World hot spots, Asian economy boost tanker industry

A stronger-than-expected Asian economy helped boost the worldwide tanker industry to a positive first quarter 2003.

That quarter, according to Clarkson Research Studies, London, in its semiannual Shipping Review and Outlook, was one of the best ever for tankers, when the low cost of capital is taken into account. "Earlier predictions turned out to be wrong," says the report.

The Atlantic segment had a poor 6 months, but Asia, especially China, exceeded all expectations.

The report says the "bust to boom" spanned exactly the 6 months between reports. The tanker earnings index rose steadily to $50,000/day in March from $12,000/day in September. This was driven by a unique combination of events, says report, including the Venezuelan strike, a hard winter in North America, congestion in the Black Sea, tribal warfare in Nigeria, nuclear power plant shutdowns in Japan, and the cutback in Iraq exports. All this boosted tonne-mile demand.

The report is cautious, however, about the next few months. "Looking ahead," says Clarkson, "we think there are too many deliveries to allow the peak to be sustained for the remainder of the year."

Tankers

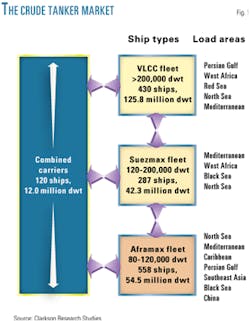

Fig. 1 shows the basic makeup of the crude tanker fleet and the loading areas for each class.

The 6 months ending Apr. 1, 2003, were very eventful for the crude oil tankers market, says Clarkson. December saw an abundance of high-profile casualty incidents. Tankers carrying crude and LNG cargoes either ran aground, sank, caught fire, or collided.

October saw a terrorist attack on the oil tanker Limburg. A small vessel full of explosives hit the 2000-built very large crude carrier, damaging it as well as giving the industry a scare.

The 1976-built, 81,564 dwt Aframax vessel Prestige broke apart and sank off Spain, taking 77,000 tonnes of fuel oil to the bottom.

Much of it washed ashore in Spain and Portugal, fueling an intense debate in the international community.

The report says the European Union has begun to advocate much stricter laws regarding the scrapping of single-hulled tankers and argues for the timetable for such laws be made as brief as possible. Clarkson believes by 2005, all tonnage older than 15 years could be banned from EU waters.

Also, individual countries, such as France, Spain, and Portugal have taken unilateral action in banning single hulls carrying certain cargoes from entering their economic zones.

Clarkson says that tanker markets are used to seasonal dips in demand, but the circumstances of tonnage supply that have helped create recent tighter market conditions and unprecedented rate levels could still leave owners in an optimistic mood.

VLCC outlook

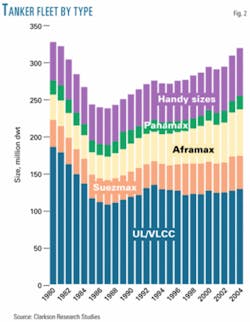

Fig. 2 shows the sizes and types of tankers covered in the Clarkson report.

Average earnings for double-hulled, modern VLCCs (>200,000 dwt) shot up to $74,929/day in January 2003 from $11,729/day in August 2002. This represents the highest earnings reported since December 2000, says Clarkson, when they had fallen to $86,139/day just below their November peak.

This compares with slightly less than a year ago in April 2002 when earnings averaged a mere $10,780/day, well below the average earnings over the past 2 years of $34,029/day.

"So far in 2003," says the report, "average earnings have fluctuated between $48,933/day and $92,664/day for modern double-hulled VLCCs, and between $45,327/day and $84,202/day for 1990s-build VLCCs."

According to Clarkson, there were 430 VLCCs at the end of February, with 71 on the orderbook. A total of 38 vessels were delivered in 2002, and 4 had been delivered in 2003 at the time the report was issued.

In 2002, 33 VLCCs were sold for scrap. Only 13% of the current VLCC fleet is more than 20 years old.

Clarkson expects 9.7 million dwt of VLCCs to be delivered in 2003, but scrapping of 7 million dwt will keep the growth of the fleet down to 2.2% as it expands to 127.5 dwt.

Suezmax market

According to the Clarkson report, worldscale rates have increased across the board on all major routes for Suezmax vessels (120-200,000 dwt). West Africa to the US Gulf of Mexico rates have seen a steep increase since September 2002.

