OGJ Newsletter

Market Movement

High prices seen for decade

The US is facing high prices for both oil and natural gas for a decade or more, analysts reported last week. "We are in the midst of an energy supply crisis, which should fuel a sharp rise in drilling activity, beginning by late 2003 and extending for several years as the US attempts to reduce its dependence on foreign oil and meet domestic gas demand," said analysts at Jefferies & Co. Inc., New York.

"What is occurring now in the US energy market can be characterized as a painful period of adjustment as a commodity [natural gas] moves from relative abundance to relative scarcity," said officials of Wood Mackenzie Ltd., Edinburgh.

"We are not in a simple commodity cycle. High prices are likely to endure, and imports will continue to increase in share of the overall North American supply for natural gas," warned WoodMac's Ed Kelly, in testimony to the US House Subcommittee on Energy and Mineral Resources last week.

Natural gas prices will remain high until an infrastructure for arctic gas is built and new domestic sources of gas are brought to market, said Kelly. However, he said, "These solutions are approximately 5-10 years away."

"The [US] natural gas situation is reducing oil supply [as NGLs are not being stripped out of high-priced gas streams as usual] and increasing [oil] demand [because of fuel-switching], and these effects will not go away in a hurry," agreed Paul Horsnell, J.P. Morgan Securities Inc., London.

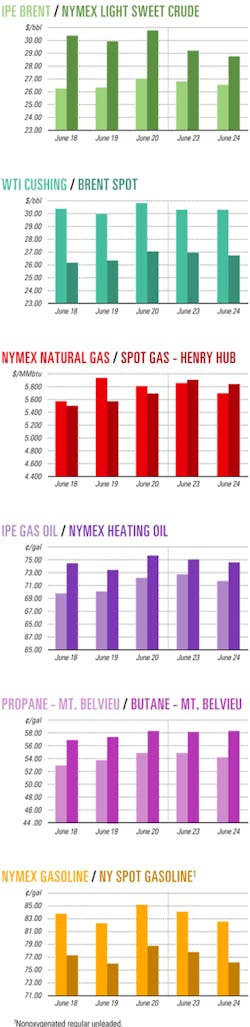

Prices jump

Energy futures prices jumped June 26 with reports of major declines in US oil inventories. The US Energy Information Agency last week reported US crude inventories fell by 4.1 million bbl during the week ended June 20. The American Petroleum Institute report was even more pessimistic, with oil stocks plummeting more than 9 million bbl.

"The quarter is drawing to a close with the average price of West Texas Intermediate homing in on $28.90/bbl. That represents the highest second quarter average since 1984," said Horsnell. "Crude oil inventories bounce up 1 week and down the next, depending primarily on the bunching of import cargoes. However, the overall pattern is no real change over the last 2 months." Moreover, he said, the market has been sending the wrong signals to US refiners "by collapsing product-to-crude [price] spreads and weakening refinery margins." As a result, said Horsnell, "Within a month, the system has gone from trying to run at a dangerously fast rate to now producing too little for balance."

Drilling is critical

"Before imports can increase substantially and before arctic gas can reach the market in large quantities [after 2010], US and Canadian drilling levels will largely determine supply on the margin or whether the gas price is closer to $3.50[/Mcf] or $5.50[/Mcf] in wholesale markets," said Kelly.

"Further restrictions on drilling activity will be accompanied increasingly quickly by higher real energy costs. Policymakers should be aware of the new cost trade-off between drilling and the environment," he advised.

LNG is an even more distant solution, Kelly said. "While increasing LNG imports are a near certainty, this growth should be put into perspective," he said. "Wood Mackenzie believes that it will be 10 years or more before LNG represents even 10% of US supplies on an annual basis."

Jefferies analysts reported, "The last several months have highlighted the risks behind US reliance on unfriendly and unstable countries for its crude oil needs. We believe crude oil prices will include a 'supply disruption' premium for at least the next several quarters, particularly given the relatively low level of worldwide inventory levels and continued political uncertainty."

Iraq

Iraq's oil production currently is projected at 300,000-400,000 b/d for the second quarter of this year, less than what was required to meet that country's prewar domestic demand of roughly 500,000 b/d (OGJ Online, June 23, 2003).

