LNG poised to consolidate its place in global gas trade

Despite marginal gas production growth for natural gas in 2002, LNG's share of the world's trade in natural gas set records.

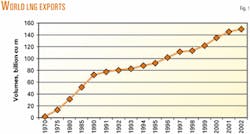

Last year, marketed world gas production edged up only 1% to 2,580 billion cu m (bcm; 1 bcm = 37.3 bcf and 0.73 million tonnes of LNG), reflecting the continued economic slowdown in many parts of the world. Exports and imports of gas rose 2.6% to 697 bcm, while LNG shipments increased 4.3% to a record 430 bcm (Fig. 1).

In the first half of 2002, demand for LNG was stagnant but rose more than 8% in the second half. Spot and short-term LNG sales accounted for a record 9% of the total. LNG now accounts for 27.4% of internationally traded volumes and 5.8% of marketed production.

Since the end of 2002, four new trains have been commissioned: Trains 2 and 3 in Trinidad and Tobago's Atlantic LNG project, Train 3 at Nigeria LNG, and the first train of Malaysia's LNG TIGA. An additional 40 million tonnes/year (tpy) of capacity is under construction.

Many more expansions and new projects are being considered not only in countries that currently export LNG but also in new parts of the world, including Iran, Bolivia, Peru, Angola, Russia, and Equatorial Guinea.

This is the first of two articles that will review major trends in LNG markets, exports, and projects based on the most recent information available. The concluding article, next week, will review exports and liquefaction facilities.

Evolving industry

When the LNG industry originally developed in the 1960s and 1970s, it was largely market-driven.

For the UK, France, Spain, and the US, LNG was a means of supplementing pipeline supplies in the face of existing or anticipated shortfalls. For Japan, which lacked domestic and pipeline supplies, LNG from Alaska and the Asia-Pacific region was virtually the only source of natural gas available and also mitigated dependence on Middle Eastern oil.

In this early period, security of supply was the main concern of buyers and project developers alike.

Plants were over-engineered to prevent supply interruptions; long-term contracts (typically 20 years) with stringent take-or-pay requirements linked buyer and seller in an iron-clad chain. Ships were exclusively dedicated to projects.

As a result, only large companies with big balance sheets could participate, creating what has been called "the world's most exclusive club."

Today, one of the major forces driving the global LNG industry is the desire of producers and resource owners to commercialize reserves they have already discovered. ExxonMobil Corp., Royal Dutch/Shell Group, TotalFinaElf SA, ChevronTexaco Inc., ConocoPhillips, Petroliam Nasional Bhd. (Petronas), Statoil ASA, Qatar Petroleum General Corp., and other private and state-owned companies with substantial reserves are seeking to develop markets by building their own terminals, buying interests in other companies' receiving terminals, or acquiring access in open-access terminals.

At the same time, LNG buyers such as Tokyo Gas Co., Tokyo Electric Co., and Korea Gas Corp. are acquiring shares in upstream reserves and liquefaction plants and buying their own ships in order to maximize their investments.

Table 1 shows proved natural gas reserves in the top 25 reserve-holding countries. There is no necessary correlation between size of reserves and LNG production capacity.

Despite its enormous reserves, Iran for political reasons, has never become an LNG exporter, although several projects are now being developed or proposed. (See accompanying sidebar.)

Apart from Abu Dhabi, the Middle East was not a participant in the LNG industry until the 1990s, in part because of policy decisions to develop gas resources for chemicals and other uses. Trinidad, on the other hand, became a major exporter because of its proximity to major markets and government support despite its much smaller reserve base.

As a rule of thumb, it takes 1 tcf of proved gas reserves to produce 1 million tpy of LNG for 20 years plus a tail-gas requirement of 1 to 3 tcf. Thus, a 6-million-tpy project requires a reserve base of around 8-10 tcf, a criterion met by many fields. If the feed gas contains economically valuable quantities of condensate and LPG, this can add 10-15% to project revenue; such impurities as CO2 and nitrogen can damage the economics. A preferred feed-gas parameter is at least 80% methane, less than 4% acid gas, less than 1% nitrogen, at least 3% propane, and 4% butane.

