Market Movement

Gas futures price hits 7-month low

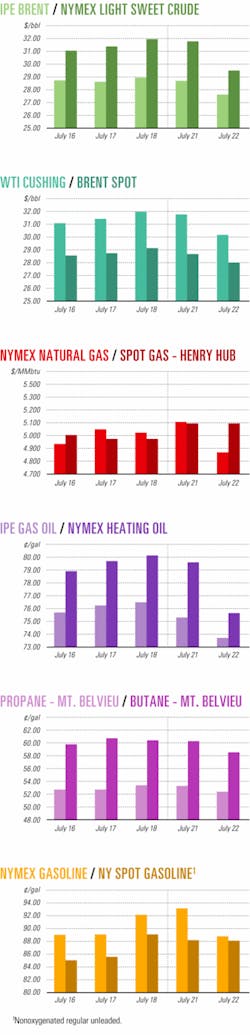

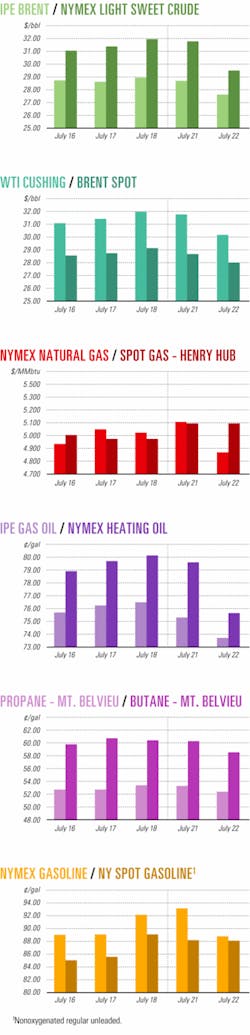

Energy futures prices plummeted July 22 on the New York Mercantile Exchange, with natural gas hitting a 7-month low of $4.87/Mcf as a tropical storm dissipated in the Caribbean.

The expiring August contract for benchmark US light, sweet crudes fell by $1.59 to $30.19/bbl, but no one seemed to know exactly why. Guesses ranged from the deaths of two of Saddam Hussein's sons, Uday and Qusay Hussein, killed that same day in a firefight with US troops in Iraq, to a call by the London-based Centre for Global Energy Studies for members of the Organization of Petroleum Exporting Countries to increase production at their July 31 meeting to make up for the continuing lack of Iraqi oil (OGJ Online, July 23, 2003).

Energy futures prices rose slightly in the next session, however, buoyed by industry and government reports of declines in US inventories of crude and gasoline. The September contract for benchmark US oil gained 18¢ to $29.67/bbl, while the August natural gas contract inched up by 0.8¢ to $4.88/Mcf on July 23.

Natural gas outlook

"The market is paying the price now for (previous) $6.50(/Mcf) gas," said Stephen A. Smith, founder and president of Stephen Smith Energy Associates, Natchez, Miss. The natural gas market earlier spent "5-6 weeks with gas prices over $6(/Mcf)," followed by "a number of weeks over $5(/Mcf). That destroyed a lot of demand," he said.

That in turn freed up enough gas for the recent major build-up of US underground gas storage, with injections exceeding 100 bcf during several weeks, including a record injection of 127 bcf of gas during the week ended June 20. As of July 18, US natural gas storage totaled 1.95 tcf, down 537 bcf from year-ago levels and 286 bcf below the 5-year average.

Smith said, "In about 6 weeks, with no major changes (in weather or gas supplies), we'll be back to more normal inventory levels and will start building a surplus" for the coming winter heating season.

Marshall Adkins, an analyst in the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla., maintains a "fairly bullish outlook" for both oil and gas, based on market fundamentals.

He said natural gas prices are now so low that more customers with dual-fuel capacity are starting to switch back to cheaper natural gas from alternative fuel oil, although it will take a while to regain fully those lost markets.

Meanwhile, he said, "A couple of weeks of warm weather will shock the market again," pushing natural gas prices higher. I think the (price) equilibrium (of natural gas supplies and demand) is above $5(/Mcf), closer to $6(/Mcf)."

Oil inventories

The American Petroleum Institute reported US oil inventories declined by 655,000 bbl to little more than 277 million bbl during the week ended July 18. US gasoline stocks dropped 1.1 million bbl to 208.4 million bbl, it said, while distillate inventories increased by 372,000 bbl to 113.8 million bbl.

