World's LPG industry shifting to a supply-driven market

Global demand for LPG has grown rapidly for many years. Much of this growth has occurred east of the Suez Canal, which has shifted international trade patterns. Weak economies in many nations, however, and high prices for LPG could slow demand during the next few years.

Conversely, LPG supplies will continue to increase, in part due to a number of new projects associated with either domestic gas production or LNG export projects. Thus, global LPGs could be subtly shifting toward a supply-driven market.

In the past 12 years, the global market for LPG has grown at about 3.5%/year, or roughly two and a half times faster than demand for petroleum. LPG demand by developing nations with large populations grew very rapidly as a result of robust economic growth, which resulted in an increase in discretionary income and spending by consumers. LPG use as a petrochemical feedstock also increased at high rates.

In 2003, the global LPG industry faces many challenges, some of which could slow this demand growth. The US war on terrorism has increased global concerns regarding security of supply and resulted in high prices. These high prices have slowed economic growth and tempered demand for all types of energy, including LPG.

In North America, a new challenge for the LPG industry has been an extremely tight market for natural gas, which has driven prices to new highs and depressed gas processing margins. The resulting higher NGL prices have adversely affected the regional petrochemical industry's ability to compete in the global market. Also, collateral damage from the collapse of Enron Corp. has reduced liquidity in the US market.

In the face of factors that could depress demand, new LPG production projects will continue to be started up and existing facilities expanded. Thus, the world LPG market could shift from a demand-driven market during the 1990s to a supply-driven market in the early part of this decade.

Rapid demand growth

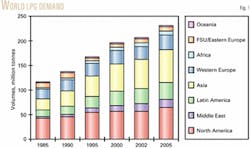

Total global demand surpassed 200 million tonnes/year (tpy) for the first time in 2002. This year, Purvin & Gertz Inc. estimates that demand will increase further to a total of about 215 million tpy. By 2005, LPG demand will total about 231 million tpy, or nearly twice the total of 116 million tpy in 1985 (Fig. 1).

During the 1990s and early 2000s, total global demand growth for LPG averaged 3.5%/year. Growth rates varied significantly, however, in different geographical regions. In all but three, demand for LPG grew faster than the global average.

Demand in the Middle East grew the fastest at 10.9%/year between 1990 and 2002.

Thus, LPG demand in the region totaling nearly 16 million tpy in 2002 was more than three times higher than in 1990. The total increase of nearly 11 million tpy roughly equaled the increase that occurred in the much larger North American market during the same 12-year period.

Saudi Arabia currently accounts for slightly more than half the total LPG consumption in the Middle East. Consumption soared to about 8.2 million tpy in 2002 from only 1.2 million tpy in the early 1990s, primarily due to increased use as a petrochemical feedstock for the production of methyl tertiary butyl ether (MTBE) and ethylene.

Now that most of these LPG-based petrochemical facilities have been started up, demand growth in Saudi Arabia will likely grow very slowly at less than 0.5%/year for the foreseeable future. This outlook does not imply that petrochemical capacity will remain stagnant in the kingdom. Rather, we expect that the next ethylene plant will use ethane as its primary feedstock.

Iran is the second largest consumer of LPG in the Middle East, accounting for about 15% of the total regional demand. Unlike Saudi Arabia, LPG demand in Iran has grown much more consistently, averaging about 4.9%/year since 1990.

Virtually all LPG consumed in Iran is used by the residential-commercial sector. The planned expansion of the petrochemical industry in the country will likely be based primarily on ethane and naphtha. Thus, LPG demand growth in the near future should continue to occur in the residential-commercial sector, which Purvin & Gertz expects to increase at about 4%/year.

The second-fastest growing region for LPG demand has been Southeast Asia, with a growth rate averaging 10.1%/year during the past 12 years. LPG demand in the region, however, currently totals only about 8 million tpy. Thus, the absolute increase of about 5.4 million tpy that occurred between 1990 and 2002 ranks fifth among the 11 major regions of the world.

