Refiners' future survival hinges on adapting to changing feedstocks, product specs

This is the fifth in a series of six special reports on Future Energy Supply

The world's refiners face a future of ever-changing feedstocks and increasingly stringent product specifications.

The global conventional crude oil slate will become markedly different from that of today, complicating refiners' processing and logistics strategies. At the same time, a whole new array of oil feedstocks will enter the picture, presenting new processing challenges.

And concerns over crude supply reliability, as evinced by outages this year in Venezuela and Nigeria, are no longer limited to the Persian Gulf region.

Meanwhile, tightening strictures on refined products, spawned by environmental concerns, present dilemmas for processing, distribution, and marketing. Chief among these concerns are the current worldwide campaign to reduce and perhaps ultimately phase out sulfur from refined products and the wrenching adjustments ahead for oxygenates in the US.

The confluence of evolving trends on feedstocks and product specs amounts to a sort of "perfect storm" for refiners in the decades to come, a relentless test of their alacrity in coping with business fundamentals.

These trends are occurring in an industry already coping with generally low returns and, in some regions, persistent excess capacity. Adding to refiners' woes is the hallmark of a mature, commodities-based industry seen elsewhere in the petroleum industry: how to manage a high-technology business with a dwindling pool of fresh talent.

It all adds up to a daunting scenario for refiners, some of which won't survive this latest round of evolution in their business. But there are strategies for thriving, if they can learn to adapt to this brave new world of 21st Century refining.

Changing feedstock slate

Generally, the refiners' basic crude slate of tomorrow will be heavier, higher in sulfur, and lower in overall quality.

As supplies of conventional light, sweet crude from mature regions such as the US and North Sea dwindle, they are being supplanted by crudes lower in gravity and higher in sulfur and other impurities.

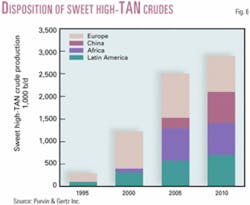

However, there also will be new light crude supplies coming onto the market this decade that will have markedly different characteristics from those of the past, notably greater volumes of crude with the corrosive characteristic denoted by a high total acid number (TAN).

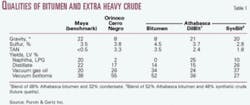

Purvin & Gertz Inc., Houston, recently estimated that high-TAN crude supplies, mainly from the Atlantic Basin, will grow by almost 2 million b/d this decade (Fig. 1). And the consultant predicts that production of extra-heavy crude oil will almost double in that timeframe (Fig. 2).

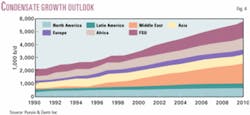

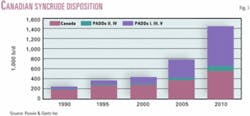

At the same time, burgeoning supplies of synthetic crude oil (SCO), upgraded from Canada's oil sands bitumen and Venezuelan Orinoco extra-heavy crude production are already having a market impact (Fig. 3). And a worldwide push to develop more natural gas fields in response to growing gas demand is producing a bumper crop of new condensates and NGLs (Fig. 4).

Because many of the high-TAN and other new feedstocks are relatively high in gravity, that poses a dilemma for refiners trying to adjust their strategies for crude acquisition and new processing investments.

Kevin Waguespack, Houston-based managing consultant with IBM Business Consulting Services, contends the chief processing hurdle facing refiners in terms of feedstocks "should continue to be those associated primarily with the heavy end of the barrel, e.g., concarbon, acidity, sulfur, metals, and nitrogen."

Martin Meyers, Cambridge Energy Research Associates director, downstream oil, offers a contrarian view, contending that the average crude slate won't become significantly heavier in the coming years.

"Rapid growth in condensate production and increased light crude production from regions such as Russia, the Caspian region, and Africa will help keep the mix light. Also, much of the extra-heavy crude development is being paired with investments in upgrading capacity, either integrated with the production site or at refineries," he said. "There are market opportunities for refiners to share some of the resource extraction rent associated with extra-heavy crude production, especially if they are able to add upgrading facilities to their configuration at lower-than-average cost. Other refiners may find opportunities if their configuration and local market demand are suited to incorporating a significant portion of condensate in their feedstock slate."

But that's only part of the picture, as refiners who invest in deep-conversion capacity find that not all the new barrels of oil are heavy.

"The biggest challenge may simply be correctly anticipating the light-heavy price spread for crude oil," said Aaron Brady, refining analyst with Energy Security Analysis Inc., Cambridge, Mass. "We tend to believe that, since there's lots of medium and heavy crude oil production coming on line in North America, refiners who invest in deep conversion capacity should benefit. But looking around the world, there's also plenty of light, sweet crude production in the wings, such as in North Africa, West Africa, and the Caspian. There's been no clear trend in terms of the light-heavy differential over the past several years, and there may not be in the future either."