The cost of production can range from effectively zero when the resources are large and rich in condensates to $1/Mcf or even higher. Typically the government of the producing country charges a royalty and also gets revenue from owning a share in the production and liquefaction plant.

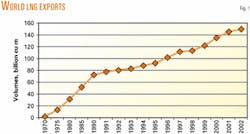

Over the past decade there has been a 35% to 50% decline in LNG production and transportation costs. The average cost of 1 tpy production capacity is now around $250/tonne for a greenfield plant and $175 for an expansion train, compared with more than $500 in 1965-70 and $300-$400 throughout the 1970s and 1980s.

Economies of scale clearly play a role in bring costs down. As Fig. 2 shows, the average train size has grown from around 1 million tpy in the 1960s to 3 million tpy in 2000, while the number of trains per project declines. Today trains in the 4-4.8-million tpy range are becoming the standard for new construction (e.g., Nigeria LNG Trains 4 and 5, Northwest Shelf Train 4, Ras Laffan Train 3), and ExxonMobil is looking at 7-million-tpy trains for a new project in Qatar.

Also contributing to lower costs are:

- Enhanced engineering know-how and project execution techniques.

- Advances in technology (e.g., gas turbines instead of steam turbines, larger more efficient axial compressors, improved equipment configurations).

- Competition at the frontend engineering design (FEED) stage as well as for construction contracts (e.g., Atlantic LNG).

- Larger and fewer storage tanks.

- Integration of LNG terminals with power plants (e.g., EcoEléctrica in Puerto Rico).

In the future, floating production storage and offloading facilities (FPSOs) could take advantage of modular construction to reduce costs.

LNG prices are falling.

As new importers China and India negotiate more favorable terms, old importers such as Japan and Korea are obtaining price and offtake concessions when they renegotiate their contracts. Although as yet no single world price for LNG exists, the expanding spot trade has led to a greater influence of US prices, and projects are being developed to supply markets in several regions.

Some people in the industry believe LNG is on its way to becoming a commodity.

Ship costs are also coming down from a peak of more than $250 million in 1991 to around $160-$170 million today. Nine new ships were delivered in 2002, bringing the total fleet to 140 at yearend.

The fall in prices reflects increased competition as new shipyards, such as Spain's Izar, enter the market; improved shipbuilding techniques; and larger tanker sizes. Most of the new ships under construction today are 138,000-140,000 cu m in size; 200,000-cu m ships are under discussion.

Imports; receiving terminals

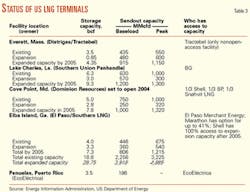

The 41 receiving terminals operating worldwide have a sendout capacity of 368 bcm/year and 223 storage tanks with a combined capacity of 29 million cu m of liquid. Last year, 10 countries imported about 113 million tonnes of LNG, up nearly 6% from 2001 (Table 2).

Asia

Asian imports in 2002 rose around 2% to 77.5 million tpy, 68.5% of the total.

- Although Japan remained the leading importer with 43.3 million tpy, its imports actually fell 2.2% for the second time in history (the first time was in 1998) because of the economic slowdown.

Japan's share of the world LNG trade declined to 48% from nearly 65% a decade ago. The decline would have been much larger if Tokyo Electric Power Co. (TEPCO) had not had to shut down many of its nuclear plants because of irregularities in its maintenance records. As a result, TEPCO took around 10% more LNG than it had earlier forecast.

Japan's Institute of Energy Economics forecasts that Japan's natural gas will grow only 1.6%/year over the next decade. To satisfy this modest growth, Japanese companies continue to expand their LNG receiving capacity.

