Market Movement

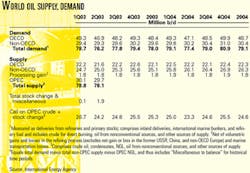

IEA projects 2004 oil supply, demand

The latest Oil Market Report from the International Energy Agency includes projections for 2004 global oil demand and supply from countries outside the Organization of Petroleum Exporting Countries. These initial estimates peg demand growth at 1 million b/d and non-OPEC supply plus OPEC NGL growth at 1.74 million b/d.

Demand growth

Although this rate of demand growth is equal to that projected for this year—when the global economy is still struggling—IEA cites several reasons as to why the 2004 figure is more bullish than it seems. For instance, 2003 oil demand growth was boosted by a number of factors related to fuel switching. Nuclear plant outages in Japan forced substitution to oil, and in the US, high natural gas prices led to additional fuel switching.

Further, the Paris-based agency said that precautionary stock building in countries outside the Organization for Economic Cooperation and Development in advance of the war in Iraq and colder-than-normal weather contributed to higher oil demand growth this year.

"Without these developments, 2003 oil demand growth would have been much lower, certainly less than 500,000 b/d. Consequently, removing these exceptional factors implies a much stronger year-on-year oil demand growth in 2004 and represents a significant step forward," the report said.

The 2004 demand growth estimate assumes a return to normal weather, a phased global economic recovery, lower average oil and gas prices, and the return to service of the Japanese nuclear reactors.

IEA expects oil demand in 2004 to grow faster where economic growth is more pronounced. The US will lead not only the global economic recovery but also oil demand growth with a 340,000 b/d increase, according to IEA projections. Among non-OECD countries, China will show the biggest gain in oil demand at 260,000 b/d.

Non-OPEC supply

The result of the projections for 2004 demand growth and the increase in non-OPEC supply is a 700,000 b/d reduction in the call on OPEC plus stock change figure. This would be the fifth consecutive year of contraction.

Iraq likely will export much more oil next year, and Nigeria and Algeria are each adding oil production capacity of more than 500,000 b/d. They are on record requesting a higher quota allocation to accommodate this increase.

With OPEC currently producing more than 25 million b/d, a big challenge for the organization will come during the second quarter of next year when the call drops to 23.25 million b/d, according to IEA estimates.

Marking the third straight year of more than 1 million b/d growth, non-OPEC oil supply is forecast to increase by 1.32 million b/d next year following growth of 1.11 million b/d this year.

Production in mature areas, such as the North Sea, Russia, and North America, will be sustained as ongoing drilling, workovers, and maintenance outpace natural decline rates in those areas. Deepwater production in the US Gulf of Mexico, the North Sea, Latin America, and West Africa will increase in 2004.

Although constrained by export capacity,

Russian output will move up as well. In total, IEA said, the former Soviet Union will account for 46% of non-OPEC supply growth next year, primarily with increases in Russia and Kazakhstan.

This special analysis of the IEA's Oil Market Report and its effects on the international oil market was provided by Marilyn Radler, Economics Editor.

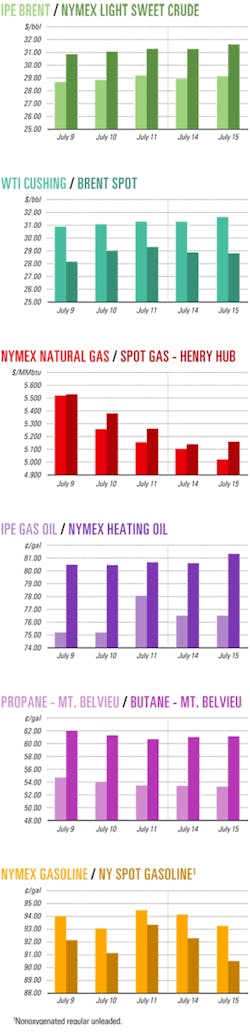

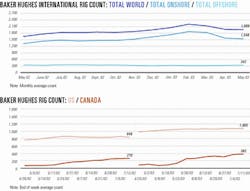

Industry Scoreboard

null

null

null

null

Industry Trends

INDONESIA APPEARS to be headed for an impending power crisis.

