OGJ Newsletter

Market Movement

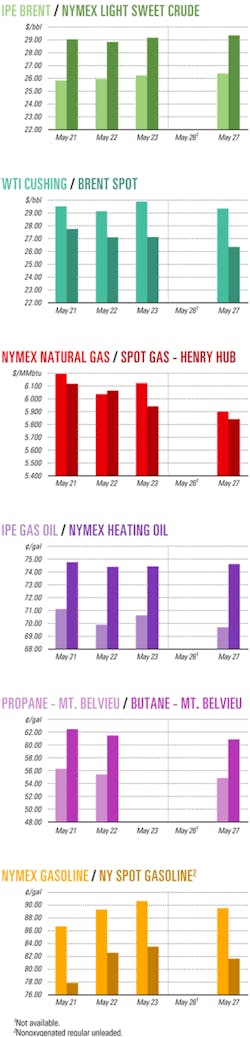

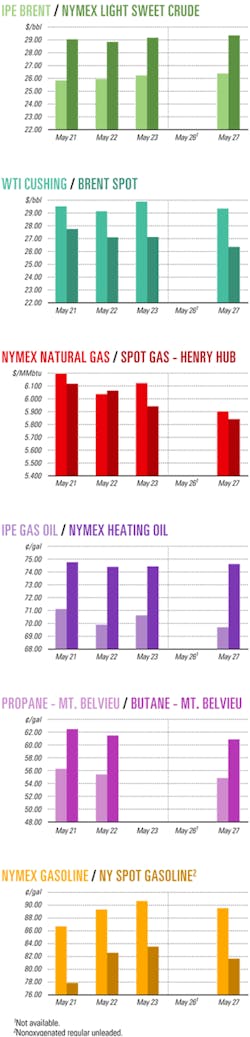

June gas price hits NYMEX record high

The June natural gas contract expired May 28 at $5.945/Mcf, the highest finish ever for that month on the New York Mercantile Exchange.

"The June contract finished 74% above last year's settlement and 16% above the April and May expirations," reported analysts last week at Enerfax Daily. But despite a late surge in prices on its expiration date, they said, the June contract fell below the 3-day settlement average. April and May contracts expired below $5.15/Mcf, both showing weakness at expiration.

On May 27, as NYMEX resumed trading after the long US Memorial Day holiday, the June natural gas contract plunged below $6/Mcf for the first time since mid-May, dropping 21.9¢ to $5.90/Mcf as moderate weather and weaker cash prices encouraged local distribution companies to liquidate, analysts reported (OGJ Online, May 28, 2003).

The next day, the market opened down and spent all morning trading around $5.80/Mcf, before rallying in the afternoon to as high as $6/Mcf as traders bought commodities to close out short sales, "despite a soft physical market and fairly mild weather forecasts through (this) week," analysts said.

The new near-month July gas contract inched up 0.5¢ to $6.016/Mcf in May 28 trading on NYMEX and was projected to move higher later in the week as traders continued to cover short positions.

Meanwhile, cash market prices for natural gas continue to lag the futures market, "which is a function of not having hot weather east of the Rockies," analysts said.

Gas futures prices had increased during NYMEX trading sessions prior to the Memorial Day weekend when Federal Reserve Chairman Alan Greenspan noted the "very serious problem" of tight supplies of North American gas. But prices then sagged a little after the US Energy Information Administration reported on May 22 the then-largest injection of gas into US underground storage for the season, with 90 bcf of gas injected during the week ended May 16.

On May 29, EIA reported an even bigger injection, 95 bcf, into US storage during the week ended May 23. US gas storage now stands at 1.09 tcf, down 762 bcf from year-ago levels and 508 bcf below the 5-year average.

Gas market problems

Prior to the latest EIA report, Enerfax analysts projected last week that for US gas storage to reach 2.8 tcf by winter, gas injections must exceed by 16% a 5-year average build of 73 bcf/week. "To get to 3 tcf, an average weekly injection of 84 bcf is needed," they said.

"It is clear that Washington, DC, is noticing the structural shortage of natural gas, demonstrated by (recent) high-level meetings to discuss options and Alan Greenspan's comments about the shortage and impact," said James K. Wicklund in a May 27 report from the Houston office of Banc of America Securities LLC, New York.

Wicklund warned, "If we get the hot summer and cold winter (combination) that analysts, investors, and oil companies normally hope for, natural gas prices could spike to levels that could severely crimp consumer spending, destroy more long-term demand than is needed or healthy, and possibly put the US into recession."

