IEA projects more oil demand growth

Market Movement

IEA projects more oil demand growth

The International Energy Agency's latest Oil Market Report includes an upward revision to some historical demand figures and a corresponding increase in the call on crude from the Organization of Petroleum Exporting Countries.

In addition, the Paris-based agency revised its forecast of global oil demand growth for 2003 to reflect China's quicker-than-expected recovery from the economic damage from the Severe Acute Respiratory Syndrome epidemic, while the demand growth projection for 2004 is unchanged at 1.05 million b/d.

Demand revisions

IEA revised its baseline demand figures for countries outside the Organization for Economic Cooperation and Development. This revision—adding 260,000 b/d of demand in 2001—stems from a reassessment of demand in China, India, and Iran.

The largest increases in non-OECD baseline demand are for Iran and India. IEA said a change in conversion factors raised the assessment of historical oil product demand in Iran, with the adjustment peaking at 175,000 b/d for 2001. The estimate of Indian demand was raised by 180,000 b/d for 2000 and 2001. A 200,000 b/d reduction in baseline Chinese demand and minor changes in several other countries partly offset the adjustments in India and Iran and smaller increases elsewhere. This net upward adjustment in demand results in a downward adjustment to IEA's "miscellaneous to balance" figure. This balancing item reflects unreported stock changes and statistical errors, which include unobserved and unreported items such as refinery gains and losses, pipeline fill, direct burn, smuggling, etc.

Adjusting this figure reflects demand flows more accurately but has no effect on actual levels of global demand or physical supply, IEA said, and the rate of demand growth is unaffected because observed demand is adjusted on a consistent basis throughout the historical data series.

These revisions carry through to the "call on OPEC plus stock change" figures. The call, which is simply observed demand less total non-OPEC supply minus OPEC NGLs, rises by the adjustment to baseline demand.

"While this adjustment could be seen as calling for more OPEC crude, there is no such requirement in reality. The restated numbers simply reflect a more accurate accounting of observed demand," IEA said.

Current demand

IEA pegs 2003 oil demand growth at 1.11 million b/d, up 100,000 b/d from the previous forecast due to the recovery from SARS effects. OECD oil demand in May increased 750,000 b/d from a year earlier, and preliminary data show that it continued to expand at 590,000 b/d more in June. The Asia-Pacific region accounted for the bulk of these increases, followed by Europe. Deliveries contracted in the US, as North American demand was lower year-on-year. Despite this temporary weakness, IEA expects the US to resume its lead in OECD demand growth for the remainder of the year as the economy recovers and easing natural gas prices boost demand for LPG.

In June, demand for residual fuel oil grew at a brisk pace across the OECD due to fuel-switching for power generation. Demand grew on switching to resid from nuclear power in Japan and from gas in the US. Resid was used in lieu of nuclear and hydro in Europe, where drought conditions in France and Italy curtailed these sources of energy.

Industry Trends

null

null

null

US REFINING margins probably will become more volatile in coming years because the industry is approaching its effective capacity limit, said Merrill Lynch Global Securities Research & Economics Group.

In an Aug. 7 research note, Merrill Lynch analyst Andrew Fairbanks forecast strong refining margins for US refiners throughout this year and into next year. The third quarter started with US refining margins running above expectations.

"Petroleum product inventories remain below average, and fundamentals are supportive of strong second half 2003 downstream earnings for the majors and refiners," Fairbanks said. "The US downstream is in the midst of a significant longer-term up cycle. Strong industry fundamentals and refining margins are translating into stronger earnings for the refiners and majors."

Refining margins already are above Merrill Lynch's forecast for most regions.

In addition, US gasoline imports are abating, Fairbanks noted, adding that he believes imports must increase to keep US markets balanced. For example, 2003 US refining margins are running above average even though gasoline imports year-over-year have increased 10%. Yet, US inventories are modestly below average.

"At the end of the day, we believe that gasoline imports, through high, should be fully absorbed this year and next with only modest demand growth," he said.

His long-term view of refining margins is that they must be higher than the average 1990s levels in order to encourage increasing import volumes to be sent to the US, which is becoming more gasoline-short each year.

COLD WEATHER at the beginning of the 2002-03 heating season provided a financial boost for US retail propane master limited partnerships (MLPs).

In its recent "Retail Propane Distribution: 2003 Midyear Update" report, Fitch Ratings Ltd. said the winter brought strong propane demand for space-heating purposes and spurred delivery volumes.

The increased propane deliveries yielded improved year-over-year financial results for the MLPs, Fitch said.

