Flexible manufacturing techniques make ultradeep water attractive to independents

The increase in risk and capex required to exploit new gas and oil reserves in ultradeepwater areas is driving the offshore energy industry to adopt lean management tools and techniques.

This is the fourth part of a series on lean energy management.1 2 3 The first three parts are posted in the archive at the Oil & Gas Journal website (www.ogjonline.com).

The traditional net present value (NPV) approach behind most offshore investments and exploitation decisions must be replaced by real options evaluation techniques in order to recognize the full investment potential, especially for independents with limited global portfolios.

NPV encourages rapid depletion of fields because of excessive future discounted cash flow (DCF). In reality, each investment generated from this methodology must be more successful than the last in order for the company to meet growth targets.

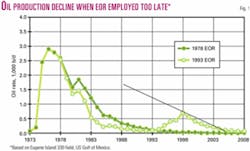

Typical exponential decline in the production profile for most oil fields is driven by NPV investment methodologies that employ enhanced oil recovery (EOR) too late in a field's life to provide base load support for the portfolio (Fig.1). In addition, this exponential decline after initial production results in a depleting reserves base for all but the most cash-rich supermajor and national oil companies.

The alternative economic model favored by more flexible lean manufacturers such as in the auto and aerospace industries is to accumulate a portfolio ranging fully from a large volume of cheap, low margin products to a smaller number of expensive, high profit vehicles. In the energy business, the electricity industry follows this model by using both cheap "base load" and expensive "peak load" to deal with cyclical prices of fuels (gas, coal, oil) and product (electricity). Real options are used to determine the real time portfolio mix that a company requires to remain profitable as market conditions change by the minute.

Real options are the algorithmic method for optimizing manufacturing under uncertainty by preserving flexibility throughout the design/build/operate life cycle of a platform or vehicle.4 Real options are more complex than linear NPV models in that they solve the stochastic control problem to maximize the expected value of DCF under constantly changing uncertainty.

We show in this article that, when linked to modern methods of controlling and shaping oil and gas production using flexible lean manufacturing techniques such as 4D, or time-lapse, production management, real options can be used to create base load that enables profitable investment by independents in the ultradeepwater provinces of the world. However, real options also point to a caution—that the portfolio of independents is not as flexible as that of supermajors and nationals. Independents must be cautious when partnering in the ultradeep water with supermajor operators who already have adequate base load in their portfolios and who therefore are producing for peak load.

NPV vs. real options value

NPV (also described in financial circles as "total economic value") is a static discounted cash flow caclulation. Future cash flows are represented by single point estimates. All implicit probability distributions are subsumed in the discount factor.

By contrast, real options calculations involve a wide range of future cash flow probability distributions, and discounting to the present is (usually) done at the risk free rate. The NPV economic model contains no incentive to flexibly produce a field other than through maximizing recovery by avoiding engineering pratfalls such as skin damage, water coning, or breakthrough.

Put simplistically, it's a "fastest money to the bank" methodology. However, new 4D production management is now available through the use of technologies commonly grouped into the term "e-Fields." e-Fields combine electronically enabled production monitoring, multilateral completions, and optimization techniques to provide flexible options for shaping the production of oil and gas assets that did not exist in the past.

When this subsurface flexibility is managed within a real options economic model, portfolio weaknesses can be filled through expeditious use of production "shaping" (cf. SPE 77586).

Real options management of ultradeepwater fields has two major kinds of flexibility.

One is strategic flexibility. The portfolio must have flexibility to deal with the volatilities of the market, the uncertainty of reservoirs, and other externalities that change day-to-day throughout the life of the assets. Presently, the common option is to buy or sell properties. Consequently, the second is to manage the shape of the production within fields through implementation flexibility.

The ultradeep water, in particular, and some deep unconventional gas reservoirs on land as well, hold reserves of the magnitude and geological type that could be "shaped" using these e-Field technologies to provide base load support for oil and gas portfolios, much like coal-fired and nuclear power plants do for electricity generation. Base load support, in turn, adds growth and sustainability options that peak load portfolios do not alone possess.

Currently, these e-Fields options are used exclusively for EOR that usually occurs too late in a field's history to affect the overall company performance much, however. A good example is Eugene Island 330 field in the Gulf of Mexico off Louisiana. A 4D seismic program begun in 1993 resulted in reserves added from a subsequent drilling campaign that caused production to peak again in 1998 (Fig. 1). If it had been carried out just after peak production in 1978, as needed for base load support, it could have resulted in considerably more production early in the field's history. However, 3D seismic techniques were not in wide field use in 1978, let alone 4D to allow for these real options.