Osaka Gas Co. Ltd. is adding an eighth 180,000-cu m storage tank at its Himeji terminal; Tokyo Gas Co. Ltd. is building a third 200,000-cu m tank at Oghishima; and Hiroshima Gas Co. Ltd. is adding a second 85,000-cu m tank at its Hatukaichi facility. Saibu Gas Co. Ltd., Sakai LNG Co. Ltd., and Mizushima LNG Co. Ltd. are building new terminals.

The deregulation of the energy industries has enhanced competition and created market uncertainties that make lower prices and greater flexibility important for gas and electric utilities. As existing Japanese contracts expire, companies have been signing new ones, often with more flexible terms and more advantageous prices.

For example, when Tokyo Electric Power Co. and Tokyo Gas renewed their expiring 20-year, 7.4 million tpy agreement with Malaysia LNG Sdn. Bhd., they obtained a 5% price reduction, according to press reports, as well as a two-tier contract term by which 1.2 million tpy is sold for 4 years and the balance for 15 years.

Of the total deliveries, up to 5.6 million tpy will be supplied on an "ex-ship" basis (sellers providing the shipping); the rest will be transported FOB in the buyers' own ships.

- Korean imports rose nearly 11% last year, similar to the previous year's rise. Korea Gas opened the country's third terminal at Tong Yeong in September 2002. The winter was unusually cold, driving Korea onto the spot market in a big way.

Korea took 40 cargoes in the winter season ending mid-February 2003, including its first and Asia's first cargo from Algeria. In April, KoGas signed a long-term agreement with Japan's Tohoku Electric Power Co. Ltd. to swap LNG cargoes as needed.

Both these unusual developments attest to the growing flexibility in the LNG industry. In March 2003, KoGas signed a 7-year contract with Australia's NorthWest Shelf project that allows a highly variable delivery schedule concentrated on winter shipments.

KoGas plans to build six additional 140,000-cu m storage tanks at the Pyeong Taek terminal by 2010, six 200,000-cu m tanks at the Inchon terminal by 2004, and seven more tanks at Tong Yeong.

POSCO, a subsidiary of Pohang Iron & Steel Co. Ltd., is building Korea's fourth LNG terminal at Kwangyang in southern Korea with a capacity of 1.7 million tpy.

- Taiwan's LNG import growth rate nearly doubled to 13%, thanks to increased sendout at the country's only LNG terminal at Yung An because of adding storage pumps and debottlenecking.

Site preparation has started for Taiwan's second terminal, the Tung Ting terminal, to supply Taiwan Power Co. with LNG for a powerplant at Tatan. Four bids have reportedly been submitted to supply 1.8 million tpy.

- China National Offshore Oil Corp. is moving ahead with plans to build LNG terminals at Guangdong and Fujian. CNOOC awarded Australia's North-West Shelf expansion a contract to supply 3.25 million tpy for 25 years starting in late 2005 and a contract to Indonesia's Tangguh project to export 2.6 million tpy to the Fujian facility also for 25 years starting in 2007.

Partners in the terminal and a 300-km trunkline include CNOOC (33%), BP Global Investments (30%), various local companies (31%), and Hong Kong companies (6%). Shipments could be delayed by perhaps 2 years, however, because the project has yet to firm up sales contracts with domestic buyers and the SARS epidemic has disrupted construction work at the site.

- In India, a buyer has yet to step up for the Dabhol receiving terminal, although reportedly its minority shareholders General Electric Co. and Bechtel Corp. have signed a letter of intent to acquire Enron's 65% interest.

State-owned Petronet LNG is still lining up customers for the 7.5 million tpy of LNG it has agreed to buy from Qatar. Deliveries are to start at yearend 2003 to the terminal at Dahej, which is nearing completion. A second terminal at Kochi is to open in 2006.

Ras Laffan LNG Co. (RasGas) has reportedly amended the contract to allow a pricing floor and ceiling, which will be pegged to the price of crude between $16 and $24/bbl, but Petronet is said to be seeking a still more favorable pricing structure.