Most of the demand growth occurred in the residential-commercial sector, which currently makes up about 72% of the regional demand. Malaysia and Thailand both accounted for about 30% of the total LPG consumed in the region during the last several years.

Purvin & Gertz expects that LPG demand growth in Southeast Asia will slow to about 5.5%/year through 2005. The most rapid growth is likely to occur in Vietnam due to rising domestic production, which only began in 1998 with the start-up of the country's first gas processing plant.

The neighboring Indian subcontinent also experienced rapid growth in LPG demand of 9.7%/year between 1990 and 2002. Thus, total demand rose by about 5.2 million tpy during the last 12 years to slightly less than 8 million tpy in 2002.

India accounts for roughly 95% of the LPG consumption in the region. The vast majority of the LPG used in the region is consumed by the residential-commercial sector.

Perhaps surprisingly, LPG demand in Eastern Europe also increased rapidly, averaging 6.8%/year from 1990 to 2002. Demand fell sharply during 1990 and 1991, however, when the economies in the region collapsed. If those 2 years are omitted, LPG demand growth in the region has averaged an impressive 9.4%/year since 1992.

Somewhat less impressive is the absolute increase in demand, which rose by about 1.6 million tpy to current demand of nearly 2.8 million tpy in 2002 from the low in 1992. Thus, on an absolute basis, Eastern Europe ranks only ninth out of the eleven major LPG consuming regions of the world.

The largest LPG consumer in Eastern Europe, Poland, accounts for roughly half of the total demand in the region. The residential-commercial sector consumes about 45% of all LPG used in the region. The fastest growing demand sector, however, is for auto fuel, which accounted for about 38% of the total in 2002.

Most of this auto fuel market occurs in Poland, with the balance in the Czech Republic and Bulgaria.

Purvin & Gertz's forecast calls for demand in the region to grow by about 3.5%/year in the near future. Much of this growth should continue to be in the auto fuel market.

The African LPG market is similar to Eastern Europe in that it has been growing quickly, averaging about 5.6%/year, but from a low starting point. Based on the total increase from 4.0 million tpy in 1990 to 7.7 million tpy in 2002, Africa ranks as only the seventh largest regional increase in LPG demand. This growth, however, roughly equals the increase that occurred in the much larger market in Western Europe during the last 12 years.

About 95% of the LPG used in Africa is consumed in the residential-commercial sector. Egypt consumes about a third of the total LPG used in the region, followed by Algeria, which consumes about a quarter of the total. Purvin & Gertz expects that demand in the region will grow at slightly more than 3.5%/year during the next few years.

Based on demand growth of about 5.1%/year, Latin America ranks only sixth in the list of LPG-consuming regions.

Due to the relatively large size of its LPG market, however, Latin America experienced the second-largest increase in total demand, behind the Far East. LPG demand in the region totaled slightly more than 30 million tpy in 2002.

Of the two largest consumers of LPG in the region, demand in Mexico rose by an average of 5.6%/year, whereas demand in Brazil grew at 3.9%/year. Residential/commercial demand accounts for nearly 80% of total LPG consumption in Latin America. LPG is consumed for a wide variety of uses, however, including engine fuel and petrochemicals production.

We look for total demand for LPG in Latin America to increase at approximately 3%/year during the next few years.

LPG demand in the Far East increased at 4.4%/year, which was only slightly higher than the world average. The growth rate is deceiving, however, because of the large size of the market, which totaled about 42.5 million tpy in 2002.

Based on an increase of more than 17 million tpy between 1990 and 2002, the Far East experienced the largest increase in demand. The residential-commercial sector accounts for about 58% of the total LPG demand in the region.

Within the region, Japan is the largest consumer of LPG totaling near 19 million tpy for the last several years. LPG consumption in China, however, has soared to slightly more than 14.5 million tpy in 2002 from only 2 million tpy in 1990, an average growth of nearly 18%/year.

Even if demand growth in China slows to only 5%-6%/year, LPG consumption in the Far East should increase by nearly 3%/year during the next few years.