The US Energy Information Administration reported even bigger declines for the same period, with crude stocks down by 2.3 million bbl to 276.3 million. It said US gasoline inventories lost 1.6 million bbl to 207.8 million bbl, with distillates growing by 500,000 bbl to 115.2 million bbl.

"The key point about (the latest EIA) data is that the deficit in total (US commercial crude and petroleum products) inventories from the 5-year average is not getting any better. Indeed, it has widened by 5.2 million bbl to now stand at 106.5 million bbl, the largest gap of this year," said Paul Horsnell, J.P. Morgan Securities Inc., London.

Moreover, Horsnell noted, EIA put US refinery utilization at 93% during the week ended July 18—"the lowest since early April, which is neither a normal pattern nor the correct path for a system that faces such yawning oil product deficits."

Despite a continued slow build, US heating oil stocks remain "woefully inadequate" and "portend distinct trouble ahead should winter conditions be anything close to normal," Horsnell said, adding, "The gasoline market is also still looking somewhat uncomfortable and not completely out of the woods."

As a result, OPEC's upcoming July 31 meeting will "probably prove to be unnecessary," he said.

"There were valid reasons (at OPEC's last session) in June to want to meet again, but the course of events has ultimately rendered the meeting somewhat superfluous," he said. "The case for making an early tweak (in OPEC production quotas for the fourth quarter of 2003) looks far less than convincing at the moment."

Industry Scoreboard

null

null

null

Industry Trends

FUTURE US low-sulfur gasoline regulations and onroad low- sulfur diesel regulations will be a key issue for both the US refining industry and for motorists throughout the next decade, said Bryan Caviness, an analyst with Fitch Ratings Ltd.

"Despite the high capital costs facing US refiners to meet the regulations, Fitch believes that the changes will prove to be very positive for refineries that remain in operation," Caviness said.

"Unanticipated supply disruptions will drive refining margins wider than historical norms and help make up for the increased investments. A lack of new capacity will further stress supply-demand balances," he added in a recent research note.

Some refiners, such as private companies with small facilities, will not be able to make the investment and will shut down, he said. The Energy Information Administration estimates that an average of 50,000-70,000 b/d of refining capacity will be shut down each year through 2007 (OGJ, July 21, 2003, p. 72).

Other refiners are disadvantaged because of higher sulfur crude slates, but they might be able to reduce operating costs by changing crude slates.

In 2004, US drivers will begin burning Tier 2 low-sulfur gasoline in their cars. This is the first in a series of regulations being implemented in phases to reduce motor vehicle sulfur emissions. Rules called for a reduction in sulfur content to 120 ppm in 2004 and 30 ppm by 2006 compared with 300 ppm today.

The Tier 2 onroad low-sulfur diesel requires 15 ppm by mid-2006 compared with 500 ppm today.

"Petroleum refiners alone are expected to invest in excess of $10 billion for the gasoline and onroad diesel regulations," Caviness said.

Despite significant capital costs and strain on free cash flows, Fitch expects surviving US refiners ultimately will benefit from the increasingly stringent regulations because refined product supply will be reduced, he said.

Although refiners and manufacturers will have to do some belt tightening, much of the costs ultimately could be passed along to the end consumers through higher prices and margins, Caviness said.

US REFINING CAPACITY is holding steady despite a decline in the number of refineries, the National Petrochemical & Refiners Association reported.

NPRA's annual US refining and storage capacity report contains data supplied by the US Department of Energy on the crude oil capacity of US refiners as of Jan. 1.

Statistics showed 149 operable refineries in the US with a total crude distillation capacity of 16.8 million b/cd. This number was down from 153 operable refineries on Jan. 1, 2002.

In spite of the reduced number of refineries, US refining capacity slipped by only 28,000 b/cd, but it remains above the figures reported for 1999-2001—16.3 million b/cd, 16.5 million b/cd, and 16.6 million b/cd, respectively.

NPRA Pres. Bob Slaughter said, "Although US refining capacity is basically flat, the disturbing trend of refinery closures has continued. This is bad news, because a healthy and diverse domestic refining industry is needed to maintain a source of supply of refined petroleum products."

Government Developments

A US FEDERAL JUDGE has struck down a "roadless" rule enacted by former President Bill Clinton's administration.

Oil and natural gas producers looking to expand drilling on certain federal lands praised the July 15 ruling by Judge Clarence Brimmer of the 10th Circuit Court based in Cheyenne, Wyo.