"Prewar production will likely not be seen until about yearend, and additional production gains from Iraq will take more time and more capital than many are forecasting," said Jefferies analysts. "Our best estimate is it will be at least late 2004 before Iraqi oil production can be sustained at or above prior peaks of 3.5 million b/d."

Horsnell is more pessimistic, however. "Before the war, we considered that regaining and then holding prewar production capacity constant within 2 years would be an ambitious target," he said. "We would now even question whether Iraqi output can ever regain the prewar production level in a sustainable fashion during what looks likely to be a lengthy period of occupation."

Industry Scoreboard

null

null

null

Industry Trends

NUMEROUS Canadian oil and natural gas properties and entire companies were put on the public sales block during the first quarter of this year.

Sayer Securities Ltd. Principal Frank J.D. Sayer of Calgary reported an estimated $2.8 billion (Can.) of assets and companies were for sale, marking the largest quarterly value in 3 years.

The statistics include assets and companies that were publicly announced as being for sale. The first-quarter volume was more than four times higher than the previous quarter and a big jump over the average 2001 and 2002 quarterly values of $1.1 billion.

"Many of the companies putting assets up for sale were avid buyers over the last 2-3 years, and they are now rationalizing their portfolios. The high selling prices for assets and companies over the winter of 2002-03 also contributed to the increase in the number of vendors attempting to tap into the market," Sayer said.

In addition, some US companies were precluded from selling anything in Canada until lately because of US securities and accounting rules.

The $2.8 billion sales volume represented production of 102,715 boe/d. Properties accounted for $2.1 billion of this total. The rest was for companies that announced they were either available for sale or were "seeking ways to enhance shareholder value."

The asset packages had production ranging from 32 boe/d to 27,000 boe/d, with an average value of $137.6 million, while corporate packages had a narrower range, from 285 boe/d to 8,088 boe/d, with an average value of $66.7 million.

Canadian units of US-based companies that were buyers in recent years, such as Marathon Canada Ltd. and Vintage Petroleum Canada, offered some of the biggest asset packages. These packages accounted for 41% of the total production for sale.

Many small public Canadian companies having production of up to 3,000 boe/d also put themselves up for sale, Sayer said.

OIL AND GAS company executives expect that US and Canadian merger and acquisition activity will increase during the next 3 years.

That was the outlook of executives polled during KPMG LLP's Global Energy conference in Houston last month. The 108 survey participants answered multiple-choice questions. Regarding M&A, 65% expect consolidation among small independents, 52% expect larger independents will acquire smaller independents, 39% expect mergers among the large independents, and 10% expect mergers among the majors.

"The results indicate that oil and gas producers will be refocusing their attention on the North American market and strengthening their balance sheets through acquisitions," said William Kimble, industry sector leader for KPMG's energy and chemicals practice.

"This industry has had to address and adjust to many changes over the past year and is still very cautious. However, we are seeing signs that it is ready to take advantage of new opportunities," Kimble said.

During the next 2 years, 31% of respondents said, their key focus is production growth and reserve replacement through drilling and acquisitions, while 23% listed cost control and profitability as their key focus.

Government Developments

JORDAN'S Energy and Mineral Resources Minister Mohammad Batayneh has confirmed that his country will continue to receive shipments of crude oil from Saudi Arabia, the UAE, and Kuwait for a further 3 months.

"Jordan has reached an agreement with the three (Persian) Gulf countries to continue oil supplies," Batayneh said, adding that the three countries will continue providing Jordan with 120,000 b/d of oil under unspecified but "comfortable" financial arrangements.

Despite the renewal agreement, which went into effect June 20, a senior energy official said Iraq will continue to be Jordan's "strategic option" when it comes to oil supply. "We are waiting for a legitimate government to be formed in Iraq to discuss the oil protocol it has with Jordan," the official said.

Prior to the outbreak of the US-led war on Iraq, Jordan had relied on Baghdad for its average consumption of 90,000 b/d of crude and fuel oil, half of which was being imported at preferential prices and the remainder as a gift from former Iraqi leader Saddam Hussein. Saudi Arabia and other Persian Gulf states, however, said they would provide Jordan with crude and fuel oil, replacing supplies from Iraq that stopped on Mar. 21, the first day of the war (OGJ Online, Mar. 28, 2003).

US DEPARTMENT OF THE INTERIOR officials have told House lawmakers that federal land managers recognize further improvements are needed to reduce oil and gas permitting delays.