Moreover, he said, the timing for such a potential disaster "could not be worse, given that the election cycle picks up steam" later this year. Among options being discussed by politicians to attempt to control the gas market are price controls and rationing of gas supplies, he said.

"Price controls and rationing should be of last resort," advised Wicklund. "Price controls have never worked, and it would reduce the economic incentive to drill and produce more natural gas, which is the best option near term to ease the crisis. Rationing would derail the free-market system for natural gas and cause significant longer-term fundamental and economic problems for the industry."

Instead, Wicklund said, "The most likely option available to Washington is to lift coal emission levels to allow for more coal-fired electrical generation, freeing natural gas for storage." Such a move would not have "any negative fundamental impact" on the gas industry, he said, "as it demonstrates to even skeptics that higher levels of natural gas production are definitely needed and for some time. This is also demonstrated by the stopgap efforts to ease the shortage near term."

The US gas "shortage is not politically inspired as might be the case with the Organization of Petroleum Exporting Countries and crude oil pricing but more structural, with market prices not providing enough supply to meet current demand," said Wicklund. "There is no question that there has been a 'step-change' in natural gas prices."

He said, "About half of the US natural gas supply base has been produced, and the balance can only be produced at higher prices. The oil industry has not been willing to use record-high prices as the longer-term baseline datum of prices to justify drilling and correctly so. Right now, the industry is using a price of about $3.30/Mcf to determine the economic viability of any given natural gas drilling project."

Furthermore, Wicklund said, "This economic threshold includes the increase in finding and development costs seen over the past few years and is likely to be raised over the next few years if costs continue to escalate."

Oil market outlook

Oil futures prices remained strong through the middle of last week, with the July contract for benchmark US light, sweet crudes closing at $28.58/bbl on May 28.

However, the United Nations Security Council vote on May 22 to lift international trade sanctions imposed for 13 years against Iraq was generally viewed by traders as a bearish indicator for the oil market.

"However, (Iraqi) sales look to be limited to oil already in storage at Turkey's port of Ceyhan, which is a different kettle of fish than ongoing production-related transactions," said Michael Rothman and Steven A. Pfeifer, first vice-presidents at Merrill Lynch Global Securities Research & Economics Group, New York, in a May 23 report. Iraq's current oil production is "still running at less than half of what's needed to satisfy domestic energy requirements," they said.

On May 27, EIA officials quoted Thamir Ghadhban, Iraq's acting oil minister, as saying he expects Iraqi oil production to double within a month. Ghadhban earlier reported that Iraqi oil production was set to rise "within weeks" to 1.5 million b/d from 235,000 b/d currently. Such production level would be enough to meet Iraq's domestic needs of around 500,000 b/d, leaving 1 million b/d to export (OGJ Online, May 6, 2003).

US and Iraqi officials last week reported that Iraq's two main export terminals Ceyhan and Mina al-Bakr in the south, are operational and ready to resume exports. The first postwar exports of Iraqi oil are expected to start in mid-June from storage tanks in Ceyhan. Close to 9 million bbl of Iraqi oil are stored at Ceyhan (OGJ Online, May 23, 2003). F

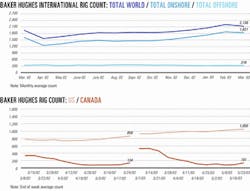

Industry Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

null

Industry Trends

EXPLORATION AND PRODUCTION companies' stock could yield potential returns of 25-40% during the next 12 months because investors are beginning to recognize the long-term sustainability of higher natural gas prices.

The St. Petersburg, Fla.-based Raymond James & Associates Inc. (RJA) issued a May 27 research note saying E&P stocks surged 4% on the S&P 500 Index for the week ended May 23.

The S&P 500 E&P Index has climbed 9.2% year to date, but has "tremendously lagged" the escalation in natural gas prices, up 33.2% year to date on the New York Mercantile Exchange 12-month natural gas futures strip.

RJA analyst Wayne Andrews offered three strategies to help investors identify E&P stocks having high-return potential:

- Target the companies that have the strongest production growth per debt-adjusted share.

- Invest in companies having the most leverage to robust North American natural gas prices.

- Buy stocks trading at discounted valuations relative to their growth, risk, and return.