Wyoming was the latest state to challenge the controversial regulation that restricts logging and road building in about one third of US national forests.

A US Department of Energy-funded study in 2000 said an estimated mean 11.3 tcf of natural gas and 550 million bbl of oil could underlie inventoried roadless areas. The vast majority of those resources are in the Rocky Mountains, where the rule would shutin an estimated 9.4 tcf of gas (OGJ Online, Apr. 4, 2001). An updated 2002 study of the Powder River basin found those numbers could be even higher (OGJ Online, Dec. 17, 2002).

In his decision, Judge Brimmer said the US Forest Service's (USFS) designation of 58.5 million acres as roadless areas "was a thinly veiled attempt to designate 'wilderness areas' in violation of the clear and unambiguous process established by the Wilderness Act for such designation."

The USFS said it might issue an interim directive to clarify current law. The agency also said it is committed to streamlining oil and gas permitting on available public lands, provided that projects are done in an environmentally responsible manner.

Meanwhile, industry lobbyists caution that many legal obstacles remain, despite the recent ruling.

Eight environmental groups have said they will ask the 10th US Circuit Court of Appeals in Denver to reinstate the ban. The groups said they are confident they could win a quick decision in their favor.

Brimmer's injunction is similar to action taken by another federal district judge in Idaho. But the Idaho judge's decision later was overturned in December 2002 by the 9th US Circuit Court of Appeals in San Francisco (OGJ Online, Dec. 19, 2002).

A US CONGRESSMAN wants to know how many energy projects are being delayed by what he calls unnecessary appeals and litigation.

US House Committee on Resources Chairman Richard W. Pombo (R-Calif.) has asked the US General Accounting Office OAO to take an inventory regarding administrative appeals and judicial litigation.

"These data will help Congress assess the economic impact of these suits, both on the energy market and on the consumer, as we continue to examine the roadblocks in getting our energy supplies to market in America," Pombo said.

In a letter to GAO, Pombo asked for that analysis to be completed by Sept. 1.

PERU has named an acting director general of hydrocarbons.

Gustavo Navarro, an engineering consultant in the vice-ministry of energy, was appointed acting director general of hydrocarbons for the Peruvian Energy and Mines Ministry.

He succeeded Pedro Touzett, who resigned because of personal reasons. After serving as director general of hydrocarbons for more than 5 years, Tourzett will continue as a government consultant.

Quick Takes

Brazil's state-owned oil firm Petroleo Brasileiro SA (Petrobras) reported that it has made an oil discovery in the Espírito Santo basin off Espírito Santo state, Brazil. The 1-ESS-123 well, drilled on Block BES-100, lies in 1,374 m of water about 60 km from shore and 80 km from that state's capital, Vitória.

Block BES-100 is one of the areas that would have to be relinquished back to the National Petroleum Agency had on Aug. 6 if no discoveries were made.

Preliminary logging confirms the occurrence of 50 m of oil-bearing sandstone at a depth of 3,784 m. Drilling will continue to 4,400 m TD, with the possibility of more discoveries at the greater depths.

This discovery is especially significant, as it represents another substantial find outside the Campos basin, which accounts for about 80% of Brazil's current 1.6 million b/d oil output, said Petrobras.

The latest find follows a nearby discovery, 1-ESS-121 on Block BC-60, about 10 km south of Jubarte field, which was discovered in 2002. Before the 1-ESS-123 discovery, preliminary estimates of other recent finds off Espírito Santo indicated reserves of 2.1 billion bbl on Block BC-60 (OGJ Online, June 6, 2003), which Petrobras owns 100%. Petrobras said that the figure represents about 23.5% of Brazil's total oil reserves.

Petrobras has discovered six fields on Block-BC-60 to date.