Testifying before the House Subcommittee on Energy and Minerals Resources, Rebecca Watson, assistant secretary of the Interior for Land and Mineral Management, said the permit process can take as short as a month or as long as a year depending on the lease involved and where the permit was filed.

In some cases, delays are inevitable because of lawsuits and overlapping environmental statutes. Nevertheless, there are still ways to streamline the system without jeopardizing stakeholder concerns, whether they come from an environmental group, Indian tribe, or landowner, she said.

Watson said the White House soon plans to unveil new energy permitting procedures that likely will reduce delays caused by redundancies by federal land managers but did not offer a specific timeframe or further details. She also said the department's Bureau of Land Management will hold an agency-wide conference to eliminate doubt among regional land planners regarding ongoing streamlining efforts. "BLM is focusing on better coordination, and more can and should be done," Watson told the subcommittee.

Last April, BLM unveiled a new management plan designed to cut out redundancy and red tape on several fronts. Producers who submit multiple permit applications with similar characteristics, for example, now can have environmental reviews processed simultaneously (OGJ, Apr. 28, 2003, p. 22). Since that guidance was issued however, some local BLM officials maintained that the management plan was voluntary, not mandatory.

Responding to lawmakers' concerns, Watson said, "We are making it clear that the instructional memorandums are not optional, they are guidance that is binding."

Quick Takes

OMAN LNG (OLNG) has enlisted Mitsubishi Corp. unit Petrodiamond Singapore for the supply of 360,000 tonnes of LNG over 2 years (OGJ, June 23, 2003, p. 9).

As part of the agreement, Mitsubishi will charter Belisaire, a refurbished 12,680 dwt oil and chemical tanker, owned by Bruges-based Petromarine SA, to carry 20-24 cargoes/year from OLNG's Qalhat plant in the Wilyat of Sur.

OLNG's deal with Mitsubishi follows a June 3 agreement between OLNG and BP PLC for the supply of as much as 4 million tonnes of LNG to BP over 6 years starting in 2004 in order to deepen BP's marketing activities in Spain.

Under terms of the agreement, BP will receive as many as 12 cargoes of LNG in Europe to underpin existing supplies. OLNG will provide shipping for the duration of the agreement.

The current capacity of OLNG's existing two-train plant at Qalhat is about 6.8 million tonnes/year, while a third train, which will have a production capacity of 3.3 million tonnes/year, is expected to begin production by first quarter 2006 (OGJ Online, Dec. 16, 2002).

In other LNG news, after more than a year of negotiations, Trinidad and Tobago has granted approval to the partners in Atlantic LNG Co. of Trinidad and Tobago to proceed with the construction of LNG Train 4—the largest single LNG train in the world. Earlier this month the Caribbean island's Prime Minister Patrick Manning told the country's Parliament that the nation's treasury stood to benefit more from this agreement than it did with the construction of LNG Trains 2 and 3. But in making the announcement, it remained unclear if Tractebel Trinidad LNG Ltd. would be part of the expansion project; the Tractebel unit's last-minute discussions with its other Atlantic LNG partners had reportedly delayed the announcement about Train 4 by nearly 2 months. Manning said the Cabinet approved the Train 4 project on June 12 with an agreement that would earn his country more than $250 million/year for the duration of the 20-year contract. Total government take at the wellhead is estimated to average $1.02 billion/year at projected natural gas reference prices. Train 4 will cost $1.2 billion to build, and construction will start in August. No tax holiday will be granted, Manning said. All taxes will be paid to the national treasury and corporate taxes are projected to exceed those from Trains 2 and 3 by 10¢/MMbtu of LNG produced. The proposed Train 4 expansion will be located south of the three existing trains at Point Fortin, on Trinidad and Tobago's southwestern coast. Train 4 is projected to produce 5.2 million tonnes/year of LNG. Construction of a second jetty and fourth storage tank will also be undertaken. A new, 56-in. pipeline is planned as well. The average gas uptake of the train is expected to be about 800 MMscfd.