Jeff Hazle, analyst with the National Petrochemical & Refiners Association, contends that a major challenge for refiners will be their ability "to characterize the crude oil well enough at the time of purchase to understand how it will affect the operation of the refinery both in the short term (yields, desulfurization requirements) and in the long term (e.g., corrosion)."

While buying crude based just on gravity, distillation curve, and sulfur content will continue for crudes that are well-known, he said, "I think that refiners will require a more extensive characterization of crude from new sources.

"Refiners will be looking for known troublemakers such as organic acids and organic chlorides, and they will need to know much more about the types of sulfur compounds that are present, since sulfur speciation will be very important when refiners begin producing ultralow-sulfur diesel (ULSD) fuel."

For Calvin Cobb and Darrell Rangnow, of Invensys Corp., "Process challenges include sulfur species management, naphthenic acid mitigation, and matching hardware to cocktail feedstock and intermediates."

Not everyone sees the evolving crude slate as exclusively a problem for refiners. Consultant Kathy Spletter, with Addison, Tex.-based Muse Stancil, contends that "oddball" crudes, such as crudes with high TAN levels and unusual yield structures are actually more of a problem for oil producers than a refining issue.

"It becomes a matter of price," she told OGJ. "Integrated companies will adjust their refining operations to accommodate unique feedstocks; nonintegrated producers either will have to discount the price or find a home for the production via a long-term relationship."

Because the future worldwide slate of crudes will be greater than ever, a lack of flexibility will be the biggest hurdle to refining profitability, said Dave Ritter, senior manager with Cap Gemini Ernst & Young.

"We believe the biggest challenge to refiners is their need to have the ability to combine process and operational flexibility with economic and business nimbleness in order to be able to decide and commit to run the most economic crude available at any given time, regardless of quality," he said

Yet the bewildering array of new crude and product slates will make that challenge even tougher, contributing to even more commodity volatility than the industry sees today, contends ESAI's Brady.

"The refiner's toolbox for producing compliant fuels is getting more and more restrictive. With refining operations becoming increasingly complex, and with units running at higher severity, there will be more chances of unplanned outages or 'knock-on' effects in the rest of the refinery that will affect different streams."

Logistical challenges

Flexibility will be the keystone in refiners' efforts to cope with an increasingly complicated logistics outlook for matching crude supply qualities to process configuration (Fig. 5).

Even the more-mundane aspects of the refining business have become more complicated.

Logistical challenges include cargo schedule optimization, pipeline scheduling integration with refinery scheduling, and managing and monitoring feedstock quality throughout the supply chain, say Cobb and Rangnow.

"Another challenge is recognizing that there are more supply chains that intersect the refinery in addition to oil," they told OGJ. "These are chemicals, power, (natural) gas, and hydrogen. Some companies are beginning to address planning for four supply chains instead of just one."

Changing tanker markets also complicate refining logistics.

"In terms of logistics, imports of crude via waterborne tankers will continue to increase as domestic production continues to decline in the large petroleum-consuming nations," Waguespack said. "For long-haul movements, bigger vessels provide the lowest unit cost; however, dock and/or tankage limitations are typically the acting constraints, and many refiners have to settle for suboptimal parcels of crude."

Regional concerns

Crude supply acquisition is becoming an increasingly knotty logistical problem as the world's oil production streams change in composition and as they shift to different areas (Figs. 6-7, Tables 1-2).

Nexant Chem Systems consultant Phil Hunt contends that the principal crude supply problems will be that "major supply sources remain remote from major consuming areas and in some cases are landlocked" and that the growing dominance of the Middle East's oil supply represents a continuing concern for security of supply.

He sees a major logistical problem with burgeoning supplies of crude from Russia and the rest of the former Soviet Union: "Abundant resources of crude oil currently are constrained by export infrastructure. Successful cooperation between the Russian government and major Russian oil companies could ensure that significant quantities of crude oil become available to global markets in the next decade."

Northwest European and Asian refiners face the prospect of declining low-sulfur crude oil availability from local sources amid ongoing tightening of product quality, according to Hunt. "Hence these refiners are likely to need to review future investments in light of a higher-sulfur crude slate."

European refiners face a "particularly interesting" set of challenges, notes Meyers.

"Residual fuel oil and gasoline demand are declining, diesel fuel demand is growing, and availability of light crudes from Russia and the Caspian region is growing, but most of these crudes are better suited to gasoline production than diesel production," he said. "How will European refiners achieve a balance among these conflicting pressures?"