Power supply constraints could begin as early as next year and potentially could reach 2,600 Mw by 2008, according to a recent study by Wood Mackenzie Ltd., Edinburgh.

Throughout this period, Java-Bali will be subject to load shedding, blackouts, and a negative effect on economic growth, said the study called "Looking Over the Edge—The Prospects for Java-Bali Gas & Power."

It examines the likely evolution of the Java-Bali gas and power markets in the context of a constrained investment climate and provides strategic guidance for upstream, midstream, and power companies.

"The successful removal of direct fuel subsidies has provided a market in which once again gas is economically preferred to oil," said Noel Tomnay, WoodMac principal consultant. "Indeed, at prevailing gas prices, newbuild gas power plants are cheaper than new coal plants, providing major opportunities for potential gas suppliers to the Java market."

Starting in 2005, Indonesia's gas market dynamics will change with the completion of state electricity company PT PLN's southern electricity transmission loop integrating East Java and West Java markets, WoodMac forecast.

"The recent electricity law also provides new opportunities for regional governments to establish power plants, providing added impetus to the captive power market and the provision of further alternative buyers of gas into power other than PLN," said Tomnay.

Development of supply options and the plant construction push hinge upon the availability of investment dollars for Indonesia.

"Despite its recent sovereign credit rating improvement, the country continues to be classed as high risk. For global power companies in particular, the past 18 months have been among the most difficult in recent times," the report noted.

CHINA'S potential oil demand surge could drive future world tanker market growth.

Erik Ranheim, research and projects manager for the International Association of Independent Tanker Owners (Intertanko), notes that the tanker market is volatile and unpredictable.

Currently, oil use is relatively low in developing countries, such as China and India, so world oil demand might not increase as quickly as some have anticipated, Ranheim said.

Despite a growing Chinese oil demand, the volumes imported are not yet enough to generate big increases in tanker demand, he said. The US economy, which accounts for 25% of tanker demand, must recover before global tanker demand will improve.

Tanker demand also is linked with volatile oil demand, Ranheim said, pointing to volatility in crude oil production from the Organization of Petroleum Exporting Countries.

Russia is boosting oil exports, which could boost world tanker demand. Russia and China have become energy partners, but increased crude oil exports to China are likely to be transported through pipelines.

Meanwhile, 95% of Russian oil exports is reaching neighboring countries either by pipeline or by relatively short-haul tankers, Ranheim said. European oil imports from Russia have increased at the expense of European imports from the Middle East, he noted.

Regarding the supply side, Ranheim said tanker companies would have to order new tankers starting in 2006 in order to meet an anticipated 2010 demand peak.

Government Developments

THE BRAZILIAN tax agency Receita Federal and Petroleo Brasileiro SA (Petrobras) are arguing about the tax status of contracts for mobile offshore drilling and production units.

Petrobras has signed international charter contracts, but the agency contends that such platforms cannot be classified as seagoing vessels and therefore should be leased—not chartered.

However, the state-owned oil company said that Brazil's Federal Supreme Court has ruled that mobile offshore d-p units are classified as seagoing vessels for tax purposes.

In light of Petrobras's practice in this case, the tax agency this year served the company tax assessment notices amounting to $30 million for 1998 and for $1 million for 1999-2002. Petrobras appealed the first and plans to appeal the second.

The company has chartered offshore units for drilling and production since beginning exploration activities on the Brazilian continental shelf.

Receita Federal's interpretation is that overseas remittances for servicing chartering agreements would be subject to a withholding tax at the rate of 15-25%, which could affect all companies involved with oil exploration and production off Brazil.

US PRESIDENT George W. Bush has named an acting administrator of the Environmental Protection Agency.

He selected Marianne Lamont Horinko, assistant administrator for Solid Waste and Emergency Response (SWER) for the agency. She is the former president of Clay Associates Inc., a public policy firm devoted to hazardous waste issues.