"Despite the existence of very high propane inventories heading into the 2002-03 heating season, strong demand combined with high natural gas and crude oil prices to push wholesale propane prices up significantly during the winter months. The propane MLPs successively passed through their higher supply costs to end-use customers, with the majority of companies actually improving their gross profit per retail gallon sold," Fitch analysts said.

In contrast to some other energy sector participants, the retail propane MLPs have maintained levels of liquidity and continued to demonstrate access to capital markets, they said.

Several MLPs have renegotiated bank facilities and completed debt and equity issuances in the past 6 months, Fitch said.

Government Developments

UTAH GOV. Mike Leavitt is US President George W. Bush's nominee as the Environmental Protection Agency administrator.

Bush praised Leavitt's position as cochair of the Western Regional Air Partnership, saying he "leads by consensus and focuses on results, instead of process." Former EPA administrator Christine Whitman resigned effective June 27 (OGJ, May 26, 2003, p. 7).

The Senate is expected to approve the Leavitt nomination upon returning in September from a recess. Several mainstream environmental groups oppose Leavitt, saying he is proindustry.

A Utah native and the nation's longest-serving governor, Leavitt said he believes he was a good environmental steward while governor. He created an environmental program, Enlibra, which the National Governors Association adopted.

"If the Senate confirms my nomination, it will require that I conclude the service of a decade to a state I love and to people I love. But I may do so knowing that the air is cleaner than when I arrived, that the water is more pureU," Leavitt said.

Leavitt helped negotiate consensus with 13 states, three tribal nations, and three federal agencies on a plan to clean up Grand Canyon smog.

Environmental groups focusing on land use issues are the most critical about President Bush's choice.

Doug Scott, Campaign for America's Wilderness policy director, said the nation's wilderness heritage should not be determined the "by narrow and parochial special interests."

But energy industry officials are enthusiastic about the Leavitt nomination, although few associations offered public comment on it.

The Electric Reliability Coordinating Council, which represents utilities, issued comments that were similar in tone to what oil lobbyists privately expressed.

ERCC Executive Director Scott Segal said his organization is pleased "that a governor with a strong record of consensus-building" was nominated.

MEXICO'S industrial gas users, dissatisfied with the nation's temporarily suspended reference sales price for natural gas, are pushing the Vicente Fox administration for permanent relief.

That is the conclusion of a report prepared by Mexico Energy Intelligence (MEI), a Houston-based trade publication covering energy markets and policy developments in Mexico. MEI is published by Baker & Associates.

"The future of Houston-indexed gas prices (in Mexico) is uncertain," said MEI Director George Baker. "These demands of Mexican industry will force the Fox administration to act—in one way or another."

From 1996 to January 2001, the Houston Ship Channel's gas hub was the reference price for natural gas sold in Mexico. This netback pricing system was suspended in January 2001 at the demand of Monterrey industry. The government granted price relief through a 3-year contract for $4/MMbtu. This so-called "Mexico price" will end Dec. 31.

Last month, Mexico's National Manufacturing Association sent a confidential letter to President Fox criticizing the pricing and regulatory decisions of the previous administration.

The letter proposes that Mexico adopt a basket of gas prices reflecting the energy input costs of Mexico's competitors, MEI said.

Quick Takes

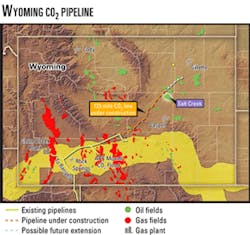

THE BUREAU OF LAND MANAGEMENT (BLM) has given final approval to Anadarko Petroleum Corp.'s wholly owned subsidiary, Howell Petroleum Corp., to begin construction on a 125-mile, 16-in., carbon dioxide pipeline across central Wyoming. The line will terminate on the Natrona and Johnson County line north of Midwest, Wyo., (see map).

The pipeline, which will extend an existing line from the Shute Creek gas processing plant in southwestern Wyoming, will enable Anadarko to deliver CO2 for an enhanced oil recovery project at its Salt Creek field north of Casper. The company will inject 7,200 ton/day of CO2 in the field to recover more than 150 million bbl of additional oil.

The injections are expected to increase Salt Creek oil production over the next several years to a peak rate of 35,000 b/d from 5,300 b/d under the multiphase, continuous development program, Anadarko said.

Based on results of a pilot injection program begun in June, the company "expects to book additional proved reserves in the field prior to yearend," said Mark Pease, Anadarko vice-president, US onshore and offshore.

"We're extending the production life of a 100-year-old oil field [while] sequestering 24 million tonnes of CO2," Pease added.

Gregory & Cook Construction Inc., Houston, is getting under way by Aug. 25 with pipeline construction about 10 miles south of Jeffrey City, Wyo., and expects to complete it by January 2004.