Interestingly, the supermajors have enough large fields in their portfolios to shape their overall production with base load that fortuitously happens over the life of some giant fields, a luxury not shared by independents. These fields are often called "cash cows" within the NPV portfolio.

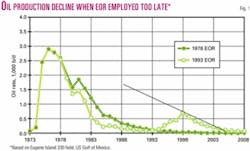

Consider, for example, a new field in the North Sea where 4D reservoir management was used from initial production. The field would already be depleted if e-Fields techniques were not used from the beginning. Instead, oil, and particularly gas production has provided base load support for the portfolio for more than 8 years (Fig. 2).

Portfolios for independents

It is hard for NPV and real options companies to successfully partner in joint ventures that are dominated by one operator, as is the usual case in the ultradeep water.

Real options produce operational decisions affected by externalities, often from different business units within the company's portfolio, whereas an NPV company will always choose the "peak load" operational choices based upon internalities within each field and business unit. However, e-Fields are moving the industry toward real-time decisionmaking, and the industry is migrating to the advantages of base load flexibility even without the driver of the real options economic modeling.

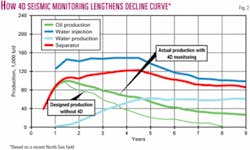

Consider the timing of 4D implementation in a recent field off Malaysia. Reservoir management from initial production actually resulted in the typical flat profile for base load production, though added 4D seismic monitoring resulted in waterflood injection rates that required considerably more water than initially planned (Fig. 3).

Hazards of peak load

One way to understand the potential value of base load fields is to understand how classical decline curves are used in the management of a company's portfolio of assets to achieve corporate performance goals.

The exponential decline of the fields means that a corporate plan guided by NPV-based portfolio management will have to stack the peak production of the fields in a way that maintains company goals year after year. Growth is particularly difficult with this model.

Petrobras is predicted to have the highest growth of all oil companies in the 2000-2005 window (Fig. 4, data from Deutsche Bank), primarily because of the discovery of four of the largest turbidite fields in the world since 1985. Only Marlim, the biggest, is providing base load.

The constantly declining peak load fields tie up the timing of cash that must be available for new field development and reduce the real options of the overall portfolio. Conversely, the overall value of the portfolio would be increased via the increase in flexibility—just as in the case of power companies, through a mix of peak and base load producers.

The peak load fields are expensive from a capex point of view because they are usually overbuilt for the capacity of peak production. However, they have cheaper opex; whereas the base load fields are cheaper from a capex viewpoint but have more expensive opex because of e-Fields costs.

Portfolio management with real options

Traditional "Markowitz-based" portfolio optimization exploits the synergies found in assets evaluated at fixed NPV against each other through the covariance matrix of the portfolio.

Risk is managed, but not cancelled, by diversity in the portfolio. Since risk is not totally hedged, the level of acceptable risk is an input to the portfolio optimization process. Typically, a parametric curve of risk-reward sensitivity is produced, called the "efficient frontier." There is debate whether volatility should even be equated to risk in portfolio management. A more direct measure of risk would be to use utility functions.5

Alternatively, real options predict the optimal shape of production within the uncertainty "manifold" of the subsurface geology of each field. In a real options portfolio, risk is managed by an "always winning" betting strategy ("Martingale" in financial terminology). The evaluation switches between the underlying asset and a fabricated financial instrument to hedge the risk generated by the uncertainties involved.

Real options also produce a clear decision procedure and not a frontier of risk-reward options. It is possible to incorporate the covariance matrix into a stochastic dynamic programming framework which uses reservoir simulations to characterize the below-ground uncertainty.

Bertimas, et al5 demonstrate this technique for a portfolio of stocks, and SPE 82018 shows an application of reservoir simulation for real options evaluation of a smart well. SPE 71414 describes a concept called stochastic integrated asset modeling for real options, and SPE 57472 discusses risk-based integrated production modeling, that also could be incorporated into this simulation-based framework.

Stochastic control framework of real options

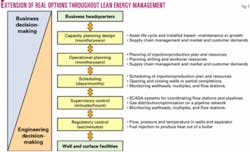

There are broader extensions of real options flexibility throughout lean energy management of oil and gas assets.