Bush's first EPA administrator, former New Jersey Gov. Christine Whitman (R), resigned June 27, saying she wanted to spend more time with her family (OGJ Online, May 21, 2003). Her deputy, Linda Fisher, was the acting administrator, but she also resigned. She too cited spending time with her family as the reason she was leaving.

The White House is expected to seek formal Senate confirmation of a new administrator in the fall. Horinko is a possible, although not probable, candidate for the position according to industry lobbyists. Fisher was never seriously considered, they said.

Other people believed to be under consideration for the position include Idaho Gov. Dick Kempthorne (R) and Jo Cooper, president of the Alliance of Automobile Manufacturers.

Before joining the Bush administration, Horinko was an advisor to Don Clay, EPA assistant administrator for SWER, during 1989-93. Earlier in her career, Horinko worked as an attorney at Morgan, Lewis & Bockius during 1986-90 and as a staff scientist at Environ Corp. during 1983-86.

Separately, Bush also named Stephen L. Johnson to be acting deputy administrator of EPA. Johnson currently serves as assistant administrator of EPA's Office of Prevention, Pesticides, and Toxic Substances.

Quick Takes

BG GROUP PLC and partners have produced first oil from the giant Karachaganak oil and gas condensate field in northwestern Kazakhstan. Oil will be exported through the Caspian Pipeline Consortium (CPC) pipeline to world markets via the Black Sea. Gas injection into the field also has begun.

The oil will be available for first sales by the end of the third quarter at Novorossiysk on the Black Sea, marking completion of a major objective under Phase II of the field's development program.

Phase II involves the $1 billion enhancement of existing facilities, including environmental rehabilitation and the construction of new gas and liquids processing and gas injection facilities; workover of more than 100 wells; construction of a 120 Mw power station; and construction of a 635 km pipeline to connect the field to the CPC pipeline at Atyrau.

Output from the field will increase to more than 10 million tonnes/year of liquids—200,000 b/d of oil—to CPC and Orenburg, Russia, and as much as 7 billion cu m/year of sales gas to Orenburg. About 70% of the field's condensate will be exported via CPC.

BG and ENI SPA are joint operators of Karachaganak, each holding 32.5% interest. Other partners are ChevronTexaco Corp. 20% and OAO Lukoil 15%. KazMunaiGaz, Kazakhstan's designated authority, jointly manages the project.

Later phases will increase liquids production, subject to the development of markets. The Karachaganak field, one of the world's largest oil and gas-condensate fields, covers 280 sq km and holds potential reserves of 5 billion boe over the 40-year license period.

Ivanhoe Energy Inc., Vancouver, BC, will test Boston-based Ensyn Petroleum International's Rapid Thermal Processing technology at South Midway field in a 250 b/d demonstration plant Ensyn is constructing in California's San Joaquin Valley. The process is designed to upgrade heavy oil to lighter crude oil in the field. The test should be completed by yearend, Ivanhoe said. If it is successful, Ivanhoe has contracted for exclusive rights to apply the technology in two countries outside the US where heavy-oil fields have been proven but are underdeveloped. Houston-based Vaalco Gabon (Etame) Inc., operator of Etame field off Gabon, has temporarily shut in production from a second well, ET-1VA, due also to a malfunctioning downhole safety valve. An onsite remotely operated vehicle will determine the cause of the malfunctions and the remedial work necessary. The remaining production well, ET-4H, continues to produce 6,400 b/d of oil. Etame field, estimated to hold more than 150 million bbl OOIP—30 million bbl of which is recoverable (OGJ Online, June 25, 2002)—has produced 4.3 million bbl of oil. Consortium members have completed reprocessing 3D seismic data and continue to finalize a 2003-04 exploration and development plan involving the drilling of two exploration wells and two development wells.

HEIDRUN FIELD licensees, which invested 600 million kroner in a plant for injecting produced water, said the field soon will meet the Norwegian government's requirement of "zero harmful discharges into the Norwegian Sea by the end of 2005." The injected water also serves as pressure support to improve oil recovery, operator Statoil ASA said.

Heidrun is producing at its plateau level of just more than 170,000 b/d of oil and about 75,000 b/d of water (OGJ Online, Oct. 10, 2001).