And the logistical dilemma deepens in terms of infrastructure as well as geography. US refiners in particular have new logistical concerns with the trend of increasing reliance on oil imports.

"Refining regions that have historically relied upon local domestic supplies by pipeline such as the Midcontinent, the Midwest, and (Petroleum Administration for Defense District, or PADD) IV, have had to adjust to changing logistics and crude oil sources with often dramatic impact on crude oil quality and supply economics," said Purvin & Gertz Inc.'s Bill Sanderson. "US West Coast refiners have had to replace declining supplies of Alaskan North Slope (ANS) and domestic California barrels with Middle East and Latin American imports, creating a logistical challenge in terms of storage capacity and access to deepwater ports."

Even the encouraging growth of oil production from the Gulf of Mexico hasn't been entirely a palliative for US refiners.

"US Gulf Coast refiners have witnessed the increase in deepwater Gulf Of Mexico supplies, which have partially offset declines in traditional domestic supplies from the Midcontinent. However, pipeline logistics and capacity have yet to fully adjust to the dynamics of Gulf of Mexico production."

A lack of infrastructure is causing concerns for future growth in other areas with burgeoning oil production.

"Western Canadian crude production needs to be able to reach a broader market and may ultimately supply the US Gulf Coast," Spletter said. "Some alternatives are under discussion to allow movement of Canadian crude further south."

She also sees US West Coast refiners struggling to find an alternative to declining ANS volumes: "This will likely be Canadian and Middle Eastern crude, but there will be some challenges in determining the optimum crudes to run. The changes in crude slate will require investment for reconfiguration and require careful study, given the severe nature of the product specifications in California."

Accommodating heavy crudes

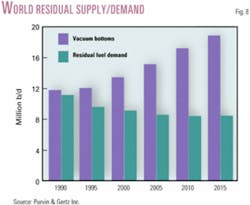

Accommodating the rising tide of heavy and extra-heavy crudes will mean sizable additions to the world's conversion capacity, in light of a growing supply-demand imbalance for residual products (Fig. 8).

Sanderson contends that additional conversion capacity will be required throughout the Atlantic Basin, including the US.

"The significant reserves of bitumen in Canada make the (US) Midwest a likely location for capacity additions," he said. "The US Gulf Coast will most likely add more conversion capacity later this decade to accommodate supplies from Latin America.

"The rate at which conversion capacity is added and where the capacity is installed will depend on the willingness of producers to integrate downstream to secure outlets for surplus heavy crude oils."

Brady notes, however, that the decline in Lower 48 oil production, much of which is light, sweet crude, is not happening fast enough to force refiners to seek massive volumes of such a different crude slate.

"The wave of coker-building that occurred in the last few years has slowed, but we may see another cycle begin if these crudes are offered at a deep enough discount," he told OGJ. "The fact that the ratio of heavy crude to light crude will be increasing dramatically in Western Canada suggests that producers will be under increasing pressure to dispose of it," thus providing more incentive for US refiners to invest in new conversion capacity."

But Hazle points out that the industry has been conditioned by its current and projected financial outlook to be cautious with capital investments, thus keeping refiners long on heavy ends.

"A few refineries will use the addition of conversion capacity to change their operating paradigm and their overall economic outlook, but I don't expect this to become a general trend (unless the passenger automobile market makes a significant conversion to diesel fuel)," he said.

Measures planned to reduce sulfur levels in heavy residual fuel could also trim the sails of any big coker push, according to Waguespeck.

"This may prove to be the most effective catalyst for reducing supply volumes of resid and could serve to reduce the profitability of coker projects undertaken specifically for yield and conversion improvements."

Nevertheless, Ritter expects that existing excess conversion capacity will be quickly absorbed this decade in the US with the surge in Canadian heavy and SCO output.

"While import economics remain strong, projected level of these crudes will necessitate FCC and hydrocracking capacity expansion well before 2010. Additional coking and/or alternative resid upgrading is also necessary," he said.

Where refiners could find attractive opportunities are long-term supply arrangements with heavy oil producers that could justify adding conversion capacity, according to Purvin & Gertz's Susan Bell.

Referring to the growing volumes of bitumen and bitumen blend feedstocks from Canada, she said, "Producers will need to enter into joint-venture agreements or long-term supply agreements with refiners to help guarantee a market for the extra-heavy crude, while sharing in the cost and profit of building incremental upgrading capacity. The model used on the US Gulf Coast to develop markets for Latin American heavy crude through producer-supported coker projects is one that may become relevant to Western Canadian heavy crude oil producers and US Midwest refiners in the future."