In other exploration news, OAO Gazprom signed a memorandum of understanding with Pakistan, agreeing to engage in exploration activities in Pakistan and to consider developing gas storage infrastructure in northern Pakistan. The July 17 agreement stemmed from Pakistan President Gen. Pervez Musharraf's visit to Russia in January, which followed the Pakistan Ministry of Petroleum and Natural Resources' efforts to promote foreign investment in oil and natural gas. In January, Pakistan discussed the privatization of government-controlled entities in that country's oil and gas sector—including Oil & Gas Development Corp. Ltd., Pakistan Petroleum Ltd., Sui Northern Gas Pipeline Ltd., and Sui Southern Gas Co. Ltd. (OGJ Online, Jan. 20, 2003). The MOU calls for Gazprom to also evaluate the possibilities of enhancing oil and gas recovery from existing fields and to provide technical and managerial training to various companies' executives in conjunction with Pakistan's Oil & Gas Training Institute. Ramco Energy PLC, London, has drilled five wells of a six-well program in its Seven Heads gas field in the Celtic Sea and expects first gas early in the fourth quarter. Previously, proved and probable reserves were independently assessed at 300 bcf (OGJ Online, Mar. 17, 2003). This figure will be reviewed once the drilling program is completed, said Ramco, which operates the project with 86.5% interest. Well 48/24-8, drilled to a depth of 4,150 ft., confirmed that a common gas-water contact exists throughout, meaning there is a greater column of gas-bearing sands than assumed in the original reserve estimate, the company said. Well 48/24-9 was drilled to 3,655 ft. Wells previously drilled were 48/24-5A, 48/24-6, and 48/24-7A. Gas flowed from each of these wells at a rate higher than the 10 MMscfd assumed in the base production forecast for the field. Ramco said it expects to spud 48/23-2 well this month, and 48/24-5A is in the process of being recompleted. This is the final work for the drilling program. All 25.5 km of 8-in. infield pipelines and associated umbilicals to connect the wells to a central field manifold have been laid on the seabed and trenched as has the 35 km of 18-in. main pipeline back to Marathon International Petroleum Ltd.'s Kinsale A platform. The central manifold also is in place on the seabed and the subsea hookup work has commenced, Ramco said. Construction to connect the Seven Heads gas pipeline to the Kinsale A platform is under way.

INDIA'S OIL & NATURAL GAS CORP. (ONGC) has reported that it has placed a $220 million order with South Korea's Hyundai Heavy Industries for a gas processing platform for its Mumbai High flagship oil field.

Hyundai will build the 14,000 tonne platform and install it in the field about 160 km west of Mumbai. The MSP platform will be bridge-linked to the existing Mumbai High South platform off India's western coast. It will have facilities for gas compression, dehydration, treatment, utility, and oil handling, the company reported. ONGC will modify existing platforms and decommission a flare system. The award is part of its $2 billion redevelopment program to boost production at the Arabian Sea field to 300,000 b/d of crude from 200,000 b/d.

ARABIAN PETROCHEMICAL CO. (Petrokemya), an affiliate of Saudi Basic Industries Corp. (Sabic), Riyadh, awarded a lump-sum, turnkey EPC contract to Samsung Engineering Co. of South Korea for the third butene-1 plant at its petrochemical complex in Al-Jubail Industrial City on Saudi Arabia's eastern coast.

The 130,000 tonne/year plant is slated for completion by first quarter 2005. The two existing butene-1 plants at Petrokemya already produce 100,000 tonnes/year. After the expansion, the affiliate will have a total butene-1 capacity of 230,000 tonnes/year.

Sabic Vice-Chairman and CEO Mohamed Al-Mady said, "With this additional plant, we are moving closer to our (total petrochemicals) production target of 48 million tonnes/year by 2010."

Petrokemya and Sabic Engineering & Project Management jointly performed preengineering leading to the contract.

null

Saudi Arabia's government owns 70% of Sabic, with the remaining 30% held by private investors.

The Jubail and Yanbu-based National Industrial Gases Co., another affiliate of Sabic, has awarded a lump-sum, turnkey contract to UK-based Air Products PLC for engineering, procurement, and construction of an air separation plant in Yanbu Industrial City in Saudi Arabia. The plant, which will process 800 tonnes/day of oxygen, is slated for completion by mid-2005. Sabic, the Middle East's largest petrochemicals company, will use the oxygen as feedstock for its downstream plants.

PETROBRAS has rejected all bids for contracts to build two electric-power generating modules for two new semisubmersible production platforms, the P-51 and the P-52.

The company said the $117-132 million offers were too high, and it will now try to negotiate lower prices from other firms, including Dresser-Rand Co., Nuovo Pignone, and Rolls-Royce PLC.

Petrobras continues to analyze technical proposals for gas compression modules for the two semis. Those bids were expected at presstime.

The P-51 semi will be installed in 1,800 m of water in Marlim Sul giant field in the Campos basin, 175 km from Rio de Janeiro, and will process 180,000 b/d of oil with a 200-member crew, a Petrobras source told OGJ.

