Japan will continue to dominate Asian LNG picture

Despite slow demand growth, Japan, as the world's LNG importer, will remain formidable overall and play a significant role in the development of Asian contract terms.

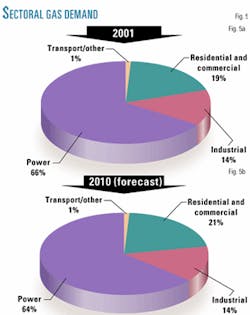

This is particularly true now because the power industry, which accounts for 66% of Japan's natural gas consumption, faces public opposition to nuclear energy. The nuclear problems have resulted in uncertainties over the country's future energy mix and will likely benefit gas demand growth in the long-run.

With that said, it is interesting to note that Japan actually imported less LNG in 2002 (53.5 million tonnes/year; tpy) than in 2001 (55.1 million tpy) and even 2000 (53.7 million tpy). This is in spite of forecasts of higher gas use due to Japan's nuclear problems.

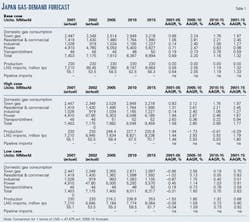

Under current economic forecasts by FACTS Inc., Honolulu, and with expected policy changes in Japan, future demand in the power sector will grow at 1.0%/year between 2003 and 2015.

This will bring Japan's overall gas demand growth to an average of 1.3%/year over the same periods.

Until at least 2015, LNG will be the only source of imported gas in Japan. LNG demand in 2005, 2010, and 2015 will be 56.5 million tpy, 62.5 million tpy, and 66.3 million tpy, respectively.

Although the ongoing gas and electric sector liberalization will have little direct impact on Japan's natural gas demand growth over the next 5 years, it nonetheless encourages significant market changes.

Gas and electric utilities have begun to look outside their traditional markets, and some oil refiners have entered the LNG market. Furthermore, finding the best price with flexible clauses in fuel procurement may become more important than in the past. Indeed, Japanese buyers have become more aggressive in renewing and signing new LNG contracts over the past several years.

This article examines the energy policy issues that may influence future natural gas demand. It also evaluates several other areas including Japan's primary energy mix, the impact of the current safety and social problems in the nuclear power sector, and forecasts of natural gas demand.

Energy consumption

Natural gas's share of the primary energy mix held steady at 12% in 2002 and will increase slightly this year. Primary energy consumption for 2002 had the following breakdown on a preliminary basis: oil was highest at 47%, followed by coal at 22%, nuclear at 16%, natural gas at 12%, hydro at 1%, and others (geothermal, solar-wind, and renewables) at 2%.

Fig. 1 shows Japan's primary energy consumption forecast for 2001-15. The average annual growth rate (AAGR) of total primary energy consumption during this time frame is 1% compared with a 1.8%/year in the 1990s.

This may seem optimistic, but it is in line with FACTS' base-case economic growth forecasts of 1%/year through 2015.

Natural gas will grow at a 2.4%/ year for 2001-15, and its portion of the energy mix will increase to 15% by 2015.

Electricity, natural gas

Japan continued to face negative growth in the power sector in 2002, amid economic deflation. This is the third time in Japan's post-war history that the country is facing negative growth in power generation, the earlier times being two "oil shocks" of 1973 and 1979-81.

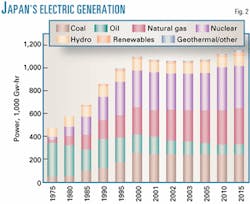

The figure shows Japan's electricity generation forecast through 2015. Power generation in 2003 will remain almost level to that in 2002 and turn positive in 2004.

Much of this increase, however, is simply bringing electricity generation back to the 2001 level.

In 2005, electricity generation will be 1,070 Tw-hr and the growth rate for 2005-10 will be 1.0%/year, with much of the growth coming from gas (Fig. 2).

As a result of the stalling economy and uncertain prospects, some electric utilities have already delayed their long-term plans to build new plants.

Natural gas will continue to be a significant fuel source for power generation as Japan does what it can to meet its Kyoto Protocol commitments. At the same time, uncertainty exists over Japan's prospects for additional nuclear power generation capacity.

Under the international agreement, Japan must cut greenhouse gas emissions in 2008-12 by 6% from 1990 levels.