Andrews sees relative stock price outperformance by companies in the RJA coverage universe that have the highest compound annual growth rate in production per debt-adjusted share.

"In 2002, companies that generated positive production growth per debt-adjusted share saw their share prices increase an average of 29% more than the S&P 1500 E&P Index. It is also important to point out that companies with negative production growth per debt-adjusted share saw their share prices decrease an average of 2.2% vs. the index," he said.

RJA evaluated future production growth/debt-adjusted share as an indicator of future stock outperformance by using RJA's production, cash flow, and capital requirement estimates. Andrews used estimates covering 2002-04 for companies in the firm's coverage universe. "Most companies under coverage are expected to grow production on an absolute basis (despite flat to down industry expectations)," and debt-adjusted growth typically is higher than the absolute growth, he said.

In the current $6/Mcf gas price environment, E&P companies are generating more cash than they can reinvest efficiently in the industry, resulting in significant free cash flow during the next 2 years, Andrews said. "Companies may choose to reduce debt or increase spending for further production growth. Either scenario bodes well for our debt-adjusted growth calculation. In this group of 25 companies, the median expected annualized production growth per debt-adjusted share is an outstanding 17.5% vs. the average absolute growth of 11.5%/year," he noted.

RJA also included each company's reserve life index to provide a guide to the timing of its ultimate production.

"While the level of hedging varies, and many companies will have exposure to volatile basis differentials, the companies with 60%-plus gas reserves should benefit from strong natural gas prices over the next few years," Andrews said.

Andrews said that as a group, E&P stocks should trade for $1.50-1.75/Mcfe of proved reserves and in the mid-to-lower end of the historical forward earnings before interest, taxes, depreciation, and amortization (EBITDA) multiple range of 4.5–6.5.

Currently, large-capitalization company stocks are trading well below the low end of historic trading ranges at $1.30/Mcfe and four times 2004 EBITDA, Andrews said.

Government Developments

AN INDIAN REFINER has received the first shipment of Indian-owned equity crude from a foreign oil field.

India's state-owned Oil & Natural Gas Corp. received the consignment of its equity oil from Sudan's Greater Nile Oil Project (GNOP), where subsidiary ONGC Videsh Ltd. (OVL) took a 25% stake.

The 80,000 tonne shipment, carried by the Seafalcon tanker and received at the New Mangalore Port Trust on May 15, will be processed by ONGC at its 193,800 b/d Mangalore refinery.

Deputy Prime Minister L.K. Advani, on hand to receive the consignment, said: "This is not imported oil. This is India's oil."

Petroleum Minister Ram Naik noted that India imported 82.3 million tonnes of crude oil and products worth $17.35 billion in fiscal year 2002-03, with more than 66% coming from the Middle East.

To diversify India's crude oil supply sources, Naik emphasized the importance of acquiring equity oil abroad.

Earlier this year, Talisman Energy Inc., Calgary, concluded the sale to OVL of its stake in a producing block covering Heglig and Unity fields in Sudan's oil-rich Muglad basin (OGJ Online, Mar. 28, 2003).

GNOP, which consists of four blocks in the Muglad basin and a 1,500 km pipeline from the producing fields to Port Sudan on the Red Sea, produces around 250,000 b/d of oil.

Apart from OVL 25%, equity owners in GNOP are China National Petroleum Corp. 40%, Malaysia's state oil company Petronas Carigali Overseas Sdn. Bhd. 30%, and Sudan's national petroleum company Sudapet Ltd. 5%.

THE US CONGRESS passed a $350 billion tax relief bill that preserved the foreign-earned-income exclusion. Oil companies say the tax break is a key incentive for them to recruit US citizens to work overseas. President George W. Bush signed the bill.

The exclusion currently allows US expatriates to shield as much as $80,000 from their income for tax purposes. The provision also allows workers to exclude some housing costs.

A House version authorized the tax break. Senators tried to kill it, but a vocal minority of lawmakers from oil-producing states, led by Sen. John Breaux (D-La.), successfully fought for it. Breaux argued the tax break keeps US businesses competitive in international markets.

The Senate narrowly approved the measure, with Vice-Pres. Dick Cheney casting the deciding vote. Under Senate rules, the vice-president casts the deciding vote when the Senate vote is tied.

THE CUBAN GOVERNMENT has invited the Brazilian state-owned oil company Petroleo Brasileiro SA (Petrobras) to search for oil in the Gulf of Mexico. The Cuban ambassador to Brazil, Jorge Lezcano Pérez, said that Spanish-Argentine giant Repsol-YPF SA already carried out prospective work in the area, which indicated potentially substantial oil reserves.

