Middle East oil production to peak within next decade

Over time, there have been a number of definitions for the Middle East, that massive territory bridging the landmasses of Europe, Africa, and Asia. However, today the region's overall limits have become more or less standard. In this report, the Middle East is defined as an ensemble of 15 countries (and a neutral zone) extending from Afghanistan and Pakistan in the east to the Mediterranean on its western flank.

Conventional oil reserves

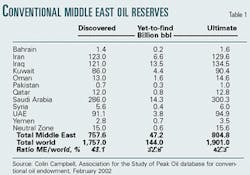

Colin J. Campbell, director of UK-based Oil Depletion Analysis Center, an independent entity working "to promote better understanding of the world's oil depletion problem" (OGJ Online, June 16, 2003), said that the Middle East accounts for 805 billion bbl of Ultimate Recoverable Reserves (URR) or 42% of a global URR of 1.9 trillion bbl. Reserves for each country are presented in Table 1, with breakdowns for "discovered" and "yet-to-find" reserves.1

Saudi Arabia controls the lion's share of URR, with 300 billion bbl, and Iraq and Iran follow with 135 billion bbl and 130 billion bbl respectively. Together these larger reserve holders control more than 70% of Middle East URR.

Interestingly, as much as 90% of Middle East oil reserves are concentrated in a narrow, horseshoe-like expanse of land bordering the Persian Gulf and covering some 900,000 sq km (Fig. 1). That extreme concentration is quite exceptional in petroleum systems.

Subdivisions

The 15 Middle Eastern countries can be subdivided into four main groups according to their oil production potential:

- Those countries with almost no potential: Afghanistan, Israel, Jordan, and Lebanon. Prospects are rather dim for this group, but in the Middle East, miracles are always possible. Potential long shots could be Israel's offshore and Jordan's eastern desert. Nevertheless, any major oil discovery would be an extraordinary event—something akin to Denmark's find of Halfdan oil field.

- Countries with low potential: Bahrain, Pakistan, Syria, and Yemen. With an aggregate output of 1 million b/d, countries in this second group seem to have reached their collective limit. Syria peaked in 1995 at 600,000 b/d and is gradually entering its decline after having plateaued during 1993-2001. Yemen's peak also seems near, with little hope for future growth.

- Countries with midsize potential: Kuwait, Oman, Qatar, and UAE.

- The three largest regional oil powers: Iran, Iraq, and Saudi Arabia.

In addition, the Neutral Zone has been subdivided into equal shares between Kuwait and Saudi Arabia.

Midsize potential

In this category, the three members of the Organization of Petroleum Exporting Countries—Kuwait, Qatar, and UAE—are bound to age gracefully after achieving a protracted output plateau.

The case of Oman, however, is of special interest. Oman has been one of the great success stories of the past 2 decades. During the 1980s, Omani oil production gradually ramped up to 700,000 b/d from 300,000 b/d; then during the 1990s it continued to rise, reaching 960,000 b/d by 2000.

Being outside OPEC's quota system, Oman could fully open its oil throttle. And it was no surprise that new records were set year after year, with Royal Dutch/Shell Group serving as technical advisor to Petroleum Development Oman LLC (PDO)—a joint venture of the government of Oman 60%, Shell 34%, Total SA 4%, and Partex (Oman) Corp. 2%—that controls roughly 94% of Omani oil output.

Then, abruptly, at the dawn of the 21st Century, everything seemed to unravel for PDO. Output began to plunge. Within 2 years PDO's black oil production had dropped to about 703,000 b/d (Shell's target for 2003)2 from 840,000 b/d. Interestingly, all this is happening as about half of Omani proved reserves have been produced, as Shell said candidly that "the decline... (was) partly because of a poor understanding of reservoirs."3

PDO pulled out all the stops to reverse the production plunge, applying enhanced oil recovery techniques, including gas injection at both the 181,000 b/d Fahud-Lekhwair and Natih fields and water injection at Saih Rawl.4 In addition, PDO drilled horizontal wells and implemented an underbalanced drilling program at Nimr and Saih Rawl fields, among others.5 This application of EOR and advanced drilling technologies might allow for some plateauing, but the inevitable decline may be irreversible, especially when bearing in mind that Campbell's estimate of Oman's "yet-to-find" reserves stands at only 1.6 billion bbl.6

Put in a nutshell, the Oman oil story is a caveat for other Middle East producers. Oman's track record had been excellent with no hint at the dramatic reverses of the past 2 years. Moreover, with the highly experienced Shell supermajor advising on the projects, inadequate technology or services should not be a factor. In due time, other Middle East producers could follow the same path, although most have a larger array of giant and supergiant fields than Oman has to rely upon. The one exception could be Iraq.