But she sees such opportunities as limited.

"Refiners generally strive to maximize feedstock flexibility and are reluctant to be tied to one oil sands-derived feedstock. In addition, refiners do not readily share refined product margins with a feedstock supplier, minimizing the economic incentive of an alliance for the producer."

One promising alternative for leaping this hurdle would be the development of a regional upgrader for Canada's oil sands, Bell said. Such a project could spread costs, achieve economies of scale, and eliminate risks associated with diluent supply. It could see even further advantages via integration with petrochemical facilities to exploit as feedstock surplus NGLs from oil sands operations.

Given the state of US refining today, says Brady, it might at first blush seem incumbent upon oil sands and other ultraheavy crude producers to resort to upgrading schemes to meet market demand. Yet a long-term oil sands producer-refiner alliance could make sense for a refiner "as a route to a more stable source of feedstock, one that is not subject to (Organization of Petroleum Exporting Countries) production decisions, oil sector strikes, or coups." He cited Suncor Energy Inc.'s recent purchase of the ConocoPhillips refinery in Denver as an indicator of that prospect.

And given large investments in oil sands development and refinery upgrading for desulfurization, Fitch Ratings Inc.'s Bryan Caviness sees the possibility of more joint ventures, "particularly in the Rocky Mountains or Midwest markets where most Canadian crude is delivered.

"Alternate routes may be pursued, including further penetration by the Canadian crudes ultimately down to the highly concentrated Gulf Coast via pipeline. There is significant idle pipeline capacity that can be tested repaired and potentially reactivated"

Cobb and Rangnow insist that upgrader investments are required to exploit the vast ultraheavy oils of Canada and Venezuela because of fungibility hurdles for the difficult-to-transport crudes.

"In the event the upgrader is marketing the crude oil on an arm's length basis with the owners, then the crude oil must be fungible and compete with other fungible crude oils in the market," they told OGJ. "Another consideration is that the upgrader crude oil sales should not cannibalize sales of the owners' crude oil.

"In the event the upgrader owners have refineries in the natural markets for the upgraded crude oil and take title to the crude oil, then the optimal hardware configuration can be developed."

Sandersen's firm undertook a comprehensive analysis on upgrading heavy crudes and residues to transportation fuels that found favor with the "symbiotic" approach. He contends that both remote and in-refinery upgrading approaches will continue to be used, "driven almost strictly by economics case by case" because it "aims at optimizing economic return across the whole production-to-market chain."

Other feedstocks

Refiners will have to make special accommodations for new, "manufactured" refinery feedstocks such as SCOs and gas-to-liquids streams.

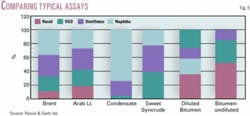

SCOs have a range of properties depending upon the degree of hydroprocessing included in SCO production and upgrading facilities, Nexant's Bruce Burke pointed out.

"However, generally, SCOs are hydrogen-deficient relative to most conventional crude oils, yielding diesel blendstocks with low cetane numbers and low-quality cat cracker feedstocks. Therefore, refiners typically must add hydrotreating and hydrogen production capacity to process significant SCO volumes."

At the same time, SCOs "with a low yield of heavy, vacuum tower bottoms are unattractive feedstocks for coking refineries," Burke added.

Bell noted that while sweet SCO generally has no vacuum bottoms, it is rich in vacuum gas oil (VGO) and distillate.

"The cetane of the distillate in synthetic crude tends to be lower than that of conventional crude, while the jet smoke point is also lower. To run a significant quantity of synthetic crude oil, conventional crude refineries would likely need to invest in additional conversion capacity to manage the incremental vacuum gas oil in the crude. Distillate or vacuum gas oil hydrocracking capacity would also be required to keep the diesel pool cetane balanced and the jet smoke point on spec."

She also pointed out that some of the oil sands bitumen blends are high in TAN, requiring refiners using those feedstocks to invest in improved metallurgy.

Because SCOs have already been processed or cracked, they have more olefins and other "bad actors" that can create an unstable mix relative to other crude oils, according to Brady.

"Furthermore, a 'light' upgraded SCO is not equivalent to a natural crude with a similar API (gravity) in terms of product yield structure. Since the crude has already been cracked, the VGO portion of the SCO is not as amenable to be upgraded as the VGO of a natural crude.

"Therefore a refinery might find the SCO yields him less gasoline or middle distillate."

However, because that compels a refiner that uses SCOs to blend them with other, natural crudes to get the right yield, more processing of SCOs may increase the premium for certain crudes that "blend well" with SCOs.