The new injection facility will be able to handle more than 110,000 b/d of produced water when it becomes fully operational Aug. 1.

In other development activities, Total SA subsidiary Total Austral SA has been delayed again in its development of Carina and Aries fields 50 miles off southern Argentina in the South Atlantic Ocean, following weather-related damage to the J. Ray McDermott SA-operated Derrick Barge 60 laybarge, formerly the ETPM 1601. McDermott has a contract to install 62 miles of chemical injection pipelines and flowlines to transport natural gas production from the fields to shore—in what would be the most southerly pipeline installation ever completed—but harsh seas broke the pipe string in June and damaged the vessel's stinger. McDermott declared force majeure and suspended operations pending assessment of damages. The fields originally were scheduled to start production in the second quarter, but the project has faced several delays. McDermott's contract, for design and installation of two platforms and the pipelines, was slated for completion this fall.

QATAR PETROLEUM CO. (QP) and ExxonMobil Corp. awarded contracts for onshore Qatargas II LNG expansion project facilities to Chiyoda Corp., Yokohama, for the main front-end engineering and design (FEED) phase and to M.W. Kellogg Ltd. for a receiving terminal. The offshore FEED contract will be awarded later this year.

Onshore facilities will be constructed at the existing Qatargas LNG plant, where three existing trains produce more than 8 million tonnes/year of LNG. Qatargas II, a joint project of QP 70% and ExxonMobil 30%, will include offshore development of new blocks on Qatar's North field; two new onshore liquefaction trains, each of which will produce 7.8 million tonnes/year of LNG; a fleet of large LNG carriers; and terminal receiving and regasification facilities. QP said LNG exports from the facility are expected to exceed 45 million tonnes/year by 2010. Gas deliveries will commence from the first train in late 2007.

Meanwhile, QP signed a heads of agreement with ConocoPhillips for feasibility studies for the development of Qatargas III, a large-scale LNG project at Ras Laffan Industrial City. QP and ConocoPhillips will own Qatargas III jointly. The project will consist of facilities that will produce gas from North field and yield about 7.5 million tonnes/year of LNG. ConocoPhillips, which will purchase the LNG, will supervise regasifying and marketing of it in the US. Average sales volumes are expected to be about 1 bcfd of gas. Start-up of the project is expected during 2008-09.

STATOIL has selected Stavanger-based offshore drilling contractor Smedvig Offshore ASA for a 12-month drilling assignment in Kristin field in the Norwegian Sea. The job is valued at 350 million kroner.

Smedvig's West Alpha drilling rig will drill four wells starting in December. Statoil also contracted last year with Saipem SPA to drill on Kristin field this summer, using its Scarabeo 5 drilling rig, which is due to spud the first well this month.

Kristin production is scheduled to begin Oct. 1, 2005. Its 900 bar pressure and 170° C temperature are higher than in any other field developed on the Norwegian continental shelf to date.

The reservoir will be produced through 12 subsea wells having a total production capacity of 126,000 b/d of condensate and 18 million cu m/day of rich gas.

PETROLEO BRASILEIRO SA (Petrobras) has arranged for $1 billion in financing to implement its Projeto Malhas ("Mesh" Project)—an expansion of the company's gas pipeline grids in southeastern and northeastern Brazil.

The expansions will enhance the natural gas transport capacity in the northeast to 9 million cu m/day of gas in the next 2 years and 14 million cu m/day in 2012. In the southeast, capacity will be enhanced to13 million cu m/day in the next 2 years.

The southeastern Brazil grid expansion includes construction of 442 km of gas pipeline, with an 8.7 million cu m/day capacity, between Campinas, in Sao Paulo state, and Japeri, near Rio de Janeiro. The project includes expansion of the gas compression system in the Campos basin. Pipeline construction is due to start in the second half of this year and is scheduled for completion in January 2005.

The northeastern expansion includes construction of seven pipelines and laterals totaling 962 km, eight city gates, and compression stations at Candeias and Catu in Bahia. Northeastern grid construction also must be started in the second half but completed in mid-2005.