The big three

In 2002 the three major Middle East producers, Iran, Iraq, and Saudi Arabia jointly produced an average of 13 million b/d, or about 17% of global supply.

Iran is facing an uphill battle to compensate for the decline in its major southwestern oil fields via EOR and minor offshore developments on a buy-back basis. But by just "muddling through" and shying away from risks, Iran will succeed only in slowing the decline. Even the big hope generated by alleged supergiant Azadegan oil field is gradually dying down as its potential is constantly downgraded. Edinburgh-based consultant Wood Mackenzie Ltd.'s latest estimate for that field's potential output stands at only 100,000 b/d.7

In order to revive its battered oil industry, Iran will have to "grasp the nettle" of production-sharing agreements (PSAs) and aggressively take exploration risks in order to find fresh opportunities while taking advantage of state-of-the-art technologies to improve recovery at its older fields. For this to occur, some momentous changes will be required in Iran and in her oil industry.

As for Iraq, it now represents the Middle East's biggest hope. All present events are favorable for a renaissance of its oil industry. The extra-low production rate of the early 1990s will allow for a further plateauing in known fields. New fields ready for development, such as West Qurna 2, Majnoon, and Nahr Umar,8 should prove very prolific, as they are so new.

Finally, the Western Desert explored by an array of international oil companies could reveal many new jewels, especially if Institut Français du Pétrole's estimate of "at least 30 billion bbl in oil reserves"9 is proven valid. All these developments will have the advantage of the best possible type of management for their incubation over the near future.

And, last—but certainly not least—there is Saudi Arabia. The largest oil producer and exporter in the world, Saudi Arabia is the main pillar of both OPEC and the Middle East. BP Group LLC estimates its proved reserves at 260 billion bbl, and Campbell gives it a URR of 300 billion bbl. These superlatives notwithstanding, even Saudi Arabia has limits. These came to light recently during the 2003 war in Iraq; Pumping at full capacity, the Saudis could produce only 9.3 million b/d. This prompted most institutions to downgrade Saudi oil production capacity from their lofty heights of 10.5-12 million b/d to a more realistic 9.5 million b/d, which now is being accepted as the fresh standard for Saudi capacity.

The Saudi problem is that output heavily relies on its unique Ghawar oil field. And Ghawar's sustainability is a well-kept secret. The only hint that there may have been problems was the drilling of some 200 horizontal wells in 1992-99.10

Although these new wells ushered in a recovery boon, they are a Damocles Sword hanging over Ghawar's head. For, as French petroleum consultant Jean H. Laherrère pointed out: "When water level hits the horizontal well, it is finished. Ghawar has not yet peaked, but when it will, it is going to be a cliff!"11

Research paths

Seven different paths for research were considered in the investigation of potential long-term capacity in the Middle East:

- Campbell's "conventional oil" ASPO (Association for the Study of Peak Oil) database.

- International institutions, such as International Energy Agency, US Energy Information Administration, and OPEC.

- Major oil companies.

- Major international banks.

- Specialized press and consultants.

- Economists and pundits.

- The World Oil Production Capacity (Wocap) Model, which subdivides the world into the categories OPEC (11 member states) and Non-OPEC (with yet another 11 subdivisions, among which are Russia and Other FSU).

Of these potential research sources, three were ultimately retained:

- The ASPO database. Campbell's predictions for the output of 64 major oil producers are among the most reliable forecasts in the oil industry. Total results for all 64 (worldwide) and for the 15 Middle East countries (inclusive of the neutral zone) over the years 2005, 2010, and 2020 are presented in Table 2 and Fig. 2.

As can be seen, Campbell predicts a long plateau covering almost 2 decades for the Middle East, with the rest of the world gradually declining during the second decade of the 21st Century.

- Deutsche Bank AG estimates. Among major international banks, Deutsche Bank has an excellent track record forecasting global energy developments in general and crude oil outputs in particular, mainly through its highly qualified Equity Research Department.

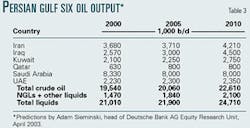

Deutsche Bank's oil output estimates' horizon is presently 2010. Its predictions for the six major Persian Gulf (PG6) producers—Iran, Iraq, Kuwait, Qatar, Saudi Arabia, and UAE—are presented in Table 3.12

Most noticeable in these Deutsche Bank forecasts are the flat 8 million b/d forecast for Saudi Arabia up to 2010, in stark contradiction to some estimates nearly doubling that amount; the 4.5 million b/d Iraqi output in 2010—realistically on the safe side; and the long plateau for the four other major Persian Gulf producers.