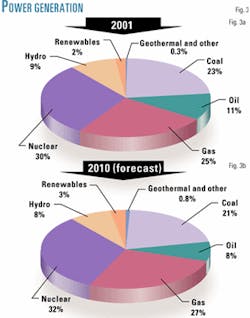

Fig. 3 illustrates natural gas's portion of total electricity generation, which will increase to 27% in 2010 from 25% in 2001. Note that nuclear will increase as well.

All gas imports by 2015 will likely be in the form of LNG; not included are piped imports of natural gas even in the high-case scenario through 2015.

If the proposed Sakhalin-I pipeline gas project becomes reality, the ExxonMobil-led consortium will start gas production in 2008 and produce 10 billion cu m (bcm) of gas by 2012.

Under the plan, the marketable gas volume would equal 6-6.5 million tpy of LNG. The pipeline routing option under consideration for gas transportation from the island of Hokkaido is an offshore Pacific route straight to Tokyo.

Japan, which is the world's largest LNG importer but lacks nationwide gas reticulation, will ensure that incremental gas demand growth is met by LNG in the near future.

There is little room for a significant piece of demand to be met by a large- volume pipeline.

Thus, a large-scale pipeline from Russia would not be viable until after 2015. It seems to be much easier to buy smaller amounts of LNG on flexible contract terms and bring them into Japan, which already has 24 regasification terminals.

Furthermore, gas buyers will become increasingly accustomed to supply contracts with shorter terms and increased flexibility. This is particularly possible with existing supply projects that have already amortized their investments.

The desires for shorter contract terms and increased flexibility will also make it quite difficult to tie down buyers with the necessary long-term commitments required for such a pipeline, as is planned from Sakhalin-I.

It must be noted, however, that the Japanese government's participation in developing the domestic infrastructure could pave the way for Sakhalin-I piped gas to reach Japan, given the project was driven by a strong national interest at the beginning of the 1960s.

Nuclear, oil, coal

Nuclear power's share will increase to 32% of total power generation by 2010, compared with 30% in 2002. The study behind this article analyzed the long-term impact of the current nuclear problems on Japan's gas demand growth.

Japan has 52 nuclear power reactors, representing a total nuclear power generating capacity of 45.7 gigawatts (Gw).

The Japanese government had a target to add at least nine new reactors by 2015 in an effort to achieve the country's obligation under the Kyoto Protocol and an "ideal" fuel mix for energy security.

Accordingly, the electric utilities maintained their plans of advancing nuclear power development as essential in ensuring a stable energy supply and accommodating such environmental issues as global warming.

Things have changed since the end of August 2002, however.

Controversy over maintenance-data cover-ups of nuclear power plants by Tokyo Electric Power Co. (Tepco) has thrown much uncertainty into the outlook; details later. As a result, electric utilities will freeze or delay some of their plans to build new reactors in the face of strong and active public opposition to nuclear energy.

Crude oil and low sulfur waxy residues (LSWR) in the fuel mix will continue to decline but play an important "swing role," as oil-fired plants can respond to immediate power-demand fluctuations and the fuels can be readily available. Mostly Japanese oil refiners supply LSWR to the electric utilities on term contracts.

Direct crude burning for power generation has come down to less than 100,000 b/d in 2001 from 240,000 b/d in 1997.

In September 2002, demand for the swing fuel rebounded as a result of sudden shutdowns of Tepco's nuclear reactors. In November, when 9 of Tepco's 17 reactors were shut for inspection, Japan's crude imports for direct burning reached 139,000 b/d, an 86% increase over November 2001 volumes.

In spite of higher direct crude burning September-December, the power sector actually burned less crude in 2002 than in 2001 due to weak power demand and a stagnant economy.

Electric utilities have since ramped up the existing units' utilization factors and started up oil-fired plants to make up for the unexpected loss of electricity supply from nuclear shutdowns. As Japan's nuclear power plant shutdowns continue, the electric utilities will depend increasingly on LNG-fired power generation, as was seen in second-half 2002, when some buyers asked for the maximum delivery amounts from their LNG supply contracts.

Coal's share in the power sector will remain steady at 21% in 2015. Although at least eight new plants (totaling 5.82 Gw) are to come online by yearend 2010, some of them may be put on hold for the time being, considering the strength of future demand prospects.

