Petroleum resources pessimism debunked in Hubbert model and Hubbert modelers' assessment

Recently, numerous publications have appeared warning that oil production is near an unavoidable, geologically determined peak that could have consequences up to and including "war, starvation, economic recession, possibly even the extinction of homo sapiens" (Colin Campbell in Ruppert 2002). The current series of alarmist articles could be said to be merely reincarnations of earlier work, which proved fallacious, but the authors insist that they have made significant advances in their analyses, overcoming earlier errors. For a number of reasons, this work has been nearly impenetrable to many observers, which seems to have lent it an added cachet. However, careful examination of the data and methods, as well as extensive perusal of the writings, suggest that the opacity of the work is—at best—obscuring the inconclusive nature of their research.

Some of the arguments about resource scarcity resemble those made in the 1970s. They have noted that discoveries are low and that most estimates of ultimately recoverable resources (URR)1 are in the neighborhood of 2 trillion bbl, about twice production to date.

But beyond that, Campbell and Jean Laherrère in particular claim that they have developed accurate estimates of URR, and thus, unlike earlier work, theirs is more scientific and reliable. In other words, this time the wolf is really here. But careful examination of their work reveals instead a pattern of errors and mistaken assumptions presented as conclusive research results.

The Hubbert curve

The initial theory behind what is now known as the Hubbert curve was very simplistic. Hubbert was simply trying to estimate approximate resource levels, and for the US Lower 48, he thought a bell curve would be the most appropriate form. It was only later that the Hubbert curve came to be seen as explanatory in and of itself, that is, geology requires that production should follow such a curve.

That the curve appears to have some validity can be easily explained: A bell, or logistic or Gaussian, curve represents exponential growth and decline, which is typical of large populations and persistent capital stock. But it is a mistake to interpret this to mean that the system is constrained to a bell curve.

The new authors, such as Campbell and Laherrère, initially argued that the bell curve reflected the effects of geology—that production should follow a bell curve, at least in an unconstrained province. In fact, discovery sizes tend to be asymmetric, with an early peak and a long tail.

Field production often follows such a pattern as well. But production within a region is heavily influenced by explorationists' access to territory, taxes, infrastructure, and a host of other factors, so that oil production rarely follows a bell curve, as can be seen in Campbell (2003), where only 8 of 51 non-OPEC countries appear to do so.

After numerous efforts to modify the theory to conform to reality, the remnant has become: "The important message from Hubbert's work, which is often forgotten by economists, is that oil has to be found before it can be produced." (Laherrère 2001b, p. 4) In other words, the Hubbert curve, originally held as scientific and inviolable, is of no particular value. Yet the authors have not only mistakenly believed in its properties, they have not been forthcoming about their own errors.

The new research

Campbell and Laherrère claim to have improved on the work of their predecessors and resolved many of the problems cited by critics. R.W. Bentley (2002) provides a good summary. Two methods determine field sizes: usage of geologists' estimates of field size, reported by IHS Energy, rather than proved reserves from corporate reports or the trade press, to avoid the problem of reserve growth. And second, by graphing production against cumulative production for some fields, they claim to "correct" estimates for field size.

These estimates are then used in two ways: plotting cumulative discoveries against cumulative wildcat wells for countries or regions to estimate an asymptote, or leveling off, which represents the ultimately recoverable resource for that area. These are referred to as "creaming curves." And cumulative discoveries are plotted over time and then shifted into the future to match against cumulative production. When cumulative discoveries begin to peak, so too does cumulative production, albeit as much as several decades later.

Unproven assertions

The lack of rigor in many of the Hubbert modelers' arguments makes them hard to refute. The huge amount of writing along with undocumented quotes and vague remarks necessitates exhaustive review and response. Perhaps because they are not academics, the primary authors have a tendency to publish results but not research. In fact, by relying heavily on a proprietary database, Campbell and Laherrère have generated a strong shield against criticism of their work, making it nearly impossible to reproduce or check. Similarly, there is little or no research published, merely the assertion that the results are good.

A number of points taken by the Hubbert modelers, which are crucial to their work, have no evident empirical or theoretical support, including the assertion that regional production should resemble a bell curve.

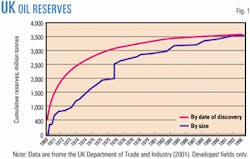

Similarly, the claim that technology increases the recoverability of oil resources is said to be incorrect without evidence.)2 Rather, historical field production curves are presented and said to reflect predetermined production patterns—determined by "the immutable physics of the reservoirs" (Campbell 2002) rather than investment. For example, a graph of production vs. cumulative production in the Forties field is said to prove that technology added no reserves because the graph follows a fairly straight line in later years, and even the use of gas lift did not change the apparent ultimate recovery (Laherrère, 1999).