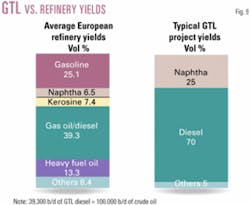

GTL streams create an "obvious challenge" for refiners' market share, Bell said, but also they offer some interesting potential opportunities.

"The highly paraffinic nature of diesel fuel from GTL sources creates an attractive potential diesel fuel blendstock for refiners with borderline cetane diesel fuel pools. Similar parallels exist for lubricating oil base stocks and solvents."

Hazle also sees both processing and marketing opportunities and challenges for refiners in the new crop of GTL products.

"GTL streams will likely be blended into their corresponding petroleum products, although some products, such as GTL waxes, may become products in their own right," he said. "However, given their unique properties (Fig. 9), some GTL streams, particularly diesel fuel and lube oil basestocks, should command a premium over conventional products."

Changes in crude oil analysis might level the playing field for these offbeat feedstocks, however.

"Invensys and a number of refiners are looking at more sophisticated ways to analyze crude oils with techniques called 'molecular modeling,'" Cobb and Rangnow told OGJ. "If these are successful, it will allow us to think about the individual species in crude oil like a chemist might.

"With greater insight into the components of oil, we may be able to tailor processing to the 'manufactured' feedstocks. Some interesting advancements are being made in characterizing oil and in the computational methods of handling the larger number of individual species. We believe some of these techniques will lead to great degrees of freedom in processing feedstocks through the critical refinery units."

Capital investment

The aforementioned caution with which refiners must approach any major capital outlays make the coming changes in crude slates and product specs even more confounding.

Because of the emphasis on high-TAN and heavy crudes, coupled with lower sulfur levels, Sanderson sees the focal point of future refining capital investment resting on "selected conversion additions, such as delayed coking and hydrocracking, investment in sulfur processing for gasoline and middle distillates, as well as metallurgical upgrades in the distillation complex to process high-TAN crudes."

Hazle contends that refiners will invest in equipment and practices that monitor and reduce corrosion rates and tolerate more-corrosive compounds.

"Crude slate (specifically sulfur speciation) will influence how much capital will be invested in ULSD hydrotreating units," he added.

But Brady thinks that as pressures grow to move toward a zero-sulfur world, "it doesn't matter how sweet the crude is, some sort of upgraded desulfurization capacity will be required.

"Deep conversion investments such as cokers will also continue to appear, especially in North America, whose crude resources are getting heavier and more sour. And we'll also see more more hydrocracking investments, especially in Europe, where there is an urgent need to produce not only more diesel, but lots of zero-sulfur diesel."

Much of the future capital investment for the world's refiners may evolve along the lines of a new paradigm for operations that could entail a combination of hardware flexibility and technology-enabled business process changes, said Cobb and Rangenow.

"Hardware flexibility include increased fractionation, feedstock blending, and employment of various sulfur removal technologies," they told OGJ. "Technology will be used to better match feedstock to hardware availability, including real-time feedstock blending, feedstock characterization, broader use of real time feedstock analyzersUand optimization of the crude unit.

"Technology-enabled business processes also will be used to improve the modeling fidelity and molecular characterization of refinery streams, particularly for sulfur species and multiringed hydrocarbons.

"With the integration of information technology and knowledge capture, crude slates will be balanced more and more in a real-time planning environment that will maximize value."

More capital must be allocated to the more-routine—but still critical—side of refinery operations, according to Ritter.

The kinds of investments needed to accommodate the new crude slates and product specs pressure refiners to achieve consistent returns on capital employed, he noted.

"One of the other key focal points for the refiner is to improve the reliability of operations through improvements in the maintenance area," Ritter said. "Investments in reliability pay off in reduced overall costs per barrel, by reducing unplanned downtime and emergency maintenance costs. The larger the overall capital investment, the larger the payoff there is likely to be from maintenance improvements."

There are regional variations in how future refining capital will be spent.

Muse Stancil sees more outlays in Europe for hydroprocessing, much of it for hydrocracking, to deal with a heavier crude slate, increasing diesel demand, and lower sulfur levels for fuel oil.

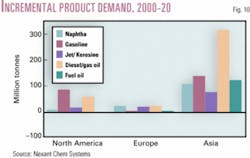

In the Asia-Pacific region, Muse Stancil's Enrico Sismondo noted that as demographics and per capita income change, the emphasis will shift to higher yields of motor fuels and petrochemical feedstocks (Fig. 10).

"This change in product demand ratios, and competition between demand growth for gasoline and for petrochemical naphtha feedstock, will drive to increase investment in catalytic cracking processes, both FCC/RFCC and (hydrocracking)," he said. "The incremental (Middle East) crude in the slate will exacerbate the demand for such process upgrading."