Dow Chemical Co. and Freeport LNG Development LP (Freeport LNG) have reached an agreement whereby Dow will have the right to use Freeport LNG's proposed LNG receiving terminal for 20 years. Freeport LNG plans to build the terminal on its Quintana Island site southeast of Freeport in Brazoria County, Tex. It would be one of the first LNG receiving terminals to be approved and built in the continental US in more than 20 years. Under the agreement, Dow will have processing rights for 500 MMcfd of non-US sourced LNG beginning in 2007. The LNG would be used partially to fuel Dow's Gulf Coast petrochemical facilities, which consume nearly 700 MMcfd of natural gas. The remaining gas will be marketed to other industrial consumers and to key Gulf Coast natural gas hubs in Texas.

THE NIGERIA-SAO TOME JOINT DEVELOPMENT AUTHORITY held June 19 in London and June 23 in Houston to elaborate on fiscal terms of production-sharing contracts that apply to nine deepwater blocks on tender through Oct. 2 in the Gulf of Guinea.

The Nigeria-Sao Tome Joint Development Zone blocks lie in 3,000-10,000 ft of water west and north of Principe Island at roughly 1-3° N. Lat. and 4-8° E. Long.

The 35,400 sq km zone is divided into 11 blocks, of which 9 that cover a combined 9,500 sq km are up for tender.

The area, an extension of Nigerian deepwater geology, is believed to contain 6 billion boe in place by the JDA's estimate.

The closest discovery to the JDZ, 20 km north, is Total SA's Akpo in 1,390 m of water on Nigeria OPL 246, estimated to hold 500 million-1 billion bbl of oil. Also in proximity are Royal Dutch/Shell Group-Statoil ASA's adjacent Nnwa and Doro finds in 1,280 m of water on OPLs 218 and 219, believed to contain a combined 50 million bbl of oil and 10 tcf of gas (OGJ, Feb. 24, 2003, p. 48).

JDZ fiscal terms call for a $30 million signature bonus on each block.

Elsewhere on the exploration front, Amerada Hess Corp. unit Amerada Hess (Thailand) Ltd. said Phu Horm-3 well on Block E5N in the northeastern province of Udon Thani in Thailand has encountered dry natural gas. The well flowed 46 MMcfd in initial production tests; an extended test is currently under way. The unit estimates that Phu Horm could contain 400-900 bcf of gas reserves and could be capable of delivering 200-300 MMcfd. Amerada said it plans to spend $200 million along with its partners over the next 5 years for exploration and development activities on the tract. Commercial gas production from Phu Horm could start as early as 2005, the company said. Gas would be supplied to the Nam Phong electric power station, about 40 km away, in Khon Kaen province. Amerada Hess (Thailand) is farming out half of its 80% interest in E5N Block to Apico LLC, a US-based oil and gas firm. As a result, both Amerada Hess and Apico will each have a 40% share in the acreage. At least two more exploration wells will be drilled in the near future to further appraise Phu Horm's gas reserves potential, in addition to the three already drilled, Thailand's PTT Exploration & Production PLC said. Calgary-based Tartan Energy Inc. reported that its test of the Lower Carneros interval of the Silver Oak No. 1 well in Bakersfield, Calif.—the first interval effectively tested in the well—has found oil and natural gas but not at economic rates. Tartan said trapped oil and natural gas in the lower zone, however, indicates that commercial production from this interval may be found in a higher structural position, and production testing of the remaining upper intervals will continue, including the Middle Carneros, Upper Carneros, Upper Temblor-Devil Water sands and the Fractured Shale-Porcelanite. Tartan also has run casing in the Williamson II P1-11 well and will begin testing when data processing and geologic interpretation are completed.

ENERGY TRANSFER CO., Dallas, said it plans to build a $50-60 million, 60 mile, 30 or 36-in. pipeline from Freestone County to Grimes County, Tex.

Energy Transfer received its first commitment of gas for the initial 650 MMcfd project this month from Fort Worth-based independent XTO Energy Inc., which signed to deliver 200 MMcfd of Freestone Trend gas to the pipeline for 9 years.

Other commitments are being sought, and capacity of the new link could be hiked to 1 bcfd later.

Pipelaying is to begin in late winter, and gas is to begin flowing in June 2004. Energy Transfer also is looking at ways to provide more take-away capacity for gas being produced in the Barnett shale gas play in the Fort Worth basin.

Elsewhere in Texas, American Central Gas Technologies Inc., Tulsa, extended its centralized, low-pressure gathering system into Bethany and Deberry fields in northeastern Panola County. The extension's capacity exceeds 12.5 MMcfd, and the largest producer connected to it is moving more than 6.5 MMcfd. The low pressure allows connection of older wells and cuts lease fuel consumption. The greater system also serves part of giant Carthage field.