Furthermore, any additions beyond 2008 would be politically difficult because of Japan's commitments under the Kyoto Protocol. Japan can afford to add coal-fired generation capacity by adding nuclear-fired capacity to counter-balance emissions. The advent of coal capacity, however, is increasingly less likely due to their nuclear problems.

LNG imports

Fig. 4 presents Japan's monthly LNG imports for 2001 and 2002. Japan's preliminary natural gas demand for 2002 is 53.5 million tpy, lower than that in 2001 of 55.1 million tpy.

In spite of stronger than expected demand for September and October due to the nuclear plant shutdowns, LNG imports in 2002 are even less than the 2000 levels of 53.7 million tpy. Even the nuclear problems were not enough to stop the effects of the country's prolonged recession and the resulting weak demand.

Under our current economic forecasts and expected changes in Japan's energy policy, LNG demand will be 56.5 million tpy in 2005, 62.5 million tpy in 2010, and 66.3 million tpy in 2015. Table 1 presents FACTS' base-case forecast for Japan's natural gas demand.

The power sector will see a projected 0.98%/year growth in gas demand 2001-15, while town gas will grow at 1.97%/year during this period.

Japan's changing demographics present an interesting situation for the commercial sector. The country is facing a growing median population with 24% of the population already at age 60 years or older, which is often referred to as the "Graying of Japan."

This sector of the population is creating demand for additional small to medium-sized businesses to facilitate care for the elderly, which translates to additional gas (under the commercial sector) required to power these businesses.

Gas demand in the industrial sector will grow at 1.27%/year 2001-15. Although Japan has no nationwide grid for natural gas supplies, the utilities are steadily extending regional pipelines within their boundaries.

Such an expansion will contribute to an increase in gas use by large-lot industrial users.

For example, Tokyo Gas, domestic oil and gas producer Teikoku Oil Co. Ltd., and Shizuoka Gas Co. Ltd. will jointly build a natural gas pipeline in central Japan by the end of 2006.

When completed, the 33-km pipeline will connect the pipeline coming from Shizuoka's LNG import terminal and the pipeline from the Niigata LNG terminal. The pipeline will also link to Tokyo Gas's proposed new pipelines in eastern Japan, with an attempt to provide more opportunities for gas growth in the industry.

Ultimately, sectoral breakdown will not significantly change in the near future (Fig. 5).

The primary difference among our three cases (base, high, and low) comes from the energy mix in the power sector, in particular Japan's nuclear power generation capacities.

Table 1 presents the high-case and low-case forecasts for Japan's natural gas demand.

The low-case gas demand forecast rests on the assumption that the Ministry of Economic Trade and Industry's plans for large capacity increases in nuclear power will materialize by 2015. On the other hand, the high-case demand forecast rests on less optimistic assumptions over METI's nuclear expansion plans.

In the high case, Japan will have more LNG-fired power plants and continue to obtain emission credits from other countries. Japan signed an agreement last year with Kazakhstan to obtain its credits and is now negotiating with other countries, including Russia, for a similar deal.

The only problem is accurately calculating emissions credits in the FSU; who is to determine if the same credits are not sold more than once to different buyers?

Issues, developments

As a result of maintenance-data cover-up problems, 21 nuclear reactors (totaling 21.15 Gw by Tepco, Chubu Electric Power Co., and Tohoku Electric Power Co.) were closed for safety reinspections and remained idle as of late May.

The shutdowns account for 44% of Japan's total nuclear power generation capacity.

It remains as an open question as to how soon the troubled nuclear units will get back to normal operation. Our view on the current nuclear turmoil is that many of the troubled nuclear reactors (Tepco's 16, Chubu Electric's 3, and Tohoku Electric's 2 reactors) will get back to normal operation by the summer season. This may help to alleviate Japan's peak electricity demand during the summer months and avoid potential blackouts.

As of late May, Tepco's Kashiwazaki-Kariwa Unit 7 (1,356 Mw), Fukushima Daiichi Unit 3 (784 Mw), Fukushima Daini Unit 1 (1,100 Mw), and Chubu Tohoku Electric's Onagawa Unit 3 (25 Mw) are close to the final stage of inspections.