This assertion, however, is not supported by evidence such as initial field development plans. While the authors appear to have direct knowledge of some field developments, most of the results apparently come from visually comparing the curves produced on their graphs and assuming that the behavior is predetermined. The curve, viewed in hindsight, is presumed to follow the path expected from initial development, but no evidence of that is presented. In fact, as a result of changes in investment, taxes, or technology, many of the curves might vary substantially from what was projected initially.

Technical data

A specific, telling example of this shortcoming relates to the proprietary nature of the database being used. Most acknowledge that the Petroconsultants (now IHS Energy) database is of high quality. However, because it is only available for a large fee, few have been able to access it and double-check the results which Campbell and Laherrère claim to have achieved.

That lack of easy access has served as the first line of defense for the two, who often respond to criticism with comments such as (in response to Lynch) "Your problem is that you do not have any reliable database (and the experience to use it)."3

Accepting that the IHS Energy database represents more-accurate assessments of reserves than corporate reports, this still leaves unanswered the question of whether or not the field size estimates will grow due to such factors as technical advances or better understanding of the geology. Campbell and Laherrère insist that it doesn't—without providing evidence.

But those who have had access to the IHS Energy database dispute these assertions, including geologists of the US Geological Survey, who relied on the database in concluding that reserve growth not only is real but substantial—600 billion bbl. (USGS 2000).

Perhaps more damning, IHS Energy personnel themselves estimate global reserve growth at 373 billion bbl and total URR at more than 3 trillion bbl. Where Campbell and Laherrère foresee remaining recoverable resources of conventional petroleum limited to 1.1 trillion bbl, IHS estimates it at more than 2.2 trillion, a huge difference (Pete Stark 2002). Perhaps the creators of the database understand it less perfectly than Campbell and Laherrère, but that is hard to accept without further evidence.

Unsupportable results

Virtually all of the work by Campbell, Laherrère, and Kenneth Deffeyes relies heavily on graphs, with claimed correlations but no statistical results provided, and it appears that the authors fall prey to statistical illusions. Creaming curves are published for some regions where the fields, apparently ordered by size, seem to yield an asymptote which is interpreted as evidence of an approaching limit.

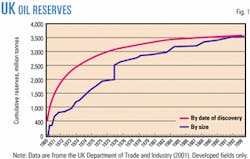

But ordered by date of discovery, the asymptote is not as clear, as Fig. 1 shows for the UK. No explanation is given for the 'hyperbolic model' or why ordering by size is more appropriate than by date of discovery. In fact, the asymptote appears to be nothing more than a statistical artifact—that is, the use of a large population, ordered by size, will frequently yield an exponential curve with an apparent asymptote. And indeed, when the 2001 discovery of the giant Buzzard field, estimated at 500 million bbl (Roy Dafter 2003) is added to the UK curve, the new asymptote will be even less obvious.

And it is hard to accept that this method generates a robust or stable estimate when it easily can be seen that these curves can be created at different points in time, always showing a clear asymptote, but at different levels. Using reserve estimates for the UK fields in production on different dates to generate hyperbolic curves shows that they clearly grow over time, but always generate an asymptote, albeit a false one.

Laherrère also notes the "good fit" in a number of instances between cumulative discovery and cumulative production, but has apparently done no statistical analysis of the actual correlation. Some countries, in fact, do not show a good fit, including China, France, Norway, and the UK. 4 In this, Laherrère appears merely to be trying to connect the peak year of discovery and the peak year of production, primarily by shifting the former curve to match what he believes to be the two peaks. Since there appears to be no particular lag time or any way of predicting it,5 his primary conclusion from this approach is that a peak in production comes after a peak in discovery. The utility and novelty of this is hard to comprehend.

Causality

The primary error for Hubbert modelers is the assumption of geology as the sole motivator of discovery, depletion, and production. In the work of Campbell, Deffeyes, and Laherrère, they go further, equating causality with correlation. This is one of the most basic errors in (physical or social) scientific analysis.

"Oil is ultimately controlled by events in the Jurassic which are immune to politics" (Campbell 2000) and "Udiscovery and depletion are set respectively by what nature has to offer and the immutable physics of the reservoirs" (Campbell 2002). The idea that production is influenced by oil prices (which determine the amount of capital available for drilling) and by policy choices in producing governments, which decide when exploration will be allowed and set production ceilings, is considered foolish.6

The argument that the drop in global discoveries proves scarcity of the resource is the best example of the importance of understanding causality. While it is true that global oil discoveries dropped in the 1970s from the previous rate, this was largely due to a drop in exploration in the Middle East. Governments nationalized foreign operations and cut back drilling as demand for their oil fell by half, leaving them with an enormous surplus of unexploited reserves. It is noteworthy that none of those pessimistic about oil resources show discovery over time by region, which would support this.

