet, future exploration sites, and possible transportation routes," he said. In addition, panelists would have an opportunity to talk with state government and industry representatives about natural gas development, transportation, and financing, he said.

Alaska's North Slope contains 35 tcf of proven reserves, with another 65 tcf estimated as potentially recoverable. Murkowski said a $20 billion pipeline system to make this gas available to the Lower 48 is a better alternative than importing the same volume of LNG, which would cost at least $26 billion.

Tauzin and Pombo are cochairmen of the Speaker's Task Force for Affordable Natural Gas, which has a Sept. 30 deadline for its recommendations. The US Senate has approved a tax credit for the pipeline project to reduce the financial risk of fluctuating gas prices, but the House has not (OGJ Online, Aug. 1, 2003).

Quick Takes

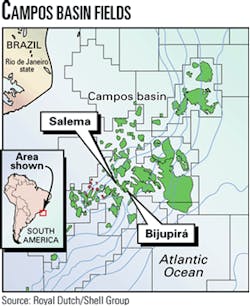

ROYAL DUTCH/SHELL GROUP has begun oil and natural gas production from Bijupirá and Salema fields in the Campos basin 120 km off Rio de Janeiro state, Brazil. The project is a joint venture of Shell Brasil Ltda., operator with 80% interest, and state-owned oil company Petróleo Brasileiro SA (Petrobras) 20%.

The fields have re- serves of 188 million bbl of oil and 62 bcf of gas. Initial production will be 20,000 b/d of oil from one of eight production wells already completed. Expected peak production rate is 80,000 b/d of 28-31º gravity oil and 35 MMcfd of gas.

Oil production will be delivered via subsea wells tied back to the Fluminense floating production, storage, and offloading vessel, and gas will be delivered via an existing pipeline from the Bijupirá area to the Petrobras P15 installation. Total project investment is about $650 million, Shell said.

In other production news, Unocal Corp. unit Unocal Thailand Ltd. has awarded a 10-year contract to Teekay Shipping Corp. for the long-term lease and management of a floating storage and offloading vessel for its oil production in the Gulf of Thailand. The vessel, to be named Pattani Spirit, will replace the 630,000 bbl Sibeia tanker that is now used to store oil produced from Plamuk, Surat, Yala, Platong, and Kaphong fields off Thailand. At a Singapore shipyard, Teekay will convert the 790,000 bbl Namsan Spirit Aframax tanker, increasing its storage capacity to 850,000 bbl. The FSO then will be installed in Thai waters in second quarter 2004.

Apparent high bids totaling $148.7 million were offered for 335 tracts at Lease Sale 187 for the western Gulf of Mexico, the US Minerals Management Service reported Aug. 20 from New Orleans. MMS received 407 bids totaling $258.7 million from 63 companies at the sale. Last year at this time, a western gulf sale netted $151.3 million in apparent high bids out of $181.6 million bid by 44 companies on 323 of the 4,102 tracts offered (OGJ Online, Aug. 21, 2002).

The latest sale offered 3,996 blocks covering 21.7 million acres on the Outer Continental Shelf off Texas and in deeper waters off Louisiana. The offered blocks are 14-357 km offshore in 8-3,000 m of water. The proposed sale could result in an estimated production of 136-262 million bbl of oil and 0.81-1.44 tcf of natural gas, MMS said.

LLOG Exploration Offshore Inc. submitted the highest single bid of $22.6 million for High Island Block 170, which lies in less than 199 m of water. The second highest single bid was by a Dominion Exploration & Production Inc.-led group for Garden Banks Block 292 for $5.4 million. Dominion also held the third highest spot for its $3.3 million bid on a tract in the High Island area.

Amerada Hess Corp. had the most apparent high bids with 59 bids totaling nearly $15.7 million, and BHP Billiton Petroleum (Deepwater) Inc., submitted 56 apparent high bids totaling almost $8.2 million.