One-year timecharter rates for modern, double-hulled, 150,000-dwt tankers soared to $29,250/day in February. That had not been seen since October 2001.

"Three-year timecharter rates had climbed to $22,750/day in February," says Clarkson, "but have, as the 1-year rates, started to come down."

Ex-West Africa trade became increasingly attractive to both the US and Asia as Middle East supplies appeared vulnerable to the effects of war. For modern double-hulled Suezmaxes, average earnings amounted to $60,352/day in February, says the report.

In the Baltic Sea, an exceptionally cold winter resulted in thicker-than-normal ice, which resulted in a series of collisions. There were many instances of ships being escorted out of the area by icebreakers.

Finland is pushing for a ban to keep all vessels that do not meet local ice-classification standards well away from these waters. Clarkson reported that, in January, most of the Baltic Sea terminals were ice-bound.

Traffic in the traditional Suezmax routes—ex-West Africa and ex-FSU—is likely to be running at maximum capacity, keeping supply tight and rates high.

Aframax

"September 2002 marked a turning point," says the report, "for a market [Aframax; 80-120,000 dwt] that had been steaming downhill since January 2001. That month hurricanes and tropical storm in the US Gulf of Mexico caused serious supply disruptions to US refineries, and winter turned out to be exceptionally cold."

Delays due to bad weather in the Bosporus caused extensive blockages and delays for vessels crossing the Black Sea as tankers queued to enter and leave the area, says Clarkson. This had the result of giving the Aframax market "a welcome squeeze," says the report.

As a result of all these events, Aframax rates firmed steadily across the board.

Cross-Mediterranean rates were high at the beginning of March, says the report, and timecharter rates also firmed significantly over the previous 6 months. At the end of February, a modern 105,000-dwt vessel could be chartered for 1 year at $22,563/day. Timecharter rates for 3 years for the same vessel were $19,500/day.

In March 2003, there were 134 Aframax ships on order. Clarkson reports that 3 years earlier, there were only 34 Aframax ships on the orderbooks.

Product tankers

The product tanker market, says the report, was at a 2-year peak and in a situation similar to that of 2 years earlier. In 2001, there were significant shortages of gasoline in the US and the single-hull debate that followed the Erika incident of 1999 (OGJ, Dec. 20, 1999, p. 38) accelerated the scrapping timetable.

Rates at the end of first-quarter 2003 were up across the board compared to 6 months earlier, says Clarkson.

Average earnings had improved significantly for both the clean and dirty products trade. Clean products earnings averaged $25,377/day in February 2003, up by 93% year-on-year, but 38% lower than the $40,848/day they reached in February 2001. Clarkson reports they climbed even higher during early March.

Average earnings for dirty products came to $38,815/day for February, a "staggering" 224% increase over February 2002 and 4% stronger than in February of the record year 2001.

A main factor influencing the product sector was the strike in Venezuela, says the report. Refineries were working at 40% capacity, and the country has had to import gasoline to satisfy its needs.

"In the US," says the report, "the loss of gasoline exports out of Venezuela is pulling in transatlantic gasoline imports from Europe and the Mediterranean. High naphtha prices in the US have also given a boost to transatlantic arbitrage liftings."

Products tankers in the report consist of Handy tankers (10,000 and 60,000 dwt; most of which are coated) and Panamax tankers (60,000-80,000 dwt).

"Both gasoline and gas oil rely on the same pool of 30,000 ton Handy tankers, and competition for them has pushed tanker rates northwards," says Clarkson.

null

The Handy tanker fleet will expand by 2.5% in 2003 to 61.9 million dwt, says the report, and by 4% to 64.4 million dwt in 2004.

Clarkson expects the Panamax fleet to grow even faster, from 2.1% in 2003 to 15.6% growth in 2004, taking the fleet to 17.2 million dwt.

Gas carriers

Worldwide, LNG is one of the fastest growing energy sectors. Most natural gas is consumed in the country where it is produced or exported by pipeline. Only about 6% of natural gas, says Clarkson, is transported by sea in liquid form.

The major part of the LNG market still consists of trade tied into contracts, covering the major LNG projects in Indonesia, Malaysia, Algeria, Australia, Qatar, Brunei, UAE, US, Nigeria, and Trinidad and Tobago.