A real options company is a learning company that seeks more flexibility in all it operations. It is constantly reestimating asset valuations as uncertainties of the market are identified and strategic plans modified.

Since it uses a simulation, the same approximate dynamic programming algorithm used for real options evaluation can also be used in several of the more operational engineering decision-making levels illustrated here. For example, model-based control methods are becoming popular for optimizing supervisory and regulatory functions for refineries and petrochemical plants (Fig. 5, adapted from SPE 83978, SPE 77703, and SPE 64621).

In addition, dynamic programming has proven its value in scheduling, operational planning, and capacity planning for many other lean manufacturing applications.

However, incorporating the Markowitz covariance matrix for portfolio optimization as a kernel under the real option evaluation's stochastic integrals worsens what is called the "curse of dimensionality" problem. At Columbia University, we are seeing promise for lowering this computational burden in work on asset management of electrical grids. We are using a type of approximate dynamic programming called "reinforcement learning." We are also looking at Lagrangian decomposition and the MAXQ method for hierarchical reinforcement learning.7

In sum, the economics of the ultradeep water are driving the development of lean energy management that combines a reinforcement learning system with a simulation-based, stochastic control framework for real-time, real options portfolio management.

Lean energy management has the potential to seamlessly integrate strategy (planning) and implementation (operations). Only with efficiency improvements from the use of such an "enterprisewide" business model will the ultradeep water become affordable, especially for independents. The learning system of this newly emerging LEM paradigm will be the topic of future parts of this continuing series.

References

1.Anderson, R., Boulanger, A., Longbottom, J., and Oligney, R., "Lean Energy Management 1: Lean energy management required for economic ultradeepwater development," OGJ, Mar. 17, 2003, p. 47.

2.Anderson, R., and Boulanger, A., "Lean Energy Management 2: Ultradeepwater development: Designing uncertainty into the enterprise," OGJ, May 19, 2003, p. 42.

3.Anderson, R., and Boulanger, A., "Lean Energy Management 3: How to realize LEM benefits in ultradeepwater," OGJ, June 30, 2003, p. 36.

4.Feurstein, M., and Natter, M., "Neural Networks, Stochastic Dynamic Programming and a Heuristic for Valuing Flexible Manufacturing Systems," Working Paper 17, Vienna University of Economics and Business Administration, 1998.

5.Cohena, M., and Natoli, V., "Risk and Utility in Portfolio Optimization," Physica A: Statistical Mechanics and its Applications, Vol. 324, 2003, pp. 81-88.

6.Bertimas, D., Lo, A.W., and Hummel, P., "Optimal control of execution costs for portfolios," Computing in Science & Engineering, Vol.1, No. 6, November/December 1999, pp. 40-53.

7.Dietterich, T., "The MAXQ Method for Hierarchical Reinforcement Learning," Proc. 15th International Conf. on Machine Learning, 1998.

Bibliography

White, David A., "Handbook of Intelligent Control: Neural, Fuzzy, and Adaptive Approaches," Donald A. Sofge, ed., VNR, 1992.

Vollert, Alexander, "A Stochastic Control Framework for Real Options in Strategic Valuation," Birkhauser, 2002.

Dixit, Avinash K., and Pindyck, Robert S., "Investment Under Uncertainty," Princeton University Press, 1994.

Gallant, L., Kieffel, H., and Chatwin, R., "Using Learning Models to Capture Dynamic Complexity in Petroleum Exploration," SPE 52954, Hydrocarbon Economics and Evaluation Symposium, March 1999.

Whiteside, M.W., Drown, C., and Levy, G., "General Solution for Option Analysis and Valuation Using a Branching Monte Carlo Method," SPE 71412, Annual Technical Conference, October 2001.

Vazquez, M., Suarez, A., Aponte, H., Ocanto, L., and Fernandes, J., "Global Optimization of Oil Production Systems, A Unified Operational View," SPE 71561, Annual Technical Conference, October 2001.

Sharma, A.K., Chorn, L.G., Han, J., and Rajagopalan, S., "Quantifying Value Creation from Intelligent Completion Technology Implementation," SPE 78277, 13th European Petroleum Conference, October 2002.

Campbell, John M., Bratvold, R.B., and Begg, S.H., "Portfolio Optimization: Living Up to Expectations?," SPE 82005, Hydrocarbon Economics and Evaluation Symposium, April, 2003.