The government is trying to keep the existing units and those under construction from closing permanently as well as implementing regulatory changes. It is likely to introduce new nuclear maintenance regulations soon, hoping to prevent similar problems from recurring.

The new regulations, similar to what the US and France use, would clearly detail regulations for the specific wear and tear of each of the plant's components and thus provide a clear guideline for the industry.

Meanwhile, METI has proposed to revise the existing petroleum tax and to impose a tax on coal for the first time. This is to discourage coal use in the power sector. The complete implementation of the new petroleum tax is to take effect in fiscal year 2007.

As far as fuels for power generation are concerned, the plan is to impose a 700 yen/tonne tax on coal and to raise the existing 720 yen/tonne tax on LNG to 1,080 yen/tonne.

Converting them yields a proposed tax of 29 yen/MMbtu for coal and 18 yen/MMbtu for LNG.

Furthermore, on a regional level, the Fukushima Prefecture's government raised the nuclear fuel tax it levies on electric utilities in the prefecture in December 2002. The tax is 10% of the value of nuclear fuel cores, compared to the previous 7%.

The prefecture's government will also create a new tax on the volume of nuclear fuel cores.

At present, Tepco is the only electric utility that owns nuclear power reactors in Fukushima. Tepco has 10 of its 17 reactors in Fukushima and plans to add 2 more reactors at the existing Fukushima plants in the future.

Despite these regulatory changes, strong and active public opposition toward nuclear energy will adversely affect METI's plan to expand Japan's nuclear energy capacity.

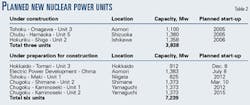

Table 2 lists METI's schedule of units "currently under construction" and in "preparation for construction" as of yearend 2002.

The nuclear issue is now a social issue, as well as an energy security and political issue.

For many villages and towns, a combination of employment and government subsidies relating to the nuclear industry plays an important role in their economies. Of the new nuclear reactors currently under construction, three (totaling 3.8 Gw) will eventually be operational by 2010, while it is unlikely that all six reactors "under preparation for construction" (totaling 7.2 Gw) will come online on schedule.

The base-case scenario includes the three currently under construction and another three, currently under preparation for construction, to be operational by 2015.

Market liberalization

While Japan's ongoing electric and gas liberalization will have little direct impact on Japan's total gas demand in the next 5 years, it has nonetheless encouraged utilities to reduce fuel costs ahead of total market deregulation.

During the current Diet session, details of electric and gas sector liberalization bills will be discussed. Full market liberalization is generally understood to take place in fiscal year 2007 and will give "home customers" a choice among utility suppliers.

Already significant changes are taking place in the market. Gas and electric utilities are entering outside their traditional markets, and oil refiners are entering the LNG market.

Japan's largest electric utility, Tepco, is already supplying gas to large industrial users in the Kanto area, including Mitsubishi Rayon Co. Ltd. and Nippon Steel Corp. Japan's largest oil refiner Nippon Oil Co. and Chugoku Electric Power Co. Inc. have established a company for LNG marketing in Okayama Prefecture.

It has become crucial for the utilities to find optimal ways to procure fuels and cut costs in order to compete in the liberalized market, especially when the market is growing so slowly.

Tepco and Tokyo Gas share some of their LNG facilities to cut costs. Tepco, Tokyo Gas, and Osaka Gas Co. Ltd. will be using more of their own LNG vessels for transportation, so that they will have an option to resell LNG if necessary, as well as save on transportation costs.

The contract clause to allow buyers a resale option will give the utilities some flexibility in dealing with domestic demand fluctuations.

Osaka Gas, Japan's second largest city gas company, will own four LNG vessels by the end of 2004. Three will transport LNG from Indonesia and Oman.

The fourth vessel will primarily transport LNG from Australia's North West Shelf Train-4 project. Osaka Gas is contracted to buy 1 million tpy of LNG on a FOB basis for 30 years from April 2004

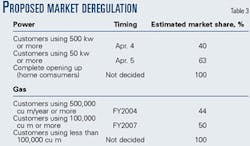

The electric utility market for large customers (using 2 Mw or more) was liberalized in March 2000. This liberalized segment represents 26% of the utilities market.

The current Diet session is considering a set of bills that will expand the areas of power-market deregulation in phases. The bills will be based on the proposal submitted in December 2002 by an advisory panel for Natural Resources and Energy.