For LPG, mature markets exist through the developed world, says the report. Europe and Japan are the biggest importers, taking 9.8 million tonnes and 10.3 million tonnes, respectively, during the first three quarters of 2002.

The overall size of the LPG fleet has declined over the last 6 months, says Clarkson, to 985 vessels of 13.85 million cu m from 993 vessels of 13.97 million cu m.

LNG

Trade in LNG was 246.6 million cu m in 2002, which represents a 5.9% increase over the previous year (Fig. 3). Clarkson says there were 12 exporting countries and 11 importing countries in 2002, utilizing a fleet of 137 LNG carriers at yearend (OGJ, June 23, 2003, p. 72; June 30, 2003, p. 64).

Asia received 169 million cu m of LNG—68% of the total imports—primarily from Malaysia, Indonesia, and the Persian Gulf.

Japan remains the world's largest importer (118 million cu m) despite a 1.3% decline in import quantities, its first ever. Clarkson reports Japan's imports now represent 48% of the world LNG trade (OGJ, July 7, 2003, p. 64).

Korea imported 11% more than 2001, receiving 39 million cu m. Taiwan deliveries went up by 13%, accounting for 11 million cu m.

Europe imported 66 million cu m in 2002 (19% more than in 2001) from nine different sources but mainly from Algeria, Nigeria, and Qatar. "France and Spain are the largest importers in [Europe]," says the report, "receiving 23 and 22 million cu m, respectively."

Belgium, Turkey, Italy, and Greece are the other European importing countries.

In the US, once the world's fastest growing LNG market, imports fell off by 4% to 12 million cu m. Trinidad and Tobago was the main source of LNG for the US market.

El Paso Global LNG announced early this year that the company will leave the LNG business. As a result, construction of one LNG carrier was cancelled at Daewoo SME.

The Clarkson report says the company's four remaining ships, two of them fitted for regasification, will be marketed by Exmar.

"In March 2003," the report says, "the fleet consisted of 141 LNG carriers of 16 million cu m. This was 7 more vessels than a year [earlier]. There are another 54 ships on order to be delivered within the next 3 years, which will bring the fleet up to 195 by the end of 2006."

By second-quarter 2003, 4 vessels had been delivered: the Gallina, Berge Boston, LNG Bayelesa, and British Innovator.

Thirteen more were set to be delivered by yearend. In 2004, there will be 20 new deliveries and thereafter 13 in 2005 and 8 in 2006.

Korea will produce 31 vessels, and another 17 will be constructed in Japan. Six ships will be constructed in Europe, mainly in Spain.

According to Clarkson, several projects are looking at vessel sizes up to 200,000 cu m in capacity. It is likely that some of these larger vessels will be ordered in 2004.

LPG carriers

For the very large gas carriers (VLGCs; > 60,000 cu m), rates have remained about the same as for 2001, reports Clarkson.

"Rising supply from Atlantic Basin producers," says the report, "remained a major feature of the market [in 2002], and arbitrage movements east continued to impact VLGC trading patterns, although firmer winter demand pushed up prices in the west and ensured product remained closer to source in the latter part of 2002."

Three VLGCs were delivered and four sold for scrap last year. By March 2003, the fleet totaled 103 vessels of 8.03 million cu m. Seven vessels are scheduled for delivery this year.

Only 1 VLGC had been sold for scrap in early 2003, but the age profile of the fleet suggested more could be scrapped. Nevertheless, Clarkson's estimates suggest the fleet will expand by more than 5% to 8.5 million cu m in 2003.

"Supply surplus in the west, lower levels of Middle Eastern exports—with no significant reversal expected near term—lower Asian exports, and rising regional demand," says Clarkson, "are likely to continue to pull LPG cargoes eastward and support tonne-mile demand."

For large gas carriers (LGCs; 40-60,000 cu m), the 6 months ending at Apr. 1, 2003, saw improvement in the market compared to 2002.

"A two-tier sector in this market," says Clarkson, "has become more pronounced, with older vessels almost exclusively trading in ammonia due to the fact that a substantial proportion of them lack the oil major approvals required for LPG."

Clarkson says the age profile of these vessels is significant in that 6 of the 21 LGCs in the fleet in early 2003 were older than 25 years.