Construction is proceeding on Shell's 2.5-million tpy terminal at Hazira, which is scheduled to go online by 2004. The LNG will initially be delivered under short-term arrangements from Shell projects in such countries as Oman and Malaysia.

Europe

In the fastest growing region last year, LNG imports into Europe soared 19.4% to 30.2 million tpy and the region's share of global imports rose to 26.7% from 23.7%. Substantially higher prices at the beginning of the year drew spot cargoes that might otherwise have gone to the US. The liberalization of European energy markets will create new opportunities for LNG, including terminal open access.

- The rise in Belgian imports to the terminal at Zeebrugge was due to the termination of a swap agreement with Sonatrach and several European companies. Owner Fluxys is studying an expansion of this facility.

- Spain's imports soared more than 30% to 10.3 million tpy as real gross domestic product (GDP) grew 2.4% in 2002, nearly double the EU's economic growth.

Spain has a single pipeline link with Europe's integrated pipeline network and must rely for most of its supply on piped natural gas and LNG from Algeria. By law, no more than 60% of Spain's supply may come from a single country, which has led Spain to diversify its sources of LNG.

The deregulation of Spain's natural gas industry has resulted in competition for new supplies and led companies such as BP PLC, Shell, Iberdrola SA, Union Fenosa, Endesa, and Eni SPA actively to develop new projects in Egypt and elsewhere.

Enagas SA is upgrading the sendout and storage capacity of its existing terminals at Huelva, Cartegena, and Barcelona. Three new terminals are under construction: one at Bilbao in northern Spain, set to start up in 2003; a second at Sagunto (2004), which is now underway; and a third at El Ferrol (2004.) Portugal's first terminal at Sines is set to start up at the end of 2003.

- In France, Gaz de France is building a new terminal at Fos-Cavaou, next to its existing terminal at Fos, which will start receiving LNG from Egypt in 2006. ExxonMobil has indicated interest in building an LNG terminal at Fos-sur-Mer near its oil refinery to import LNG from Qatar by 2009.

TotalFinaElf has interests in LNG projects in Qatar, Abu Dhabi, Oman, Nigeria, Norway, and Indonesia and is looking for markets. It reportedly abandoned, however, its plans to build a new terminal in southwest France and will instead seek capacity at third-party terminals in Europe.

- As many as 10 terminals have been announced for Italy, although probably only a couple will ultimately be built. BG has received most of the necessary authorizations for a terminal at Brindisi to receive an initial 3 million tpy of LNG from Egypt starting around 2006.

Enel SPA, the Italian electricity agency, has a letter of intent to take up to a 50% interest in this terminal. Edison SPA and BP are seeking approval for a terminal at an industrial site at Rosignano Marittimo near Livorno. ExxonMobil, and Edison are planning a terminal offshore Rovigo in the Adriatic Sea to receive Qatari LNG. The Qatar government may take a share in this project.

- The UK was the first country to import LNG (in 1964) but dismantled its LNG terminal on Canvey Island with the arrival of North Sea oil and gas. Faced with a supply shortfall that the government estimates could reach 50% by 2020, the UK is again looking at LNG imports.

National Grid Transco, operator of the UK gas grid, has awarded contracts for the design and construction of an LNG terminal on the Isle of Grain. ExxonMobil is looking for terminal capacity in the UK as a market for its production from Qatar, either by joining third-party initiatives or building a large terminal that could receive 200,000-cu m tankers.

Western hemisphere

In 2002, US natural gas production fell 1.8% to 19.0 tcf. At the same time, gross imports rose for the fifteenth year in a row by 1.6% to 4.07 tcf, although net imports fell 2.4% to 3.6 tcf because of a significant rise in exports to Mexico and Canada. More than 94% of all imports came by pipeline from Canada; the rest was mainly LNG.

Fig. 3 shows the volatile history of US imports 1970-2002. The peak year was 1979 when three terminals were receiving Algerian LNG. Deliveries were halted by a pricing dispute and the abundance of domestic supplies that followed deregulation, causing the terminals at Cove Point, Md., and Elba Island, Ga., to be mothballed for more than 20 years.