At the same time, the consultant sees strong potential for new grassroots refining capacity and additional process upgrading in the high-growth economies of India, China, and Indonesia.

By and large, however, the bulk of refining investment worldwide will focus on how to deal with an increasingly heavy, more sour crude slate at a time when demand for heavy fuel oil is declining due to greater inroads by natural gas. This generally leaves a focus on either residue upgrading, via such approaches as hydrocracking, or destruction via coking or gasification.

"A key challenge in terms of capital investment is the range of residue processing technologies that are available, none of which is a "clear winner," said Nexant's Hunt.

"The need for improved technology solutions will promote innovation in the industry and, potentially, will deliver solutions currently not available. The industry has demonstrated its capabilities in this area in the way it has facilitated production of products with much higher quality at much lower investment levels than originally thought possible."

Sulfur concerns

The refining industry will have ample opportunity to demonstrate its capabilities in meeting future changes in product specs.

At the top of list is the push to desulfurize gasoline, diesel, and fuel oil, a campaign that is spreading across the world (Table 3).

"The desulfurization campaign is far from complete, and this will be a major issue for most refiners for years to come," Ritter said. "The potential reduction of sulfur levels in transport fuels from 500 ppm currently to 15 ppm in the future essentially implies sulfur-free diesel fuel—as the reproducibility of the lab tests is 17 ppm. This will require significant investments in catalytic hydrodesulfurization."

Reducing sulfur content in refined products to levels once thought untenable is already posing processing dilemmas for refiners.

"The biggest challenges (in desulfurization), besides dealing with a more severe operational modeUmay be how to dispose of unwanted refinery streams," Brady said. "As product specs tighten, certain refinery streams have to be blended into lower grades as they are excluded from the premium product pools either through cut point or blending restrictions. High-sulfur distillate cuts, for example might get dumped in the fuel oil or high-sulfur heating oil pools.

"But what happens when the fuel oil market is shrinking dramatically? Worse, what happens when regulators target fuel oil sulfur content, as is being done in Europe?"

Brady suggests that there is a limit to which conventional refining can meet new fuel standards, which could open the door further for more "exotic" blending, such as with GTL products.

The tighter specs also mean quality control concerns, as ultralow-sulfur requirements become a pipeline contamination issue, Brady added.

"Batches of diesel will go off spec if even a minute amount of sulfur from a higher-sulfur product becomes commingled with the diesel. That will necessitate more processing, cost, etc."

In a sense, contamination concerns are a relatively short-term issue, notes Muse Stancil Pres. Mike Lovett, although "as the system works through the problems, it may result in some price spikes and localized shortages.

"The regulatory authorities have a history of relaxing constraints if they cause shortages, but too often the changes come in the midst of the problem and seem to negatively impact the industry, which has struggled to achieve compliance per the original rules."

In some instances, industry has been ahead of the regulatory curve on low sulfur; for example, some refiners introduced low-sulfur gasoline in California ahead of the regulatory mandate.

"Although California has been successful in maintaining the low-sulfur gasoline, the ability for the entire country to continuously meet the new regulations has yet to be seen," Caviness said. "Although ultralow-sulfur gasoline has been proven on a wide scale, ultralow-sulfur diesel has not. The evolution of the diesel regulations to 15 ppm for both on and off road diesel over the next few years could put a significant strain on supplies. "Consistent quality will be an issue, given the diversity of feedstocksUand the diversity of processing units. Refineries come in all shapes and sizes, and some refineries will have more difficulty meeting the regulations than others."

An increasingly sour global crude slate will only exacerbate refiners' ability to meet the new ultralow-sulfur fuel specs. Muse Stancil's Ken Cowell sees that problem cropping up with the shift to incremental Russian crude oil sources: "The higher sulfur in these crudes will aggravate the fuel oil sulfur content problems. The 2-3% sulfur fuel oil derived from these crudes will be more market-challenged than lower-sulfur fuel oils and will drive some investment."

Other spec concerns

Ultralow-sulfur levels are only part of the picture facing refiners when it comes to adapting to stringent new standards for fuels.

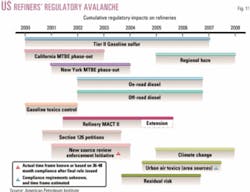

Fig. 11 depicts what the American Petroleum Industry calls a "regulatory avalanche" cascading over US refiners this decade.

Of special concern is the recent brouhaha over oxygenates in US gasoline. Because of some instances of contamination of groundwater from leaking tanks, a campaign is gathering momentum at the state and federal levels to phase out or ban the most widely available oxygenate, methyl tertiary butyl ether (MTBE). At the same time, proposed federal legislation would establish what amounts to a nationwide mandate to replace MTBE with corn-based ethanol, giving US refiners another headache.