In adjacent Oceania, LPG demand growth averaged about 4.2%/year between 1990 and 2002. This growth, however, only equates to an increase of about 1 million tpy.

Australia accounts for the vast majority of LPG consumption in the region. Unlike any other region in the world, auto fuel demand dominates consumption at almost 65% of the total.

Purvin & Gertz expects that total LPG demand in the region will grow at about 3.3%/year through 2005.

North America is one of the three regions in which LPG demand grew more slowly than the world average. Demand growth in the region averaged only 1.9%/year during the last 12 years.

Due to the extremely large size of the market, however, this slow growth resulted in an increase of roughly 11 million tpy to about 57 million tpy in 2002.

The LPG market in North America is unique in that the production of petrochemicals makes up an unusually large share of the market of about 40%-45% of the total. This market share fluctuates based on the relative economics of cracking LPG vs. either ethane or naphtha-gas oil.

Because LPG demand for most end-uses is very mature in North America, future growth primarily depends on the petrochemical feedstock market. Purvin & Gertz currently expects total LPG demand to increase at about 5%/year through 2005, depending on the health of the petrochemical industry.

This market is somewhat at risk, however, due to high prices for natural gas that have driven LPG prices upward.

These higher feedstock prices have damaged the region's ability to compete in the global petrochemical market and could slow the potential growth in LPG demand.

Western Europe is also a mature market for LPG with an average growth rate of only 1.4%/year during the last 12 years. The region is the fourth largest market for LPG in the world, however.

Thus, the relatively slow growth rate amounted to an increase of almost 4 million tpy since 1990.

The top five consuming countries in 2002 were (in order) Italy, France, Turkey, Spain, and the UK. LPG demand by the residential-commercial sector accounts for about 40% of the regional total.

The industrial sector, auto fuel market, and petrochemical feedstock market, however, all make up fairly large segments of the total.

The last region in which LPG demand rose more slowly than the world average is the former Soviet Union (FSU).

Because of the very weak economy, demand in the FSU declined fairly steadily between 1990 and 1998. Overall demand growth was therefore negative at -4.5%/year during the last 12 years. Demand started to rebound in 1999, however, and has increased by an average of about 5.8% for the last 4 years, reaching about 5.2 million tpy in 2002.

Russia accounts for about three fourths of the total LPG consumption in the region. The residential-commercial sector uses about 55% of the total. Also, Russian-based petrochemical companies consume roughly 35% of the total.

New supply projects

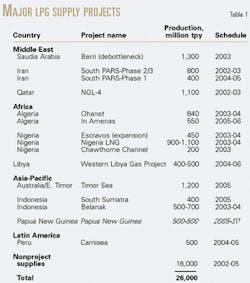

Global supply of LPG has risen to about 205 million tpy in 2002 from 140 million tpy in 1990. Thus, supply increase has averaged about 3.2%/year. Purvin & Gertz looks for supplies to reach about 231 million tpy by 2005 (Fig. 2).

LPG production from natural gas consistently accounted for about 60% of the total LPG supplies during the last 12 years.

Refineries typically produced most of the remaining 40% of the total, with other miscellaneous sources accounting for roughly 1%.

Although the sources of the supplies have remained fairly consistent, regional production rates have shifted noticeably. In 1990, East of Suez produced slightly less than 30% of the world total. In 2000, East of Suez's share of the total had risen to nearly 35%. By 2005, Purvin & Gertz estimates that almost 37% of world's LPG supplies, or about 84 million tonnes, will come from East of Suez.

On a percentage basis, production increases have been particularly high in the Indian subcontinent, averaging 9.6%/year between 1990 and 2002, followed by the Far East at 7.2%/year. Supplies also rose quickly in both Africa and Southeast Asia, at 6.4%/year and 6.3%/year, respectively. The regional ranking is somewhat different when based on the total increase, however.