And two recent discoveries, Kashagan in Kazakhstan and Azedagan in Iran, reportedly would together equal over 10% of Campbell and Laherrère's estimated remaining undiscovered oil. Statistically speaking, this is unlikely. Laherrère's argument that the Middle East is near the end of its undiscovered oil is based entirely on the assumption that the observed fall-off in discoveries was due to a lack of geological opportunities, rather than government decision-making. (Laherrère 2001b). To an economist, the drop in exploration reflects optimal behavior: They do not waste money exploring for something they will not use for decades.

A more technical example is telling. Laherrère notes that the first 1,920 new field wildcats in the Middle East discovered 723 billion bbl by 1980, while, by the year 2000, a subsequent 1,760 had found a mere 32 billion bbl. From this he concludes that the Middle East is essentially played out, extrapolating the falling returns to drilling and stating: "This graph shows clearly that the belief by some economists that the Middle East has a great potential left is wrong" (Laherrère 2002, p. 10). He achieves similar results for OPEC as a whole.

There are three primary errors here. First, the assumption that the discoveries in 2000 will not be revised upwards; but what is more important, the presumption that geology is driving the trend and thus it is immutable. And, finally, the third error is more basic: equating all wells in the Middle East, regardless of location. In fact, analysis of country drilling activity shows what should be obvious: drilling in Iran and Iraq dropped sharply in 1980, following the Iran-Iraq war, and sanctions have kept Iraqi drilling at a minimum in the past decade. At the same time, lesser provinces such as Oman, Syria, and Yemen have seen increased amounts of drilling. Thus, by referring to "Middle Eastern" wildcats and extrapolating the success rate of pre-1980 and post-1980 wells, he is comparing earlier wells in Saudi Arabia with later ones in Yemen, which can only yield fallacious results.7

Production profile

Finally, Campbell and Laherrère use production data to estimate field size, "improving" on the IHS Energy data. By graphing production against cumulative production, as in Fig. 2, they claim that a clear asymptote can be seen, allowing for a more accurate estimate of ultimate recovery from the field. However, there is no explanation for how often the method is employed. Laherrère (2001a) has many examples from around the world, but only a few per country. And some of the figures he used in Laherrère (1999), such as East Texas, which didn't seem to conform to his argument, have not been published in later works, unlike Forties, which is.

Again, field production data are not publicly available in most instances, so the method's reliability is difficult to test. Also, there is an astonishing presumption of causality, that the production profile was determined by the geology, and that nothing can alter it, and that the historical curve is exactly as anticipated from the discovery of the field. Because the line appears straight, they extrapolate it to the zero point. However, this is an assumption, and as shall be seen, an incorrect one.

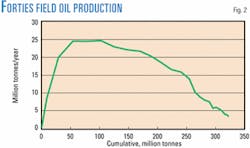

Fortunately, the UK (UK Department of Trade and Industry) publishes historical production data for all fields, allowing it to serve as a test case. Examining this data does confirm that some fields display a clear-cut asymptote. However, of 21 fields whose peak production was more than 2 million tonnes/year, only 7 show such behavior. The rest do not show a clear asymptote, or worse, show a false one, as Fig. 3 indicates. Clearly, this method is not reliable for estimating field size.

Particularly damning is the failure of Campbell and Laherrère to admit that some fields do not generate stable production curves, or to address the implications of this. If the behavior only shows a correlation in a fraction of the instances, then how can it be based on universal physical factors? If not, then why have the authors not explained how and when it works—or doesn't—and what they have done to avoid misinterpretation? What assurances are there that Forties will not plateau, as Murchison did?

In any large, complex problem, there is typically much conflicting evidence, and it is the proper role of a scientist to consider all of it, acknowledging that which doesn't support the theory and attempting to explain it. The repeated failure of these authors to do so implies that their work in general cannot be considered reliable.

Effect on results

The various problems have a clear impact on the results of the forecasts generated by these modelers, particularly Campbell and Laherrère. The former has been prolific in publishing production forecasts for regions and countries. In a classic instance, Campbell (1991) projected UK production to decline at a rate of 10%/year, the same as Forties field. This conforms to his belief that there would be no significant additional supplies from reserve growth and no new large discoveries, or small and medium fields. Yet actual UK production was flat to 1999, and since has dropped by less than 2%/year. Campbell (1997), supposedly more reliable due to the Petroconsultants data, projects a 1999 peak in European production, followed by "only" a 7%/year decline.