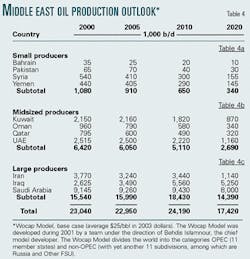

- The Wocap model was developed in 2001.13 Fed with URR developed by Campbell, Wocap was simulated to predict oil production capacities14 for the 11 major Middle East producers up to 2020. The base case results are presented in Table 4.

The respective predicaments of the three major oil powers—Iran, Iraq, and Saudi Arabia—is summarized as follows.

Iran: the small risk

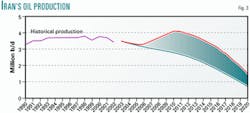

The envelope of Iran Wocap scenarios is shown in Fig. 3. As illustrated, prospects for Iranian oil output are far from bright. This is mainly due to declining reserves that currently are not being replaced.

Even the officially much-advertised supergiant Azadegan is being continuously downgraded: to 20,000 b/d by the Japanese consortium still mulling over its development and by NIOC, which now is advancing an output of 250,000 b/d.15

Negotiations are ongoing between the two sides, with Shell having refused a share proposed by the Japanese group. On the other hand, Iran's "yet-to-find" reserves are only 6.6 billion bbl, according to Campbell, so there seems to be little hope on this side. The only bankable Iranian hope is in the large amounts of "oil-in-place" still in its supergiant and giant oil fields, but this will have to wait for PSAs with supermajors able to face the momentous challenge of increased recovery.

Altogether, there still is a risk that Iran's production could decline, like Oman's, during the present decade, especially if it continues to pursue its "muddle through" strategy.

Iraq: the big hope

All trump cards seem stacked up in Iraq's oil pack. Only the Iraqi people could throw to the wind the present exceptional opportunities, as a multinational task force of highly qualified oil experts endeavors to place the domestic oil industry on the right track.

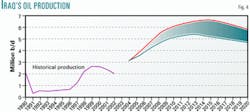

Wocap simulation results for Iraq are shown in Fig. 4. All lead to high capacities of 5-6.5 million b/d for the next decade, with a longer plateau than any other Middle East rival. Probably maximum possible output would be "the 6.8 million b/d in 2012 for unrestrained Iraqi oil production" predicted by Wood Mackenzie. 16

But the 12 million b/d advanced by former Iraqi oil minister Fadhil al-Chalabi clearly seems excessive, as there are also some dark spots on the rosy Iraqi predicament:

- The prolific Kirkuk field, Iraq's northern kingpin, has already produced some 14 billion bbl vs. an ultimate potential of 16 billion bbl.18

- The other major Iraqi field, Rumaila, has been producing for half a century.

- New export facilities will be required, especially in southern Iraq where 2 million b/d could be forthcoming for export from the three fresh supergiants: West Qurna 2, Majnoon, and Nahr Umar by 2007-08. Possibly twin, 1 million b/d pipelines from the Majnoon Islands to Kharg Island could prove a cheap solution to that problem.

Saudi Arabia: big risk

The Wocap simulations for Saudi oil are presented in Fig. 5. They clearly show a long plateau at 8-10 million b/d. Here the main question is: How long can Saudi Arabia plateau at that level? Or in other words: Will it age gracefully? Much will depend on Ghawar.

With 100 billion bbl of crude oil produced so far, Saudi Arabia should not be far from the midway point of its proved reserves of 260 billion bbl—that means just 10 years at the going rate of roughly 3 billion bbl/year. Bearing in mind the "spurious revision" of 1990 that boosted proved Saudi reserves to 257.5 billion bbl from 170 billion bbl,19 the midway point could happen even sooner than that.

Furthermore, the 35 billion bbl produced during 1990-2002 has not been accounted for, as Saudi "proved reserves" were still being reported at 260 billion bbl by the close of 2001.

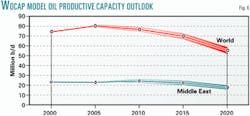

The overall Wocap simulations for the world and the Middle East region are presented in Fig. 6.

Intangibles

These predictions, however, were all based on there being constant, rational developments in the Middle East, based mostly on tangible parameters such as URR and production capacities.

The problem is that the region is by far the least constant in the world. Intangibles are more prone to erupt on this regional scene than anywhere else. Over the past 2 decades, such intangibles have wreaked havoc in the region, i.e., the Iranian revolution, the Iran-Iraq war, and the two Iraqi wars of 1991 and 2003, leading to dramatic revisions in oil output predictions.