TRANSOCEAN INC.'s Searcher rig Aug. 13 began drilling the first production well on the Statoil ASA-operated Alpha North satellite in Sleipner West gas-condensate field in the North Sea. The field will be developed with three or four wells and a subsea production system. Statoil said drilling is expected to take about a year.

The rig will drill and complete three wells on the Alpha North structure, which will be tied back to the Sleipner A platform via an 18 km pipeline to the Sleipner T gas treatment platform (OGJ Online, Aug. 23, 2003). Carbon dioxide will be removed by the Sleipner T platform's separation plant before gas is pumped into the Utsira aquifer via the Sleipner A platform. Production is to start Oct. 1, 2004.

Alpha North reserves are put at 13 billion cu m of gas and at 32 million bbl of condensate.

KAZAKHSTAN and Ukraine may use a recently built, still-idle oil pipeline through Ukraine as an export pipeline for Kazakh oil, Dow Jones Business News reported. Built by Ukraine in 2001 to transport Caspian oil to Europe, the 9 million tonne/year capacity pipeline extends from Odessa on the Black Sea to Brody in Ukraine. Ukraine state oil pipeline company Ukrtransnafta is said to be negotiating with Swiss Capital Group and Drake Group over forming a consortium to operate the line. The company also said it plans to involve experienced foreign firms in a $450 million project to extend the line to Eastern Europe. The pipeline originally was designed to extend to Potsk, Poland, then to the Gdansk refinery. Kazakhstan might finance the Potsk extension, a ministry spokesman said. Kazakhstan's oil production this year is expected to reach 52 million tonnes, of which 44 million tonnes would be exported.

In other pipeline activities, Egyptian Natural Gas Co. (Gasco) reported the completion of the precommissioning phase for its East Gas Pipeline Project. Halliburton Energy Services Group precommissioned the pipeline for Gasco, completing 4 days ahead of schedule under a tight schedule. Gas-in commissioning was completed in June. The 36-in., 166 mile pipeline, which will export natural gas to Jordan, Lebanon, Syria, Turkey, and European countries, extends from El-Arish, Egypt, to Aqaba, Jordan. The system comprises a 155 mile land section and an 11 mile section offshore.

QATAR'S RASGAS CO. LTD., operator of the $1.1 billion Al Khaleej Gas (AKG-1) project, has awarded a $50 million, lump-sum turnkey contract to Chicago Bridge & Iron Co. unit CB&I Constructors Inc., The Woodlands, Tex., to design and construct two LPG storage tanks at Ras Laffan, Qatar.

CB&I will perform the engineering, procurement, and construction of the double-wall, steel, full containment tanks—a 125,000 cu m propane tank and a 110,000 cu m butane tank—and will be responsible for foundations, piping, electrical, and instrumentation work.

The fast-track schedule calls for completion of both tanks within 27 months.

PT NANINDAH MUTIARA SHIPYARD—a unit of Indonesian state oil and natural gas firm Pertamina—and another Pertamina unit have placed a $17.21 million order with Singapore-based Labroy Marine Ltd. for the construction of two oil product tankers, OPEC News Agency reported.

Labroy will construct a 6,500 dwt oil product tanker and a 3,500 dwt tanker, OPECNA said.

The tankers are expected to be delivered in 18 months, Labroy said.

Meanwhile, Pakistan officials reported a Greek-registered oil tanker grounded off Karachi and spilled oil. The MV Tasman Spirit ran aground July 27 while being piloted to the Keamari port during stormy weather. It has a cargo of 67,000 tonnes of oil, some of which has polluted 16 km of the Arabian Sea coast. A Karachi port spokesman said the evacuated oil tanker has cracks and may split from the middle, possibly catching fire. Special containment booms from the UK have been deployed, and additional equipment is arriving, along with a C-130 plane from Singapore to help with aerial.