P-52 will be installed in Roncador field, also in the Campos basin, in 1,255 m of water. P-52 also will process 180,000 b/d of oil, working 110 km from Rio de Janeiro with a 200-member crew. The semi will replace P-36, which sank in March 2001 as a result of explosions due to gas leakage (OGJ Online, Mar. 16, 2001).

In other development activities, Dominion Exploration & Production Inc. has selected Weatherford International Ltd. to install the production risers for the Devil's Tower dry-tree truss spar in the Gulf of Mexico. Work on the risers for the deepwater floating production system will be conducted in 5,610 ft. of water on Mississippi Canyon Block 773. The first riser installation is scheduled for first quarter 2004. Dominion plans eight dry-tree spar wells, which are tied back from the sea floor with the production risers. All risers will be installed using Weatherford's Stabberless method of running casing and tubing and will have a top-tension, single-barrier riser design. Dominion, with 75% interest, is operator of Devil's Tower and partner Pioneer Natural Resources USA Inc. holds the other 25%.

GULFTERRA ENERGY PARTNERS LP, Houston, and San Antonio-based Valero Energy Corp. have completed agreements to form a 50:50 joint venture in the $458 million Cameron Highway oil pipeline project. A $325 million nonrecourse financing for the project also was completed, the companies said.

GulfTerra was formerly known as El Paso Energy Partners LP, which changed its name earlier this year (OGJ Online, May 7, 2003).

Cameron Highway, which was announced in February 2002, will be a 390 mile, 500,000 b/d pipeline from the southern Green Canyon and western Gulf of Mexico areas to refineries in Port Arthur and Texas City, Tex. "When completed, the pipeline will be one of the largest crude oil delivery systems in the Gulf of Mexico, sized to handle oil movement for the major deepwater trend discoveries, Holstein, Mad Dog, and Atlantis, its initial anchor fields, as well as other deepwater oil discoveries," the companies said.

GulfTerra will build and operate the pipeline, which is scheduled for completion during third quarter 2004.

Turkmenistan has named contractors to construct a 60,000 b/d crude oil pipeline along its Caspian Sea coast to be placed in service in 2005. The $60 million pipeline would transport crude oil produced at Korpedzhe oil and gas field to Balkanabad. From there, the crude would move through an existing system to the Turkmenbashi refinery (see map, OGJ, Oct. 14, 2002, p. 44). Press reports quoted the Turkmenistani Oil, Gas, and Natural Resources Ministry as saying President Sapurmurat Niyazov signed a resolution committing money for construction from the state fund for the development of the Turkmen oil and gas industry. State company Turkmenneftegazstroi would tackle 55% of the project, and Caspro Pipeline Service AG of Liechtenstein would handle the rest through three subcontractors. Turkmenneftegaz was to be given a quota for oil and products equal to the amount needed to cover the pipeline's cost. Caspian tankers now ship crude from the field to the refinery. PetroKazakhstan Inc. has signed an MOU with Russia's OAO Lukoil under which Lukoil will designate Turgai Petroleum (formerly CJSC Kumkol-Lukoil) as an affiliated shipper in the Caspian Pipeline Consortium (CPC). CPC this year will ship as much as 6 million tonnes of crude oil from the Caspian to Baltic and Black Sea export outlets with capacity gradually expected to increase to 12 million tonnes/year in 2006. It is anticipated that Turgai Petroleum's shipments through CPC will begin by yearend and are expected to reach 1.5 million tonnes/year, half of which PetroKazakhstan will own. Gas Authority of India Ltd. (GAIL) has signed a natural gas sale and transportation agreement with the PY-1 consortium, comprising Mosbacher India LLC and Hindustan Oil Exploration Co., both of Houston. GAIL will receive gas from the PY-1 consortium's offshore facilities and transport gas and condensate through a pipeline to its facilities onshore in Tamil Nadu, India.

PY-1, which is the first offshore natural gas field being developed in theCauvery basin, lies 18 km off Porto Novo. It has gas reserves of more than 200 bcf. GAIL will be laying its first offshore pipeline, to begin in the next 3 years, connecting to the Pillai Perumal Nellore power plant.

LIQUID RESOURCES OF OHIO LLC, Medina, Ohio, has purchased a facility in Medina and plans to convert it to an ethanol production facility—the first in Ohio. The company will collect waste liquids from beverage and other manufacturers for conversion into fuel-grade ethanol. The company has entered into a contract with Cargill Inc. to distribute Liquid Resources' entire ethanol output.