Calgary-based PetroKazakhstan Inc. reported that construction has been completed on the 16-in., 177 km KAM oil pipeline (formerly known as QAM pipeline) and Dzhusaly railcar loading terminal. The $77 million line was built to "reduce transportation distance by 1,300 km on westbound exports of crude oil from the company's oil fields in the South Turgai basin" in Kazakhstan, the company said. "The first 22,100 bbl of crude oil, filling 49 tank cars, have been loaded for shipment," PetroKazakhstan said. The oil will be delivered to Atyrau on the Caspian Sea, where it will be exported to Europe. KAM will have an initial capacity of 100,000 b/d of oil and is reportedly the first high-pressure oil pipeline built in Kazakhstan, the company stated. PetroKazakhstan, formerly Hurricane Hydrocarbons Ltd., changed its name earlier this year (OGJ Online, Apr. 7, 2003).

THE US COAST GUARD MARINE SAFETY UNIT in Galveston, Tex., is continuing an investigating into the cause of a well-control incident and fire June 17 in which one employee died on Transocean Inc.'s Rig 62. Four others were injured.

Firefighters brought the fire under control by the following day with the remaining fire confined to the mud pits.

Transocean said there were no visible signs of pollution. The inland barge rig was drilling for TransTexas Gas Corp. in upper Galveston Bay.

At presstime last week, no damage assessment to the rig had been made.

SUNCOR ENERGY INC., Fort McMurray, Alta., reported that operations at its original oil sands upgrading plant near Fort McMurry is ramping up to its full production capacity of 225,000 b/d of oil.

The facility had been shut down since May 19 for maintenance on its No.1. upgrader unit During the shutdown, Suncor also commissioned a new $80 million fractionator, which is expected to improve reliability.

Production during the unit shutdown had averaged about 110,000 b/d.

Suncor said it has delayed returning one unit in Upgrader No. 1 by 3 weeks to conduct additional repairs to the hydrogen plant.

Burlington Resources Inc. June 20 reported that it would shut in all of its sour natural gas production feeding Madden field's Lost Cabin gas plant in central Wyoming. The company emphasized that no failures or release of gas prompted its decision.

The company said it decided to shut in production "after localized pipe deformations were found during inspection of the field's high-pressure gathering system." Engineering studies are currently under way to determine the cause of these deformations.

Inlet capacity of the plant is about 310 MMcfd of gas, with about 210 MMcfd of treated sales gas capacity, the company reported.

Shortly after Burlington's announcement, Standard & Poor's Ratings Services said, "The Madden facility accounts for roughly 3-4% of Burlington's daily production. At this point, the extent and duration of the curtailment has not been determined."

TAIWAN'S CABINET-LEVEL COUNCIL OF LABOR AFFAIRS (CLA) has agreed to revamp existing regulations in order to make it easier for the Formosa Plastics Group (FPG) to hire the foreign laborers that FPG says are essential if the fourth-phase expansion plan of its Mailiao petrochemical complex is to be completed on schedule.

FPG officials reported that completing the $3.61 billion project by the end of 2005 as scheduled will require 19,000 workers. Taiwan's domestic labor pool, however, will only be able to supply only about 12,000 of these.

CLA officials discussing the case said that they are willing to change the rules governing large-scale investment projects to permit the hiring of foreign workers at a 3:7 ratio to domestic workers. Under the new formula, FPG would be allowed to take on 5,700 foreign workers, some 1,300 less than the 7,000 it says it will need.

A number of high-ranking government officials, including Premier Yu Shyi-kun, have indicated that they will lend their support to FPG in its efforts to obtain the foreign workers it needs to complete the project.

When the fourth-phase expansion is completed, the combined annual production of the facility, commonly referred to as the Sixth Naphtha Cracker, will be more than $6.7 billion and will boost Taiwan's gross domestic product by 2.3%.

An explosion and fire shook the Sunoco Inc. petrochemical plant in La Porte, Tex., June 19, injuring a worker who was flown to a Houston hospital, said a spokeswoman with Sunoco, Philadelphia. The blaze was quickly extinguished, and the cause of the fire was under investigation, she said, adding that no other details were immediately available.