BHP Billiton Petroleum Inc. subsidiary BHP Billiton LNG International Inc., Oxnard, Calif., plans to construct and operate Cabrillo Port, a $550 million floating LNG terminal, 21.5 miles off Ventura County, Calif. BHP anticipates that all necessary permits could be in place by yearend 2004 and the proposed terminal operational in 2008.

The terminal would be a permanently moored floating, storage, and regasification unit (FSRU). LNG would be stored in traditional storage tanks, regasified, and transported via subsea pipeline into a local pipeline system. Anticipat- ed average send-out from the proposed FSRU is 800 MMcfd of natural gas.

BHP Billiton intends to apply within weeks to the US Coast Guard Maritime Administration, seeking permission for the deepwater port license.

In other LNG news, a BP PLC-led consortium has signed a memorandum of understanding to supply LNG from the Tangguh project in Indonesia to two South Korean companies: refiner SK Corp. unit SK Power Co. Ltd. and steel manufacturer Posco Co. SK plans to construct a 1,080 Mw power station at Gwangyang. Posco is building an LNG terminal at Gwangyang to regasify LNG. Posco has two gas-fired power plants with 845 Mw total generating capacity at steel mills in Pohang and Gwangyang. The MOU calls for LNG imports of as much as 1.35 million tonnes/year for 20 years, starting in 2005. BP will negotiate a final supply and purchase contract later this year. The project previously secured a 2.6 million tonne/year LNG sales contract, starting in 2007, for the Fujian LNG project in China. A two-train liquefaction plant is planned to handle gas production from Tangguh field (OGJ Online, May 27, 2003). BP's partners are MI Berau BV, CNOOC Ltd., Nippon Oil Exploration Berau, BG Group, KG Cos. (held by Japan National Oil Corp., Kanematsu Corp., and Overseas Petroleum & Investment Corp.), and LNG Japan Corp. (held by Nissho Iwai Corp. and Sumitomo Corp.).

AN INVESTIGATION is under way to determine the cause of an Aug. 14 fire in the vacuum crude unit at Suncor Energy Products Inc.'s Sarnia, Ont., refinery, that killed one worker. The fire was brought under control quickly, Suncor said.

The Aug. 14 electric power blackout in the US Northeast shut down the entire refinery the same evening, and start-up was getting under way at presstime last week, according to a company spokesperson.

The vacuum unit will remain down, pending results of the investigation, but other plant functions may be back in service by Aug. 23, he said. The plant has a capacity of 70,000 b/d (OGJ Online, Aug. 19, 2003).

BP EXPLORATION (ALASKA) INC. and its technology partner, London-based Davy Process Technology Ltd., started up an $86 million gas-to-liquids demonstration plant July 27 in Nikiski, Alas., south of Anchorage on the Kenai Peninsula. The plant, currently producing about 100 b/d of synthetic crude oil, is ramping up to about 250 b/d, BP said.

Spokesman Dave MacDowell said the goal of the Nikiski plant is to test two propriety technologies, a compact reformer, and a proprietary converter catalyst. The successful demonstration of these new technologies could play an important role in commercializing stranded natural gas resources worldwide, he said.

BP is using the proprietary compact reformer technology in the first of three stages at the facility. BP will test the initial stage—the manufacturing of synthesis gas in which methane is broken down into hydrogen and carbon monoxide when mixed with heat and steam.

BP Alaska's GTL demonstration plant in Nikiski, Alas. Photo from Eagle Eye Helicopter.

In the second stage, a waxy hydrocarbon product is produced from the syngas, and in the third stage a variety of clean-fuel products—including synthetic crude oil—can be made from these paraffins with standard hydrocracking.

When the company announced in June 2000 the selection of Nikiski as the site for the facility, it said the GTL technology is one of a number of options the company is exploring to make large-scale North Slope gas sales commercial (OGJ Online, Aug. 25, 2000). However, MacDowell said, "As far as North Slope gas resources are concerned, our efforts are focused on developing the natural gas pipeline from Alaska's North Slope to Canadian and Lower-48 markets."