During the past 12 years, LPG production increased most in North America, with an increase of about 13.3 million tpy. Production increased by about 10 million tpy in both the Far East and the Middle East. The increase in the Far East primarily resulted from rapidly rising LPG production by refineries in both Korea and China.

In the Middle East, production increased by roughly 2.5 million tpy in both Saudi Arabia and Iran. Natural gas processing was the primary source of the increase in LPG production in Saudi Arabia. In Iran, however, gas processing and refineries both contributed to the increase in LPG production.

LPG production in Latin America increased by slightly less than 10 million tpy during the last 12 years, reaching about 27 million tpy in 2002. Venezuela led the region with an increase of about 4 million tpy. LPG production rose by nearly 2 million tpy in Argentina between 1990 and 2002, and Brazil was in third place with an increase of about 1.4 million tpy.

Africa is the fifth region that experienced a significant increase in its LPG production. In the last 12 years, production rose by about 8 million tpy to a total in 2002 of roughly 15.6 million tpy. Algeria accounted for about 5 million tpy of this increase, with a current production rate near 10 million tpy.

LPG production in Western Europe increased by about 6.7 million tpy between 1990 and 2002. About two thirds of the increase came from increasing natural gas production, primarily in the North Sea.

The remaining one third of the increase was from refineries in the region.

Two regions that experienced moderate increases in their LPG production were Southeast Asia, with an increase of 5.0 million tpy during the past 12 years, and the Indian subcontinent, where production rose by 4.3 million tpy.

Of the remaining three regions, LPG production in Oceania rose by about 850,000 tpy, production in Eastern Europe inched up by only 300,000 tpy, and production in the FSU dropped by 3.2 million tpy.

Purvin & Gertz's forecast of future LPG production rates is based partly on announced projects (Table 1) that account for an increase of about 10 million tpy between 2002 and 2005. New projects in the Middle East should add about 3.7 million tpy of LPG production to the world markets. Production projects in Africa are to add roughly 3.5 million tpy.

In Asia-Pacific, four new projects will increase LPG production in the region by about 2.7 million tpy.

Finally, the Camisea project in Peru will produce about 500,000 tpy of LPG. These projects all are primarily intended to increase natural gas production, for either domestic use or for LNG exports.

The LPG that is extracted at these projects is primarily a "necessary evil" that is required to market the gas or LNG. In addition to specific projects that are listed in Table 1, LPG production will increase from a huge number of existing facilities around the world.

The amount of additional LPG that will be produced by these facilities is difficult to determine accurately, but Purvin & Gertz estimates that LPG production from these miscellaneous sources will add about 16 million tpy of LPG to the world markets.

Changing trade patterns

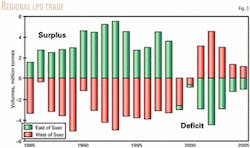

A careful review of the preceding descriptions of LPG demand and supply shows that an interesting shift is occurring in the global LPG market. Demand in the five regions East of Suez increased by a total of almost 40 million tpy between 1990 and 2002. Demand in the regions West of Suez increased by only 29 million tpy during the same period.

Conversely, LPG production in the regions East of Suez rose by only about 32 million tpy during the last 12 years. Production West of Suez increased by nearly 37 million tpy.

Due to this shift of approximately 8 million tpy, the LPG supply-demand balance East of Suez has shifted from a surplus of supplies to a deficit, whereas West of Suez has experienced an equal but opposite shift in its balance (Fig. 3).

These relative changes in the supply-demand balances have changed world LPG trade patterns. The Far East remains the largest LPG importing region in the world, but the imports must now come from increasingly diverse sources. This change is shown by recent LPG shipments from both West and North Africa to Far East destinations. Also, LPG from the North Sea has been exported to the Far East on a fairly regular basis.

The US continues to be the swing destination or supplier of LPG to the global market. During periods of surplus supplies, the US often becomes the "dumping ground" for excess LPG from many producing regions.

Because of the extremely large LPG storage facilities along the US Gulf Coast, the excess LPG can be stored for future consumption within the US or for re-export to other regions as needed.