In fact, production did decline by 2.4% in 2001 from 2000, but 2002 saw a drop of less than 1%. Apparently, reserve growth and small fields do matter.

And although they claim their methods yield reliable, stable URR estimates, this is far from true. They have repeatedly increased their estimates of URR, from 1.575 trillion bbl in Campbell (1989) to 1.95 trillion bbl in Campbell (2002), and on an individual country basis, the amount of discovered oil now exceeds their 1997 estimates of URR for 30 out of 57 countries! If these estimates do not prove valid for as short a time as 5 years, how can they be expected to hold true for the long term, as claimed?

Curve-fitting?

It is well documented that field size can be modeled and forecast in a geologically homogenous basin, given sufficient exploration, with an early peak and a long tail.8 And in claiming their work is scientific, the authors would seem to be attempting to emulate this work to generate their creaming curves. But there are two differences: first, they are not modeling geological basins, but political regions and in some cases, corporate programs. Second, the method does not predict the discovery of new basins, which Campbell and Laherrère assert is irrelevant, since no new basins remain. In fact, they are doing nothing more than curve-fitting, rather like stock market "chartists" who argue that the data patterns alone are the best means to predict stock market behavior, and that understanding companies, the economy, and such is not necessary.

Conclusions

The many inconsistencies and errors, along with the ignorance of most prior research, indicates that the current school of Hubbert modelers have not discovered new, earth-shaking results but rather have joined the large crowd of those who have found that large bodies of data often yield particular shapes, from which they attempt to divine physical laws. The work of the Hubbert modelers has proven to be incorrect in theory, and based heavily on assumptions that the available evidence shows to be wrong. They have repeatedly misinterpreted political and economic effects as reflecting geological constraints and misunderstood the causality underlying exploration, discovery, and production.

The primary flaw in Hubbert-type models is a reliance on URR as a static number rather than a dynamic variable, changing with technology, knowledge, infrastructure, and other factors, but primarily growing. Campbell and Laherrère claim to have developed better analytical methods to resolve this problem, but their own estimates have been increasing, and increasingly rapidly.

The result has been exactly as predicted in Lynch (1996) for this method: a series of predictions of near-term peak and decline, which have had to be repeatedly revised upwards and into the future. So much so as to suggest that the authors themselves are providing evidence that oil resources are under no strain, but increasing faster than consumption.

The controversy will no doubt continue, but for upstream companies, there is a clear choice inherent in the two schools of thought. If the Hubbert modelers and their colleagues are correct, then the appropriate strategy would be to assume much higher oil prices soon, hire and hoard geologists and engineers, sign long-term rig contracts, and invest in high-cost production, including gas-to-liquids, and even oil shale. Borrow against future elevated revenue and buy reserves whenever possible.

If, however, the arguments here and elsewhere that there is no peak visible for non-OPEC oil production (absent a price collapse), let alone global production, and volatility will remain high, then keep a low debt level, focus on low-cost projects, and maintain flexible inputs (personnel and equipment) so as not to be caught with high expenses when the occasional price collapse comes. That most companies are following such a path suggests that they have already judged the issue.

References

1. URR refers to the amount of oil thought to be recoverable given existing technology and economics (price and costs). It includes estimates of undiscovered oil but is only a fraction of the total resource.

2. "While technology has enhanced the production of conventional reserves, it has had little impact on ultimate reserve values." Laherrère (1999).

3. Post Sept. 21, 2002, on http://groups.yahoo.com/group/energyresources/.

4. Jean Laherrère (2001a) has the most complete collection of graphs.

5. For the US, he gives 30 years, UK 10, France 20, Mexico and Colombia 5, and so forth. Laherrère (2001a)

6. R.W. Bentley (2002), p. 197, for example criticizes Schollnberger (2001) by saying, "This paper has serious weaknesses. Its lines of argument on oil are: Economics dictates reserves. (But see the US experience during the 'oil frenzy' following the oil shocks, when some gas, but little extra oil, was found.)" In fact, before 1980, oil production in the US Lower 48 was declining by over 3%/year, then grew slightly in 1980-85.

7. I do not have access either to data on wildcats or pre-1976 rig usage data, but during 1976-80, Iran and Iraq were running an average of 80 rigs each year. After 1980, the typical number was 20. And Oman, Yemen, and Syria were probably not the source of most drilling or discoveries in earlier years. The data is from International Energy Statistics Sourcebook, Pennwell Corp.