Pérez said the initial idea is establishing a partnership between Petrobras and Cuba. A Petrobras spokesperson said the company is interested in the offer, and a deal could be struck later this year. In the late 1990s, Petrobras invested in exploratory work off northern Cuba, but the results were negative.

Quick Takes

JORDAN has short-listed three international groups to build, own, operate, and transfer (BOOT) a 750 km, 100,000 b/d crude oil pipeline from Iraq to Jordan that would replace recently curtailed Iraqi-Jordan tanker truck transport (OGJ Online, Mar. 28, 2003).

Project consultant, German-Austrian group ILF Consulting Engineers, currently is examining tenders from Petrofac Ltd. of the UK, Oman's Shanfari Group, and a consortium of India's state-run Indian Oil Corp and Russia's OAO Stroytransgaz.

The first section of pipeline will extend 300 km to the Jordan-Iraq border from Jordan's 100,000 b/d refinery at Zarqa, 27 km northeast of Amman.

From the border, it later would extend an additional 450 km to oil pumping stations at Haditha, 260 km northwest of Baghdad.

The line's ultimate 150,000 b/d design capacity could be expanded later to 350,000 b/d.

Jordan will finance pipeline construction at $120-140 million on the BOOT basis.

Jordan and Egypt will open Phase I of the Arab Mashreq natural gas pipeline this month as Egypt begins shipping 1.1 billion cu m/year (bcmy) of gas to Aqaba, Jordan, on the Gulf of Eilat. The 250 km pipeline originates in Mediterranean gas fields off Egypt, passes through Al Arish in Sinai, and continues to Taba where a 15 km subsea section extends to the 650 Mw Aqaba thermal power station, which will switch this month from heavy fuel oil to gas. From Aqaba, the pipeline will extend to southern and central Jordan to supply gas to power stations there. Plans call for eventual extension to Syria, Lebanon, Turkey, and possibly Europe, with a capacity ultimately projected at 10 bcmy.

Baku Tbilisi Ceyhan Pipeline Co. has begun construction on its 1,768 km pipeline from Baku, Azerbaijan—via Tbilisi, Georgia—to Ceyhan, Turkey. The 1 million b/d BTC pipeline will be an important export route for oil from the southern Caspian Sea area to the Mediterranean. Plans call for the $2.9 billion line to be ready in first quarter 2005 to carry oil from Central Azeri field, Phase I of BP PLC's Azeri-Chirag-Gunashli development expansion in the Caspian. Shareholders in BTC Pipeline Co. are BP, State Oil Co. of the Azerbaijan Republic, Unocal Corp., Statoil ASA, Turkish Oil Corp., Total SA, ENI SPA, Japan's Itochu Corp. and Inpex Corp., ConocoPhilips, and the Delta Hess Alliance (OGJ Online, Feb. 4, 2003).

El Paso Corp. subsidiary Cheyenne Plains Gas Pipeline Co., Houston, has applied for Federal Energy Regulatory Commission approval to construct and operate a 380 mile interstate natural gas pipeline from the Cheyenne Hub south of Cheyenne, Wyo., to Greensburg, Kan. The $332 million Cheyenne Plains pipeline system will interconnect with interstate and intrastate pipelines serving Midcontinent markets. The 30-in. pipeline would have an initial capacity of 560 MMcfd of natural gas, expandable by about 500 MMcfd if markets require it. Long-term firm contracts are already in place for 100% of the system's initial capacity, El Paso said. Construction will begin following FERC approvals, and pipeline operation is scheduled to begin by mid-2005.

Snam Rete Gas awarded GE Oil & Gas, a Florence, Italy-based unit of GE Power Systems, a $43 million contract to supply, install, commission, and start up three new compression units at three compression stations—Gallese, Tarsia, and Melizzano—on its Snam Rete Gas pipeline system in southern Italy. The equipment will be manufactured at GE's plant in Florence, with the first unit shipped in first quarter 2004, and commercial operation expected during third quarter 2004. Each unit will include a 23 Mw GE PGT-25 gas turbine and a PCL602 centrifugal compressor.