Two companies have been formed to facilitate the project—Nova Transportadora do Nordeste SA (NTN), and Nova Transportadora do Sudeste SA (NTS)—equity in which is held by Mitsui & Co. 40%, and Itochu Corp. and Mitsubishi Corp. 30% each.

Petrobras intends to increase consumption of natural gas in Brazil's automotive industry through the use of compressed natural gas in urban fleets.

It has completed technical and feasibility studies for nearly 1,200 km of pipeline to connect the two grids. This mainline will deliver natural gas from Bolivia and future discoveries in the Santos basin to the northeast.

Negotiations are under way with Amazonas and Rondônia states in northwestern Brazil for construction of 550 km of gas pipelines between Urucu, Amazonas, and Porto Velho, Rondônia, and 420 km from Coari to Manaus that would deliver gas from Urucu fields. This would provide natural gas as an alternative for the industrial and power sectors.

The likelihood of India finding large reserves of natural gas on its Krishna-Godavari basin in Andhra Pradesh District and in the deepwater Andamans area in the Bay of Bengal (OGJ, June 9, 2003, p. 44) has cast doubts on the proposed Iran-India natural gas pipeline project, which could be shelved if more discoveries are made, sources said. The country's LNG policy is being reviewed in light of the discoveries—the largest in the last 25 years. If India still chooses to import gas from Iran, it is unlikely to be via a gas pipeline through potentially hostile territory for 25 years with take-or-pay commitments, the source said. Some Indian LNG projects already are in a fairly advanced stage. The latest supply-demand projections show that India would have sufficient gas supplies to match the expected 135-140 million standard cu m/day of gas demand in the final year of its tenth 5-year plan (2002-07). Meanwhile, prequalification for construction and operation of the Turkmenistan-Afghanistan-Pakistan natural gas pipeline has been put on hold pending further studies, said Seethapathy Chander of the Asian Development Bank. Additional studies would include a route survey for the southern arm through Herat, Kandahar, in Afghanistan and Quetta and Multan in Pakistan, an estimate of reserves in Dauletabad gas fields in Turkmenistan, and finalization of host country agreements, gas sales and purchase agreements, and the gas transportation agreement.

ROYAL DUTCH/SHELL GROUP and Total signed an agreement with Saudi Arabia to form a joint venture with Saudi Aramco for a gas exploration program in a 200,000 sq km area in the kingdom.

"This agreementUheralds the first time after the creation of Saudi Arabian Oil Co. that foreign international oil companies have gained access to gas acreage in the kingdom of Saudi Arabia...," said Shell.

The area involved is in the Empty Quarter or Rub Al-Khali desert. Shell, as consortium leader, has 40% interest, while Saudi Aramco and Total each have 30% interest.

Negotiations between multinational oil companies and state-owned Saudi Aramco concerning a key part of the "Saudi Gas Initiative" concluded last month (OGJ Online, June 10, 2003).

Saudi Arabia initiated talks almost 4 years ago with foreign companies, mostly US-based, on pursuing three core ventures designed to leverage the country's plentiful natural gas production into Saudi petrochemical, power, and water projects.

Pakistan recently signed its first production-sharing agreements for petroleum exploration off Pakistan. It issued PSAs to a Total-led consortium for two blocks in the ultradeepwater Indus Delta, 200 km off Karachi. The first agreement was for exploration on Block "G" No. 2265-1, which covers an area of 7,466 km, while the other was for Block "H" No. 2165-1, covering a 7,150 km area. The exploration area is in l,700-3,400 m of water. The consortium will drill at least one $30 million exploration well starting in October. India's Oil & Natural Gas Corp. (ONGC) plans to kick off a $390 million deepwater exploration program for 2003-04 with the drilling of three wells off the country' s eastern coast and two off the western coast. ONGC hopes to drill 35 wells on the acreage awarded it under the first three rounds of its exploration licensing policy. ONGC said the expenditure on each deepwater well is expected to be 800 million to 1 billion rupees. It is hiring two rigs for the exploration. ONGC, which plans to invest another 17 billion rupees to develop three discovered fields in India, will open up its oil and gas acreage to other companies for exploration. It expects to spend $1.2 billion/year in exploration-related activities.