"As with California, a national phase-out of MTBE will put an even greater strain on logistics, at least in the short term as individual states implement their own regulations," Caviness said. "The ability of major interregional pipelines to meet these demands will be crucial, as we have seen in recent years with both the Explorer and Colonial pipelines having difficulties during periods of peak demand."

In addition, industry will have to devote more capital to avoid stranding the investments in MTBE capacity they've already made by converting that hardware to produce gasoline-blending components, according to Cobb and Rangenow.

Industry experts canvassed by OGJ generally concurred that there is little likelihood of stopping the ethanol juggernaut in light of its popularity with agricultural interests and its status as a renewable fuel.

"It is probable that refiners will have to deal with renewable fuels, given Congress's determination to support the 'family farm' at the expense of fuels producers, consumers, and the environment," Hazle said. "Complying with these requirements will be very challenging, given ethanol's high (Reid vapor pressure) and the difficulties of distributing it."

What's more, Hazle added, is that the implementation of the renewable fuel standard is likely to overlap that of the gasoline and diesel desulfurization requirements, which will increase industry's costs and operational complexity.

"In addition to these legislative and regulatory requirements, engine makers will continue to push for fuels changes that are driven by engine performance issues cloaked as environmental concerns," he said. "Although Europe has started down this path, these changes appear unlikely to gain traction in the US."

What's next in the regulatory crosshairs for refiners?

"In terms of future regulations, aromatic content and toxics, perhaps driveability index, are likely the next fuel parameters to be targeted after sulfur," Brady said.

Hazle said he thinks that toxics are already on the docket as the next environmental regulation for refiners to meet: "It is very probable that refiners will be talking to (the Us Environmental Protection Agency) about toxics in 2004."

Part of the regulatory impetus behind higher fuel efficiency is for control of greenhouse gas (GHG) emissions, namely carbon dioxide, to deal with fears of purported catastrophic global warming.

"Given this regulatory focus, it is logical to expect future U.S. regulatory programs to move in the direction of reducing GHG emissions consistent with similar programs in Europe and Canada," Sanderson said.

But Hazle is skeptical on that score: "I think that CO2 regulations are much more problematic, since it is not clear that the US will tolerate limitations on economic growth, which would be one of the consequences of CO2 emissions limits."

European refiners will also be faced with addressing CO2 emissions, "both directly and as a result of the drive to force auto manufacturers to increase efficiency, reducing the resultant vehicle CO2 emissions," Cowell noted.

Cobb and Rangenow see the next big product challenge as being largely market-driven rather than driven by regulatory mandate.

"We tend to feel that diesel aromatics content may be significantly further reduced to enhance the expanded use of the new direct-injection turbocharged diesels brought on by their higher efficiency(relative to a spark-ignited gasoline engine) and improved performance."

Other concerns

Among other refining concerns cited by industry experts canvassed by OGJ, the worsening lack of qualified personnel to supplant an aging workforce ranked at the top of the list.

For Cobb and Rangenow, the biggest issue the refining industry faces is attracting and retaining talent, not only in the refining industry, but also its supporting industries.

"The problem will become more acute with the aging of the baby boomers, which have been the mainstay of the industry. As this shift occurs, costs will increase dramatically, and companies will continue be to be faced with difficult decisions about staffing, outsourcing, and maintaining technical and managerial capacity."

The Invensys consultants see innovations ahead for addressing the staff shortage, including creating a collaborative environment that enables a refiner to leverage scarce talent by channeling refinery problems to "centers of excellence."

In addition, they foresee, among other innovations, greater use of expatriate personnel, more innovative approaches to knowledge management, and increased use of remote monitoring and control of facilities.

Another long-term concern for refiners is the persistence of excess capacity. This problem is likely to continue, says Sanderson, because the long-term outlook for petroleum demand growth is only 1-1.5%/year worldwide, and lower in developed regions.

"However, the continued drive toward cleaner fuels and displacement of residual fuel oil by natural gas is likely to concentrate refining capacity into fewer, larger refineries with more-sophisticated processing operations, making it less likely that the decade-long conditions of overcapacity that plagued the industry in the 1980s and 1990s will be repeated for long periods," he said.

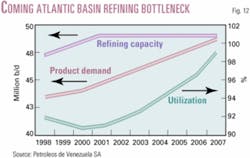

The problem of excess capacity will remain largely regional, as a capacity squeeze may emerge in the Atlantic Basin before the end of the decade (Fig. 12). In the US, incremental capacity "creep"—which always seems to come in parallel with revamps spurred by new, environmentally driven product specs—is tracking a steady climb back up toward historic highs by the end of the next decade.