The twin liberations of Afghanistan and Iraq have already brought much-needed change to the region. But looking down the road, one can envision more changes in the waiting.

Today, the "Great Powers' Game" overshadows all other regional considerations. Any further change in the Persian Gulf inevitably will impact future regional oil production patterns.

Summation

With more than 40% of global URR and roughly one third of "yet-to-find" worldwide oil reserves, the Middle East is bound to play an ever-increasing role in the global oil scene.

Among the region's 15 countries, the "Persian Gulf Six" clearly dominate the rest, and that share should ramp up even more with time.

The three major sources of predictions reviewed are in agreement on general forecasts for the PG6, as can be seen in a summary of overall results presented in Table 5.

So, in the world of oil, the international oil industry focus will tend to concentrate on the Middle East in general and the Persian Gulf in particular.

Middle East production should plateau during the present decade before peaking early in the next one. As world production is bound to peak much sooner, the Middle East's share of global output should increase gradually.

Notwithstanding its mighty oil reserves, the Middle East has its limits too. And although the Middle East's share of global oil output will gradually increase as other regions witness sharper declines, this peaking will usher in a new chapter in the history of oil. Perhaps present events are a prelude to that new era.

Acknowledgment

The author wishes to acknowledge the assistance of Miss Behdis Islamnour in all phases of this report's draft from initial compilation to its presentation, and he also thanks Eng. Muhammad Faham (NIOC Exploration) for permission to use his "Horseshoe Theory" in the article.

References

1. Campbell, Colin J., ASPO database for 64 major oil-producing countries, February 2002.

2. Interview with PDO's Managing Director, John Malcolm, Shell in the Middle East, No.20, January 2003, p. 7.

3. "Oman seeks to stop the rot," Weekly Petroleum Argus, Dec. 23, 2002.

4. Arab Oil and Gas Directory, 2002, p. 298.

5. "Low risk, high reward drives underbalance for PDO," Drilling Contractor, March-April 2003, pp. 20-23.

6. Campbell, Colin J., op cit.

7. Brown, Iain, "The only way is down," Petroleum Review, April 2003, p. 15.

8. Middle East Economic Survey, July 16, 2001.

9. An estimate by Institut Français du Pétrole expert J.F. Giannesini (as quoted in Jean Laherrère e-mail, Mar. 23, 2003).

10. Kamal, Rami A., and Al-Shahri, Ali M., "Giant Achievements by a Giant Producer; the Saudi Aramco Success Story with Horizontal Drilling," www.kgs.ukans.edu/PRS/AAPG/papers/kamal.html

11. Laherrère, Jean, e-mail, Mar. 16, 2003.

12. Sieminski, Adam, head of the Deutsche Bank Equity Research Unit, April 2003.

13. The Wocap model was developed in 2001 by a team under the direction of Behdis Islamnour. It was duly revised in 2002.

14. Capacity and production rate are not synonymous in Middle Eastern terminology in contrast to the accepted Western practice. For example, in Iran, a number of definitions and conventions are being used for these two concepts: Available Well Capacity (AWC); Planning Guide Capacity (PGC); Planning Guide Rate (PGR) with AWC > PGC and PGR = 0.95 * PGC. Average daily production is estimated at PGC * 0.90.

15. Middle East Economic Survey, Apr. 14, 2003, p. A16.

16. Brown, Iain, op. cit.

17. Lauerman, Vincent, "Iraq: OPEC's Prodigal Son," Geopolitics of Energy, April 2000 (22/4), p. 9.

18. These statistics were retrieved from the graphical presentation of the historical Kirkuk production presented by Jean Laherrère, e-mail, Apr. 6, 2003.

19. Bentley, R.W., "Global oil & gas depletion; an overview," Energy Policy, Vol. 30, No.3, February 2002, p.197.

The author

Ali Morteza Samsam Bakhtiari (www.samsambakhtiari.com) is a senior expert in the corporate planning division of National Iranian Oil Co., Tehran. He specializes in questions related to the global oil, gas, and petrochemical industries, with special emphasis on the Persian Gulf and the Organization of Petroleum Exporting Countries. Formerly, he lectured on design and economics at the chemical engineering department of Tehran University's Technical Faculty. He holds a PhD in chemical engineering from the Swiss Federal Institute of Technology at Zurich.

A summarized version of this article was presented at the Institut Français du Pétrole near Paris May 26-27 at the Second International Workshop on Oil Depletion sponsored by the Association for the Study of Peak Oil—a network of scientists, universities, and government departments.