SHELL OIL PRODUCTS US and Motiva Enterprises LLC, the companies that market the Shell brand of gasoline in the US, are converting more than 100 Texaco branded stations in New York City and the surrounding areas to the Shell brand. The action, part of the largest brand conversion in US business history Shell said, is planned for completion by the end of the year.

The acquisition and conversion of Texaco stations came as part of a federal antitrust agreement to allow the Chevron Corp.-Texaco Inc. merger to proceed. Shell will spend about $530 million to convert thousands of stations across the US.

STATOIL has spudded the first exploration well to be drilled on its Verdandi prospect on Block 16/1 about 25 km southwest of Norsk Hydro ASA's Grane field in the North Sea, Statoil reported.

The well, "primarily looking for oil," is being drilled by the Borgland Dolphin drilling rig, which was converted by Fred Olsen Energy ASA unit Dolphin AS. Drilling is expected to take 1 month.

Statoil, as operator, holds an 80% stake in the license area, which was awarded in the 13th licensing round in 1991.

PTT Exploration & Production PLC, the largely Thai state-owned oil firm, has farmed in on, with a 40% stake in onshore petroleum prospects, Blocks 433a and 416b in Algeria, joining Viet Nam's state-owned Petrovietnam, now 35%, and Sonatrach, the Algerian national oil company 25%. The two blocks cover 6,472 sq km near Touggourt, in southeastern Algeria 50 km from Hassi Messaoud. PTTEP will inject $13 million for additional exploration activities over the next 3 years, including drilling three exploration and delineation wells.

Woodside Energy (Kenya) Pty. Ltd., an affiliate of Woodside Petroleum Ltd. of Australia, has signed a farm-in agreement with Dana Petroleum PLC subsidiary Dana Petroleum (E&P) Ltd. for a 40% interest in production-sharing contracts covering Blocks L5, L7, L10, and L11 off Kenya. Star Petroleum International (Kenya) Ltd., a wholly owned subsidiary of Global Petroleum Ltd. of Australia, is a 20% partner in the PSC. Woodside will be operator with a 40% interest and will pay 80% of development costs, including seismic and drilling, until two exploration wells are drilled and flow-tested. The seismic survey is expected to begin in the third quarter and could lead to drilling as early as 2005. The area covers 47,500 sq km in a Cretaceous-Tertiary sedimentary basin characterized by seven potential play types from which about 100 early-stage exploration leads and prospects have been identified in 200-3,000 m of water, Dana Petroleum said.

Goodrich Petroleum Corp., Houston, reported a discovery on its Tunney prospect in West Delta 83 field in Plaquemines Parish, La. Goodrich's SL 15016 No. 1 well was drilled and logged to a total depth of 16,753 ft and logged 86 ft of net pay in three separate zones in the field—the 10,100 ft, MQ, and OJ sands. Goodrich, which is operator of the field and owns a 46% interest, currently is completing the well in the OJ sand and expects completion results about June 13.

Agip Petroleum Co. Inc. has drilled another successful deepwater subsalt appraisal well on the K2 discovery on Green Canyon Block 562 in the Gulf of Mexico about 180 miles south of New Orleans, reported partner Anadarko Petroleum Corp. May 27. Agip spudded the K2 No. 3 well in February in about 3,900 ft of water. Drilled to more than 27,000 ft TD, the well encountered 208 ft of oil pay in two sands with no oil-water contact, confirming prior estimated gross reserves of 100 million boe and suggesting additional reserve potential. The well extended the limit of the proven oil column on the K2 structure downdip an additional 800 ft. Development options include a separate structure or a tieback to nearby Marco Polo, which Anadarko will install and operate late this year. First production from K2 could begin in late 2004 or early 2005. Operator Agip holds 18.2% of the field, Anadarko holds 52.5% working interest, ConocoPhillips holds 16.8%, and Unocal 12.5%.

Houston-based El Paso Production Oil & Gas Co., operator, and 50% partner Houston Exploration Co., Houston, made a shallow-water, deep-shelf natural gas discovery on High Island Block 115. The No.1 well, drilled in 44 ft of water to 19,800 ft TD, flowed on test at a rate of 20 MMcfd. Production is expected during the fourth quarter. Houston Exploration plans to drill five deep-shelf wells this year, spudding its next well on West Cameron Block 227 in July.

INDIA has agreed to import 5 million tonnes of LNG in phases from Iran under a 25 year contract. India will receive 2.5 million tonnes in 2007-08 and an equal quantity beginning in 2012.