In 1982, the terminal at Lake Charles opened, but after several months it too stopped deliveries until 1989.

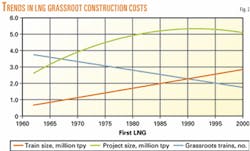

Today three terminals are operating on the US mainland and one in Puerto Rico (Table 3). The facility at Cove Point is set to open as a receiving terminal later this year. It has operated as a peaking and storage facility for several years.

All the Lower 48 terminals have changed ownership in the past few years. The Puerto Rico plant is owned by Ecoeléctrica LP, a joint venture of Edison Mission Energy and Enron Corp., which has put its share on the market.

All the terminals except Everett, Mass., are open-access; the capacity holders are shown on the table. All are planning expansions. When completed, they will raise US import capacity to more than 4 bcfd, equivalent to 1.5 tcf/year or 31.5 million tpy.

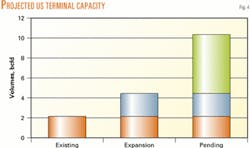

If all the terminals with pending applications are approved, capacity would reach 10 bcfd (Fig. 4).

In 2002, five companies imported 105 cargoes and 228.8 bcf of LNG (around 5.2 million tonnes) into the Lower 48. This was down 3.9% from the 2001 level.

Distrigas Corp., now owned by Tractebel NA, accounted for 48 cargoes and 109.8 bcf, up 21.5%. BG LNG Services imported 92.1 bcf into the Lake Charles, La., terminal, up 23.1%. CMS Marketing, Services and Trading Co. and Shell NA LNG imported 10 bcf under short-term arrangements at Lake Charles.

Imports into Southern LNG Inc.'s terminal at Elba Island, purchased by El Paso Global Gas, totaled 16.8 bcf this year, the first of full operation.

LNG into the US came from six countries in 2002: Algeria, Australia, Nigeria, Oman, Qatar, and Trinidad (Table 4). Qatar is using the US market to dispose of its surplus production, whereas Oman, which sold only one cargo into the US in 2002, turned to the European market where prices were higher. Shippers must obtain import authorization from the US Department of Energy's Office of Fossil Fuels.

A record 74% of all US LNG imports were brought in under short-term or spot arrangements, compared with 64.3% in 2001and only 12% in 1996.

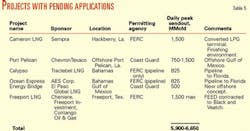

As Table 5 shows, by far the largest exporter was Trinidad, which supplied 170 bcf. Algeria's share has steadily declined since 1980-95 when it supplied virtually all the country's LNG.

The US is the only market in which imported LNG is priced on a netback-to-market basis and thus competes directly with other gas supplies. LNG prices are linked to the Henry Hub (La.) price adjusted for transportation differentials. The average price of Lower 48 imports in 2002 was $3.24/Mcf, but prices exceeded $10 during the winter of 2000 when domestic prices spiked.

As of the end of May 2003, six projects had applications pending for LNG import projects (Table 5). Four are for offshore facilities.

The two Bahamas plants would connect with Florida Gas Transmission Co.'s pipelines, although much of the gas would be moved by displacement. El Paso is building the first ship based on the Energy Bridge concept, which would entail building regasification facilities aboard tankers located offshore and connecting into existing pipelines through an offshore buoy and turret system.

The first Energy Bridge is to enter service by 2005 in the Gulf of Mexico. Cheniere Energy Inc., sponsor of the plant at Freeport, Tex., has awarded Black & Veatch Corp. a contract to design and engineering for two more terminals at Corpus Christi, Tex., and Sabine Pass, La., in preparation for a January filing with the Federal Energy Regulatory Commission.

On Dec. 19, 2002, in its preliminary determination on Dynegy Inc.'s application, FERC ruled that where markets are competitive, it will not require approval of cost-based rates or open-access tariff for new terminal service but instead would view an LNG plant as a production facility in competition with other sales of natural gas on the Gulf Coast. The sponsors will bear the full economic risk of the project.

