Algeria becoming North Africa's reserves hot spot

An estimated $50-73 billion in investment is expected to be spent in the next 10 years developing Algeria's oil and gas reserves potential of 43 billion bbl of oil and 282 tscf of natural gas, according to a study released in June by analysts at Surry, UK-based Bayphase Ltd.

In the study, Bayphase's Technical Director Malcolm Brierley and Managing Director Geoff Eyre analyzed Algeria's upstream oil and gas fields, including the assets and development of its three main oil and gas basins—Trias-Ghadames or Berkine, Ahnet-Grand Erg, and Illizzi—as well as the emerging Reggane basin and the country's pipelines and oil export terminals, its refineries, petrochemical and gas treatment facilities, and its power and transportation infrastructure.

Despite many in the oil and gas industry viewing Algeria as a politically difficult and challenging region in which to operate, at least 30 international oil and gas companies currently are active in the country's underexplored and immature hydrocarbon provinces, which cover two thirds of the country. Although commercially attractive contracts have been available since 1986, in the past, the impact of Islamic fundamentalist activities has had a limiting effect on major inward investments.

Now, however, the resulting exploration success is feeding through to a year-on-year increase in liquids production to 1.9 million b/d in 2002 from 1.4 million b/d in 1997, with a projected target of more than 2.5 million b/d by 2004.

Similarly, natural gas production has increased to nearly 14 bscfd in 2002 from 5 bscfd in 1982, Bayphase said. Gas projects under development such as In Salah, Ahnet, Ohanet, In Amenas, Gassi Touil, and the recently discovered Menzal Ledjmet East, will have an immense impact on the commercial viability of gas production in the region.

In terms of future potential for Algeria, this means that significant opportunities for both existing and new international investors will be generated through a rapid increase in major investments via the current fourth licensing round being held this year, Bayphase reported. In addition, opportunities exist in the major midstream and downstream contracts required for the upgrading of export, refining, and communications infrastructure.

Reserves assessment

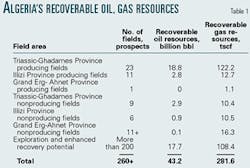

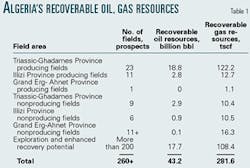

Until yearend 2002 Algeria had produced 14.3 billion bbl of oil and 83 tscf of gas, which would leave 28.8 billion bbl of oil and 199 tscf of potential gas reserves remaining. This represents, Bayphase said, an amount of oil equivalent to one and one-half times the historical production from the UK North Sea that could remain available for exploitation, generating the associated investment requirement. In terms of gas reserves, this represents an amount equivalent to about three times the historical production from the UK North Sea, Bayphase said.

Overall, the status of Algeria's upstream oil industry is probably best expressed in terms of those reserves (Table 1). In terms of future exploration potential, Bayphase said it believes Algeria has a significant number of world-class exploration opportunities available in each of its three primary hydrocarbon provinces, and that new exploration provinces are now being opened up in the north of the country, along with offshore acreage.

Investment assessment

Bayphase assessed Algeria's entire oil and gas sector to determine the range of investment required for upstream, midstream, and downstream sectors as well as the investment requirements of Algeria's oil and gas industry-related infrastructure (Table 2).

These are capital costs that will be encountered in the further development of its oil and gas industry. This opportunity is based on an assessment on the known status of each facility and, where available, on published plans for expansion.