Lower Gulf Coastal exploration gets three-pronged focus

Partners in the Padre Island Joint Venture have restructured the project by prospect depths in an effort to reinvigorate drilling opportunities in three depth ranges.

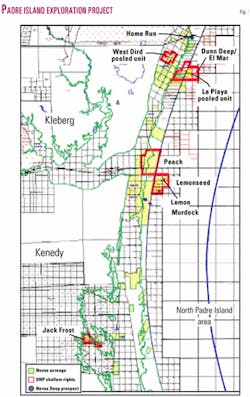

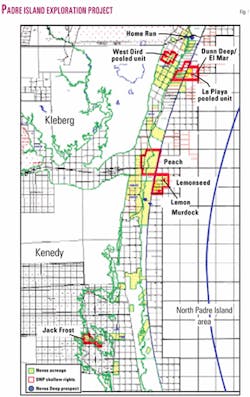

The project involves acreage along the Texas Gulf Coast mainly in Kleberg and Kenedy counties from just south of Corpus Christi to near the Kenedy-Willacy county line.

The participants believe the area has large gas potential. More partners are being sought to spread out the working interests.

Meanwhile, a branch of the Sierra Club said drilling should not be permitted in Padre Island National Seashore and that it will work to organize support for a federal buyout of mineral rights under the park.

The Sierra Club sued Interior Sec. Gale Norton, the National Park Service, and the US Fish & Wildlife Service last year after BNP Petroleum Corp., private Corpus Christi operator, announced its initial drilling program. A federal district court rejected Sierra's claims under the Endangered Species Act, and the club's appeal is due for hearing in early August.

Redirected project

As restructured, the project operators and three depth ranges are:

- BNP will operate some of the prospects in the project as deep as 11,000 ft and will continue to operate the producing La Playa and West Bird fields.

- Novus Petroleum Ltd., Sydney, Australia, will operate prospects that lie roughly between 12,000 and 16,500 ft.

- BP North America will operate prospects in different geology generally at 15,000-20,000 ft.

The depth ranges dovetail with the corporate objectives of the three main participants.

Novus said it had close to 50,000 net acres under lease in the play as of early June. The company has been building Gulf Coast operational expertise and last fall acquired a unit of Darcy Energy Ltd., and Novus's first operated US well was a discovery in South Louisiana (OGJ Online, May 15, 2003).

The restructuring

BNP originated the PIJV and farmed out an interest to Novus in May 2001. MOEX Texas Oil & Gas LP, a Mitsui subsidiary, and Long Flat Ltd., of Long Flat, N.S.W., Australia, joined Novus thereafter.

The main attraction to Novus is the undrilled sedimentary section below existing shallow shut-in fields. Novus said, "Recently acquired 3D seismic data revealed a layer of undrilled prospectivity that could be drilled up from onshore locations for less than the cost of similar wells drilled in nearby offshore acreage.

"Depths for these prospects are roughly between 12,000 and 16,500 ft, with prospect sizes interpreted to be between 50 and several hundred billion cubic feet."

The partners' initial hope that cash flow from numerous shallow prospects would help fund more expensive deeper drilling did not pan out as the shallow drilling pace has been slower than expected.

The joint venture in late March 2003 closed a farmout that gave BP 9 months to complete a technical study and mature prospects to be drilled. BP can then withdraw or nominate prospects for drilling. The PIJV has the rights to all data and analysis from the farmout to BP.

Also, the main PIJV partners exchanged interests to align acreage by prospectivity at depths more suitable to each partner. This resulted in a $3.45 million payment to BNP by Novus.

Novus retained interests in La Playa and West Bird fields and in acreage subject to the farmout to BP. The company also seeks to take partners in the mid-depth prospects to cut its working interest ownership to 40% from 70%.

Planned activity

The outcome of the restructuring is essentially three joint ventures, Novus said.

BNP will retain operatorship of the two shallow gas fields, its 30% working interest in the Lemon Seed prospect in Kenedy County, and 90% interests in leases on shallow prospects named Jack Frost, Hook Fault/County Line, El Mar, Peach/Manzano shallow, and Lemon. These generally involve Upper Frio objectives.

Novus will not participate in further shallow drilling, including the Jack Frost prospect.

Novus identified 15-20 prospects and leads in its depth range. Of roughly a dozen in the first rank, six will be chosen for initial drilling. Pre-drill estimates are typically 100-600 bcf mean recoverable and $5-10 million/well. At least two are to be spudded by yearend 2003. Some have upsides in excess of 1 tcf.

Early candidate prospects are Homerun, Murdock Deep, Valley Crest, and Plum Deep.

BP probably would not begin drilling until 2004, tackling high-pressure, higher cost wells that cost $5-10 million/well.

The structures that BP targets have independently determined potential of 1-3 tcf each and are similar to some deepwater Gulf of Mexico fields that the major oil companies are drilling, Novus said. Novus can elect to participate in any wells operated by BP.

The Novus and BP prospects are mainly in Lower Frio rocks.

Montenegro

Ramco Energy PLC, Aberdeen, UK, raised $6.5 million through a private stock placement that it plans to use for its share of an exploration program on the 3,100 sq km Ulcinj block in the Adriatic Sea.

Ramco 40% and its partner Hellenic Petroleum SA of Greece 60% plan to acquire 200 sq km of 3D seismic data this year over a shallow water area of high potential, thought to be gas bearing. A well would follow in 2004 to test the structure.

The block is on trend with Southern Apennines discoveries in southern Italy (OGJ Online, Apr. 16, 2003).