The Indian government is expected to build a fourth LNG import terminal on the country's west coast to receive and process the LNG.

Under the agreement, ONGC Videsh Ltd., the overseas subsidiary of state-owned Oil & Natural Gas Corp., will acquire equity in certain Iranian oilfields.

India's government-run Gas Authority of India Ltd. will assist Tehran in developing a compressed natural gas network for use as automobile fuel, and Indian Oil Corp. (IOC) will lend its expertise in modernizing and increasing the capacity utilization of Iranian refineries.

IOC also has renewed its contract with National Iranian Oil Corp. to import 5 million tonnes of crude oil during the 2003-04 fiscal year.

BP, on behalf of partners Pertamina and China National Offshore Oil Co., awarded a $1.4 billion contract to a consortium—led by Halliburton Co.'s engineering and construction arm KBR and including Japan's JGC Corp. and Indonesia's engineering firm PT Pertafenikki—for engineering, procurement, and construction of the two-train Tangguh LNG processing plant in Indonesia, reported OPEC News Agency. The plant will be built on Berau Bay in Irian Jaya (Papua) province to process natural gas from offshore fields containing 14.4 tcf of proven gas reserves, which BP, CNOOC, and several Japanese companies will develop. The plant is designed to produce 7 million tonnes/year of LNG.

Marathon Offshore Alpha Ltd., a Marathon Oil Corp. subsidiary, has signed a letter of understanding with BG Group PLC subsidiary BG Gas Marketing Ltd (BGML) whereby Marathon will supply BGML with 3.4 million tonnes/year of LNG for 17 years. LNG would come from a proposed LNG project Marathon and partners will develop on Bioko Island, Equatorial Guinea. Deliveries will begin in 2007, with the principal market the Lake Charles, La., LNG import terminal in Louisiana, BG said. Natural gas primarily would come from Marathon-operated Alba field off Equatorial Guinea, which contains reserves of 5 tcf of gas and 300 million bbl of condensate. Marathon and its partners currently are expanding facilities to increase Alba's gas production to 90,000 boe/d from 50,000 boe/d by yearend 2004. Marathon signed the agreement on behalf of its LNG project partner, GEPetrol, the new national oil company of Equatorial Guinea. This project could provide the basis for a regional gas hub to develop stranded gas in the area, Marathon said.

FALCON GAS STORAGE CO., Houston, reported that unexpected responses to recent open seasons for storage capacity at two separate locations both exceeded the company's planned capacity for those sites.

Bids requested by Falcon subsidiary Hill-Lake Gas Storage LP for expanded storage at the proposed Phase II Hill-Lake gas storage facility serving the Dallas-Fort Worth area and other north, west, and east Texas areas exceeded by 50% its planned additional working gas capacity of 3.7 bcf, Falcon said, indicating a need for more high-deliverability, multicycle (HDMC) storage.

Falcon earlier had announced that capacity bids for Phase I of its new MoBay storage hub in Mobile County, Ala., exceeded proposed working gas capacity for that site (OGJ Online, Apr. 16, 2003).

MoBay, also an HDMC facility, is scheduled to be in service during fourth quarter 2004.

Phase I originally was planned for 20 bcf of working gas capacity and 450 MMcfd of injection and withdrawal capacity, but Falcon is reassessing the design plans based on the open season response.

THE 7-CRL-4D WELL in Coral field off Brazil has started production, flowing 10,000 oil b/d of 41° gravity oil, said Petroleo Brasilero SA (Petrobras), Brazil's state-run oil company.

The well is a part of the development project for Coral and Estrela do Mar fields on two offshore Santos basin development blocks. Estrela do Mar is 180 km off the state of Paraná in 150 m of water (OGJ Online, Jan. 16, 2003).

Coral, 170 km off Santa Catarina state in 500 ft of water, started production earlier this year (OGJ Online, Feb. 5, 2003).

The project involves three wells in Coral field and one in Estrela do Mar that connect with the Atlantic Zephyr semisubmersible platform. The Avaré tanker is anchored in the oil processing and storage area, and oil is transported via vessels to refineries.

Petrobras has 35% interest. Partners are Brazil's Queiroz Galvão Perfuracoes SA 30%; Coplex Petroleo do Brasil Ltda., the indirect wholly owned subsidiary of Naftex Energy Corp., Vancouver, BC, 27.5%; and Brazilian independent Starfish Oil & Gas Co. 7.5%.