In other pipeline news, Trans-Northern Pipelines Inc. has received National Energy Board approval to increase capacity on its 10-in. products pipeline system from Montréal, Que., to Farran's Point near Ingleside, Ont., to 132,300 b/d from 66,150 b/d and to reverse the direction of flow from Farran's Point to the Clarkson Junction in Mississauga, Ont. The $85.58 million (Can.) project is scheduled for completion by yearend 2004 (OGJ Online, Nov. 8, 2002). Trans-Northern will replace a total of 45 miles of 10-in. pipe with 16-in. pipe in four line segments and will upgrade four existing pump stations, construct four storage tanks, and add three new pump stations. Capacity from Farran's Point to Belleville will increase to 72,450 b/d from 63,000 b/d, and capacity from Farran's Point to Ottawa will increase by 18,900 b/d to 100,800 b/d.

ALBERTA'S legislature and its Energy and Utilities Board have given partners Nexen Inc., Calgary, and OPTI Canada Inc. approval to proceed with the $3 billion Long Lake oil sands project in Alberta. Long Lake, 40 km southeast of Fort McMurray in northern Alberta, will combine steam-assisted gravity drainage (SAGD) with onsite upgrading.

In the first phase of the project, the joint venture will produce 70,000 b/d of 8° gravity SAGD bitumen and upgrade it, using the OPTI Canada patented "OrCrude" technology combined with commercially available hydrocracking and gasification. Nexen said the end product would be a 38° gravity synthetic crude with low sulfur content.

The 50:50 JV plans to start production in 2006, with the upgrader commencing operation in 2007.

FREEPORT LNG DEVELOPMENT LP has awarded a contract to Technip unit Technip USA Corp., Houston, for the front-end engineering design (FEED) for its planned LNG receiving terminal on Quintana Island near Freeport, Tex. (OGJ Online, June 20, 2003). FEED work is slated for completion by yearend, and engineering and procurement leading to construction is expected to begin in first quarter 2004. Construction is expected to be completed by 2007.

The facilities would enable suppliers to bring up to 1.5 bcfd of gas into the country, said Freeport LNG CEO Michael Smith. Natural gas will be transported through a 9.4-mile pipeline to Stratton Ridge, a point of interconnection for many Texas intrastate pipeline systems.

"The proposed LNG marine terminal, storage, vaporization units, and natural gas pipeline will be located entirely in Brazoria County, Tex.," Smith said.

Freeport LNG is a Delaware limited partnership whose sole general partner and 60% limited partner are owned and controlled by Michael Smith. The partnership's other limited partners are Cheniere LNG Inc. 30% and Contango Oil & Gas Co. 10%.

PETRÓLEO BRASILEIRO SA (Petrobras) has awarded a $31 million contract to Halliburton Co. unit Halliburton Energy Services for a 274-ft, world-class, well stimulation vessel to optimize production in Petrobras's Campos basin field off Brazil. Campos basin accounts for about 80% of Brazil's oil production.

From the 17,500-hp hydraulic vessel, which is equipped with Level II dynamic positioning and other sophisticated technology, Halliburton will provide sand control, fracturing, acidizing, and pumping services and products for 2 years and has an option for 2 additional years. Services include engineering, stimulation equipment, fluids, and completion equipment.

The UK DEPARTMENT OF TRADE AND INDUSTRY has offered 88 new exploration licenses covering 137 blocks on the UK Continental Shelf to 62 companies, in its 21st offshore licensing round.

Energy Minister Stephen Timms said that 53 of the licenses awarded are the new "Promote" licenses designed to encourage new, smaller independent players to invest in the North Sea, and the remaining 35 were traditional offshore production licenses. A record 27 companies are new entrants to the area.

The new 'Promote' license offers the licensee the opportunity to assess and promote the prospectivity of the licensed acreage for a 2-year period without the stringent financial, technical, and environmental entry checks required for traditional licenses.

However, these licensees will not be approved as operators or permitted to drill wells until they have passed those checks. A full breakdown of successful applicants is available at: www.og.dti.gov.uk.