Our analyses indicate that the increase in global supplies of LPG will outrun the increase in base demand during the next few years. Therefore, discretionary consumption of LPG as a feedstock for petrochemical production (price-sensitive demand) will need to increase.

We estimate that price-sensitive demand will increase to roughly 12 million tpy by 2005 from approximately 4.5 million tpy in 2002.

Regional ethane markets

Ethane is seldom transported in ships from one region to another due to the high costs of shipping cryogenic products.

Ethane is an extremely important component to the global petrochemical industry, however. Purvin & Gertz and its strategic partner, Chemical Market Associates Inc. (CMAI), Houston, have analyzed the ethane markets in all regions.

Nearly all ethane is extracted from natural gas. Its physical properties are relatively similar to methane, which is the main component of natural gas. Therefore, ethane can either be left in the gas or it can be extracted.

The decision to recover ethane is generally based on extraction economics. If ethane is to be recovered, its price must be higher than the extraction and purification costs, including its gas-based heating value.

In 2002, ethane was used to produce about 28 million tonnes of ethylene, or approximately 30% of all ethylene produced in the world.

Approximately 35 million tpy of ethane were consumed to produce this ethylene.

Despite this very large market, ethane is used extensively in only a few regions of the world.

The largest regional use of ethane occurs in the US and Canada, which account for about 20 million tpy or approximately 60% of all the ethane consumed in the world.

Supplies of ethane are adequate in the US. Supplies from existing facilities in Canada, however, are falling behind demand. Therefore, new and expanded sources of ethane supplies are being evaluated.

During the last few years, Latin America (including Mexico) consumed slightly more than 2 million tpy of ethane, or about 7% of the global total. Similarly, ethane consumption in Western Europe averaged roughly 2 million tpy during the last few years.

Lastly, the only other region of any significance to the global ethane market is the Middle East, where consumption has grown from roughly 4 million tpy in the mid-1990s to about 6.5 million tpy in 2002. Thus, the region's share of the global ethane market has risen from about 15% in 1995 to nearly 19% in 2002.

Ethane consumption should continue to rise during the next few years, reaching about 40 million tpy in 2005. Most of this expected increase should occur in the Middle East.

The authors

Ronald L. Gist is a senior principal in the Houston office of Purvin & Gertz Inc., joining the company in 1996. He began his career with E.I. DuPont de Nemours & Co. in 1971 after receiving both BS and MS degrees in chemical engineering from Colorado School of Mines. Gist is Purvin & Gertz's representative to GPA's Market Information committee.

Ajey Chandra is a principal in the Houston office of Purvin & Gertz Inc. After 12 years with Amoco Corp., he joined Purvin & Gertz in 1998 and was elected a principal in 2000. He holds a BS in chemical engineering from Texas A&M University and an MBA from the University of Houston. He is a member of GPA and SPE.

Ken W. Otto is a vice-president and director in the Houston office of Purvin & Gertz Inc. He joined E.I. DuPont de Nemours & Co. in 1977, then moved to Champlin Petroleum Co. in 1979 and served 4 years at Corpus Christi Petroleum Co. Otto joined Purvin & Gertz in 1986, was elected principal of the company in 1987, senior principal in 1990, and vice-president in 1997. He holds a BS (1977) in chemical engineering from the University of Texas at Austin.

S. Craig Whitley is a senior principal in Purvin & Gertz Inc.'s Houston office. He joined the company in 1993, working in market analysis of natural gas, LPG, and NGL markets. Whitley has a BS in chemistry and zoology from Northwestern Louisiana State University, Nachitoches. He is a member of GPA, International Association of Energy Economists, National Propane Gas Association, and is Purvin & Gertz's representative on GPA's international committee.

Alfred L. Luaces is a principal in the Houston office of Purvin & Gertz Inc. After 9 years with ExxonMobil Refining & Supply, he joined Purvin & Gertz in 2000. He holds a BS in mechanical engineering from the University of Florida.