8. This has been the subject of much work by geologists, statisticians, and economists, although none of the Hubbert modelers seem familiar with it. See, for example, the section by G. Kaufman in Adelman et. al. (1983).

Bibliography

Adelman, M. A., Houghton, J.C., Kaufman, G.M., and Zimmerman, M.B. Energy Resources in an Uncertain Future, Ballinger, 1983.

Bentley, R.W., "Global oil & gas depletion: an overview," Energy Policy, 2002.

Campbell, C.J., The Essence of Oil & Gas Depletion, Multi-Science Publishing Co., 2003.

Campbell, C. J., "Oil Depletion-Updated Through 2001," February 2002, www.oilcrisis.com/campbell/update2002.htm.

Campbell, C. J., "World oil and gas industry: peak oil: an outlook on crude oil depletion," http://www.mbendi.

co.za;/indy/oilg/p0070.htm, October 2000.

Campbell, C. J., "The Coming Oil Crisis," Multi-Science Publishing Co. and Petroconsultants SA, 1997.

Campbell, C. J., "The Golden Century of Oil, 1950-2050: The Depletion of a Resource," Kluwer Academic Publishers, 1991.

Campbell, C. J., "Oil Price Leap in the Nineties," Noroil, December 1989.

Dafter, Roy, "Plenty of life left in the North Sea," (OGJ, Feb. 24, 2003, p. 51).

Deffeyes, Kenneth S., Hubbert's Peak: The Impending World Oil Shortage, Princeton University Press, 2002.

Hubbert, M. King, "Nuclear Energy and the Fossil Fuels," Drilling and Production Practice, 1956.

Laherrère, Jean, "Modeling future liquids production from extrapolation of the past and from ultimates," International Workshop on Oil Depletion, Uppsala, Sweden, May 23, 2002.

Laherrère, Jean, "Forecasting future production from past discovery," presented to OPEC seminar, Vienna, Austria, September 2001. (2001b)

Laherrère, Jean, "Estimates of Oil Reserves," presented at the EMF/IEA/IEW meeting, IIASA, Laxenburg Austria June 2001 (2001a).

Laherrère, Jean, "Learn strengths, weaknesses to understand Hubbert curve," (OGJ, Apr.17, 2000, p. 63).

Laherrère, J. H., "Reserve Growth: Technological Progress, or Bad Reporting and Bad Arithmetic?" Geopolitics of Energy, April 1999.

Lynch, Michael C., "The Economics of Petroleum in the Former Soviet Union," Gulf Energy and the World: Challenges and Threats, the Emirates Center for Strategic Studies and Research, Abu Dhabi, 1997.

Lynch, Michael C., "The Analysis and Forecasting of Petroleum Supply: Sources of Error and Bias," in Energy Watchers VII, ed. by Dorothea H. El Mallakh, International Research Center for Energy and Economic Development, 1996.

Ruppert, Michael C., "Colin Campbell on oil: perhaps the world's foremost expert on oil and the oil business confirms the ever more-apparent reality of the post-9-11 world," http://www.

fromthewilderness.com/free/ww3/102302_campbell.html, October 2002.

Schollnberger, W., "Security of energy supply in Europe," submitted to the Public Hearing on the security of energy supply in Europe, June 2001.

Smith, N. J., and Robinson, G. H., "Technology pushes reserves 'crunch' date back in time," (OGJ, Apr. 7, 1997, p. 43).

Stark, Pete, "Energy Supply Setting—A Synopsis," Sept. 23, 2002, AAPG President's Conference on National Issues, "Energy and Environment: A Partnership That Works," in Washington, DC.

UK Department of Trade and Industry, Development of UK Oil and Gas Resources, annual.

US Geological Survey, World Petroleum Assessment, 2000.

The author

Michael C. Lynch is president of Strategic Energy & Economic Research Inc. and a research affiliate at the Massachusetts Institute of Technology's Center for International Studies. He has combined BS and MS degrees in political science from MIT, and has performed a variety of studies related to international energy matters, including forecasting of the world oil market, energy and security; corporate strategy in the energy industries; and analysis of oil and gas supply. Lynch is a former chief energy economist at consulting firm DRI-WEFA Inc. and a past president of the US Association for Energy Economics as well as being an appointed council member of the International Association for Energy Economics. His publications have appeared in six languages, and he serves on the editorial board of the journal Energy Policy. He currently is writing a book, The Fog of Commerce: Oil Crises and Economic Security, which he expects to publish within the next year.