In other exploration activities, Petrobras and its partners on Block BS-3, in the Santos basin 175 km off Santa Catarina state in southern Brazil, sent a filing to Brazil's National Petroleum Agency on Aug. 6, declaring the commerciality of its Caravela Sul discovery made by well 1-SCS-10 A earlier this year (OGJ Online, Jan. 17, 2003). The new field has been given the name Cavalo Marinho ("Sea Horse"). Petrobras earlier this year upgraded the field's reserves to 60 million bbl of oil from 40 million bbl, mainly because of its successful production test in the SCS-10A appraisal well. Petrobras, with 35% interest, is the operator of Block BS-3, along with the Coral and Estrela-do-Mar licenses in the same area. Its partners in all three licenses are Queiroz Galvão Perfurações SA 30%, Vancouver-based Naftex Energy Corp.'s Brazilian unit Coplex Petroleo do Brasil Ltda. 27.5%, and Starfish Oil & Gas Co. 7.5%. BHP Billiton Petroleum (Americas) Inc. reports that its Neptune-5 appraisal well—spudded July 2 on Atwater Valley Block 574 in the Gulf of Mexico 135 miles off Louisiana—found a gross hydrocarbon column of nearly 1,200 ft, with more than 500 ft (total vertical thickness) of net oil pay. Neptune prospect is in the Atwater Foldbelt region of the central Gulf of Mexico (see map, OGJ, Nov. 5, 2001, p. 84). Neptune-5 was drilled to 19,142 ft TD in 6,215 ft of water using BHP's CR Luigs drillship. It will be sidetracked. The well logs indicated thick sands and "are among the most impressive we've seen in the Gulf of Mexico," BHP said. BHP and partners have drilled three wells in the field since getting positive results from the Neptune-3 well in July 2002. Statoil ASA has an oil discovery with its Ellida wildcat drilled in the Norwegian Sea on Block 6405/7. Ellida is 37 miles north of Ormen Lange gas field. Statoil said that cores have been taken out, and logging is being carried out on the discovery well in Cretaceous sandstone.

Statoil said it found oil but that it is unknow yet whether it can be produced. The well, being drilled by the West Navigator rig in 1,200 m of water, is programmed to 4,000 m TD. Unocal Ganal Ltd. made a natural gas condensate, and oil discovery on the 32.4 sq km deepwater Gehem prospect in the Ganal production-sharing contract area, 5.6 km south of Ranggas field off East Kalimantan, Indonesia (OGJ Online, Mar. 25, 2002). Unocal said there was "an extremely thick, high-quality, hydrocarbon-bearing reservoir at previously untested depths." The Gehem-1 well encountered 617 ft of net gas and gas-condensate pay and 18 ft of net oil pay. The well was drilled in 5,981 ft of water to a total vertical depth of 15,241 ft. More than 400 ft of the net pay was in an interval that had not been penetrated during drilling in nearby Ranggas field (OGJ Online, Aug. 4, 2003). Deeper intervals will be tested in subsequent appraisal wells.

OIL & NATURAL GAS CORP. LTD. (ONGC) awarded a $137 million, 3-year contract to Houston-based Transocean Inc. Aug. 6 for its Discoverer Seven Seas deepwater drillship to drill off India.

India's state-owned ONGC plans to commence a $390 million deepwater exploration campaign shortly and expects to spend about $1.2 billion/year in exploration activities to increase its crude oil production from deepwater fields (OGJ Online, July 14, 2003). The program includes opening oil and gas fields in India to other companies for exploration.

null

Discoverer Seven Seas, a dynamically positioned drillship capable of drilling in water as deep as 7,000 ft., underwent an extensive multiphase upgrade to its DP system in January.

Under the contract, Transocean will undertake well-planning, operations support, and logistics management. The integrated services contract is expected to begin in first quarter 2004, following the mobilization of the rig to India from a Brazilian shipyard.

CONSTRUCTION on Methanol Holdings (Trinidad) Ltd.'s $500 million methanol plant has begun at Point Lisas Industrial Estate on the west coast of Trinidad and Tobago. Slated for startup in 2005, it will have a capacity of 5,000 tonnes/day.

The state-owned National Gas Co. Trinidad & Tobabo Ltd.will provide gas for the plant from Trinidad and Tobago's national grid.

The island's Energy Minister Eric Williams said the government would give priority to proposals for new gas-intensive projects with downstream products as an integral element.

The German Development Bank KFW is financing the project with a $425 million loan, another $100 million having been sourced privately.

In other petrochemical news, Formosa Chemicals & Fiber Corp. has selected the proprietary downstream ethylene technology of Stone & Webster Inc. for a grassroots ethylbenzene-styrene monomer facility that it plans to build at Haifeng, Taiwan. The Taiwan facility will have an initial capacity of 600,000 tonnes/year of styrene monomer. Stone & Webster—a subsidiary of Shaw Group Inc., Baton Rouge, La.—will provide the technology through its recently acquired Badger Technologies unit. Formosa will use the Mobil-Badger EBMax ethylbenzene process integrated with the Fina-Badger styrene technology.