"The public interest is served through encouraging gas-on-gas competition by introducing new imported supplies of natural gas which will be accessible to all willing purchasers," said FERC.

To facilitate the construction of offshore plants, Congress passed the Deepwater Port Amendments which gives the US Department of Transportation authority over LNG offshore plants in federal waters and allows companies building these plants to use the entire capacity for their own requirements, thereby eliminating any open-access constraints.

As many as 20 other plants have been proposed or discussed for the US East, West, and gulf coasts, including Mitsubishi Corp.'s announced LNG terminal at Long Beach, Calif., to receive gas from Sakhalin Island. Several factors will determine the ultimate contribution made by LNG to US energy supplies.

Despite the sterling safety record of the LNG industry and the introduction of new port security regulations under the 2002 Maritime Transportation Security Act (see related article in General Interest section), public opposition to LNG plants is likely to continue on environmental, security, and aesthetic grounds.

In July 2002, El Paso withdrew its proposal to build a terminal at Radio Island, NC, and in February 2003 Shell and Bechtel shelved their plans to build a terminal on Mare Island, Calif. This explains why four of the six pending FERC applications are for offshore facilities, while the other two are in an area (the Gulf Coast) where many energy facilities are located.

In some regions, additional pipeline capacity may be needed to deliver the LNG, which is expensive and requires regulatory approval. As the US imports LNG from more countries, the composition of the LNG could become an important consideration, especially in places where the regasified LNG is not diluted by other supplies as it is on the Gulf Coast.

US prices must remain high enough to support LNG imports. So far, $3/MMbtu appears to have provided a threshold for most producers to supply LNG to the US. At a Henry Hub price of around $2.50, only projects with low costs, such as Trinidad, and that are located near the US are likely be economic.

Prices of $3.50/MMbtu would probably make all but the highest cost projects economically viable.

In Mexico, at least six plants have been proposed for the east and west coasts, where gas demand is rapidly expanding at a time when domestic production is stagnant. Some of the plants would supply gas to both Mexico and California.

The Mexican government estimates that by 2010, imports will be needed to meet 20% of domestic gas requirements, including power plants.

In May 2003, the Mexican regulatory agency Comisión Reguladora de Energía issued a storage permit for the terminal near Tijuana in Baja California proposed by Marathon Oil Corp., Golar LNG Ltd., and Grupo GGS SA de CV, a local construction company. (Pertamina was once listed as a partner but is no longer).

They must still get environmental and local land-use permits. No sources have been identified; Marathon is reportedly holding talks with potential suppliers in the Asia Pacific and Latin America

Two projects have received approval from Semarnat, Mexico's environmental regulatory agency. Sempra Energy plans to build a 1-bcfd facility near Enseñada in Baja California on the West Coast of Mexico, set to start up in 2006. The LNG could come from Bolivia. Some of the LNG could be sent to the US in Sempra and PG&E's Baja Norte pipeline, which would be reversed. Royal/Dutch Shell is proposing a 1-bcfd Altamira terminal on the Gulf Coast, with a 2007 start-up date.

Elsewhere in the Western Hemisphere, in early 2003 AES Corp. took the first cargo from Trinidad into its new 2-million tpy terminal at Andres in the Dominican Republic.

BP has a deal to provide AES with 750,000 tpy for 20 years, without specifying the source. The LNG will supply a 300-Mw power plant and a 210-Mw plant being converted from oil. AES is also looking at building a terminal in Honduras. Other potential Western Hemisphere markets are Brazil, Cuba, and Jamaica.

The author

Colleen Taylor Sen is associate director, LNG research, for the Gas Technology Institute, Des Plaines, Ill. She is the editor of the World LNG Source Book and organizes courses and seminars on all aspects of the LNG industry. Previously she served director of external relations at the Institute of Gas Technology. Sen holds a BA and MA from the University of Toronto and a PhD from Columbia University.