Table 3 lists the advisory panel's proposed deregulation scheme, as of December 2002.

According to the panel proposal, liberalization efforts will be expanded to include midsize factories and buildings in fiscal year 2004 and small factories and buildings in 2005.

The deadline for the final phase of full liberalization, however, was left undecided.

There are many key details to be further discussed before the panel's recommendations go into effect. The power industry has long opposed the separation of power generation and transmission mechanisms. Also, how the electric utilities will allow new entrants to access their existing LNG terminals and facilities is another issue.

With regards to the existing "transfer fees" and "connection fees," the electric utilities accepted in general the concept that transfer fees throughout the country will be uniformly set. Currently, regional electric utilities must pay transfer fees in order to send electricity to customers through regions other than their own, as well as connection fees to use the facilities owned by other utilities.

In November 1999, the gas industry opened up the market to large users with a minimum consumption of 1 million cu m/year; they account for 40% of the gas market. The current Diet is considering a set of bills that will expand the areas of gas-market deregulation in phases.

The bills will be based on the proposal made by an advisory panel for Natural Resources and Energy in early January 2003. Table 3 also lists the advisory panel's proposed deregulation scheme.

The advisory panel suggested further liberalization to occur in phases in fiscal year 2004 and 2007, while leaving the deadline for full liberalization, including "home consumers," undecided.

In 2004, liberalization will be expanded to include users consuming at least 500,000 cu m/year (midsize buildings and factories). In 2007, expansion will include users consuming 100,000 cu m/year (small size buildings and factories).

As with electricity liberalization, some crucial details must be further discussed.

The panel has suggested having current gas providers allow new entrants to use their pipelines, whereas only the top four firms are obligated to do so today.

Although Japan's electricity and gas liberalization will have little direct impact on Japan's total LNG demand, it has made it very difficult for each utility to forecast its own future gas demand and market share because the future landscape of Japan's deregulated market is yet unclear.

Shifting priority

There are 10 million tpy of current LNG contracts that will expire around 2010. With the exception of Indonesia's expiring Arun contracts, many of the remaining ones will most likely be under discussion for renewal. The common thread among the renewals is that they are all for much shorter periods of 5 to 15 years.

Japan's 3-year deflation run and uncertainty over future energy demand helped bring an even faster change, as buyers are reluctant to commit supplies to potentially decreasing market share as a result of ongoing gas and electric liberalization.

The Asia-Pacific LNG market certainly presents buyers with more supply options so that the buyers can ask for improved contract terms and potentially different pricing arrangements. Indeed, Japanese buyers have already become aggressive in renewing and signing new LNG contracts.

In 2002, Malaysia LNG (MLNG) Satu and Tiga and North West Shelf Train-4 contracts had already given their Japanese buyers more flexibility, which effectively relaxes the traditional take-or-pay clauses, through greater offtake flexibility and resale options.

The next key price negotiation will be the existing 7.33 million tpy contract for NWS. By March 2004 (at the latest), the Japanese consortium and NWS suppliers will review the existing price, as stated in their contracts.

The consortium (five electric utilities: Tepco, Chubu Electric, Kansai Electric Power Co. Inc., Chugoku Electric, and Kyushu Electric Power Co. Inc.; and three gas utilities: Tokyo Gas, Osaka Gas, and Toho Gas Ltd.) will raise the issue that it's unreasonable to pay significantly higher prices than the Guangdong contract for basically the same gas.

Ultimately, all long-term suppliers will face a similar situation in which Japanese buyers will ask to revise contracts to bring both terms and formulas in line with Guangdong terms.

Japanese buyers are clearly shifting their priority from ensuring long-term supply to being more efficient with improved pricing formula and contract terms. The landscape of the Asia-Pacific LNG market has been changing significantly to the advantage of the buyers.

The author

Tomoko Hosoe is senior associate for FACTS Inc., Honolulu. She is also professional associate at East-West Center, Energy and Economic Development Group in Hawaii. Her focus is primarily on downstream oil and natural gas East of the Suez, energy policy, and environmental issues in the Asia-Pacific region, with special emphasis on Japan. She holds a master of public affairs from the School of Public and Environmental Affairs, Indiana University. ([email protected])