Given the rush to desulfurize, a new hurdle will emerge for refiners to cope with: disposition of growing volumes of elemental sulfur.

Caviness notes that this is a profitable area for refiners now, but that "this may become a breakeven or loss part of the business going forward."

Nexant, which is planning a new study to assess the issue, sees sulfur disposition becoming a "severe" problem not only because of growing volumes but because of low demand concentrated in large commodity industries that are mature and slow-growing.

"Major new uses of sulfur, such as for paving asphalt and construction concrete, will need to rapidly be developed," Burke said. "Use as an agricultural supplement also has high volume potential. Such developments will take time, especially since there are a number of important environmental questions that need to be addressed for each."

Big picture: profitability

With all of these daunting challenges, the big picture for refiners in the decades to come will be: How to sustain profitability in an already low-margin business?

And a corollary question follows: How many refiners will be around to enjoy what profits are to be had?

Complicating the big picture are uncertainties over future changes in transportation fuels. "During the next 20 years, improved conventional engines, hybrid vehicles, and, potentially, fuel cells will begin to have a measurable impact on the demand for transportation fuels," said Muse Stancil. "Researchers expect fuel economy improvements of more than 50% compared to current engine performance. Reduced per capita demand for transportation fuels will present fuel supply and economic challenges to accommodate the existing fleet of conventional gasoline and diesel-fueled vehicles along with the growing requirements for advanced fuel formulations."

Most of the experts OGJ consulted foresee further consolidation in the number of refineries and refiners in the coming decades, as more marginal plants fall by the wayside and more companies exit the busines. However, the expectation is that overall capacity will not be greatly affected as bigger companies and more-complex refineries take their place.

"Refining is a commodity-transformation industry, and such industries typically display modest average profitability over time," Meyers said. "In the US, this has been the case, on average, over the last 20 years, and CERA does not expect this to change.

"The number of refineries and refiners in the US will probably continue to decline slowly, although the scope for further consolidation is declining because of likely concerns on the part of regulators regarding concentration of ownership."

Sanderson sees the trend toward larger, more sophisticated refineries that has taken place in North America continuing and accelerating in other regions, such Europe, the former Soviet Union, and Asia.

Still, there are refineries operating and being built in regions such as Asia and Middle East for reasons other than economics, notes Muse Stancil, adding that some governments in these regions regard refineries as strategic assets.

In fact, refiners can expect "tighter linkages" with national oil companies (NOCs), according to Waguespack, who sees a kind of "utility" model evolving in the industry whereby refiners extract tolling tariffs from either or both NOCs and product marketers.

Taking it a step further is the prospect of refiners filling a purely merchant role, affiliated with no upstream or marketing entity—even the majors—"selling their volume at the rack, based on economics, to all comers regardless of affiliation," says Waguespack. He adds that another likely new model for refiners is a "holistic" approach, in which refiners completely integrate their operations with their supply, trading, and marketing functions, managing the entire downstream portfolio as one business to maximize profit.

Others see refining centers becoming increasingly integrated with petrochemical complexes or other processing operations, reducing overall feedstock and ancillary operating costs.

And the pressure to reduce costs without increasing operating risks will not let up over the foreseeable future, contends Waguespack.

"Better use of information and the ability to safely and optimally run a refinery with significantly less engineering and management could be one of the next focus areas for cost reduction," he said. "Information technology and an extended network of external specialists could catalyze this develpoment. A fairly significant reduction in payroll can be achieved by the refiners that are the first to succeed in this area."

Whatever the refiners of tomorrow look like, there will be fewer of them.

Noting that only 10 companies own 80% of US refining capacity today, Cobb and Rangenow see that number shrinking to less than 6 by 2015.

"Refineries without scale, niche markets, or conversion capacity will continue to be rationalized, particularly for marginal refineries in a multirefinery system," they told OGJ. "The next major capital commitment will force many of these marginal refineries to be shut down."

With such consolidation will come decreased cyclic behavior of refining margins, the Invensys consultants said

"With consolidation, the refining companies will be able to make more intelligent decisions around 'speculative' processing, which should result in better meeting market needs without destroying the market."

Staying competitive in tomorrow's refining environment requires that 20¢/bbl/year in refining-marketing costs be eliminated "just to stay even," Cobb and Rangenow said.

"This imperative will require refining and marketing companies to be creative in their approach to staying competitive, in addition to consolidation, such as employing technology-enabled business processes that have the potential of fundamentally changing the industry. These changes will result in different organizational, cultural, operational, and commercial paradigms."